Mexico Chocolate Market Size, Share, Trends and Forecast by Product Type, Product Form, Application, Pricing, Distribution, and Region, 2026-2034

Mexico Chocolate Market Size, Share & Analysis:

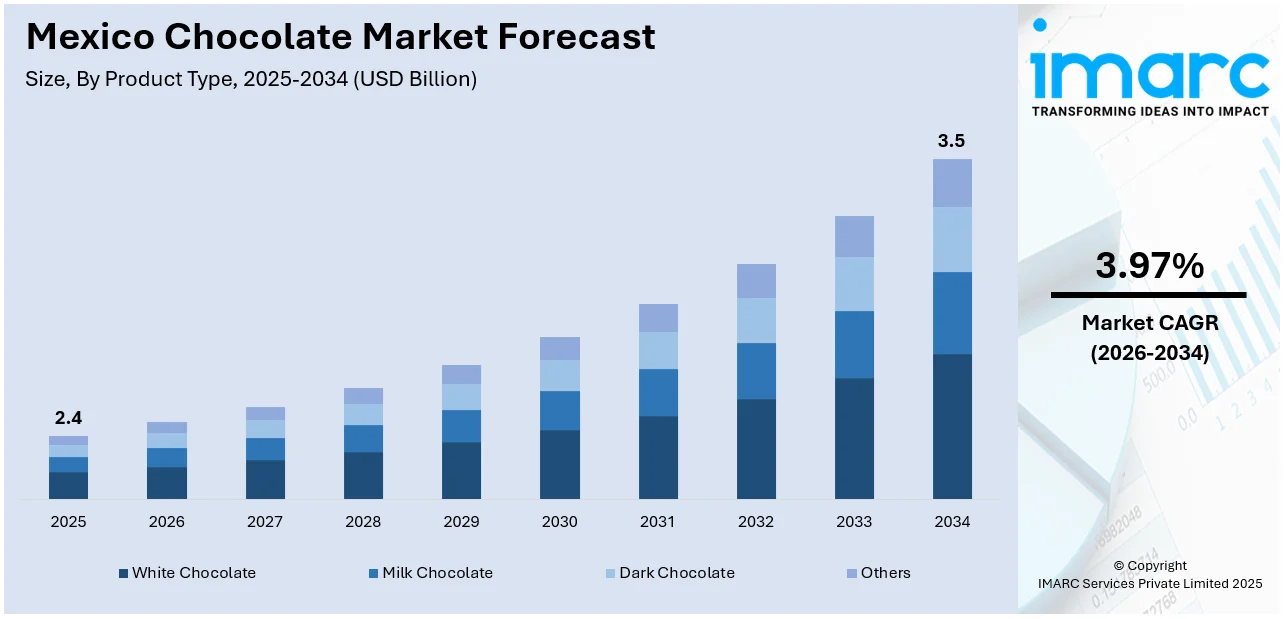

The Mexico chocolate market size reached USD 2.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2034, exhibiting a growth rate (CAGR) of 3.97% during 2026-2034. The rising disposable incomes, urban lifestyle changes, growing demand for premium product, shifting consumer interest across traditional, mass-market, and premium chocolate segments, changing festive consumption patterns, and rapid e-commerce growth are some of the factors boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.4 Billion |

| Market Forecast in 2034 | USD 3.5 Billion |

| Market Growth Rate 2026-2034 | 3.97% |

Mexico Chocolate Market Insights:

- Key Market Drivers: Increased consumer demand for health, organic, and premium chocolate, combined with higher disposable incomes and urbanization, is driving growth in the Mexican chocolate market, driven especially by retail modernization and changing dietary habits.

- Key Market Trends: Artisanal chocolate, dark chocolate with functional ingredients, and locally themed seasonal assortment are defining the Mexican chocolate market, as consumers show interest in authenticity, wellness, and experiential treatiness.

- Competitive Landscape: The Mexican chocolate industry boasts a vibrant combination of local manufacturers and global companies, where competition is heating up through innovation in taste, packaging, sustainability of sources, and retail through the internet.

- Challenges and Opportunities: Though price sensitivity and supply chain issues hamper expansion, increased demand for sustainable cacao sources and health-focused formulations present strong opportunities amid the developing Mexico chocolate marketplace.

To get more information on this market Request Sample

Mexico Chocolate Market Trends:

Innovation in Flavor Profiles

One of the major factors driving Mexico's chocolate market growth is the launch of new and exotic flavor combinations. Native and unconventional ingredients, such as chili, cinnamon, mezcal, hibiscus and amaranth, are being incorporated to reimagine traditional tastes. In line with this, artisanal chocolatiers and premium brands are actively working to develop these profiles to set their products apart in an increasingly saturated market. For instance, in 2025, Nestlé introduced a new product, Choco Trio, a chocolate in bar form in Mexico to provide a sensory layered experience. Choco Trio, positioned as a local market first, combines three textures, crunchy, creamy and smooth, in one bar.

Rising Disposable Incomes and Premiumization

The growing middle-class population and rising economic mobility in Mexico have significantly boosted chocolate demand. Consumers are increasingly willing to spend on premium chocolate products, driving demand for high-quality imported and artisanal chocolates that offer superior taste, refined packaging, and premium ingredients. Currently, single-origin cacao, organic certification or gourmet flavor blends are key focus areas for brands in the segments. Moreover, the trend of gifting during holidays and celebrations is further propelling the sales of luxury chocolate items, which is providing a positive Mexico chocolate market outlook.

Health-Conscious Preferences and Product Innovation

The changing chocolate consumption habits, especially among urban, younger population, and the growing inclination toward nutrition and well-being are primary factors boosting the Mexico chocolate market share. Consumers are growing more conscious of ingredients, sugar levels, and processing methods, which has compelled the manufacturers to launch products line with high cacao levels, sugar-free, and organic or plant-based options. For instance, in 2023, Barry Callebaut launched SICAO Zero, a sugar-free chocolate line in the Mexican market. This product line is crafted to deliver high-quality, user-friendly, and affordable chocolate alternatives, targeting health-conscious consumers looking for guilt-free indulgence. Apart from this, key players are also launching new products that incorporates functional ingredients such as added fiber, superfoods or antioxidants, which align with wellness-centric lifestyles. Moreover, the rising focus on clean-label products, with few additives and preservatives, is another key factor supporting the market growth.

Mexico Chocolate Market Segmentation:

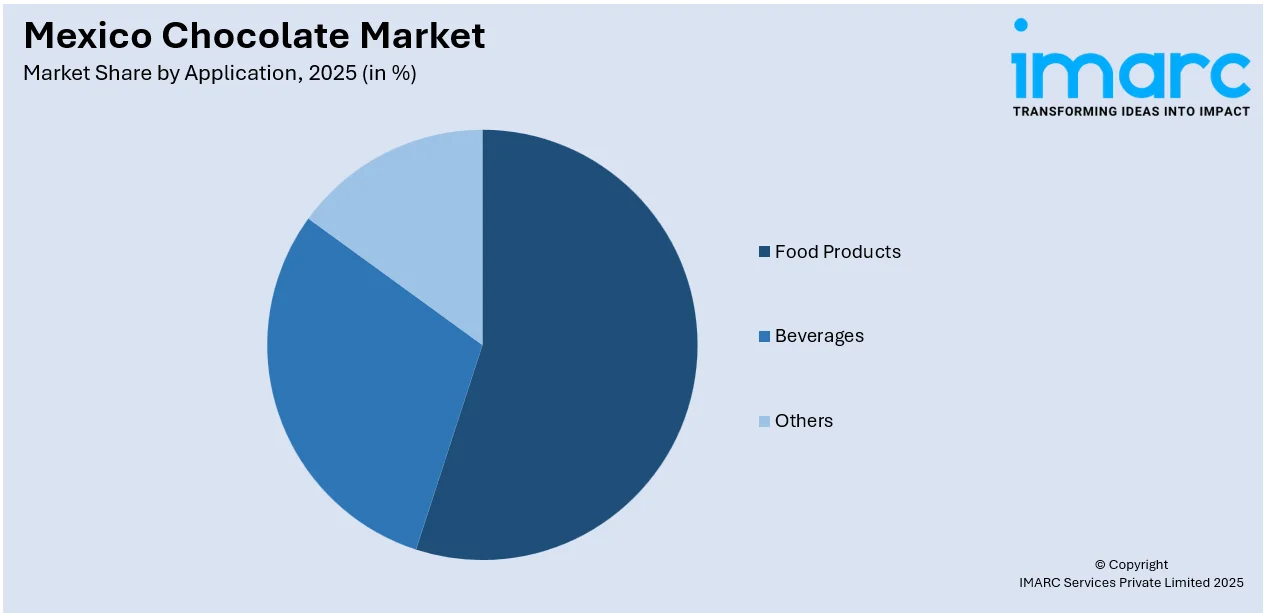

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, product form, application, pricing, and distribution.

Product Type Insights:

- White Chocolate

- Milk Chocolate

- Dark Chocolate

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes white chocolate, milk chocolate, dark chocolate, and others.

Product Form Insights:

- Molded

- Countlines

- Others

A detailed breakup and analysis of the market based on the Product Form have also been provided in the report. This includes molded, countlines, and others.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food Products

- Bakery Products

- Sugar Confectionery

- Desserts

- Others

- Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food products (bakery products, sugar confectionery, desserts, and others), beverages, and others.

Pricing Insights:

- Everyday Chocolate

- Premium Chocolate

- Seasonal Chocolate

A detailed breakup and analysis of the market based on the pricing have also been provided in the report. This includes everyday chocolate, premium chocolate, and seasonal chocolate.

Distribution Insights:

- Direct Sales (B2B)

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution have also been provided in the report. This includes direct sales (B2B), supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Chocolate Market News:

- In February 2025, the Mexican government launched the "Chocolate del Bienestar" program to support cacao farmers and provide affordable, high-quality chocolate through government-run stores. This initiative aims to strengthen the agricultural sector and improve consumer access to quality chocolate La Verdad Noticias.

- In 2025, Mondelēz’s Cocoa Life program pledged over USD 1 billion, including a new USD 600 million investment through 2030, to support sustainable cocoa farming. The initiative’s expansion in Mexico focuses on farmer empowerment, ethical sourcing, and supply chain transparency, reinforcing the country’s position in responsible chocolate production.

- In 2023, Barry Callebaut extended its long-standing chocolate supply agreement with Mars Wrigley in Mexico, reinforcing the strategic importance of the country in the global confectionery supply chain. Under the renewed deal, Barry Callebaut will continue to supply a wide range of chocolate products to Mars Wrigley’s manufacturing facilities in Mexico, ensuring consistent quality and volume for one of the world’s leading confectionery brands.

Mexico Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | White Chocolate, Milk Chocolate, Dark Chocolate, Others |

| Product Forms Covered | Molded, Countlines, Others |

| Applications Covered |

|

| Pricings Covered | Everyday Chocolate, Premium Chocolate, Seasonal Chocolate |

| Distributions Covered | Direct Sales (B2B), Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico chocolate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico chocolate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chocolate market in Mexico was valued at USD 2.4 Billion in 2025.

The Mexico chocolate market is projected to exhibit a (CAGR) of 3.97% during 2026-2034, reaching a value of USD 3.5 Billion by 2034.

The major drivers in the Mexico chocolate market are amplified consumer demand for indulgent snacks, increasing urbanization, and rising disposable incomes. Demand for premium and artisanal products, custom of chocolate as part of traditions, and improving retail access are other forces that affirm consumption growth within various demographic groups and domestic and foreign markets alike.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)