Mexico Cryptocurrency Exchange Market Size, Share, Trends and Forecast by Exchange Type, Cryptocurrency Type, User Type, Revenue Model, Trading Service, and Region, 2025-2033

Mexico Cryptocurrency Exchange Market Overview:

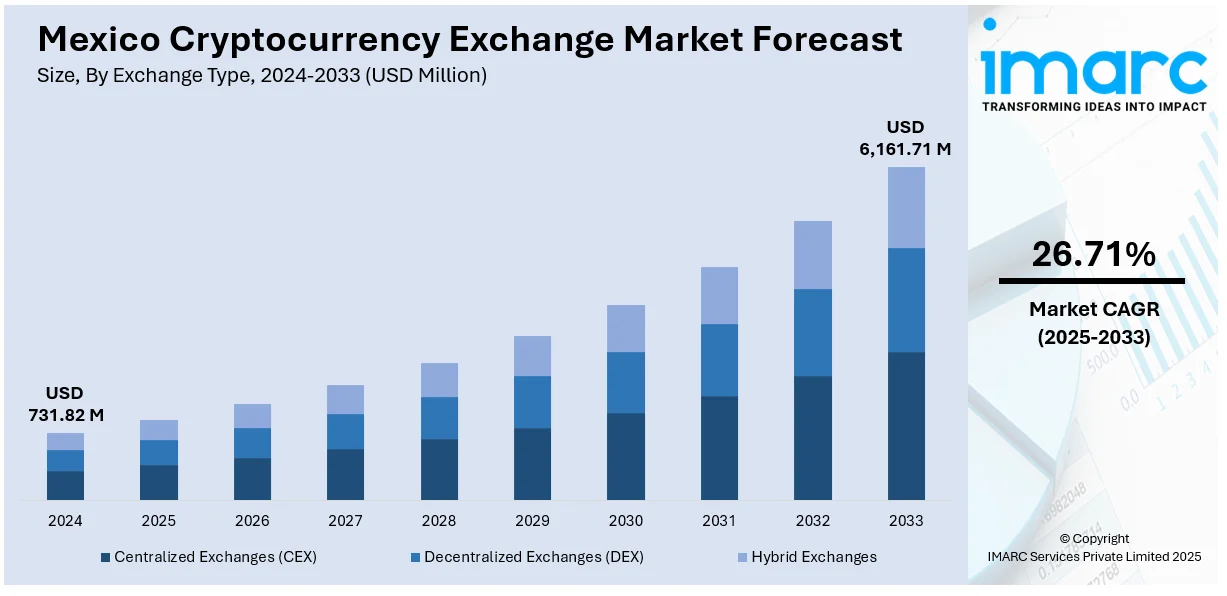

The Mexico cryptocurrency exchange market size reached USD 731.82 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,161.71 Million by 2033, exhibiting a growth rate (CAGR) of 26.71% during 2025-2033. The market is growing due to a thriving fintech ecosystem and increased foreign investment. Fintech integration with blockchain is driving innovation, while strategic partnerships bring capital, technology, and expertise. Together, these factors enhance user access, market infrastructure, and long-term growth potential across the digital asset landscape, further contributing to the expansion of the Mexico cryptocurrency exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 731.82 Million |

| Market Forecast in 2033 | USD 6,161.71 Million |

| Market Growth Rate 2025-2033 | 26.71% |

Mexico Cryptocurrency Exchange Analysis:

- Major Market Drivers: Growing remittance flows from the United States, increasing smartphone penetration, regulatory clarity improvements, and rising fintech adoption are driving Mexico cryptocurrency exchange market demand. Strategic partnerships with international crypto companies and venture capital investments enhance market infrastructure development.

- Key Market Trends: Expansion of decentralized finance (DeFi) services, integration of stablecoins for cross-border payments, development of regulatory-compliant platforms, and partnerships between traditional financial institutions and crypto exchanges characterize the evolving market landscape.

- Challenges: Regulatory uncertainty, cybersecurity concerns, limited banking partnerships, and low crypto literacy among traditional users pose significant barriers. Infrastructure limitations and compliance costs also challenge smaller exchanges entering the Mexico cryptocurrency exchange market analysis.

- Opportunities: Financial inclusion initiatives, growing unbanked population needs, expansion of mobile payment solutions, and increasing institutional interest present substantial growth potential. Cross-border remittance optimization offers significant market expansion opportunities for crypto exchanges.

Mexico Cryptocurrency Exchange Market Trends:

Expansion of Local Fintech Ecosystem

The extensive fintech surge in Mexico is significantly contributing to the expansion of cryptocurrency exchanges, as a growing number of startups and established technology companies integrate blockchain and digital assets into their primary services. The nation’s growing array of fintech accelerators, incubators, and venture capital backing is creating an innovation-focused atmosphere where crypto-related businesses can thrive. As financial technology transforms areas like lending, payments, and personal finance, embracing cryptocurrency is becoming a natural advancement in this ecosystem. Numerous fintech platforms are now integrating crypto exchange features directly into their services, facilitating easier access for users to digital assets seamlessly. Furthermore, Mexico’s fintech sector achieved USD 20.0 billion in 2024 and is expected to expand to USD 65.9 billion by 2033, as reported by IMARC Group, with a compound annual growth rate (CAGR) of 12.80% from 2025 through 2033. This swift growth is paired with an increasing number of experienced experts in blockchain development, cybersecurity, and adherence to regulations. The collaboration between conventional financial technology and decentralized finance (DeFi) is boosting user adoption by reducing entry hurdles and providing more cohesive, secure, and user-friendly platforms.

To get more information on this market, Request Sample

Strategic Partnerships and Foreign Investment

The influx of foreign investment and strategic partnerships is bolstering the Mexico cryptocurrency exchange market growth. International crypto companies and venture capital firms are increasingly recognizing Mexico as a gateway to the broader Latin American market because of its size, location, and economic potential. These collaborations bring much-needed capital, technology, and operational expertise, enabling local exchanges to scale more rapidly. In 2024, CoinFlip expanded into Mexico, marking its eighth international market, a move that underscored the growing global interest in the region. The company introduced over 20 digital currency kiosks in Mexico City, offering users a simple and secure method to conduct cash-based crypto transactions. CoinFlip’s strategic expansion also included promoting its app, which facilitated wallet creation and global crypto transfers, further integrating cryptocurrency services into everyday life. These foreign investments help drive regulatory dialogue, introduce global best practices, and accelerate the development of local market infrastructure. Furthermore, partnerships with fintechs, payment providers, and telecom companies foster deeper integration of crypto services, making digital currencies more accessible and convenient for users. As more international companies expand into Mexico, these collaborations are not only enhancing the overall user experience but also helping to mature the cryptocurrency ecosystem in the country, providing increased liquidity, support, and opportunities for innovation across the market.

Mexico Cryptocurrency Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on exchange type, cryptocurrency type, user type, revenue model, and trading service.

Exchange Type Insights:

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

- Hybrid Exchanges

The report has provided a detailed breakup and analysis of the market based on the exchange type. This includes centralized exchanges (CEX), decentralized exchanges (DEX), and hybrid exchanges.

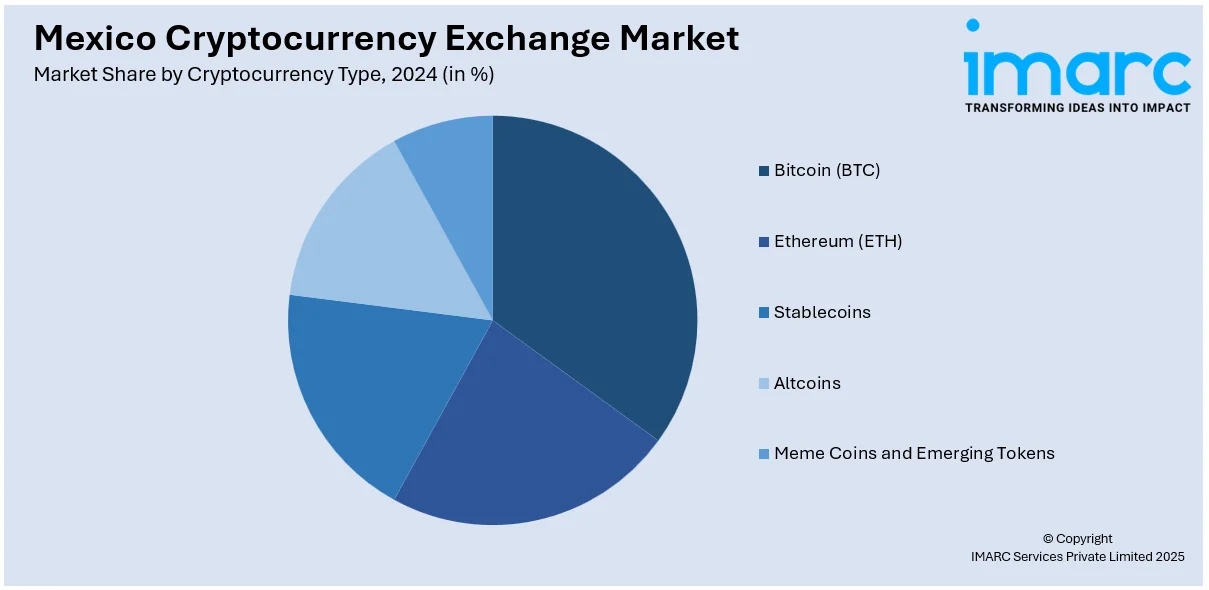

Cryptocurrency Type Insights:

- Bitcoin (BTC)

- Ethereum (ETH)

- Stablecoins

- Altcoins

- Meme Coins and Emerging Tokens

A detailed breakup and analysis of the market based on the cryptocurrency type have also been provided in the report. This includes bitcoin (BTC), Ethereum (ETH), stablecoins, altcoins, and meme coins and emerging tokens.

User Type Insights:

- Retail Traders

- Institutional Investors

- High-Frequency Traders

The report has provided a detailed breakup and analysis of the market based on the user type. This includes retail traders, institutional investors, and high-frequency traders.

Revenue Model Insights:

- Transaction Fees

- Subscription-Based Models

- Listing Fees

- Staking and Yield Farming Services

A detailed breakup and analysis of the market based on the revenue model have also been provided in the report. This includes transaction fees, subscription-based models, listing fees, and staking and yield farming services.

Trading Service Insights:

- Spot Trading

- Futures and Derivatives Trading

- Margin Trading

- Peer-to-Peer (P2P) Trading

A detailed breakup and analysis of the market based on the trading service have also been provided in the report. This includes spot trading, futures and derivatives trading, margin trading, and peer-to-peer (P2P) trading.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Recent News and Development:

- In September 2025, Binance is expanding in Mexico with the launch of Medá, a new local entity and fintech hub registered as an Electronic Payment Funds Institution (IFPE). The exchange plans to invest over 1 billion pesos ($53 million) over four years to advance digital financial services across Latin America. Medá reflects Binance’s long-term commitment to regional growth, building on initiatives that began more than two years ago, aiming to enhance access to innovative, user-friendly fintech solutions for the Mexican population.

- In August 2025, Bybit launched its “Mexico in USDT Mode” P2P campaign, offering Mexican users a share of 12,500 USDT in rewards. Running until September 10, 2025, the event rewards new users with a 20 USDT coupon for depositing 100 USDT, while existing users can earn up to 20 USDT through qualifying P2P trades. Participants must register, complete Identity Verification Level 1, and trade via Bybit P2P, with rewards credited within 10 working days after the campaign ends.

Mexico Cryptocurrency Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Exchange Types Covered | Centralized Exchanges (CEX), Decentralized Exchanges (DEX), Hybrid Exchanges |

| Cryptocurrency Types Covered | Bitcoin (BTC), Ethereum (ETH), Stablecoins, Altcoins, Meme Coins and Emerging Tokens |

| User Types Covered | Retail Traders, Institutional Investors, High-Frequency Traders |

| Revenue Models Covered | Transaction Fees, Subscription-Based Models, Listing Fees, Staking and Yield Farming Services |

| Trading Services Covered | Spot Trading, Futures and Derivatives Trading, Margin Trading, Peer-to-Peer (P2P) Trading |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cryptocurrency exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cryptocurrency exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cryptocurrency exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cryptocurrency exchange market in Mexico was valued at USD 731.82 Million in 2024.

The Mexico cryptocurrency exchange market is projected to exhibit a CAGR of 26.71% during 2025-2033, reaching a value of USD 6,161.71 Million by 2033.

Key factors driving Mexico’s cryptocurrency exchange market include growing fintech adoption, favorable regulatory frameworks, increasing smartphone and internet penetration, rising interest in digital assets among retail and institutional investors, and cross-border remittance demand. These elements collectively boost crypto trading, P2P platforms, and innovative financial services in the Mexican market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)