Mexico Craft Spirits Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Mexico Craft Spirits Market Overview:

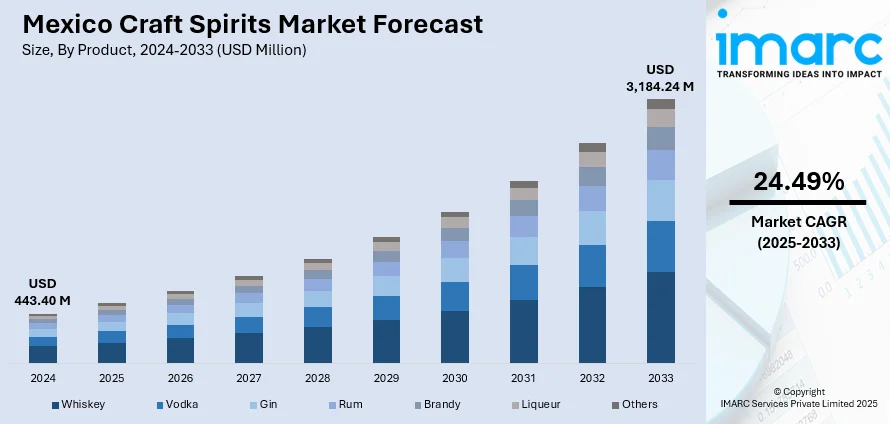

The Mexico craft spirits market size reached USD 443.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,184.24 Million by 2033, exhibiting a growth rate (CAGR) of 24.49% during 2025-2033. The market is fueled by the growing consumer demand for distinct, artisanal drinks with clear taste profiles and quality production processes. The country's booming tourism industry also plays a significant role in escalating the product demand since foreign tourists try to discover and get immersed in local alcoholic drinks. Government support for tequila exports and small-scale makers further contribute to the expansion of the Mexico craft spirits market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 443.40 Million |

| Market Forecast in 2033 | USD 3,184.24 Million |

| Market Growth Rate 2025-2033 | 24.49% |

Mexico Craft Spirits Market Analysis:

- Major Market Drivers: Rising consumer preference for premium, artisanal spirits with authentic production methods drives significant growth in the market analysis. Tourism expansion encourages demand for distinctive local alcoholic beverages. Government support for tequila exports and small-scale distilleries enhances market development. Cultural heritage preservation through traditional distillation processes attracts quality-conscious consumers seeking authentic Mexican spirit experiences.

- Key Market Trends: Premiumization trend leads consumers toward high-quality, small-batch products over mass-market alternatives. The Mexico craft spirits market demand benefits from experimental aging processes and limited releases. Traditional agave-based spirits like mezcal gain international recognition. Growing cocktail culture drives demand for versatile, complex spirits suitable for sophisticated mixology applications and premium drinking experiences.

- Competitive Landscape: Market features diverse mix of family-owned traditional distilleries and emerging artisanal producers focusing on heritage preservation. The market size expansion attracts international partnerships and investments. Competition intensifies through product differentiation, unique aging techniques, and regional specialization. Traditional producers maintain competitive advantage through authentic production methods and cultural authenticity.

- Challenges and Opportunities: Sustainable agave harvesting concerns present environmental challenges as Mexico craft spirits market share grows rapidly. Opportunities exist in international market expansion, premium product development, and eco-friendly production practices. Rising disposable incomes create opportunities for luxury spirit positioning. Export potential remains significant through strategic partnerships and global distribution network development efforts.

Mexico Craft Spirits Market Trends:

Resurgence of Traditional Agave Spirits

Mexico's craft spirits segment is witnessing an impressive resurgence of traditional agave-based drinks, most noticeably mezcal and artisanal tequila. Consumers are becoming increasingly attracted to these spirits due to their authenticity, distinctive methods of production, and strong cultural heritage. Craft distilleries are adopting traditional methods like earthen pit roasting, stone milling, and open-air fermentation, which give the spirits characteristic flavors and fragrances. This trend is a part of a wider global shift toward artisanal and small-batch products as consumers increasingly look to authentic and sustainable options to the mass-produced drinks market. The Mexico craft spirits market analysis indicates increasing popularity of these old-fashioned techniques has seen an increase in the number of craft distilleries throughout Mexico, with each producing distinctive expressions of agave spirits that speak to the rich heritage and diversity of the nation's regions.

To get more information on this market, Request Sample

Premiumization and Consumer Sophistication

The Mexican craft spirits sector is experiencing premiumization, as consumers shift toward premium, small-batch, high-quality products over mass-market ones. This is fueled by consumers seeking superior quality, craftsmanship, and distinct flavor profiles. The distilleries are reacting by creating limited releases, single-estate agave spirits, and experimenting with aging in different types of casks to produce layered and sophisticated products. The growth of cocktail culture and the popularity of mixologists have further driven this demand, as drinkers look for spirits that provide versatility and complexity in their cocktails. This trend of premiumization serves the changing sensibilities of Mexican consumers and fuels the Mexico craft spirits market growth, appealing to global connoisseurs and collectors.

Sustainability and Ethical Production Practices

Sustainability and ethical production methods are becoming increasingly integral to the identity of Mexico's craft spirits sector. Consumers are becoming more conscious of the social and environmental implications of their spending, and as a result, distilleries are starting to employ green methods. These include sustainable harvesting of agave, water conservation protocols, and reducing waste through recycling and compost. Moreover, most craft distilleries are paying attention to equitable labor practices as well as the support of the local communities to guarantee that the industry's benefits are equitably distributed. Such a commitment to sustainability is attracting environment-conscious consumers which increases the products' authenticity and integrity. With for socially responsible beverages, Mexican craft spirits are poised to deliver on these expectations with the integration of age-old production techniques and contemporary values of sustainability and social responsibility

Mexico Craft Spirits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Whiskey

- Vodka

- Gin

- Rum

- Brandy

- Liqueur

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes whiskey, vodka, gin, rum, brandy, liqueur, and others.

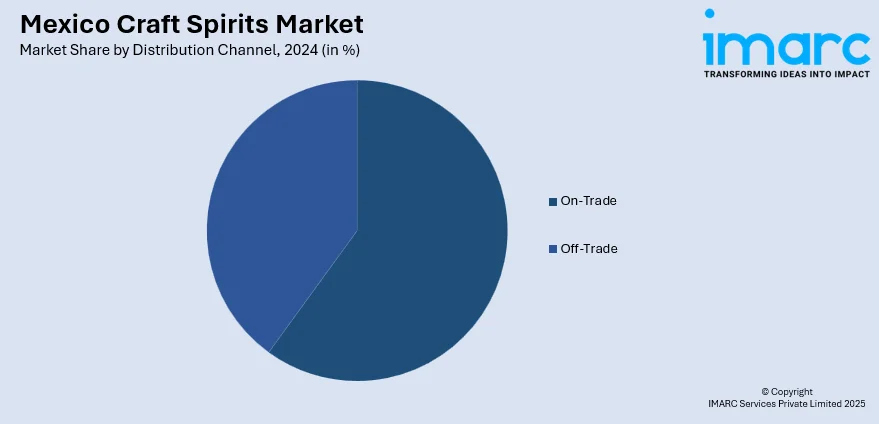

Distribution Channel Insights:

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Recent News and Developments:

- In July 2025, La Pulga Tequila expanded into Florida, introducing Blanco, Reposado, and Añejo expressions. Crafted in Jalisco, Mexico from 100% Blue Weber agave, the brand emphasizes artisanal quality, additive-free production, and affordability, while supporting the hospitality sector and reflecting the heritage and tradition of Mexican agave spirits.

- In April 2025, Luxco, Inc. launched Escasa Tequila nationwide in the U.S. The brand offers Blanco and Reposado aged in Albariño wine barrels, crafted from single-estate 100% Blue Weber agave in Jalisco, Mexico, highlighting artisanal production, traditional techniques, and distinctive flavors that reflect Mexico’s heritage and terroir.

Mexico Craft Spirits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Whiskey, Vodka, Gin, Rum, Brandy, Liqueur, Others |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico craft spirits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico craft spirits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico craft spirits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The craft spirits market in Mexico was valued at USD 443.40 Million in 2024.

The Mexico craft spirits market is projected to exhibit a CAGR of 24.49% during 2025-2033, reaching a value of USD 3,184.24 Million by 2033.

The market is driven by growing consumer demand for distinct, artisanal drinks with authentic taste profiles, booming tourism industry encouraging local spirit discovery, government support for tequila exports and small-scale makers, and increasing preference for premium quality production processes over mass-market alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)