Mexico Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

Mexico Cement Market Overview:

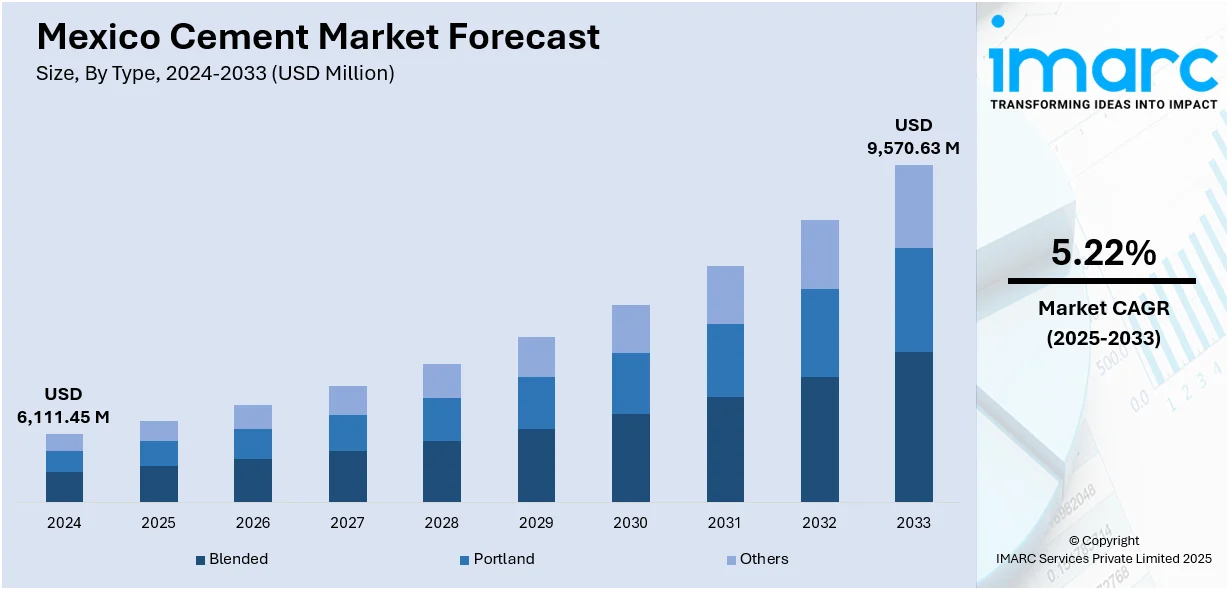

The Mexico cement market size reached USD 6,111.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,570.63 Million by 2033, exhibiting a growth rate (CAGR) of 5.22% during 2025-2033. The market is driven by urbanization, government infrastructure projects, and sustainability trends. Rapid city expansion and the country’s strong culture of self-built housing sustain constant demand for cement. Simultaneously, government-backed infrastructure developments like roads, airports, and housing programs provide a stable, large-scale consumption base. Additionally, environmental regulations and technological innovation are pushing manufacturers toward greener, more efficient production methods. These factors combined ensure continuous rise in Mexico cement market share, balancing both public and private sector needs with evolving sustainability expectations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6,111.45 Million |

| Market Forecast in 2033 | USD 9,570.63 Million |

| Market Growth Rate 2025-2033 | 5.22% |

Mexico Cement Market Trends:

Economic Growth, Urbanization & Self-Build Culture

Mexico’s cement market is shaped by steady economic growth, urban expansion, and a strong tradition of self-construction. As cities develop and new urban zones emerge, demand rises for housing, commercial spaces, and public infrastructure. One notable aspect of the market is that, as of 2024, over 57% of Mexican homes are constructed or progressively enlarged by homeowners themselves, with small-scale projects mostly depending on bagged cement. This self-build culture ensures ongoing cement demand beyond major public or private sector works. The expanding middle class also drives this trend as more families invest in home improvement and property development. Additionally, continued urban migration fuels the need for essential infrastructure such as hospitals, schools, and transportation networks. Together, large-scale developments and household-level projects create a stable, broad-based demand for cement, supporting long-term market resilience across various regions of Mexico.

To get more information on this market, Request Sample

Government Infrastructure Projects & Policy Support

Another significant Mexico cement market trend is the shift towards government-led infrastructure development that remains a central driver of cement demand in Mexico. Major public projects like railways, highways, airports, and ports require large volumes of cement for their construction. Housing programs initiated by federal and local authorities to improve living conditions for low-income populations also contribute to cement usage, particularly in rural and developing urban areas. The Mexican government’s focus on improving transportation networks, water systems, and public services brings long-term stability to the cement industry. Furthermore, favorable policy frameworks and collaborations between the public and private sectors enhance investment in infrastructure. Even during economic slowdowns, government-backed construction projects provide a buffer for the market, ensuring ongoing consumption of cement. These state-driven efforts create a foundation of demand that private sector projects and international investments can build upon, maintaining the sector’s momentum.

Sustainability Push, Technological Advances & Efficiency

Environmental concerns and technological advances are driving significant changes in Mexico’s cement industry. Manufacturers are adopting cleaner production methods to cut carbon emissions and energy use, responding to both global and local environmental demands. The shift toward innovative materials, such as blended cements and alternative binders, offers greener construction options. For example, Holcim Mexico used eco-friendly technologies including ECOPlanet, ECOCycle, and ECOPact to cut 1.7 million tons of CO₂ in 2024 enough to power 355,000 homes a year. Technological upgrades, including automation and real-time data monitoring, enhance operational efficiency and reduce costs. These improvements also optimize logistics, making delivery more reliable. Growing awareness among developers and consumers about sustainable building further fuels demand for eco-friendly cement. Together, these factors drive ongoing innovation, helping the Mexican cement industry stay competitive and aligned with global sustainability goals thus strengthening the Mexico cement market growth.

Mexico Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others.

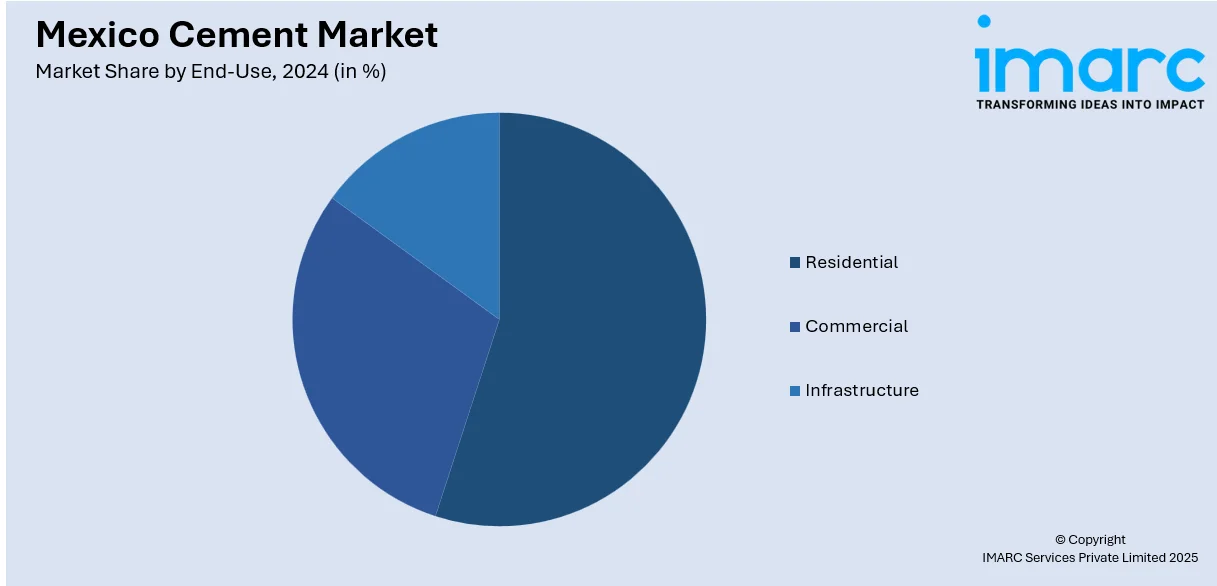

End-Use Insights:

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cement Market News:

- In September 2024, Cemex introduced a new water-repellent cement under its Vertua brand in Mexico, aimed at combating dampness in construction projects. Launched at the Construrama Convention on 12 September 2024, this innovative cement mixes like standard grey cement but includes built-in moisture resistance. Cemex Mexico’s president, Ricardo Naya, highlighted that the product offers added protection and a smoother finish, making it an all-in-one solution for common humidity challenges on construction sites.

Mexico Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cement market on the basis of type?

- What is the breakup of the Mexico cement market on the basis of end-use?

- What is the breakup of the Mexico cement market on the basis of region?

- What are the various stages in the value chain of the Mexico cement market?

- What are the key driving factors and challenges in the Mexico cement market?

- What is the structure of the Mexico cement market and who are the key players?

- What is the degree of competition in the Mexico cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)