Mexico Contract Lifecycle Management Software Market Size, Share, Trends and Forecast by Deployment Model, CLM Offerings, Enterprise Size, Industry, and Region, 2025-2033

Mexico Contract Lifecycle Management Software Market Size and Share:

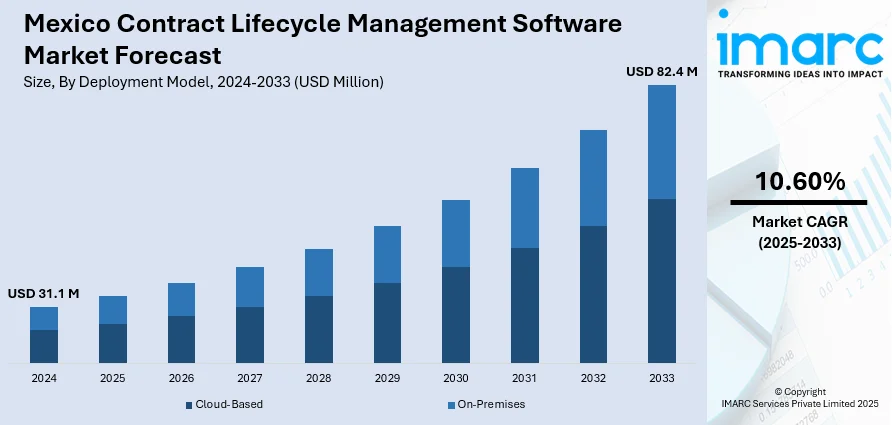

The Mexico contract lifecycle management software market size reached USD 31.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 82.4 Million by 2033, exhibiting a growth rate (CAGR) of 10.60% during 2025-2033. The market share is driven by factors such as the increasing demand for automation to streamline contract processes, the growing need for compliance and risk management due to evolving regulations, and the shift toward cloud-based solutions for improved accessibility, cost-efficiency, and scalability across businesses.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 31.1 Million |

| Market Forecast in 2033 | USD 82.4 Million |

| Market Growth Rate 2025-2033 | 10.60% |

Mexico Contract Lifecycle Management Software Market Trends:

Increasing Adoption of Automation in Contract Processes

Automation is transforming Mexico contract lifecycle management software market outlook as more companies implement Contract Lifecycle Management (CLM) software to automate contract development, approval, and tracking. Automating these processes decreases manual errors, speeds up workflows, and enhances compliance. Core features such as artificial intelligence (AI)-based contract drafting and e-signatures help speed up contract signing, while keeping administrative burdens and overhead low. These technologies allow businesses to easily manage contracts from inception to fruition without the fear of delays or errors. As such, there is an increase in Mexican firms acknowledging the use of automation for increasing operational effectiveness, productivity, and reducing risk that comes with manual contract administration, leading to the increased uptake of CLM software across all industries.

Growing Focus on Compliance and Risk Management

With more stringent and complicated regulatory environments in Mexico, companies are finding it increasingly convenient to use CLM software to achieve compliance and avoid legal risks. CLM applications offer functionality to monitor contract terms, timelines, and obligations to guarantee that businesses are in line with the law. The capability of the software to indicate possible issues in real time ensures organizations respond to threats beforehand, and keeping auditable records for transparency and accountability. By streamlining these activities, companies can sidestep expensive fines, lower the incidence of errors, and improve regulatory compliance. This increased emphasis on compliance and risk management is a central factor in the increasing use of CLM software in Mexico, as companies focus on legal security and operational efficiency. For instance, Icertis released its inaugural "State of Contract Lifecycle Management Report," highlighting a surge in interest among legal, finance, procurement, and sales decision-makers to enhance contract management processes through AI technology.

Rise in Cloud-Based Solutions

In Mexico, the use of CLM software is motivated by various trends. The rise in automation of contract processes streamlines creation, approval, and monitoring, minimizing human errors and improving efficiency. Artificial intelligence (AI)-based capabilities such as contract generation and e-signatures improve workflow velocity and compliance. As legal rules become increasingly complicated, companies are resorting to CLM software to monitor compliance and avoid legal risks by monitoring deadlines and commitments, guaranteeing compliance with regulations. Cloud-based CLM solutions are also becoming popular due to their adaptability, scalability, and affordability. The cloud facilitates easier access to contracts from anywhere, encourages collaboration between remote teams, and lowers infrastructure expenses, contributing to the Mexico contract lifecycle management software market growth.

Mexico Contract Lifecycle Management Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on deployment model, CLM offerings, enterprise size, and industry.

Deployment Model Insights:

- Cloud-Based

- On-Premises

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes cloud-based, and on-premises.

CLM Offerings Insights:

- Licensing and Subscription

- Services

A detailed breakup and analysis of the market based on the CLM offering have also been provided in the report. This includes licensing and subscription, and services.

Enterprise Size Insights:

- Large Enterprise

- Small and Medium Enterprise

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprise, and small and medium enterprise.

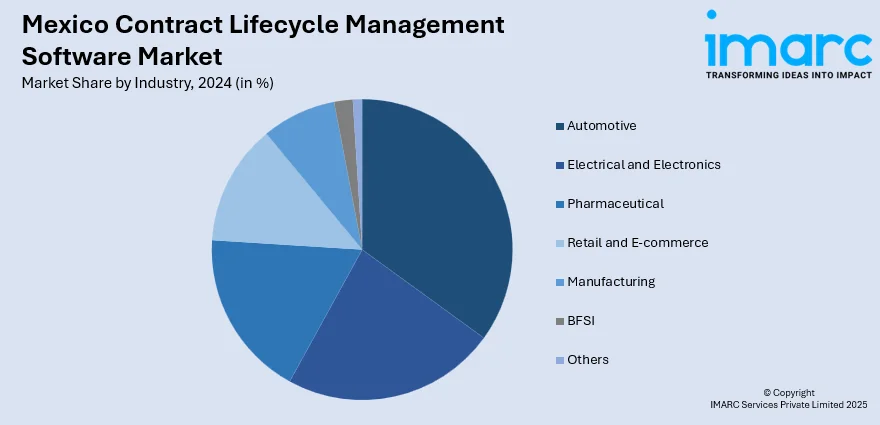

Industry Insights:

- Automotive

- Electrical and Electronics

- Pharmaceutical

- Retail and E-commerce

- Manufacturing

- BFSI

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes automotive, electrical and electronics, pharmaceutical, retail and e-commerce, manufacturing, BFSI, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Contract Lifecycle Management Software Market News:

- In March 2025, LinkSquares been named a Leader in G2's Spring 2025 Grid® for Contract Lifecycle Management (CLM), ranking #1 in the Mid-Market Grid® for CLM. This recognition reflects positive feedback from verified users, highlighting LinkSquares' focus on empowering legal, sales, finance, and procurement teams with efficient tools for managing contracts. The company’s commitment to customer support and delivering value is reflected in its impressive G2 ratings and customer satisfaction.

- In February 2025, Ironclad been named a Leader in The Forrester Wave™: Contract Lifecycle Management Platforms, Q1 2025. The company was recognized for its strong market share among tech firms and those undergoing digital transformation. Ironclad excels in contract digitization, workflow flexibility, and self-service capabilities. Its focus on efficiency, AI, and support for sell-side contracts and legal operations, including native integrations and e-signature, earned it top marks across 26 evaluation criteria.

Mexico Contract Lifecycle Management Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Models Covered | Cloud-Based, On-Premises |

| CLM Offerings Covered | Licensing and Subscription, Services |

| Enterprise Sizes Covered | Large Enterprise, Small and Medium Enterprise |

| Industries Covered | Automotive, Electrical and Electronics, Pharmaceutical, Retail and E-commerce, Manufacturing, BFSI, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico contract lifecycle management software market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico contract lifecycle management software market on the basis of deployment model?

- What is the breakup of the Mexico contract lifecycle management software market on the basis of CLM offerings?

- What is the breakup of the Mexico contract lifecycle management software market on the basis of enterprise size?

- What is the breakup of the Mexico contract lifecycle management software market on the basis of industry?

- What is the breakup of the Mexico contract lifecycle management software market on the basis of region?

- What are the various stages in the value chain of the Mexico contract lifecycle management software market?

- What are the key driving factors and challenges in the Mexico contract lifecycle management software market?

- What is the structure of the Mexico contract lifecycle management software market and who are the key players?

- What is the degree of competition in the Mexico contract lifecycle management software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico contract lifecycle management software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico contract lifecycle management software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico contract lifecycle management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)