Mexico Cookware Market Size, Share, Trends and Forecast by Type, Product, Material, Application, Distribution Channel, and Region, 2025-2033

Mexico Cookware Market Overview:

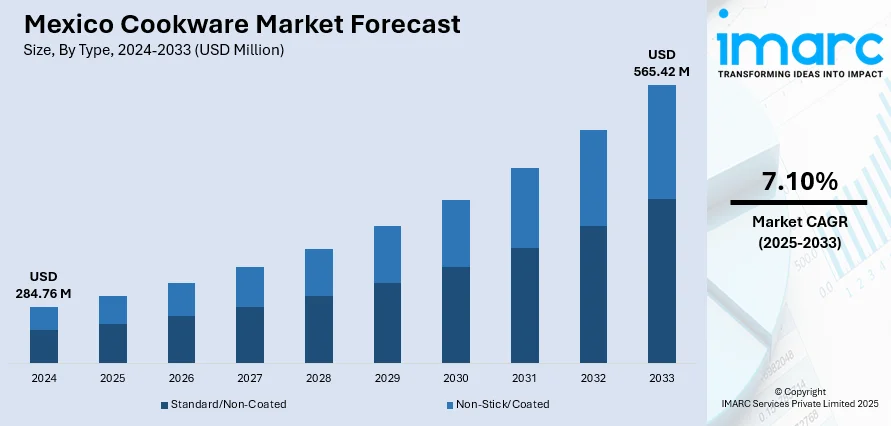

The Mexico cookware market size reached USD 284.76 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 565.42 Million by 2033, exhibiting a growth rate (CAGR) of 7.10% during 2025-2033. The market is driven by urbanization, evolving culinary preferences, and increasing health and sustainability awareness. The growing adoption of both traditional and modern cookware, with a notable demand for non-stick, stainless steel, and eco-friendly options is also impelling the market. The rise of e-commerce and premium kitchenware trends are further positively influencing the Mexico cookware market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 284.76 Million |

| Market Forecast in 2033 | USD 565.42 Million |

| Market Growth Rate 2025-2033 | 7.10% |

Mexico Cookware Market Trends:

Culinary Heritage and Changing Cooking Habits

Mexico's strong culinary traditions significantly influence cookware demand, especially for items like clay pots (ollas de barro) and comales used in traditional dishes. At the same time, rising urbanization and modern lifestyles are shifting preferences toward more convenient cookware, such as non-stick pans, pressure cookers, and induction-compatible products. The younger population, balancing work and home responsibilities, seeks time-saving tools without compromising on taste or tradition. As a result, there’s a dual demand, preserving cultural authenticity while adapting to modern cooking styles. This trend encourages manufacturers to develop hybrid products that honor traditional methods but offer ease of use, durability, and speed. This blend of heritage and innovation is a central driver of the Mexico cookware market’s evolving product range and consumer base.

Health and Sustainability Awareness

Increasing awareness about health and environmental sustainability is significantly influencing cookware preferences in Mexico, which is further driving the Mexico cookware market growth. Consumers are actively avoiding products made with harmful coatings like PFOA and PTFE, favoring non-toxic alternatives such as ceramic and stainless steel cookware. Additionally, sustainability concerns are prompting buyers to choose eco-friendly products, including those made from recycled or ethically sourced materials. These shifts are not just personal; they are reinforced by national discussions around food safety and climate responsibility. Cookware companies are responding by investing in sustainable manufacturing processes and marketing certifications like “BPA-free” or “eco-safe.” As health and environmental consciousness grow, cookware purchasing decisions in Mexico are increasingly driven by the long-term value of safety, responsibility, and sustainable living, fostering a stronger demand for ethical cookware.

Premiumization and Technological Innovation

Mexican consumers are increasingly leaning toward premium cookware that combines design, durability, and advanced features. Rising disposable incomes, urban migration, and changing tastes have encouraged buyers to invest in higher-quality, longer-lasting cookware. Non-stick pans with enhanced coatings, cookware compatible with induction stoves, and multi-layered stainless-steel products are gaining traction. Additionally, innovation in smart cookware, products that integrate with mobile apps or include temperature sensors, is gradually emerging, especially among tech-savvy consumers in urban centers. Aesthetic appeal also matters; visually appealing cookware is often chosen for both function and kitchen décor. This trend reflects a broader movement toward valuing craftsmanship, innovation, and lifestyle integration. Premiumization thus not only drives up average purchase values but also shifts brand loyalty toward quality-focused and design-forward companies.

Mexico Cookware Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, material, application, and distribution channel.

Type Insights:

- Standard/Non-Coated

- Non-Stick/Coated

- Teflon (PTFE) Coated

- Ceramic Coated

- Enamel Coated

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes standard/non-coated and non-stick/coated (Teflon (PTFE) coated, ceramic coated, enamel coated, and others).

Product Insights:

- Pots and Pans

- Pressure Cooker

- Cooking Racks

- Cooking Tools

- Bakeware

- Microware Cookware

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes pots and pans, pressure cookers, cooking racks, cooking tools, bakeware, and microware cookware.

Material Insights:

- Stainless Steel

- Carbon Steel

- Cast Iron

- Aluminum

- Glass

- Stoneware

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes stainless steel, carbon steel, cast iron, aluminum, glass, stoneware, and others.

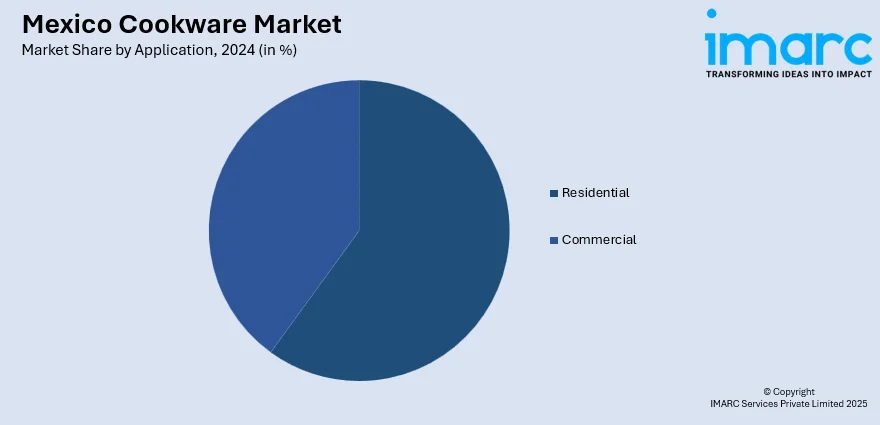

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Distribution Channel Insights:

- Supermarket/Hypermarket

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarket/hypermarket, specialty stores, online, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cookware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Products Covered | Pots and Pans, Pressure Cookers, Cooking Racks, Cooking Tools, Bakeware, Microware Cookware |

| Materials Covered | Stainless Steel, Carbon Steel, Cast Iron, Aluminum, Glass, Stoneware, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Supermarket/Hypermarket, Specialty Stores, Online, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cookware market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cookware market on the basis of type?

- What is the breakup of the Mexico cookware market on the basis of product?

- What is the breakup of the Mexico cookware market on the basis of material?

- What is the breakup of the Mexico cookware market on the basis of application?

- What is the breakup of the Mexico cookware market on the basis of distribution channel?

- What is the breakup of the Mexico cookware market on the basis of region?

- What are the various stages in the value chain of the Mexico cookware market?

- What are the key driving factors and challenges in the Mexico cookware?

- What is the structure of the Mexico cookware market and who are the key players?

- What is the degree of competition in the Mexico cookware market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cookware market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cookware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cookware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)