Mexico Dairy Alternatives Market Size, Share, Trends and Forecast by Product Type, Source, Formulation, Nutrient, Distribution Channel, and Region, 2025-2033

Mexico Dairy Alternatives Market Overview:

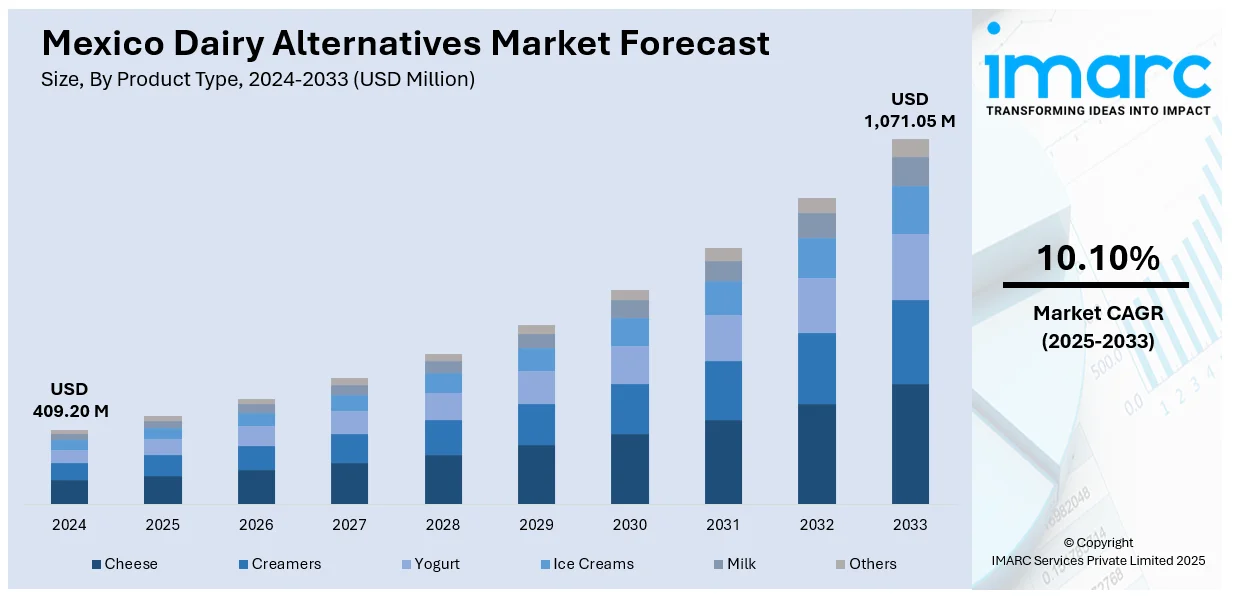

The Mexico dairy alternatives market size reached USD 409.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,071.05 Million by 2033, exhibiting a growth rate (CAGR) of 10.10% during 2025-2033. The market is driven by growing consumer demand for plant-based products due to health, environmental, and ethical reasons. With the growth of lactose intolerance and dietary changes toward vegan and flexitarian diets, consumers are increasingly looking for plant-based milk and dairy alternatives. Product flavor and formulation innovations are expanding the market, and sustainability practices are gaining importance in manufacturing processes, resulting in a shift in Mexico dairy alternatives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 409.20 Million |

| Market Forecast in 2033 | USD 1,071.05 Million |

| Market Growth Rate 2025-2033 | 10.10% |

Mexico Dairy Alternatives Market Trends:

Plant-Based Dairy Alternatives Growth

The Mexica market for dairy alternatives has been growing strongly, mainly due to a growing preference for plant-based dairy alternatives. Lactose intolerance, rising health awareness, and increasing concern for the environment's degradation due to animal agriculture are driving this trend. With more consumers turning to plant-based milk alternatives like almond, oat, and soy milk, the market for dairy alternatives is growing in all segments. This expansion is most notable in the urban areas, where vegetable-based diets are highly popular owing to exposure to international food trends. For instance, in July 2024, NotCo showed how its AI, "Giuseppe," mimics animal-based products with plant-based ingredients. This AI innovation also applies to fragrance creation with their Generative Aroma Transformer (GAT) model. Moreover, the greater access to plant-based foods in stores, coupled with the growth in foodservice options, drives the industry's expansion. The Mexico dairy alternatives market forecast is promising, with this trend continuing to influence the dairy alternative market share in Mexico. As consumer tastes change, the market is likely to diversify further with new products.

Move Towards Health-Oriented Lifestyles

Health-conscious consumers in Mexico intensely opt for dairy alternatives as part of their emphasis on healthier, more balanced diets. Dairy-free products like plant-based milk and yogurts are perceived as healthier due to less fat content, lack of lactose, and fewer additives than conventional dairy products. For example, in August 2024, NIÚKE Foods launched its QMILQ, the initial quinoa-derived plant milk, at the America's Food & Beverage Show in Miami, which provides a healthy, gluten-free, and lactose-free choice to conventional dairy. Furthermore, as the lifestyle diseases such as obesity, diabetes, and cardiovascular disease increase, more Mexicans are seeking alternatives that enable them to lead a healthier lifestyle. Plant-based dairy alternatives also include added vitamins, minerals, and probiotics, which are of interest to consumers seeking functional food. Increasing knowledge of these health benefits has contributed immensely to Mexico dairy alternatives market growth. This trend will likely persist as accelerating numbers of consumers make health a priority, causing the dairy alternatives market to continue its growth. The need for functional and healthy plant-based foods will shape the market trend and proportion of dairy alternatives in Mexico.

Growing Demand for Sustainable Products

Growing demand for environmentally friendly and sustainable products has significantly affected Mexico's dairy alternatives market. With the heightening awareness among people to protect the environment, plant-based dairy alternatives become more appealing because they are less harmful to the environment. Plant-based dairy production consumes less water and land than traditional dairy and causes fewer greenhouse gases. As sustainability increasingly becomes an emerging consumer value, Mexican consumers highly make purchasing choices based on environmental impact, rather than traditional tastes and flavors. This shift is driving more eco-friendly plant-based alternatives, from recyclable packs to ethically sourced produce. The sustainability thrust is further given a boost with global movements in support of a reduction in consumption of animal products to curb climate change. This amplified demand for more sustainable choices is propelling the Mexico dairy alternatives market share, and the outlook for the market indicates further growth as consumers insist on more ecologically friendly choices in their food.

Mexico Dairy Alternatives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, source, formulation, nutrient, and distribution channel.

Product Type Insights:

- Cheese

- Creamers

- Yogurt

- Ice Creams

- Milk

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cheese, creamers, yogurt, ice creams, milk, and others.

Source Insights:

- Almond

- Soy

- Oats

- Hemp

- Coconut

- Rice

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes almond, soy, oats, hemp, coconut, rice, and others.

Formulation Insights:

- Plain

- Sweetened

- Unsweetened

- Flavored

- Sweetened

- Unsweetened

The report has provided a detailed breakup and analysis of the market based on the formulation. This includes plain (sweetened and unsweetened) and flavored (sweetened and unsweetened).

Nutrient Insights:

- Protein

- Starch

- Vitamin

- Others

A detailed breakup and analysis of the market based on the nutrient have also been provided in the report. This includes protein, starch, vitamin, and others.

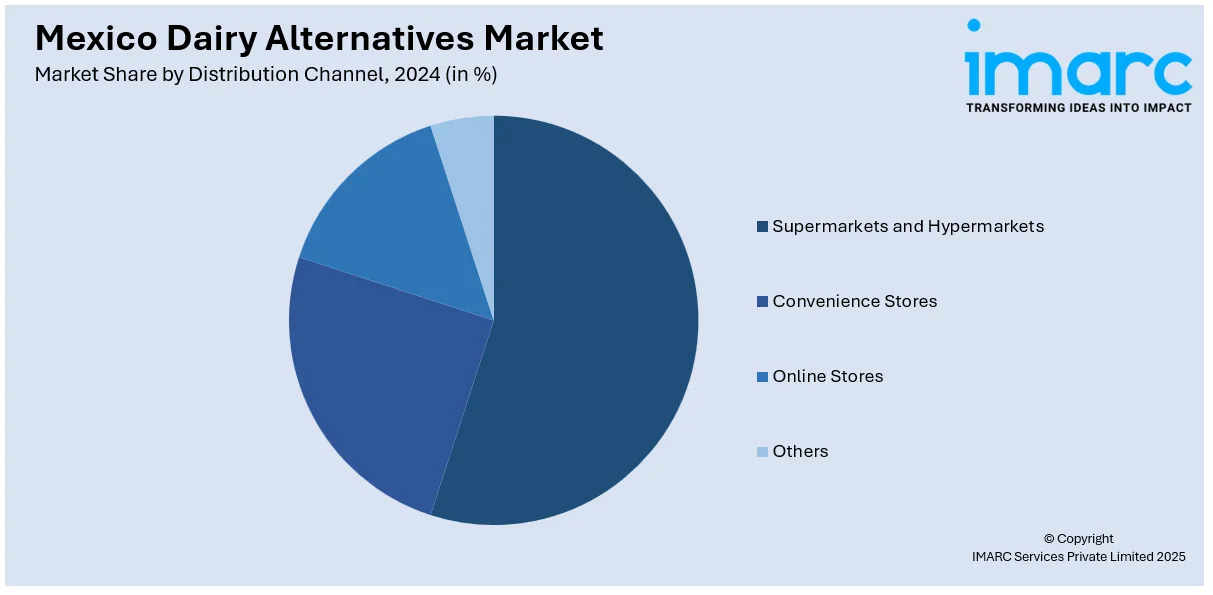

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Dairy Alternatives Market News:

- In September 2024, Nestlé introduced a new line of vegan almond milk in Mexico and Ecuador under the Nature's Heart brand. The product combines almond milk with fruit juices in Almond + Apple and Almond + Tropical Fruit flavors, reflecting Nestlé's focus on growth in the expanding plant-based food market.

Mexico Dairy Alternatives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cheese, Creamers, Yogurt, Ice Creams, Milk, Others |

| Sources Covered | Almond, Soy, Oats, Hemp, Coconut, Rice, Others |

| Formulations Covered |

|

| Nutrients Covered | Protein, Starch, Vitamin, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico dairy alternatives market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico dairy alternatives market on the basis of product type?

- What is the breakup of the Mexico dairy alternatives market on the basis of source?

- What is the breakup of the Mexico dairy alternatives market on the basis of formulation?

- What is the breakup of the Mexico dairy alternatives market on the basis of nutrient?

- What is the breakup of the Mexico dairy alternatives market on the basis of distribution channel?

- What is the breakup of the Mexico dairy alternatives market on the basis of region?

- What are the various stages in the value chain of the Mexico dairy alternatives market?

- What are the key driving factors and challenges in the Mexico dairy alternatives?

- What is the structure of the Mexico dairy alternatives market and who are the key players?

- What is the degree of competition in the Mexico dairy alternatives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico dairy alternatives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico dairy alternatives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico dairy alternatives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)