Mexico Customer Relationship Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Application, Industry Vertical, and Region, 2025-2033

Mexico Customer Relationship Management Market Overview:

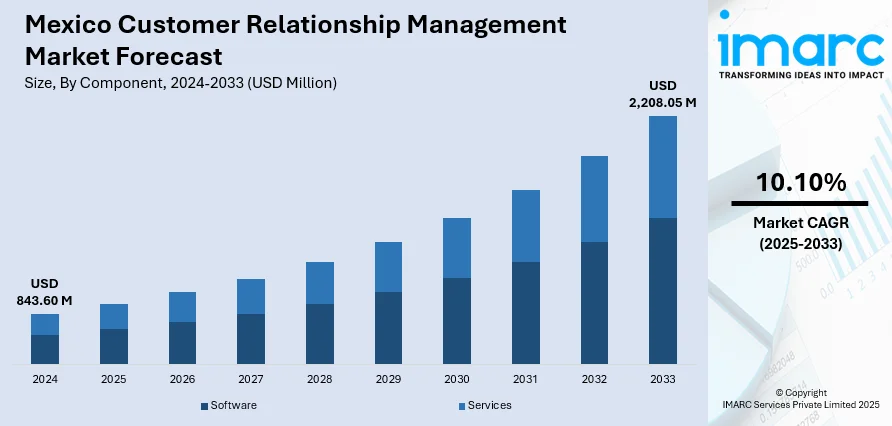

The Mexico customer relationship management market size reached USD 843.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,208.05 Million by 2033, exhibiting a growth rate (CAGR) of 10.10% during 2025-2033. The market is being driven by increasing digital transformation across industries, the adoption of AI-powered CRM solutions, and the rising demand for cloud-based, scalable platforms among small and medium-sized enterprises (SMEs) seeking cost-effective and flexible tools thus surging the Mexico customer relationship management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 843.60 Million |

| Market Forecast in 2033 | USD 2,208.05 Million |

| Market Growth Rate 2025-2033 | 10.10% |

Mexico Customer Relationship Management Market Analysis:

- Major Drivers: Acceleration of digital transformation for Mexican businesses, along with government digitalization efforts, fuels CRM adoption. Expansion of e-commerce industry and increasing demand for customer data analytics spur demand for advanced CRM platforms. Fintech-enabled SME growth generates opportunity for cloud-based deployment of CRM.

- Key Market Trends: AI adoption revolutionizing customer interaction with predictive analysis and automated processes. Cloud solutions becoming popular among SMEs looking for low-cost, scalable platforms. Mobile-first CRM strategies being developed to facilitate remote work and field sales across Mexico's geographically varied terrain.

- Market Challenges: In rural areas, the scarce IT infrastructure hampers deployment capabilities for CRM. Concerns regarding data privacy and cybersecurity threats impede cloud adoption. Language localization and integration complexity with existing systems present implementation challenges for conventional Mexican companies looking to transform digitally.

- Market Opportunities: Based on the Mexico customer relationship management market analysis, the fintech ecosystem expansion opens up opportunities for niche financial services CRM solutions. Moreover, the government digital transformation initiatives provide market expansion opportunities. Increasing smartphone penetration makes mobile CRM adoption possible for micro-enterprises. Industry-specific CRM customization opportunities are present in manufacturing, tourism, and agricultural industries.

Mexico Customer Relationship Management Market Trends:

Growing Adoption of AI-Driven CRM Solutions

The integration of AI into CRM platforms is revolutionizing customer engagement for Mexican businesses. AI-powered CRM systems enhance interactions by providing predictive analytics, personalized recommendations, automated lead scoring, and intelligent chatbots, allowing companies to streamline operations and offer highly tailored customer experiences. AI facilitates deeper data analysis and segmentation, boosting customer retention and conversion rates. It also helps reduce churn, a key challenge in sectors like retail, telecom, and financial services. In Mexico’s retail and e-commerce sectors, AI-enhanced CRM has led to an increase in customer engagement thus strengthening the Mexico customer relationship management market growth. The use of AI for sentiment analysis is also becoming widespread, enabling real-time responses to customer behavior. As AI tools become more accessible, their integration with CRM platforms is set to further transform customer relationship strategies in the region.

To get more information on this market, Request Sample

Surge in Cloud-Based CRM Adoption Among SMEs

Cloud-based CRM solutions are experiencing significant growth in Mexico, particularly among small and medium-sized enterprises (SMEs) looking for flexible, cost-effective tools to manage customer relationships. Unlike traditional on-premise systems, cloud CRMs require minimal infrastructure and offer scalable features ideal for businesses with limited IT resources. Cloud platforms allow SMEs to quickly deploy CRM systems and access real-time customer data from any device or location. This trend is further supported by government-led digital transformation initiatives and fintech-driven SME growth. Additionally, businesses using platforms like Zoho CRM and HubSpot have reported an increase in productivity and an improvement in customer response times. The availability of Spanish-language support and industry-specific templates for sectors like logistics and hospitality is also enhancing the appeal of cloud-based CRM solutions in Mexico’s SME sector.

Mexico Customer Relationship Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, application, and industry vertical.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

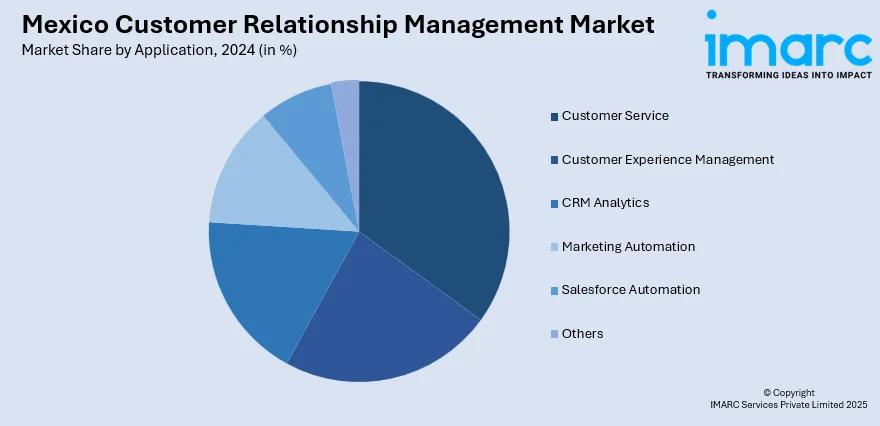

Application Insights:

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Salesforce Automation

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes customer service, customer experience management, CRM analytics, marketing automation, salesforce automation, and others.

Industry Vertical Insights:

- BFSI

- Retail

- Healthcare

- IT and Telecom

- Discrete Manufacturing

- Government and Education

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, retail, healthcare, IT and telecom, discrete manufacturing, government and education, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Recent News and Development:

- In February 2025, Alibaba Cloud has launched its first cloud region in Mexico, expanding its global network to 87 availability zones across 29 regions. The move aims to accelerate Mexico’s digital transformation, offering secure, scalable, and cost-effective cloud services to businesses, startups, and developers. Partnering with local stakeholders, Alibaba Cloud seeks to foster innovation, collaboration, and sustainable growth, reinforcing Mexico City’s position as a leading regional tech hub.

- In November 2024, Zoho launched Zoho One Essentials in Mexico, targeting micro and small businesses at $180 MXN (US$8.8) per user/month. The suite offers 12 essential apps across sales, marketing, HR, finance, collaboration, and productivity, with no feature or usage limits. Designed for affordability and scalability, it enables seamless upgrades to Zoho’s full suite. Zoho highlights AI-driven automation, localization, and ease of use to drive digital adoption.

- February 2024, IntouchCX acquired Beliveo, a leading nearshore contact center and business processing outsourcer (BPO) in Mexico. This acquisition aims to expand IntouchCX's client capabilities and strengthen its leadership in the region.

Mexico Customer Relationship Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Customer Service, Customer Experience Management, CRM Analytics, Marketing Automation, Salesforce Automation, Others |

| Industry Verticals Covered | BFSI, Retail, Healthcare, IT and Telecom, Discrete Manufacturing, Government and Education, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico customer relationship management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico customer relationship management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico customer relationship management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The customer relationship management market in Mexico was valued at USD 843.60 Million in 2024.

The Mexico customer relationship management market is projected to exhibit a CAGR of 10.10% during 2025-2033, reaching a value of USD 2,208.05 Million by 2033.

The market is driven by increasing digital transformation across Mexican industries, widespread adoption of AI-powered CRM solutions providing predictive analytics and automation capabilities, rising demand for cloud-based scalable platforms among SMEs, government-led digitalization initiatives, and expanding fintech ecosystem supporting business growth and customer engagement requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)