Mexico Consumer Credit Market Size, Share, Trends and Forecast by Credit Type, Service Type, Issuer, Payment Method, and Region, 2025-2033

Mexico Consumer Credit Market Overview:

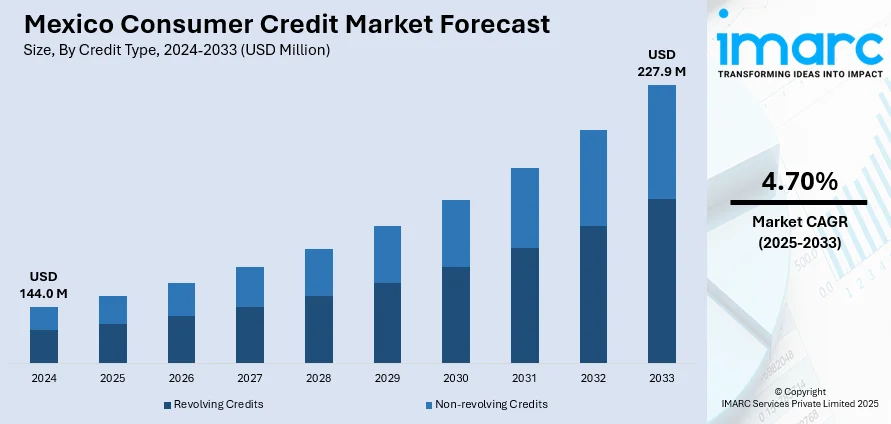

The Mexico consumer credit market size reached USD 144.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 227.9 Million by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. The market is expanding, driven by the advancing level of financial inclusion, technological advancements in the financial sector, heightened digitalization of incumbent banks, and policy efforts for increased financial awareness and formal sector jobs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 144.0 Million |

| Market Forecast in 2033 | USD 227.9 Million |

| Market Growth Rate 2025-2033 | 4.70% |

Mexico Consumer Credit Market Trends:

Rising Financial Inclusion and Credit Awareness

One of the greatest revolutions in Mexican consumer credit is the advancing level of financial inclusion. Government and non-government efforts aimed at bringing access to financial services to low-income and rural markets. Based on research conducted by BBVA Research, in six years (2018 Q2 to 2024 Q2) the total number of transactional and savings account in Mexico has increased by 37.1%. This trend has established a wider population base of potential borrowers who are now able to borrow consumer loans and credit lines. Credit awareness schemes, frequently funded by financial institutions, non-governmental organizations (NGOs), or government organizations, have been instrumental in teaching citizens how to borrow responsibly, understand interest charges, and the need to have good credit scores. People are now better informed and more comfortable to deal with credit markets. Over time, this heightened confidence and engagement not only lift loan disbursements but also facilitated the building of a more mature and robust financial ecosystem.

Digitalization of Financial Services and Fintech Growth

Technological innovation in Mexico's financial sector is a primary driver of consumer credit growth. The growth of fintech companies and the digitalization of incumbent banks have enhanced access to credit, particularly among the underbanked. Mobile banking apps, digital wallets, and peer-to-peer lending are facilitating quicker loan approvals and more tailored credit products. Furthermore, fintech firms are utilizing alternative data, including mobile usage and e-commerce behavior, to evaluate creditworthiness, making it possible for individuals who were previously excluded from the credit system to gain access. The open banking support of the Mexican government, through policies also contributed to this growth by pushing competition and innovation. This regulatory framework promotes partnerships among financial institutions and technology firms, resulting in improved product diversity and reduced borrowing expenses. The IMARC Group predicts that the Mexico fintech market size is expected to reach USD 65.9 Billion by 2033.

Macroeconomic Stability and Policy Support

Macroeconomic variables like inflationary stability, consistent growth of GDP, and good interest rate environment are most essential in terms of facilitating the expansion of consumer credit. The policy efforts for increased financial awareness and formal sector jobs have benefited creditworthiness at the household level indirectly as well. Government-sponsored credit bureaus and risk management systems have also enhanced lending transparency, which increases lender confidence and promotes wider market participation. Ongoing formalization of the economy, such as attempts to enroll informal workers in the financial system, also adds to a larger pool of eligible borrowers. Collectively, these macroeconomic and regulatory environments offer a solid basis for credit expansion by reducing systemic risk and encouraging long-term market stability.

Mexico Consumer Credit Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on credit type, service type, issuer, and payment method.

Credit Type Insights:

- Revolving Credits

- Non-revolving Credits

The report has provided a detailed breakup and analysis of the market based on the credit type. This includes revolving credits and non-revolving credits.

Service Type Insights:

- Credit Services

- Software and IT Support Services

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes credit services and software and IT support services.

Issuer Insights:

- Banks and Finance Companies

- Credit Unions

- Others

A detailed breakup and analysis of the market based on the issuer have also been provided in the report. This includes banks and finance companies, credit unions, and others.

Payment Method Insights:

- Direct Deposit

- Debit Card

- Others

A detailed breakup and analysis of the market based on the payment method have also been provided in the report. This includes direct deposit, debit card, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include northern Mexico, central Mexico, southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Consumer Credit Market News:

- In July 2024, Blu Financiero, a Mexican FinTech focused on the underbanked, announced its "mass market" credit card, which features a 99% approval rate and is available without a traditional credit history.

- In October 2024, Chinese fast-fashion company, Shein launched a new branded credit card via a collaboration with Mexican fintech Stori.

Mexico Consumer Credit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Credit Types Covered | Revolving Credits, Non-revolving Credits |

| Service Types Covered | Credit Services, Software and IT Support Services |

| Issuers Covered | Banks and Finance Companies, Credit Unions, Others |

| Payment Methods Covered | Direct Deposit, Debit Card, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico consumer credit market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico consumer credit market on the basis of credit type?

- What is the breakup of the Mexico consumer credit market on the basis of service type?

- What is the breakup of the Mexico consumer credit market on the basis of issuer?

- What is the breakup of the Mexico consumer credit market on the basis of payment method?

- What is the breakup of the Mexico consumer credit market on the basis of region?

- What are the various stages in the value chain of the Mexico consumer credit market?

- What are the key driving factors and challenges in the Mexico consumer credit?

- What is the structure of the Mexico consumer credit market and who are the key players?

- What is the degree of competition in the Mexico consumer credit market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico consumer credit market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico consumer credit market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico consumer credit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)