Mexico Commercial Real Estate Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Mexico Commercial Real Estate Market Overview:

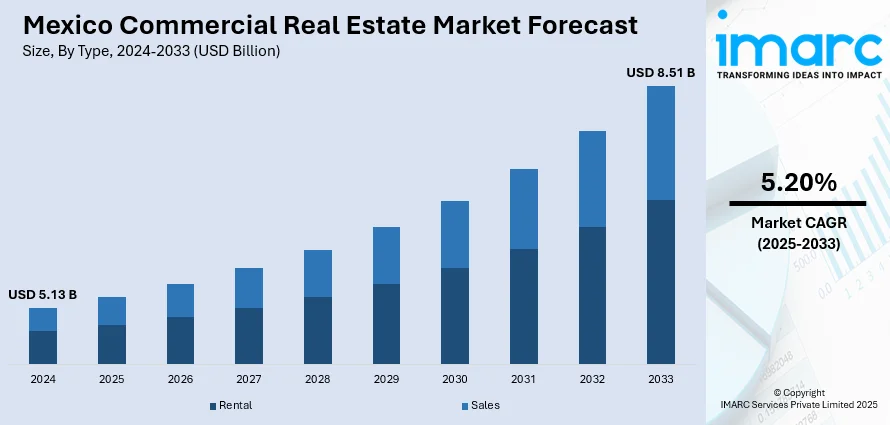

The Mexico commercial real estate market size reached USD 5.13 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.51 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is evolving with changing urban trends and digital retail growth. Retail spaces are shifting toward mixed-use, experiential formats, while offices emphasize flexibility and sustainability. Developers are retrofitting properties to meet new tenant needs, including environmental, social, and governance (ESG) standards and tech upgrades. Additionally, e-commerce growth is catalyzing the demand for last-mile hubs and modular fulfillment centers. These shifts are redefining Mexico commercial real estate market share dynamics, emphasizing adaptive, user-centric developments in both urban centers and logistics-focused areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.13 Billion |

| Market Forecast in 2033 | USD 8.51 Billion |

| Market Growth Rate 2025-2033 | 5.20% |

Mexico Commercial Real Estate Market Trends:

Retail and Office Space Reconfiguration

Urban development and changing user trends are transforming the organization and functionality of commercial real estate in Mexico's urban centers. Retail environments are no longer solely focused on transactions, but are being transformed into experiential centers that combine leisure, wellness, and digital shopping solutions. Developers are redirecting their attention to mixed-use spaces that accommodate evolving lifestyles. In the office segment, the rise of remote and hybrid work models is redefining space requirements, emphasizing flexible layouts, strategic locations, and environmentally sustainable design. Premium office properties in major cities are progressively appealing to multinational companies looking for regional headquarters or service centers. As a result, property owners are updating current structures, conforming to ESG standards, and implementing innovative technologies to improve flexibility and user satisfaction. The focus is shifting from growth solely for expansion's sake to redevelopment that adds value and customization tailored to tenants. A significant instance of this trend is the 2025 purchase by Industrial Realty Group (IRG), which, via its subsidiary Industrial Realty Mexico (IRM), acquired a 121,608 sq. ft. ex-Lowe’s location in Hermosillo. IRG's 11th property in the nation is anticipated to be converted for retail or industrial use depending on market trends. This purchase signifies a wider strategic change in the market, which is favoring adaptable, demand-driven repurposing of key urban locations that correspond with the evolving requirements of tenants and clients. Overall, the Mexico commercial real estate market growth is being influenced by the construction of smarter, more sustainable, and user-oriented developments.

Growth of E-Commerce and Fulfillment Infrastructure

The rapid expansion of e-commerce in Mexico is significantly reshaping the logistics and commercial real estate environment, leading to ongoing demand for last-mile delivery hubs, dark stores, and regional fulfillment centers. As digital retail becomes entrenched in everyday consumer behavior, businesses are facing increasing pressure to offer faster deliveries, enhanced inventory control, and broader geographic coverage. This is encouraging logistics providers and retailers to target commercial spaces in urban outskirts, major transportation corridors, and densely populated residential zones. In response, developers are building modular and scalable facilities that support specialized e-commerce operations, such as cross-docking, sorting, and returns processing. The intense rivalry for strategically positioned warehouse space is reducing vacancy rates and driving lease prices higher in major logistics markets. This structural transformation is initiating a prolonged phase of investment centered on commercial real estate designed for quickness, effectiveness, and digital retail integration. Aiding this transition, Mexico's e-commerce sector hit USD 47.5 billion in 2024 and is expected to rise to USD 176.6 billion by 2033, with a CAGR of 14.5% from 2025 to 2033, as reported by the IMARC Group. These figures underscore the immense and sustained momentum behind e-commerce, reinforcing the need for a resilient logistics infrastructure. As a result, the commercial real estate industry is pivoting decisively toward facilities that align with the demands of a rapidly digitizing retail ecosystem, fundamentally redefining space use, location strategy, and development priorities in Mexico.

Mexico Commercial Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Rental

- Sales

The report has provided a detailed breakup and analysis of the market based on the type. This includes rental and sales.

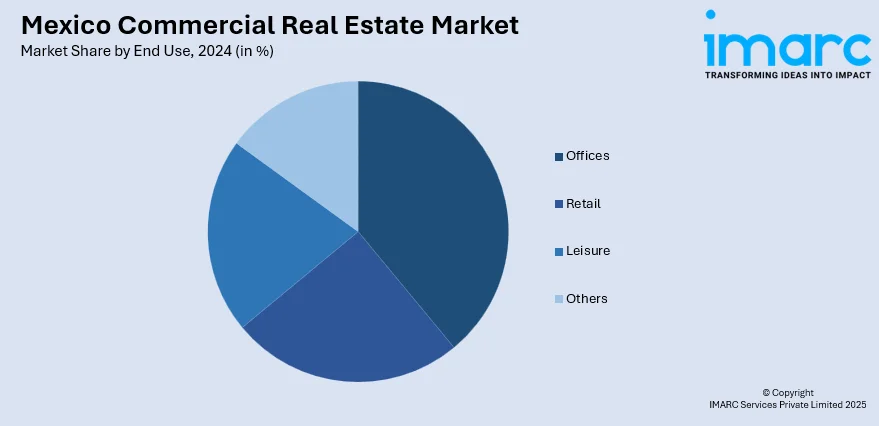

End Use Insights:

- Offices

- Retail

- Leisure

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes offices, retail, leisure, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Commercial Real Estate Market News:

- In March 2025, Walmart Mexico (Walmex) announced a $6 billion investment for the year—triple its 2024 spending. The funds will be used to open new stores and complete two distribution centers.

- In August 2024, Emergent Cold Latin America announced a new temperature-controlled food warehouse in Guadalajara, Mexico, with a capacity of 12,000 pallet positions. The move aimed to support the rapid expansion and strengthen logistics links to key Mexican ports.

Mexico Commercial Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rental, Sales |

| End Uses Covered | Offices, Retail, Leisure, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico commercial real estate market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico commercial real estate market on the basis of type?

- What is the breakup of the Mexico commercial real estate market on the basis of end use?

- What is the breakup of the Mexico commercial real estate market on the basis of region?

- What are the various stages in the value chain of the Mexico commercial real estate market?

- What are the key driving factors and challenges in the Mexico commercial real estate market?

- What is the structure of the Mexico commercial real estate market and who are the key players?

- What is the degree of competition in the Mexico commercial real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico commercial real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico commercial real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico commercial real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)