Mexico Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2025-2033

Mexico Confectionery Market Overview:

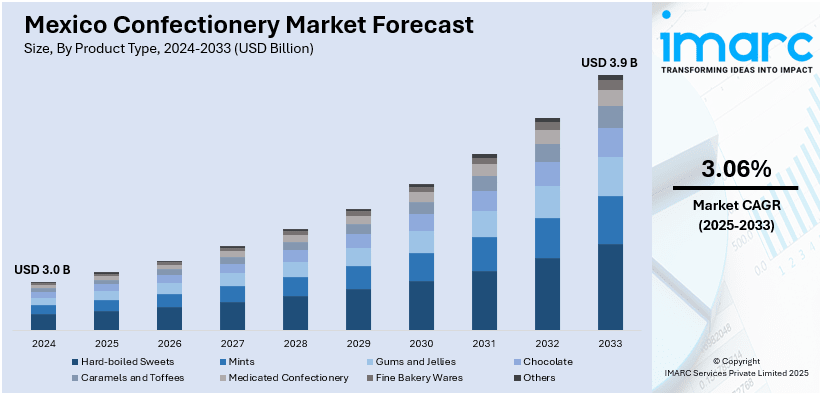

The Mexico confectionery market size reached USD 3.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.9 Billion by 2033, exhibiting a growth rate (CAGR) of 3.06% during 2025-2033. The market is growing steadily with high consumer base, rising urbanization, and a solid cultural predisposition toward sweets, driven by steady demand across age groups and distribution channels to its sustained performance and favorable long-term prospects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.0 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Market Growth Rate 2025-2033 | 3.06% |

Mexico Confectionery Market Trends:

Premiumization and Artisanal Confectionery Development

The Mexico confectionery industry is being fundamentally reshaped by a growing appetite for artisan and premium goods. Consumers increasingly seek sweets that manifest high-end ingredients, subtle and refined flavors, and an apparent sense of uniqueness. The phenomenon is highly prominent among middle- and higher-income consumers who evince an ability to spend money on items offering more differentiated sensory experiences and aesthetic presentation. Handcrafted confections tend to include local elements, including indigenous fruits and heritage recipes, which resonate with the cultural values of local consumers. For example, in August of 2024, La Monarca Bakery extended its packaged Mexican cookies and drinks to all 43 Northgate Markets increasing retail availability of culturally based products such as Café de Olla and Wedding Cookies. Furthermore, these products are often supplemented by sophisticated packaging and storytelling that emphasizes craftsmanship and heritage. The trend towards premiumization in the confectionery sector aligns with a broader global shift that emphasizes quality over quantity, particularly within indulgent product categories. The Mexico confectionery market outlook remains positive since as ongoing innovation within the industry is inspiring consumer participation, spurring diversification of brands, and getting both local business owners and worldwide investors with differentiated offerings.

Health-Oriented Reformulation and Functional Ingredients

One of the leading trends in the Mexico confectionery market is reformulation to support the growing consumer focus on health and wellness. There is accelerating demand for confections with lower sugar, natural sweeteners, and added functional benefits like vitamins, minerals, and plant-based ingredients. These changes are being driven by a better-informed consumer who actively demands indulgent choices that do not sacrifice dietary aims. The creation of products appropriate for diabetics, along with allergen-free options, is an example of the industry's responsiveness to contemporary nutritional needs. Retail environments are also responding, with more prominence and availability of health-aware confectionery products. Mexico confectionery market growth is aided by this trend, as producers who position their products in line with wellness trends will be better equipped to capture changing market segments. This movement towards functional and reformulated confections reflects a long-term shift in consumption habits based on health-consciousness and guilt-free indulgence.

Cultural and Seasonal Innovation in Product Offerings

Seasonally and culturally themed innovation remain key drivers of product development in Mexico’s confectionery market. Numerous confectionery products are specially designed to align with major cultural celebrations like Día de los Muertos, Christmas, and national public holidays, on which traditional sweets see heightened demand. These events present manufacturers with the chance to launch limited-edition flavors, celebratory packaging, and regionally themed variants that speak strongly with buyers. Such seasonal activity not only reaffirms the cultural significance of confectionery but also sustains brand loyalty by appealing to nostalgia and emotional ties. For instance, in December 2024, Mexican soda brand Jarritos rolled out a candy line consisting of gummies and lollipops in pineapple, mango, lime, fruit punch, tamarind, and mandarin flavors. Moreover, regional translations also enable producers to customize their products to suit local taste cultures, ensuring sustained consumer interest in various geographic markets. Mexico confectionery market share stands to gain from such a strategic move, which aligns product innovation with the national culture calendar. Through combining heritage with new design and formulation, the industry continues to reinforce its position in community traditions while increasing its presence in modern consumer culture.

Mexico Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

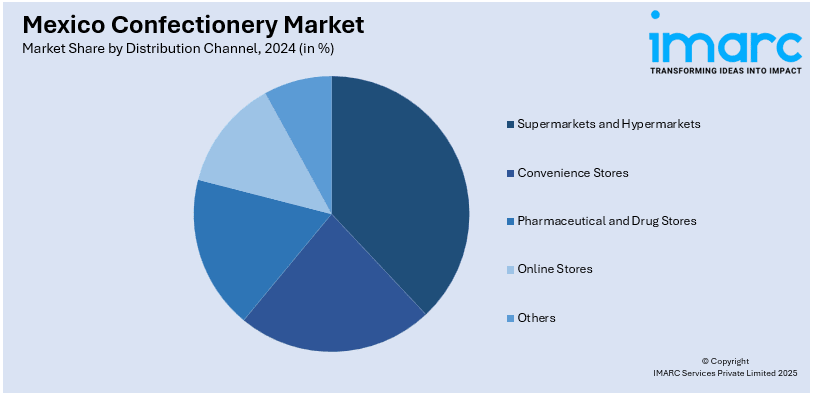

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Confectionery Market News:

- In February 2025, Mexico introduced "Chocolate del Bienestar," a state-sponsored program providing quality, affordable chocolate via state-owned outlets. The program seeks to provide support for sustainable farming by buying directly from farmers producing cacao for fair prices, thus contributing to national food sovereignty along the confectionery value chain.

- In November 2024, Nestlé launched Choco Trio in Mexico, a new chocolate portfolio that takes inspiration from worldwide culinary traditions. The launch signals an increasing consumer desire for high-quality, experience-driven confectionery and reflects market trends for internationally inspired flavors and creative formats in the shifting landscape of Mexico's sweets and chocolate market.

- In August 2024, Coca-Cola and OREO introduced limited-edition Coca-Cola® OREO™ Zero Sugar and OREO® Coca-Cola™ Sandwich Cookies in Mexico. The partnership features co-branded packaging and digital "Bestie Mode" experiences, with products at select retailers across the country as part of a global campaign honoring friendship and iconic brand fusion.

Mexico Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico confectionery market on the basis of product type?

- What is the breakup of the Mexico confectionery market on the basis of age group?

- What is the breakup of the Mexico confectionery market on the basis of price point?

- What is the breakup of the Mexico confectionery market on the basis of distribution channel?

- What is the breakup of the Mexico confectionery market on the basis of region?

- What are the various stages in the value chain of the Mexico confectionery market?

- What are the key driving factors and challenges in the Mexico confectionery?

- What is the structure of the Mexico confectionery market and who are the key players?

- What is the degree of competition in the Mexico confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)