Mexico Commercial Kitchen Appliances Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, and Region, 2025-2033

Mexico Commercial Kitchen Appliances Market Overview:

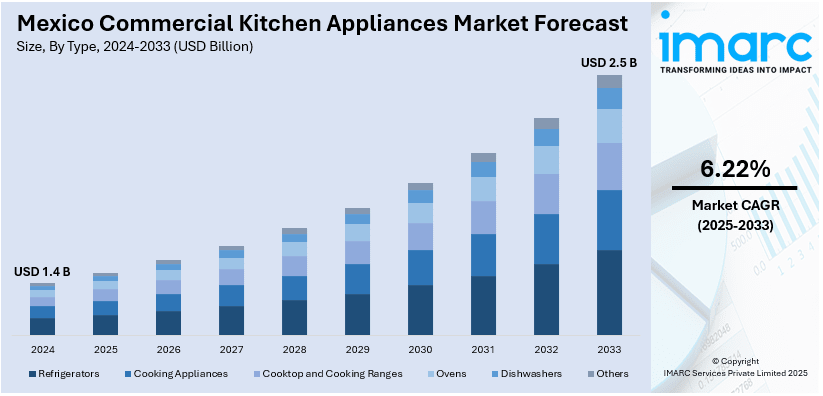

The Mexico commercial kitchen appliances market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.22% during 2025-2033. The market is led by the increasing demand for convenience, rising investments by the foodservice industry, and expansion by fast-food chains. Moreover, trends toward technology, energy efficiency, along with government support for the hospitality industry and infrastructure development, and escalating consumer desire for better quality food also drive the Mexico commercial kitchen appliances market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Market Growth Rate 2025-2033 | 6.22% |

Mexico Commercial Kitchen Appliances Market Trends:

Adoption of Energy-Efficient Appliances

Increased demand for sustainability is compelling the use of energy-efficient commercial kitchen appliances in Mexico. As the cost of energy increases and concerns regarding the environment continue to rise, small as well as large foodservice businesses are looking for appliances that consume less energy and cut operational costs. Energy-saving appliances, like induction cooking, energy-saving refrigerators, and high-efficiency dishwashers, are finding favor with commercial kitchens. These appliances cut electricity bills and also assists in fulfilling environmental requirements and company sustainability objectives. Industry pressure for environmentally friendly solutions is backed by technological developments in intelligent kitchen appliances that maximize power use. In Mexico, where power consumption is a primary consideration for companies, the trend is gaining momentum as growing numbers of foodservice companies see the long-term advantages of investing in energy-saving technologies. This trend is expected to continue increasing as the government adopts tighter energy rules and incentives for green practices, further propelling the Mexico commercial kitchen appliances market share growth.

Smart Kitchen Appliances Integration

The inclusion of smart technology in business kitchen appliances is one of the major trends influencing the Mexican market. The appliances, such as Wi-Fi-connected refrigerators, smart ovens, and connected dishwashers, provide better control and efficiency. Restaurant owners and chefs can monitor and control kitchen operations remotely through mobile applications, thereby providing optimal performance, minimizing downtime, and ensuring increased consistency in food quality. Furthermore, predictive maintenance warns users of potential problems before they escalate into expensive issues. In Mexico, where the foodservice business is more competitive, smart appliances present companies with the chance to reduce operations, increase productivity, and decrease labor costs. The phenomenon is especially strong in large foodservice businesses like hotels, resorts, and chains, while it is also increasingly being adopted into smaller operations. As more Mexican operators introduce technology, the need for smart, connected kitchen equipment will keep growing.

Growth of Cloud Kitchens and Delivery Services

The Mexico commercial kitchen appliances outlook is witnessing the growth of cloud kitchens and delivery-only food outlets. Cloud kitchens or virtual kitchens have become increasingly popular with the increasing trend toward online ordering and delivery of food. These units do not have a dine-in space, and all activity is confined to the kitchen to cater to order deliveries. The demand for effective, high-performance kitchen equipment that can accommodate higher demand for delivery-only food is driving the market for specialty appliances. High-capacity ovens, food warming units, and automated cooking machines are in demand. Flexibility and space optimization are also a priority for cloud kitchens, which is fueling demand for compact, multi-functional appliances. In Mexico, where food delivery platforms such as UberEats and Rappi are doing well, this trend is driving the growth of the commercial kitchen appliance market, with an increasing number of operators embracing technology-based solutions to enable high-volume delivery operations.

Mexico Commercial Kitchen Appliances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, distribution channel, and application.

Type Insights:

- Refrigerators

- Cooking Appliances

- Cooktop and Cooking Ranges

- Ovens

- Dishwashers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes refrigerators, cooking appliances, cooktop and cooking ranges, ovens, dishwashers, and others.

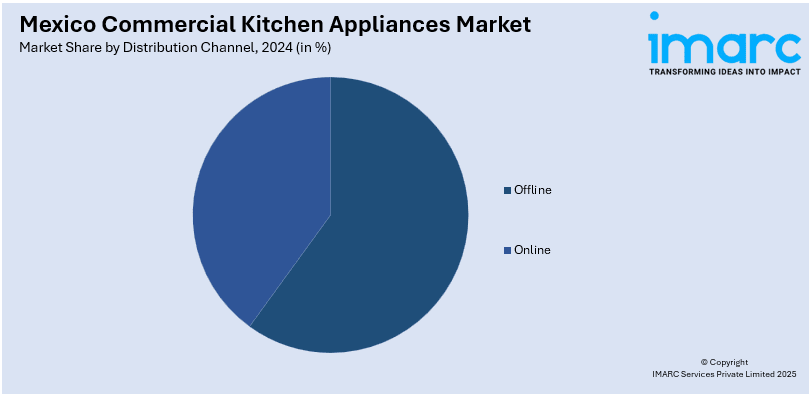

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Application Insights:

- Quick Service Restaurant (QSR)

- Railway Dining

- Institutional Canteen

- Resort and Hotel

- Hospital

- Full Service Restaurant (FSR)

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes quick service restaurant (QSR), railway dining, institutional canteen, resort and hotel, hospital, full service restaurant (FSR), and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Commercial Kitchen Appliances Market News:

- In January 2024, LG Electronics (LG) revealed the launch of a new scroll compressor manufacturing line at its plant in Monterrey, Mexico. The new production line enhances LG’s scroll compressor manufacturing capabilities, allowing the company to generate more of its renowned, environmentally friendly solutions while establishing a more efficient supply chain for serving customers in North America.

Mexico Commercial Kitchen Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Refrigerators, Cooking Appliances, Cooktop and Cooking Ranges, Ovens, Dishwashers, Others |

| Distribution Channels Covered | Offline, Online |

| Applications Covered | Quick Service Restaurant (QSR), Railway Dining, Institutional Canteen, Resort and Hotel, Hospital, Full Service Restaurant (FSR), Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico commercial kitchen appliances market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico commercial kitchen appliances market on the basis of type?

- What is the breakup of the Mexico commercial kitchen appliances market on the basis of distribution channel?

- What is the breakup of the Mexico commercial kitchen appliances market on the basis of application?

- What is the breakup of the Mexico commercial kitchen appliances market on the basis of region?

- What are the various stages in the value chain of the Mexico commercial kitchen appliances market?

- What are the key driving factors and challenges in the Mexico commercial kitchen appliances market?

- What is the structure of the Mexico commercial kitchen appliances market and who are the key players?

- What is the degree of competition in the Mexico commercial kitchen appliances market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico commercial kitchen appliances market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico commercial kitchen appliances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico commercial kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)