Mexico Community Cloud Market Size, Share, Trends and Forecast by Component, Application, Industry Vertical, and Region, 2025-2033

Mexico Community Cloud Market Overview:

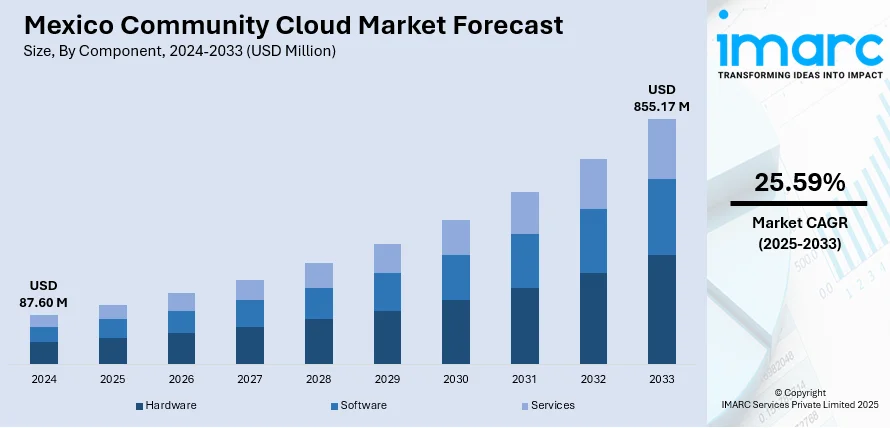

The Mexico community cloud market size reached USD 87.60 Million in 2024. The market is projected to reach USD 855.17 Million by 2033, exhibiting a growth rate (CAGR) of 25.59% during 2025-2033. The market is driven by growing demand for locally stored data management, regulatory requirements, and shared digital infrastructure collaboration. Government, healthcare, education, and finance industries are embracing community cloud implementations to increase operational efficiency while maintaining data security and sovereignty. Shared environments are an economically viable option for institutions with the same compliance and performance expectations. As digital transformation speeds up across the country, the above trends are heavily supporting the growth of Mexico community cloud market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 87.60 Million |

| Market Forecast in 2033 | USD 855.17 Million |

| Market Growth Rate 2025-2033 | 25.59% |

Mexico Community Cloud Market Trends:

Increased Demand for Data Sovereignty and Regulation Compliance

There is a significant trend in Mexico toward localized cloud solutions fueled by increasing concerns about data sovereignty and regulatory compliance. Organizations dealing with sensitive information governmental bodies, healthcare, and education institutions—most commonly utilize community cloud infrastructure to have their data stored and processed within the territorial laws of the country. According to the sources, in December 2024, Google Cloud welcomed its Querétaro region its third in Latin America providing low-latency services, local data residency, and AI infrastructure to enable public sector and business innovation, increasing Mexico community cloud market share. Moreover, this need is being fueled by changing national policies that require greater control over how organizational and personal data is handled. The community cloud model is well-poised to address these needs, providing shared infrastructure for organizations with comparable compliance requirements while ensuring robust data segregation and policy enforcement. The community cloud framework enables cost-effectiveness, operational standardization, and centralized control, which renders it a desirable option as opposed to public and private cloud solutions. These benefits are driving Mexico community cloud market growth, particularly as confidence and regulatory compliance become integral aspects of institution digital transformation programs throughout the nation.

To get more information on this market, Request Sample

Increased Integration with Public Sector and Smart Government Programs

Implementation of community cloud infrastructure is picking up across Mexico's public sector in general as part of larger efforts at modernizing administrative processes and facilitating digital governance. Community clouds provide a strong infrastructure that enables multiple government agencies and departments to securely share services and infrastructure, minimizing redundancy and maximizing operational efficiency. This common model ties in with the nation's smart government programs, which seek to improve transparency, accessibility, and responsiveness through harmonized digital platforms. By facilitating standardized applications, safe data exchange, and shared resource management, community clouds are important to providing uniform service delivery on a regional and municipal level. The centralized strategy also enables greater control and quicker implementation, as well as national policy reforms. These advances underscore some of the most important Mexico community cloud market trends, in which strategic cloud adoption is not merely a technology upgrade but a facilitator for policy implementation and public engagement in scale across government tiers.

Sector-Specific Cloud Adoption Fueling Targeted Infrastructure Demand

Mexico's increasing dependence on digital infrastructure in sectors like education, healthcare, and finance is driving a steep spike in demand for community cloud platforms. These industries demand cloud environments that not only cater to general computing and storage but also address each industry's specific compliance, performance, and workflow requirements. Community clouds address this need by providing industry-specific tailoring while providing cost-sharing across institutions sharing similar operating models. In education, for example, these platforms provide shared research environments, secure student data management, and shared e-learning tools. In the healthcare sector, they enable safe sharing of patient data and compliance with regulations, especially under local privacy regulation. Banking and financial institutions enjoy joint, secure platforms that are compliant with anti-money laundering and financial reporting requirements. The community model facilitates better data governance and industry-specific innovation, driving Mexico community cloud market growth through addressing the intricate needs of regulated sectors while enabling scalable, compliant digital transformation.

Mexico Community Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application, and industry vertical.

Component Insights:

- Hardware

- Server

- Networking

- Storage

- Others

- Software

- Enterprise Application Software

- Collaboration Tools Software

- Dashboards Business Intelligence Software

- Services

- Training Services

- Maintenance and Support

- Regulation and Compliance

- Consulting

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (server, networking, storage, and others), software (enterprise application software, collaboration tools software, and dashboards business intelligence software), and services (training services, maintenance and support, regulation and compliance, and consulting).

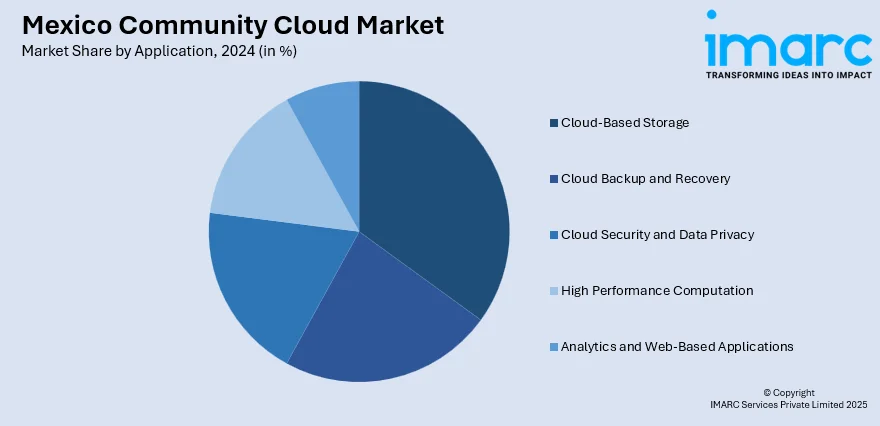

Application Insights:

- Cloud-Based Storage

- Cloud Backup and Recovery

- Cloud Security and Data Privacy

- High Performance Computation

- Analytics and Web-Based Applications

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cloud-based storage, cloud backup and recovery, cloud security and data privacy, high performance computation, and analytics and web-based applications.

Industry Vertical Insights:

- BFSI

- Gaming

- Government

- Healthcare

- Education

- Others

The report has provided a detailed breakup and analysis of the market based on the industrial vertical. This includes BFSI, gaming, government, healthcare, education, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Community Cloud Market News:

- In February 2025, Alibaba Cloud opened its first cloud region in Mexico, which will offer scalable and secure cloud services to enable local innovation, digital transformation, and data residency. The new infrastructure will cater to sectors like e-commerce, finance, and telecom, and enhance Mexico as a regional technology hub.

- In January 2025, AWS opened its initial cloud region in Mexico in Querétaro with three Availability Zones. Facilitating data residency, AI ability, and compliance, the region enhances digital infrastructure and fuels Mexico community cloud market share through a projected $5 billion investment within a period of 15 years.

Mexico Community Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Cloud-Based Storage, Cloud Backup and Recovery, Cloud Security and Data Privacy, High Performance Computation, Analytics and Web-Based Applications |

| Industry Verticals Covered | BFSI, Gaming, Government, Healthcare, Education, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico community cloud market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico community cloud market on the basis of component?

- What is the breakup of the Mexico community cloud market on the basis of application?

- What is the breakup of the Mexico community cloud market on the basis of industrial vertical?

- What is the breakup of the Mexico community cloud market on the basis of region?

- What are the various stages in the value chain of the Mexico community cloud market?

- What are the key driving factors and challenges in the Mexico community cloud?

- What is the structure of the Mexico community cloud market and who are the key players?

- What is the degree of competition in the Mexico community cloud market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico community cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico community cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico community cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)