Mexico Co-Working Office Space Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Mexico Co-Working Office Space Market Overview:

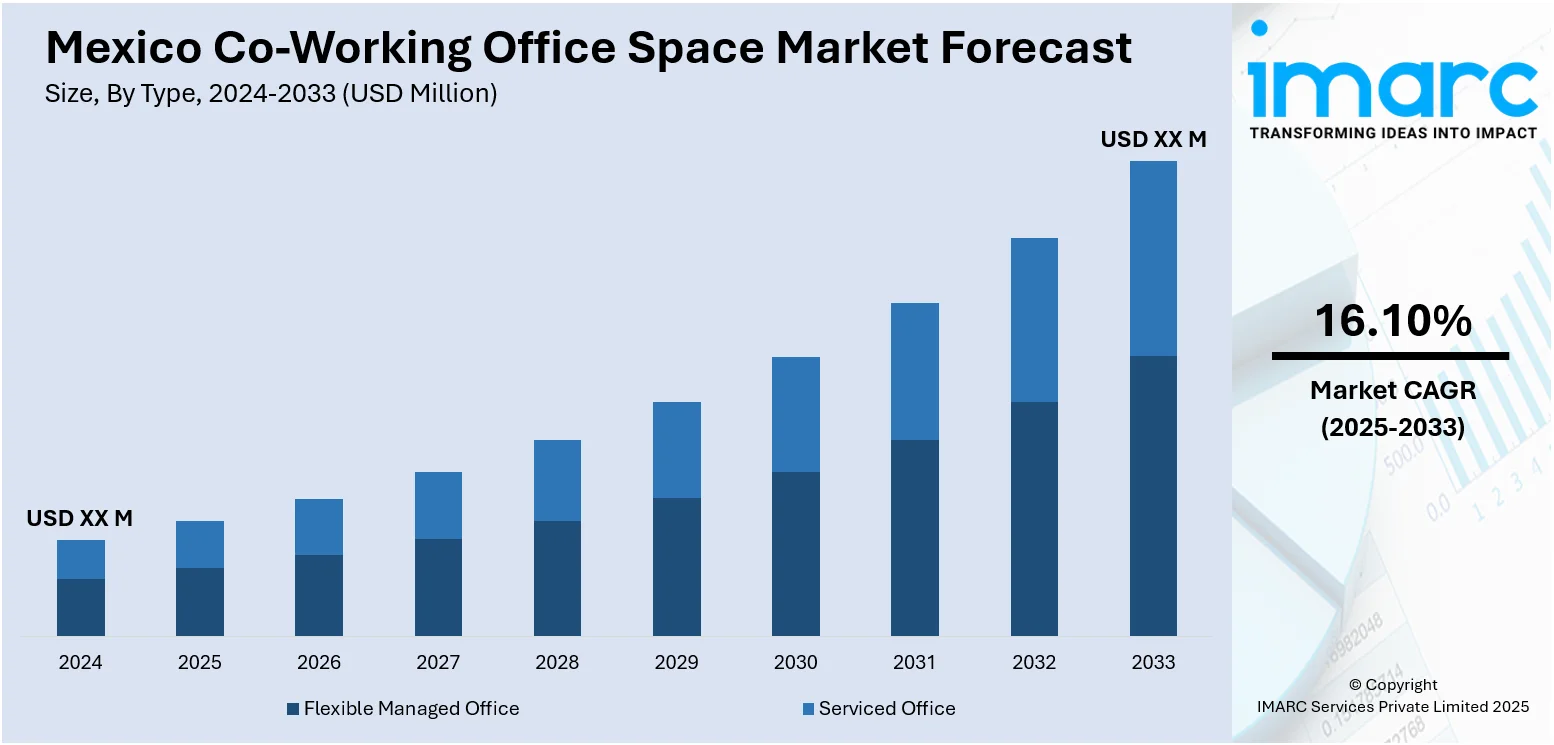

The Mexico co-working office space market size is projected to exhibit a growth rate (CAGR) of 16.10% during 2025-2033. At present, the broadening of tech companies is driving the demand for flexible, scalable, and innovation-friendly work environments. Startups continue to benefit from the shared amenities, minimized overhead costs, and access to like-minded professionals. Besides this, freelancers, digital nomads, and contract workers are employing efficient hubs to collaborate, attend events, and stay connected with industry peers. This is fueling the Mexico co-working office space market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 16.10% |

Mexico Co-Working Office Space Market Trends:

Expansion of tech companies

The expansion of tech companies is positively influencing the market in Mexico. As more tech startups and established IT firms are emerging in cities like Mexico City, Guadalajara, and Monterrey, the need for dynamic office solutions is growing rapidly. Tech companies often prefer co-working spaces because they offer modern infrastructure, high-speed connectivity, and collaborative settings that align with their fast-paced and agile operations. These companies value the ability to scale up or down without long-term lease commitments, making co-working spaces an ideal choice. Moreover, co-working hubs foster a culture of innovation, networking, and knowledge exchange. Startups especially benefit from the shared amenities, reduced overhead costs, and access to like-minded professionals. Many co-working spaces also organize events, hackathons, and workshops, which aid in attracting and supporting the tech community. In addition, international tech firms entering the Mexican market are using co-working spaces for initial operations before setting up permanent offices. This trend is facilitating the continuous growth of co-working infrastructure in tech-heavy zones. As the information technology industry is expanding, it is catalyzing the demand for co-working environments that offer flexibility, creativity, and a vibrant professional network, thereby strengthening the market in Mexico. As per industry reports, the Mexico IT industry is expected to attain an impressive market value of USD 18 Billion by 2028.

To get more information on this market, Request Sample

Rising remote workforce

Increasing remote workforce is impelling the Mexico co-working office space market growth. As more companies are adopting remote or hybrid work models, employees continue to seek spaces that offer a productive atmosphere with reliable internet, office amenities, and a sense of community. As per industry reports, in 2024, more than one-third of job hunters favored a hybrid model in Mexico. Co-working spaces meet these needs by providing well-equipped workstations, meeting rooms, and networking opportunities. Remote professionals prefer these spaces to avoid distractions at home and to maintain a work-life balance. Freelancers, digital nomads, and contract workers are also employing co-working hubs to collaborate, attend events, and stay connected with industry peers. Businesses with remote teams are utilizing these spaces as satellite offices or for occasional team gatherings. This shift in work culture is encouraging co-working providers to expand their presence in cities like Mexico City, Monterrey, and Guadalajara. The convenience, cost-efficiency, and social interaction that co-working spaces offer continue to attract the growing remote workforce, strengthening the market across Mexico.

Mexico Co-Working Office Space Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Flexible Managed Office

- Serviced Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes flexible managed office and serviced office.

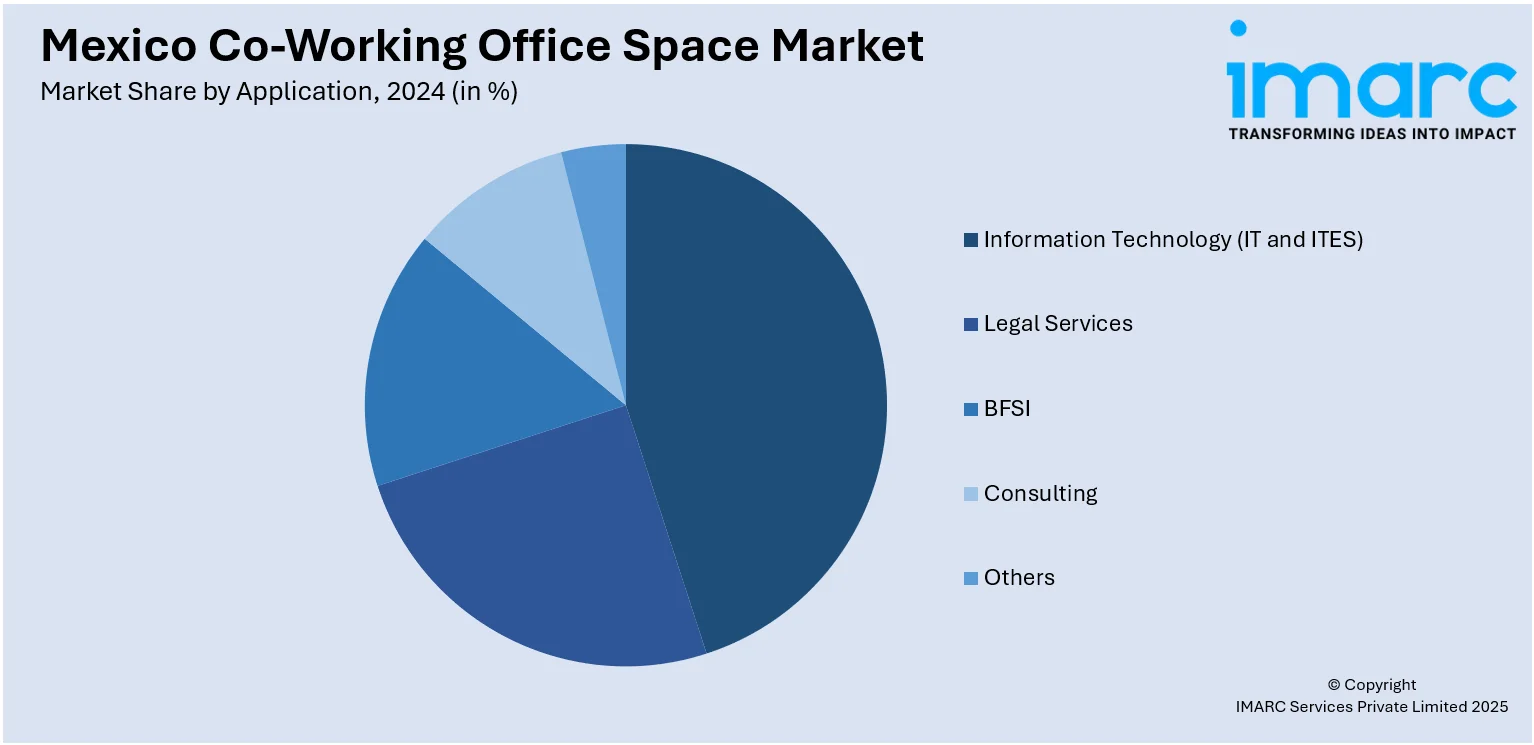

Application Insights:

- Information Technology (IT and ITES)

- Legal Services

- BFSI

- Consulting

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes information technology (IT and ITES), legal services, BFSI, consulting, and others.

End User Insights:

- Personal User

- Small Scale Company

- Large Scale Company

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes personal user, small scale company, large scale company, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Co-Working Office Space Market News:

- In February 2024, Spaces announced plans to launch a new 1,300-square-meter coworking hub in Torres Obispado in Monterrey, the tallest building in Mexico and Latin America. The adaptable office area offered practicality, outstanding design, and a prime location to enhance business efficiency and innovation.

Mexico Co-Working Office Space Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flexible Managed Office, Serviced Office |

| Applications Covered | Information Technology (IT and ITES), Legal Services, BFSI, Consulting, Others |

| End Users Covered | Personal User, Small Scale Company, Large Scale Company, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico co-working office space market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico co-working office space market on the basis of type?

- What is the breakup of the Mexico co-working office space market on the basis of application?

- What is the breakup of the Mexico co-working office space market on the basis of end user?

- What is the breakup of the Mexico co-working office space market on the basis of region?

- What are the various stages in the value chain of the Mexico co-working office space market?

- What are the key driving factors and challenges in the Mexico co-working office space market?

- What is the structure of the Mexico co-working office space market and who are the key players?

- What is the degree of competition in the Mexico co-working office space market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico co-working office space market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico co-working office space market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico co-working office space industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)