Mexico Connected Vehicles Market Size, Share, Trends and Forecast by Technology, Application, Connectivity, Vehicle Connectivity, Vehicle, and Region, 2025-2033

Mexico Connected Vehicles Market Overview:

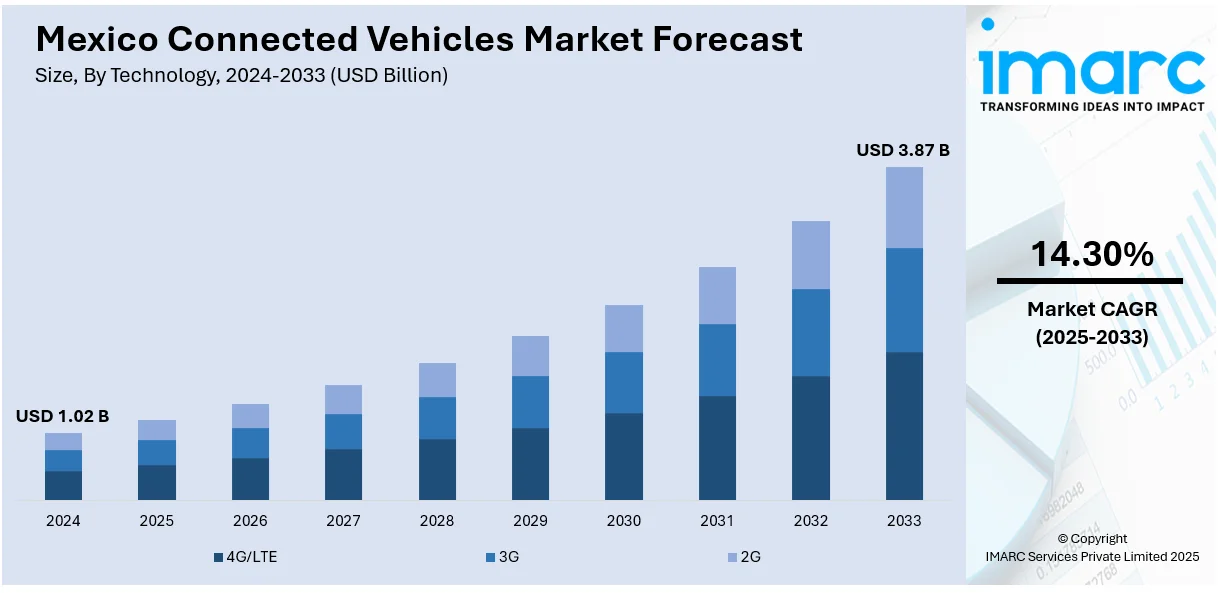

The Mexico connected vehicles market size reached USD 1.02 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.87 Billion by 2033, exhibiting a growth rate (CAGR) of 14.30% during 2025-2033. The market is advancing through increased smartphone integration, government-led digital infrastructure initiatives, and growing demand for safety features like ADAS and telematics. Urban areas are adopting infotainment and fleet management systems, while regulatory frameworks ensure data privacy and technical compliance. These developments collectively shape the competitive dynamics of the Mexico connected vehicles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.02 Billion |

| Market Forecast in 2033 | USD 3.87 Billion |

| Market Growth Rate 2025-2033 | 14.30% |

Mexico Connected Vehicles Market Analysis:

- Major Market Drivers: Growing smartphone penetration and government infrastructure investments are accelerating connected vehicle adoption. Rising safety consciousness drives demand for ADAS features. Digital transformation initiatives and supportive regulatory frameworks facilitate market expansion. Fleet operators seek telematics solutions for operational efficiency and cost reduction. Urbanization demands smart transportation systems with real-time traffic management and connectivity solutions.

- Key Market Trends: Advanced connectivity technologies like 5G enable enhanced vehicle communication systems. Integration of artificial intelligence improves driver assistance capabilities and autonomous features. Cloud-based services provide over-the-air updates and personalized user experiences. Mexico connected vehicles market demand increases as manufacturers prioritize infotainment systems with seamless smartphone integration and voice recognition technologies.

- Competitive Landscape: Leading automotive manufacturers integrate connected technologies to differentiate products in competitive markets. Technology partnerships drive innovation in telematics, infotainment, and safety systems. Local assembly plants adopt global connectivity standards while meeting Mexican regulatory requirements. Market consolidation occurs through strategic alliances between traditional automakers and technology companies.

- Challenges and Opportunities: Infrastructure development challenges limit connectivity in rural areas, while cybersecurity concerns require robust data protection measures. Limited technical expertise constrains local innovation capabilities. Opportunities emerge through government digitalization initiatives and growing middle-class purchasing power. Mexico connected vehicles market analysis reveals significant potential for expansion across passenger and commercial vehicle segments.

Mexico Connected Vehicles Market Trends:

Government Initiatives and Regulatory Frameworks

The Mexican government plays a crucial role in fostering the connected vehicles market through supportive policies and regulations. The National Connectivity Plan and the Sustainable Mobility Strategy aim to develop technology-based infrastructure and move towards smarter ways of travel. Regulatory bodies make certain that connected vehicle technology follows the proper safety, emissions, and privacy rules set by each nation. They support new ideas in the industry and increase the faith that people have in connected vehicle systems. When the government follows international rules and spends on infrastructure, it prepares Mexico’s transportation network for the rise and use of connected vehicles, shaping the overall Mexico connected vehicles market share.

To get more information on this market, Request Sample

Rising Consumer Demand for Connectivity and Safety Features

Mexican consumers are increasingly seeking vehicles equipped with advanced connectivity and safety features. The proliferation of smartphones and affordable data plans has heightened expectations for seamless in-car connectivity, including infotainment systems, navigation, and real-time traffic updates. Simultaneously, safety concerns drive demand for features like collision avoidance, lane departure warnings, and emergency assistance. Automakers are responding by incorporating these technologies into a broader range of vehicle models, making connected features more accessible. This shift in consumer preferences is a significant catalyst for the expansion of the Mexico connected vehicles market demand, as manufacturers strive to meet the growing need for integrated, technology-driven driving experiences.

Integration of Advanced Driver-Assistance Systems (ADAS)

Integrating Advanced Driver-Assistance Systems (ADAS) is becoming increasingly prevalent in Mexico's automotive sector. Features like automatic emergency braking, adaptive cruise control, and blind-spot detection enhance vehicle safety and driving comfort. These systems rely on sensors, cameras, and connectivity to function effectively, necessitating robust vehicle communication networks. The adoption of ADAS is driven by consumer demand for safer vehicles and regulatory pressures to reduce traffic accidents. As technology becomes more affordable, ADAS features are transitioning from luxury models to mainstream vehicles, broadening their impact. This trend underscores the role of ADAS in advancing the Mexico connected vehicles market analysis, which contributes to safer and more efficient transportation, thus driving overall growth.

Mexico Connected Vehicles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, application, connectivity, vehicle connectivity, and vehicle.

Technology Insights:

- 4G/LTE

- 3G

- 2G

The report has provided a detailed breakup and analysis of the market based on the technology. This includes 4G/LTE, 3G, and 2G.

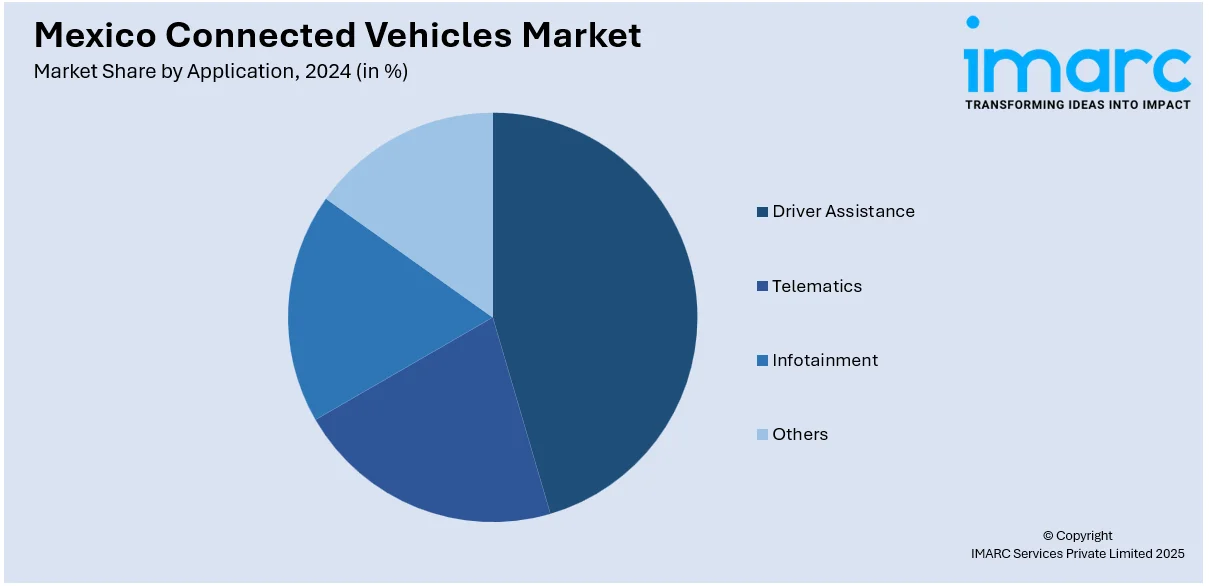

Application Insights:

- Driver Assistance

- Telematics

- Infotainment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes driver assistance, telematics, infotainment, and others.

Connectivity Insights:

- Integrated

- Embedded

- Tethered

A detailed breakup and analysis of the market based on connectivity have also been provided in the report. This includes integrated, embedded, and tethered.

Vehicle Connectivity Insights:

- Vehicle to Vehicle (V2V)

- Vehicle to Infrastructure (V2I)

- Vehicle to Pedestrian (V2P)

A detailed breakup and analysis of the market based on vehicle connectivity have also been provided in the report. This includes Vehicle to Vehicle (V2V), Vehicle to Infrastructure (V2I), and Vehicle to Pedestrian (V2P).

Vehicle Insights:

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle have also been provided in the report. This includes passenger cars and commercial vehicles.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Recent News and Developments:

- March 2025: Geotab and General Motors Mexico launched the country's first OEM telematics integration, enabling direct data access from GM vehicles equipped with OnStar technology. This partnership eliminates external hardware requirements and provides fleet operators with real-time vehicle performance insights through seamless API integration.

Mexico Connected Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | 4G/LTE, 3G, 2G |

| Applications Covered | Driver Assistance, Telematics, Infotainment, Others |

| Connectivity Covered | Integrated, Embedded, Tethered |

| Vehicle Connectivity Covered | Vehicle to Vehicle (V2V), Vehicle to Infrastructure (V2I), Vehicle to Pedestrian (V2P) |

| Vehicles Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico connected vehicles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico connected vehicles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico connected vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The connected vehicles market in Mexico was valued at USD 1.02 Billion in 2024.

The Mexico connected vehicles market is projected to exhibit a CAGR of 14.30% during 2025-2033, reaching a value of USD 3.87 Billion by 2033.

The market is driven by increasing smartphone integration, government-led digital infrastructure initiatives, and growing demand for safety features like ADAS and telematics. Rising consumer expectations for connectivity, urbanization trends, and regulatory support for smart transportation systems significantly contribute to market expansion and technological advancement.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)