Mexico Crop Protection Chemicals Market Size, Share, Trends and Forecast by Product Type, Origin, Crop Type, Form, Mode of Application, and Region, 2025-2033

Mexico Crop Protection Chemicals Market Overview:

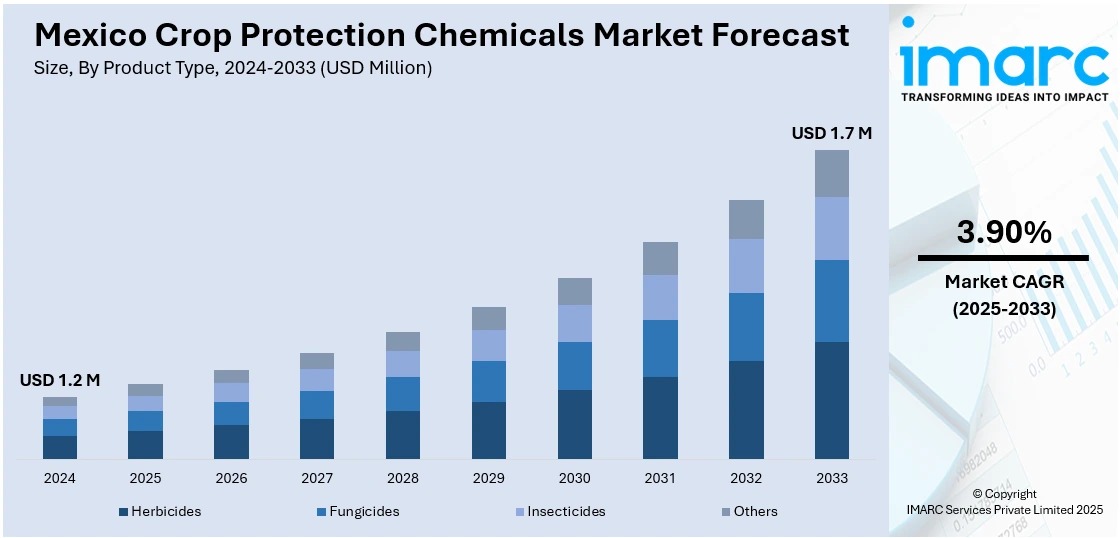

The Mexico crop protection chemicals market size reached USD 1.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1.7 Million by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is driven by growing demand for higher agricultural productivity, government support for modern farming practices, and rising awareness of crop losses due to pests and diseases. Additionally, shifting consumer preferences toward quality produce and increasing export opportunities are boosting the use of crop protection solutions, contributing to the growth of the Mexico Crop Protection Chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Million |

| Market Forecast in 2033 | USD 1.7 Million |

| Market Growth Rate 2025-2033 | 3.90% |

Mexico Crop Protection Chemicals Market Trends:

Rising Preference for Biopesticides and Eco-Friendly Solutions

Producers and farmers in Mexico are now increasingly relying on biopesticides as concern spreads about the health and environmental effects of traditional agrochemicals. Biopesticides, derived from natural substances, are regarded as more benign to ecosystems and human health and are therefore more appealing for sustainable agriculture. Global trends favoring organic and ecologically friendly farming also drive this change. Consequently, crop protection companies are aiming to create greener solutions and sustainable product offerings. This shift is consistent with reducing chemical residues in foods and conserving biodiversity and further assisting in satisfying the increasing demand for clean, organic fruits and vegetables locally and within export markets further impelling the Mexico crop protection chemicals market share.

Government Support Driving Chemical Use in Agriculture

The Mexican government is crucial to developing the crop protection chemicals market through the support of agricultural growth via numerous programs and initiatives. Such programs promote farmers to implement advanced agriculture practices, such as the application of crop protection solutions such as herbicides and insecticides, which ensure yields are maximized and crops protected from disease and pests. With agriculture becoming more advanced, the need for better and more varied chemical solutions increases. In 2024, the Secretariat of Agriculture and Rural Development (SADER) invested 74.1 billion pesos (about USD 4.3 billion) in promoting agricultural development. More than 70% of the budget went towards support programs, such as the Fertilizer Program, which received almost a quarter of the budget. These initiatives reflect the government's interests in building food security, increasing agricultural productivity, and maintaining the economic sustainability of farming communities, indirectly propelling the Mexico crop protection chemicals market growth.

Supply Chain Vulnerabilities and Import Dependency

Mexico's reliance on foreign crop protection chemicals has exposed the market to outside disruption. In the absence of a robust domestic production base, the sector is prone to outside influences such as shipping disruptions, trade embargoes, and international conflicts. Disruptions of this nature have resulted in both product availability and price instability, which impact farmers' access to necessary agricultural inputs. This dependency has made Mexico realize the necessity of seeking domestic production or diversified sources of import. Developing a more stable supply chain would stabilize the Mexico crop protection chemicals market outlook and provide farmers with regular access to the chemicals that they require for crop protection and maintaining productivity across the growing periods.

Mexico Crop Protection Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, origin, crop type, form, and mode of application.

Product Type Insights:

- Herbicides

- Fungicides

- Insecticides

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes herbicides, fungicides, insecticides, and others.

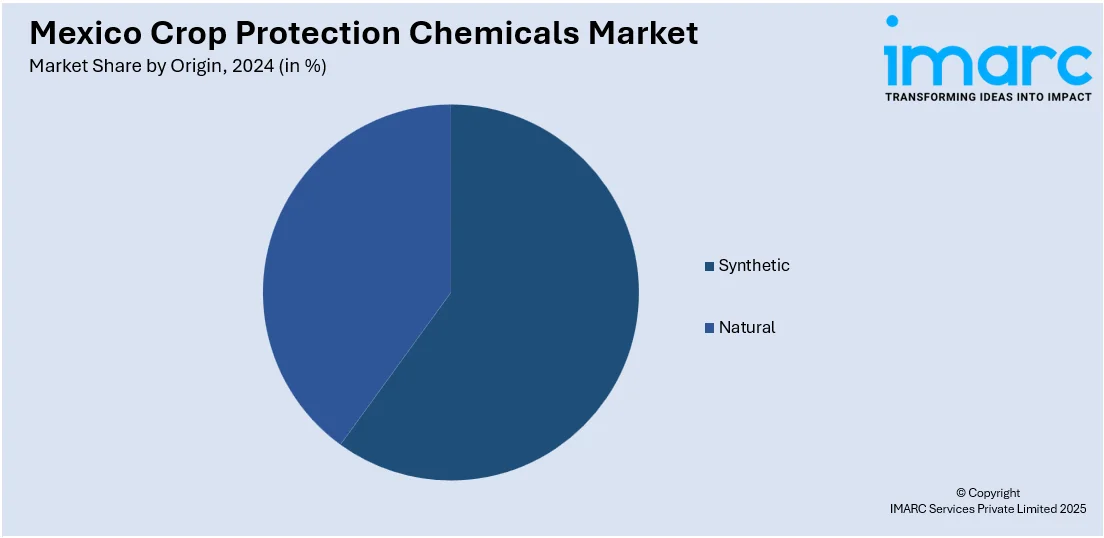

Origin Insights:

- Synthetic

- Natural

A detailed breakup and analysis of the market based on the origin have also been provided in the report. This includes synthetic and natural.

Crop Type Insights:

- Cereal and Grains

- Fruits and Vegetables

- Oilseed and Pulses

- Others

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereal and grains, fruits and vegetables, oilseed and pulses, and others.

Form Insights:

- Liquid

- Solid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid.

Mode of Application Insights:

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the mode of application. This includes foliar spray, seed treatment, soil treatment, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Crop Protection Chemicals Market News:

- In December 2024, Nichino Mexico expanded its crop protection portfolio by incorporating innovative products developed by its parent company, the NICHINO Group. This move enhances the company’s leadership in specialized agricultural solutions tailored to Mexico’s farming needs. With a strong focus on research, a skilled technical team, and a robust distributor network, Nichino Mexico reinforces its commitment to delivering effective, science-based solutions that support growers and open new market opportunities.

- In February 2024, Trichomax and Klamic, biological therapies that target nematodes and soilborne diseases, were introduced in Mexico by Biotor Labs, a Nicaraguan biotech company. Klamic employs Pochonia chlamydosporia, whereas Trichomax uses Trichoderma asperellum. Certified as low-risk by COFEPRIS, both products offer chemical-free, eco-friendly solutions. Their innovative formulations and strong scientific backing meet regulatory standards and respond to rising consumer demand for sustainable crop protection.

Mexico Crop Protection Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Herbicides, Fungicides, Insecticides, Others |

| Origins Covered | Synthetic, Natural |

| Crop Types Covered | Cereal and Grains, Fruits and Vegetables, Oilseed and Pulses, Others |

| Forms Covered | Liquid, Solid |

| Mode of Applications Covered | Foliar Spray, Seed Treatment, Soil Treatment, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico crop protection chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico crop protection chemicals market on the basis of product type?

- What is the breakup of the Mexico crop protection chemicals market on the basis of origin?

- What is the breakup of the Mexico crop protection chemicals market on the basis of crop type?

- What is the breakup of the Mexico crop protection chemicals market on the basis of form?

- What is the breakup of the Mexico crop protection chemicals market on the basis of mode of application?

- What is the breakup of the Mexico crop protection chemicals market on the basis of region?

- What are the various stages in the value chain of the Mexico crop protection chemicals market?

- What are the key driving factors and challenges in the Mexico crop protection chemicals?

- What is the structure of the Mexico crop protection chemicals market and who are the key players?

- What is the degree of competition in the Mexico crop protection chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico crop protection chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico crop protection chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico crop protection chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)