Mexico Cigarette Lighter Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, and Region, 2025-2033

Mexico Cigarette Lighter Market Overview:

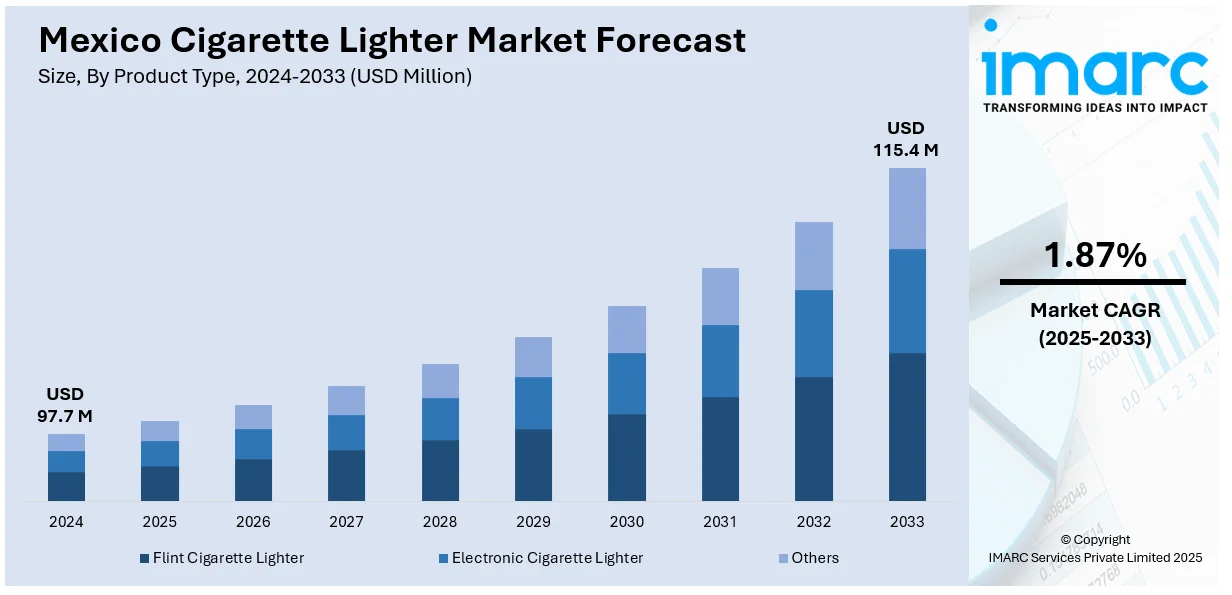

The Mexico cigarette lighter market size reached USD 97.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 115.4 Million by 2033, exhibiting a growth rate (CAGR) of 1.87% during 2025-2033. The market is driven by rising demand for eco-friendly and reusable lighters, stricter regulations on single-use plastics, and growing consumer preference for safety-focused electric lighters. Additionally, rapid urbanization, increased smoking rates, and the popularity of outdoor activities are further encouraging innovations and competition among manufacturers and augmenting the Mexico cigarette lighter market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 97.7 Million |

| Market Forecast in 2033 | USD 115.4 Million |

| Market Growth Rate 2025-2033 | 1.87% |

Mexico Cigarette Lighter Market Trends:

Growing Demand for Eco-Friendly and Reusable Lighters

The increasing shift toward eco-friendly and reusable lighters as environmental concerns rise among consumers is significantly supporting the Mexico cigarette lighter market growth. Traditional disposable lighters contribute to plastic waste, prompting brands to introduce sustainable alternatives such as refillable metal lighters, windproof models, and solar-powered options. Companies are also emphasizing durability and long-term use to appeal to cost-conscious buyers. Government regulations on single-use plastics further drive this trend, encouraging manufacturers to innovate with biodegradable materials and energy-efficient designs. With plastics accounting for 3.14% of Mexico’s manufacturing GDP in 2023, the industry is under increasing pressure as regulations around single-use plastics and sustainability transform. This has fueled the encouragement of the adoption of a circular economy, with more than 1.68 million tons of annual plastic waste being recycled and reforms to merge existing federal and state laws awaiting approval. These changes are expected to impact adjacent markets, such as Mexico’s cigarette lighter market, which depends significantly on plastic parts and packaging compliance. Additionally, premium reusable lighters are gaining popularity as stylish accessories, particularly among younger demographics. As sustainability becomes a key purchasing factor, brands that prioritize eco-conscious products are likely to capture a larger market share in Mexico’s changing lighter industry.

Increasing Popularity of Electric and Flameless Lighters

The growing demand for electric and flameless lighters, driven by safety concerns and technological advancements is creating a positive Mexico cigarette lighter market outlook. Unlike traditional flame lighters, electric models use plasma arcs or heating coils, reducing fire hazards and offering wind-resistant performance. These lighters are rechargeable via USB, appealing to tech-savvy consumers seeking convenience and cost efficiency. In 2024, 19% of Mexicans 20 and older were smokers, and nearly 975,000 were considered active e-cigarette users. It is also reshaping Mexico’s nicotine landscape despite the presence of rigorous prohibitions on sales and marketing. Supported by annual cigarette sales amounting to 48 billion, major brands are investing in sleek, portable lighter designs with extended battery life to attract urban and younger consumers. With increasing awareness of fire safety and a preference for modern gadgets, electric lighters are expected to see steady growth in Mexico, reshaping the competitive landscape of the lighter industry.

Mexico Cigarette Lighter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, material type, and distribution channel.

Product Type Insights:

- Flint Cigarette Lighter

- Electronic Cigarette Lighter

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes flint cigarette lighter, electronic cigarette lighter, and others.

Material Type Insights:

- Metal

- Plastic

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes metal, plastic, and others.

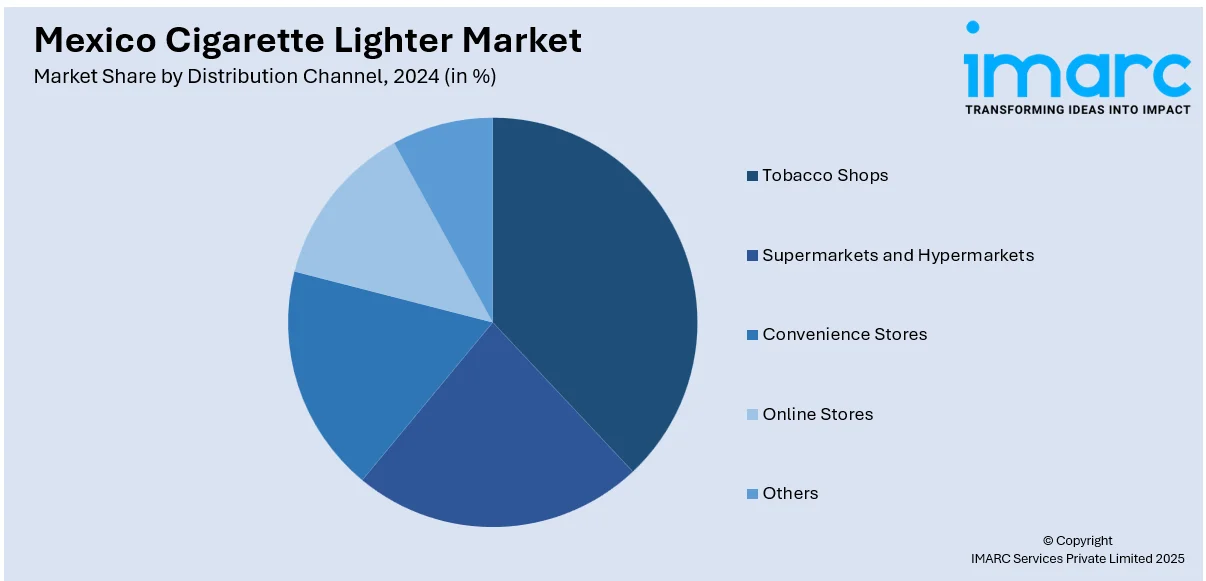

Distribution Channel Insights:

- Tobacco Shops

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes tobacco shops, supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cigarette Lighter Market News:

- June 04, 2024: BIC, known for the manufacturing of clipper lighters, expanded its Ramos Arizpe site facility in Saltillo, Mexico, thus enhancing its manufacturing capacity and marking 15 years of operations in the area. The plant, which began production as a shaver packager in 2009, currently has nearly 800 employees and has since broadened its product offering to include markers and mechanical pencils. This investment reinforces BIC's strategic position as a leader in the Mexican cigarette lighter market and its commitment to innovation and quality for export.

Mexico Cigarette Lighter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Flint Cigarette Lighter, Electronic Cigarette Lighter, Others |

| Material Types Covered | Metal, Plastic, Others |

| Distribution Channels Covered | Tobacco Shops, Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cigarette lighter market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cigarette lighter market on the basis of product type?

- What is the breakup of the Mexico cigarette lighter market on the basis of material type?

- What is the breakup of the Mexico cigarette lighter market on the basis of distribution channel?

- What is the breakup of the Mexico cigarette lighter market on the basis of region?

- What are the various stages in the value chain of the Mexico cigarette lighter market?

- What are the key driving factors and challenges in the Mexico cigarette lighter market?

- What is the structure of the Mexico cigarette lighter market and who are the key players?

- What is the degree of competition in the Mexico cigarette lighter market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cigarette lighter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cigarette lighter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cigarette lighter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)