Mexico Diagnostic Labs Market Size, Share, Trends and Forecast by Provider Type, Test Type, Sector, End User, and Region, 2025-2033

Mexico Diagnostic Labs Market Overview:

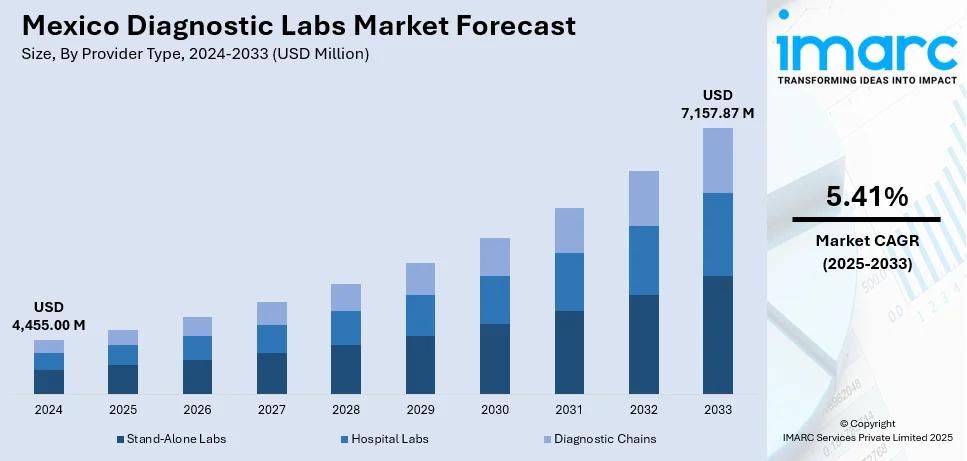

The Mexico diagnostic labs market size reached USD 4,455.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,157.87 Million by 2033, exhibiting a growth rate (CAGR) of 5.41% during 2025-2033. The market is propelled by increased need for preventive medicine, growing incidence of chronic disease, and rising awareness about early disease detection. Advancements in technology, such as molecular diagnostics and automation, which are enhancing test speed and accuracy, along with government efforts to increase healthcare availability, especially to underserved communities, are also significantly contributing to the Mexico diagnostic labs market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,455.00 Million |

| Market Forecast in 2033 | USD 7,157.87 Million |

| Market Growth Rate 2025-2033 | 5.41% |

Mexico Diagnostic Labs Market Trends:

Growth of Point-of-Care Testing (POCT)

Point-of-care testing (POCT) is increasing in Mexico's diagnostic labs market due to the demand for timely and affordable diagnostic solutions. POCT allows medical professionals to conduct tests at or near the location of patient care, decreasing result wait times and enabling immediate clinical decisions. This is especially useful in rural and disadvantaged regions where access to central laboratories can be a problem. This adoption is facilitated by the development of portable diagnostic equipment and mobile health software, making healthcare services more accessible and efficient throughout the nation. According to the IMARC Group, the Mexico point-of-care diagnostics market size reached USD 637.3 Million in the year 2024, and is further expected to reach USD 1,363.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.9% during 2025-2033. Apart from this, the COVID-19 pandemic has also accelerated the adoption of POCT, as timely diagnosis plays a vital role in controlling infectious diseases. Consequently, diagnostic laboratories are now adopting POCT into their services in order to accommodate the increasing need for rapid and accurate testing.

Artificial Intelligence Integration in Diagnostics

Artificial intelligence- and machine learning-based systems introduced into diagnostic laboratories mark a significant revolution in medical diagnostics in Mexico. AI algorithms are capable of scanning through complex medical data, ranging from imaging to genetics, to promote early detection of multifaceted diseases and facilitate tailored treatment planning. It enhances the accuracy and speed of diagnosis, lessening the probability of human error, and hence ensuring better outcomes for patients. Apart from that, AI tools are also helpful in automating laboratory workflows, which allows for better utilization of resources, and provides aid in decision-making process in the clinical arena. The deployment of AI in diagnostics resonates with precision medicine discourse on a global front and will only keep escalating as providers of health care seek solutions for the emerging needs of patients.

Focus on Preventive Healthcare and Early Detection

In Mexico's diagnostic laboratories market, preventive healthcare is becoming more prominent, which translates into an emphasis on early disease detection and health monitoring. Regular check-ups and health screenings are promoted so that potential health problems can be detected before they advance to more serious conditions. Diagnostic laboratories play an important part in this scheme by increasing access to a range of tests that detect diseases like cancers, diabetes, and cardiovascular illness at an early stage. While these measures provide for an opportunity to improve individual outcomes, they also stem long-term healthcare costs through timely interventions. With more people becoming aware of the advantages of preventive medicine, demand for diagnostic services will likely expand, thus further propelling the Mexico diagnostic labs market growth.

Mexico Diagnostic Labs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on provider type, test type, sector, and end user.

Provider Type Insights:

- Stand-Alone Labs

- Hospital Labs

- Diagnostic Chains

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes stand-alone labs, hospital labs, and diagnostic chains.

Test Type Insights:

- Pathology

- Radiology

The report has provided a detailed breakup and analysis of the market based on the test type. This includes pathology and radiology.

Sector Insights:

- Urban

- Rural

The report has provided a detailed breakup and analysis of the market based on the sector. This includes urban and rural.

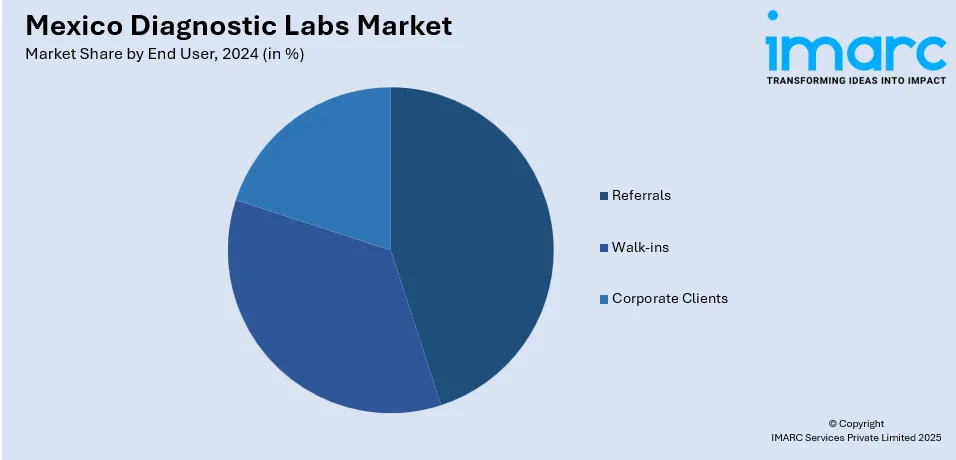

End User Insights:

- Referrals

- Walk-ins

- Corporate Clients

The report has provided a detailed breakup and analysis of the market based on the end user. This includes referrals, walk-ins, and corporate clients.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Diagnostic Labs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Provider Types Covered | Stand-Alone Labs, Hospital Labs, Diagnostic Chains |

| Test Types Covered | Pathology, Radiology |

| Sectors Covered | Urban, Rural |

| End Users Covered | Referrals, Walk-ins, Corporate Clients |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico diagnostic labs market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico diagnostic labs market on the basis of provider type?

- What is the breakup of the Mexico diagnostic labs market on the basis of test type?

- What is the breakup of the Mexico diagnostic labs market on the basis of sector?

- What is the breakup of the Mexico diagnostic labs market on the basis of end user?

- What is the breakup of the Mexico diagnostic labs market on the basis of region?

- What are the various stages in the value chain of the Mexico diagnostic labs market?

- What are the key driving factors and challenges in the Mexico diagnostic labs?

- What is the structure of the Mexico diagnostic labs market and who are the key players?

- What is the degree of competition in the Mexico diagnostic labs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico diagnostic labs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico diagnostic labs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico diagnostic labs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)