Mexico Cosmetics Market Size, Share, Trends and Forecast by Product Type, Category, Gender, Distribution Channel, and Region, 2025-2033

Mexico Cosmetics Market Overview:

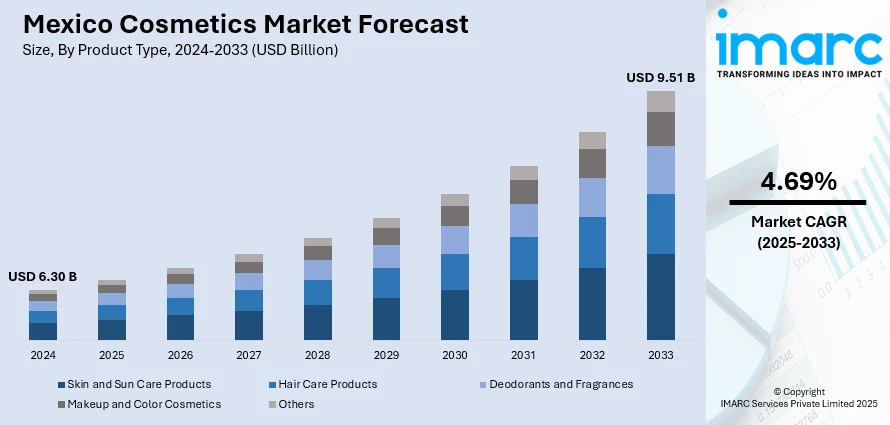

The Mexico cosmetics market size reached USD 6.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.51 Billion by 2033, exhibiting a growth rate (CAGR) of 4.69% during 2025-2033. The market is being driven by rising disposable incomes, increasing urbanization, growing beauty consciousness among consumers, a surge in social media influence, expanding retail channels, and elevating demand for organic and natural products, along with technological innovations in product formulations and an expanding youthful population keen on personal grooming and skincare solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.30 Billion |

| Market Forecast in 2033 | USD 9.51 Billion |

| Market Growth Rate 2025-2033 | 4.69% |

Mexico Cosmetics Market Trends:

Cultural Beauty Norms and Social Media Influence

One of the underlying forces behind the cosmetics industry in Mexico is the culturally entrenched focus on beauty and looks, compounded by the immense social media influence. Personal appearance and grooming have historically been an important part of Mexican culture, especially for women. These deeply ingrained values have adapted alongside digital networks, building a strong consumer base for beauty products that address a broad spectrum of aesthetic interests. Social media platforms such as Instagram, TikTok, and YouTube are driving and influencing consumer behavior among millennials and Gen Z. Mexican influencers and beauty content creators have extensive followings, and their recommendations of products have the power to influence buying decisions. Consequently, cosmetic companies are pouring increasing amounts of money into influencer marketing campaigns, keeping in line with online-induced beauty trends ranging from contouring methods to statement lip colors and skincare regimens. Additionally, social validation by appearance has become more salient in city centers where image-sensitivity is intensified. Consumers thus feel compelled to continuously buy cosmetics to have a popular online image or digital reputation.

Economic Growth and Urban Middle-Class Expansion

Another driver of Mexico's cosmetics market is the nation's continuing economic development, including the growth of its urban middle class. Mexico has seen growing consumer purchasing power in its major metropolitan centers like Mexico City, Monterrey, and Guadalajara in recent years. This economic boost has enabled more consumers to transcend material needs and spend on discretionary items such as cosmetics. With increasing disposable incomes, the desire to buy premium and imported beauty brands also rises, thus opening up opportunities for local and foreign players alike. This change in the economy is also followed by better access to contemporary forms of retail like malls, specialty outlets, and the internet, which have a larger assortment of cosmetic products. Retailers are capitalizing on this trend by creating more in-store experiences and providing distinctive product ranges that meet the aspirational requirements of the middle class. Furthermore, better access to financing arrangements and credit supports increased consumer expenditure on discretionary items, such as skincare, haircare, and makeup. Urban consumers seek high-quality products with greater value—such as anti-aging or organic offerings.

Mexico Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, category, gender, and distribution channel.

Product Type Insights:

- Skin and Sun Care Products

- Hair Care Products

- Deodorants and Fragrances

- Makeup and Color Cosmetics

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin and sun care products, hair care products, deodorants and fragrances, makeup and color cosmetics, and others.

Category Insights:

- Conventional

- Organic

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes conventional and organic.

Gender Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the gender. This includes men, women, and unisex.

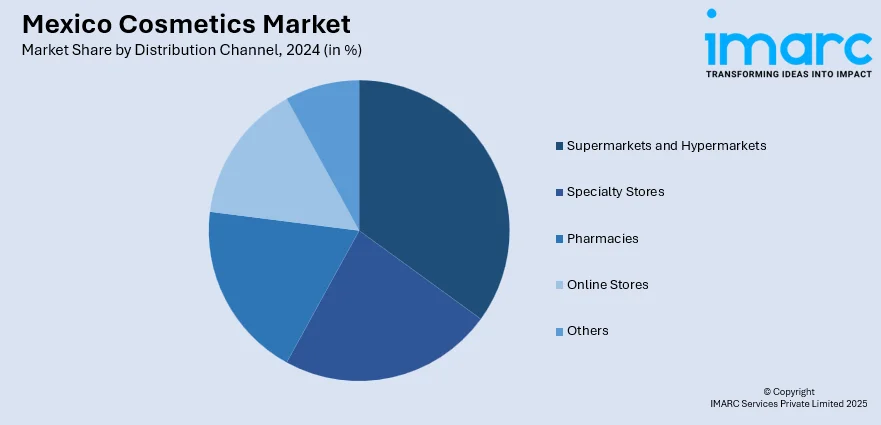

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, pharmacies, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cosmetics Market News:

- November 2024: Givaudan expanded its Pedro Escobedo facility in Mexico, doubling its production capacity for encapsulation technologies. This strategic move enhanced the company's ability to meet growing consumer demand for innovative fragrance and beauty solutions, particularly in the cosmetics sector.

- October 2024: e.l.f. Cosmetics launched its products in Sephora Mexico, marking its debut in Sephora stores globally. This expansion introduced e.l.f.'s vegan cosmetics to Mexican consumers, emphasizing accessibility and affordability.

Mexico Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, Others |

| Categories Covered | Conventional, Organic |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cosmetics market on the basis of product type?

- What is the breakup of the Mexico cosmetics market on the basis of category?

- What is the breakup of the Mexico cosmetics market on the basis of gender?

- What is the breakup of the Mexico cosmetics market on the basis of distribution channel?

- What are the various stages in the value chain of the Mexico cosmetics market?

- What are the key driving factors and challenges in the Mexico cosmetics?

- What is the structure of the Mexico cosmetics market and who are the key players?

- What is the degree of competition in the Mexico cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)