Mexico Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033

Mexico Cryptocurrency Market Size and Share:

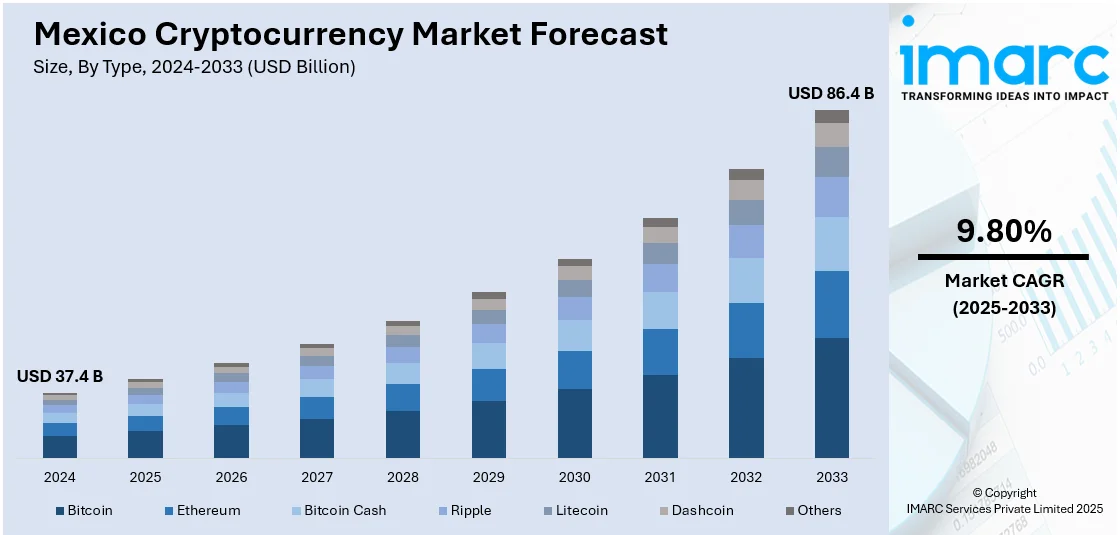

The Mexico cryptocurrency market size reached USD 37.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 86.4 Billion by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The market is propelled by expanding digital uptake, demand for effective cross-border remittances, and expanding fintech infrastructure. Regulatory improvements, increasing financial inclusion initiatives, and increasing crypto-payment solutions further stimulate growth. Further, changing consumer tastes in favor of decentralized finance and blockchain advancements continue to define market growth and mainstream adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 37.4 Billion |

| Market Forecast in 2033 | USD 86.4 Billion |

| Market Growth Rate 2025-2033 | 9.80% |

Mexico Cryptocurrency Market Trends:

Growing Cryptocurrency Adoption

Mexico is experiencing a surge in cryptocurrency adoption, driven by increasing demand for decentralized financial solutions and efficient cross-border transactions. Approximately 3.1 million individuals, or 2.5% of the population, now own digital assets such as Bitcoin, Ethereum, Solana, Dogecoin, and Binance Coin. This ranks Mexico third-highest in Latin America to adopt cryptocurrency after Brazil and Argentina. The increased popularity of crypto-based remittances has further accelerated this adoption, as cryptocurrencies have lower transfer fees and speeds. Young generations and technophile investors are openly adopting blockchain technology, driving the mainstream acceptance further. Different exchanges for cryptocurrencies and payment platforms are growing their influence, bringing digital assets closer to people. This increasing adoption indicates a larger movement towards digital finance, with increasing numbers of people and enterprises examining the utility of cryptocurrencies for routine transactions and investment purposes.

Evolving Regulatory Framework

Mexico’s cryptocurrency market is experiencing regulatory shifts as authorities refine policies to enhance compliance and financial stability. The government has established guidelines defining virtual assets within the financial system, focusing on preventing illicit activities like money laundering. However, regulatory clarity remains a challenge, particularly in taxation, legal recognition, and investor protection. Cryptocurrency profits are subject to capital gains tax, with rates ranging from 1.92% to 35%, while transactions below a specific threshold are exempt. Banks are subjected to limitations in providing crypto-linked services, which has led fintech companies to advocate for more transparent regulations in order to facilitate innovation. While international standards keep changing, Mexican regulators are still weighing the risks and opportunities and seeking to balance consumer protection and digital asset growth. All these regulatory updates will have a strong impact on long-term integration of cryptocurrencies in Mexico's economy.

Central Bank Digital Currency (CBDC) Developments

Mexico is actively working to launch a central bank digital currency (CBDC) in its efforts to contemporize the nation's financial sector. The launch is part of an initiative focused on boosting financial inclusion, accelerating payment infrastructure development, and instituting a government-backed solution rivaling decentralized crypto assets. The government wants to simplify digital transfers using blockchain-based technology while it retains regulation powers. A CBDC would fill the gap between conventional banking and fintech, providing a secure and convenient payment system. The action is in line with worldwide trends as central banks assess digital currencies to use alongside current monetary systems. As the debate continues, the creation of a CBDC could transform the financial sector in Mexico, changing the way digital funds exist alongside conventional financial products.

Mexico Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining, and transaction.

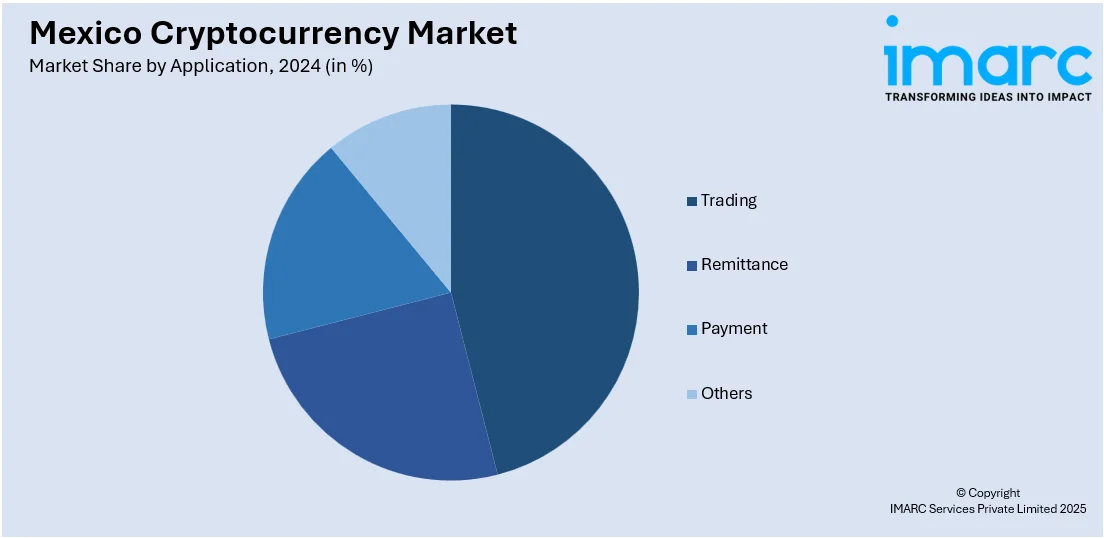

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Cryptocurrency Market News:

- In March 2025, Latin American crypto exchange Bitso introduced MXNB, a Mexican peso-backed stablecoin, through its independent subsidiary, Juno. Designed to enhance cross-border payments, MXNB aims to offer a more efficient financial alternative for global businesses in Latin America. Ben Reid, Head of Stablecoins at Bitso Business, highlighted its role in attracting foreign investment by streamlining transactions beyond traditional financial infrastructure.

- In August 2024, CoinFlip, a leading U.S.-based digital currency platform, expanded into Mexico, marking its eighth international market. Its Bitcoin ATMs, now available in over 20 locations across Mexico City, offer a secure and convenient way to buy and sell cryptocurrency. CEO Ben Weiss emphasized Mexico's growing crypto adoption, while Country Director Alejandro Bravo highlighted its role in financial inclusion. This expansion follows CoinFlip’s Canadian launch, completing its North American presence.

Mexico Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico cryptocurrency market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico cryptocurrency market on the basis of type?

- What is the breakup of the Mexico cryptocurrency market on the basis of component?

- What is the breakup of the Mexico cryptocurrency market on the basis of process?

- What is the breakup of the Mexico cryptocurrency market on the basis of application?

- What is the breakup of the Mexico cryptocurrency market on the basis of region?

- What are the various stages in the value chain of the Mexico cryptocurrency market?

- What are the key driving factors and challenges in the Mexico cryptocurrency market?

- What is the structure of the Mexico cryptocurrency market and who are the key players?

- What is the degree of competition in the Mexico cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)