Mexico Debt Collection Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033

Mexico Debt Collection Software Market Overview:

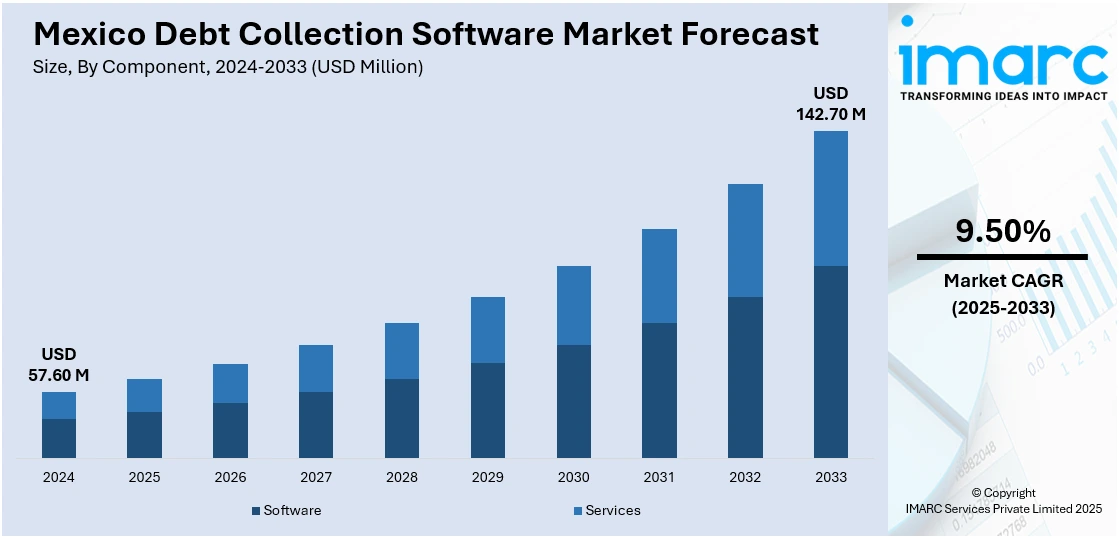

The Mexico debt collection software market size reached USD 57.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 142.70 Million by 2033, exhibiting a growth rate (CAGR) of 9.50% during 2025-2033. The market is driven by the elevating need for automation and digitization in financial services to manage growing consumer and corporate debt, alongside increasing regulatory compliance requirements that push institutions to adopt more efficient, transparent, and technologically advanced debt recovery solutions for improved performance and reduced operational costs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 57.60 Million |

| Market Forecast in 2033 | USD 142.70 Million |

| Market Growth Rate 2025-2033 | 9.50% |

Mexico Debt Collection Software Market Trends:

Rising Consumer Debt and Non-Performing Loans (NPLs)

One of the most important drivers of the Mexico debt collection software industry is the rise of consumer debt and NPLs within financial institutions. While Mexico's financial industry expands and credit becomes more available, there has been a significant surge in consumer borrowing in the form of credit cards, personal loans, car loans, and mortgages. Yet, this increase in credit adoption has come at the expense of an upsurge in delinquencies and defaults, particularly in low- and middle-income individuals who are most vulnerable to economic downturns and inflation. Banks, fintech companies, and microfinance institutions are extensively under pressure to better manage their books of loans to lower default levels. Old-fashioned debt tracking and collection techniques are fast becoming outdated as they are inefficient and non-scalable. In this scenario, debt collection software offers sophisticated analytics, automation, and segmentation features that enable creditors to focus on the most important accounts, tailor repayment approaches, and communicate across channels in an efficient manner. These programs also allow regulatory compliance monitoring and real-time reporting, which are essential in a highly regulated financial landscape.

Regulatory Modernization and Digital Transformation in Financial Services

Another driver of the debt collection software market in Mexico is the regulatory modernization and wider drive for digital transformation across the financial services industry. In the last ten years, the Mexican government and financial regulators have been implementing policies designed to raise transparency, enhance financial inclusion, and improve risk management among lending institutions. Some of the primary regulations by institutions such as CONDUSEF (National Commission for the Protection and Defense of Users of Financial Services) and CNBV (National Banking and Securities Commission) include strict reporting, data safeguarding, and ethical debt recovery methods. Such changes in rules are prompting banks to discard legacy systems and opt for innovative, compliant, and secure digital alternatives. Platforms for debt collection software are becoming highly popular due to the provision of audit trails, encryption, workflow customization, and legal document support that complies with requirements from regulators. In addition, Mexico's well developed fintech sector, coupled with government-supported digital economy projects, has caused even small- and mid-size lenders to put money into tech-enabled operations.

Mexico Debt Collection Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, and end user.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

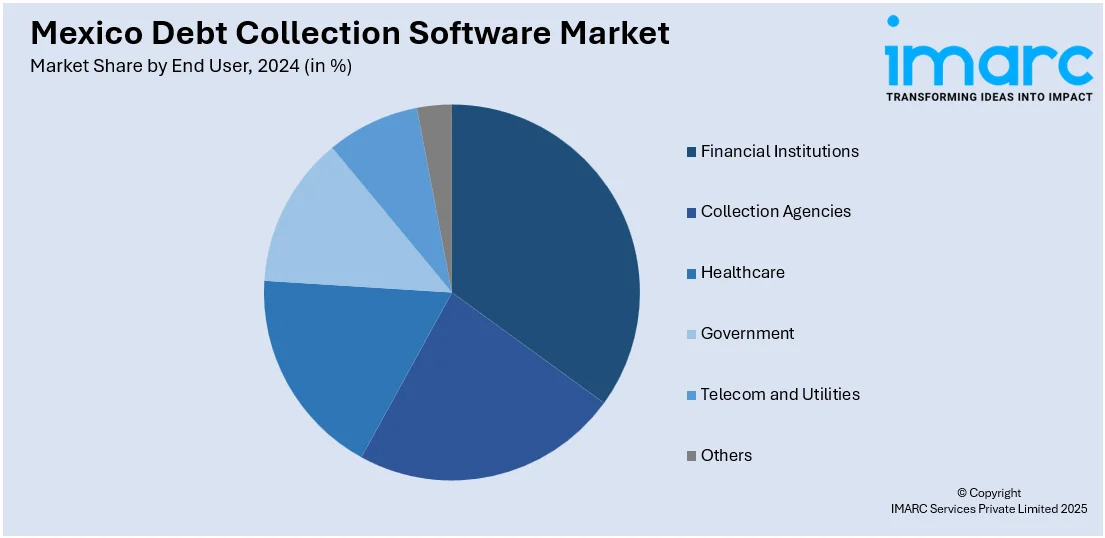

End User Insights:

- Financial Institutions

- Collection Agencies

- Healthcare

- Government

- Telecom and Utilities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes financial institutions, collection agencies, healthcare, government, telecom and utilities, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Debt Collection Software Market News:

- February 2025: Santander's Openbank launched in Mexico, offering a fully digital banking experience with features like a 12.5% annual return on savings accounts, no minimum balance requirements, and access to over 10,000 ATMs. Openbank's proprietary technology platform includes advanced tools for managing various banking operations, encompassing debt collection processes.

- January 2024: Invenium Legaltech assisted RTS, a software solutions provider for the corrugated cardboard industry, in recovering debts in Mexico and Dubai through out-of-court settlements. This demonstrates the effectiveness of strategic credit management in complex legal environments.

Mexico Debt Collection Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Users Covered | Financial Institutions, Collection Agencies, Healthcare, Government, Telecom and Utilities, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico debt collection software market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico debt collection software market on the basis of component?

- What is the breakup of the Mexico debt collection software market on the basis of deployment mode?

- What is the breakup of the Mexico debt collection software market on the basis of organization size?

- What is the breakup of the Mexico debt collection software market on the basis of end user?

- What are the various stages in the value chain of the Mexico debt collection software market?

- What are the key driving factors and challenges in the Mexico debt collection software market?

- What is the structure of the Mexico debt collection software market and who are the key players?

- What is the degree of competition in the Mexico debt collection software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico debt collection software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico debt collection software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico debt collection software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)