Mexico Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Mexico Diaper Market Overview:

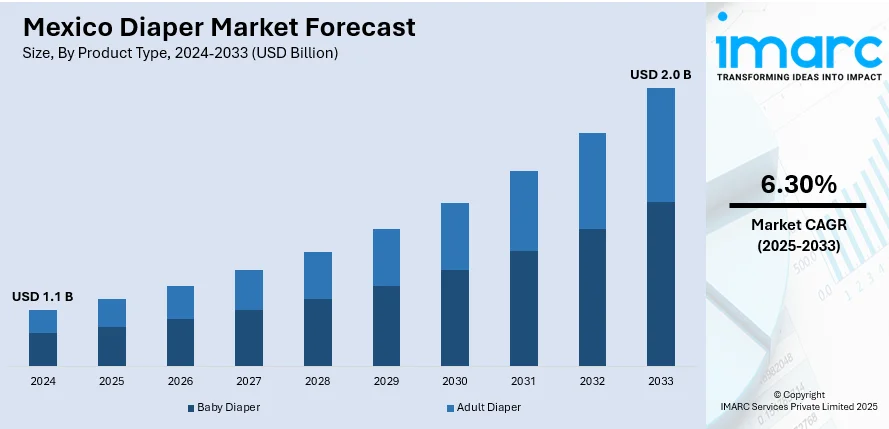

The Mexico diaper market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. The market is driven by a rising birth rate, increased female workforce participation, expanding middle-class income, and growing awareness of hygiene. Additionally, product innovations, urbanization, and retail penetration support market expansion. Increased demand for adult incontinence products also contributes to overall growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Market Growth Rate 2025-2033 | 6.30% |

Mexico Diaper Market Trends:

Expansion of Eco-Friendly and Biodegradable Diapers

Environmental concerns and consumer demand for sustainable products have prompted brands in Mexico to introduce eco-friendly and biodegradable diaper alternatives. These products utilize organic cotton, plant-based liners, and compostable materials to reduce landfill waste. The trend is gaining traction among environmentally conscious parents, particularly in urban centers where awareness of ecological impact is higher. For instance, a 2025 study indicated that 60% of Millennials and 59% of Gen Z are open to spending more on sustainable products and services. Additionally, 81% of Millennials and 79% of Gen Z believe companies have a responsibility to do more in helping consumers make environmentally conscious buying choices. Manufacturers are marketing these products with certifications and transparency about ingredient sourcing. This shift has created a niche yet expanding market segment, prompting both multinational and local players to invest in green innovation. Additionally, regulatory emphasis on reducing plastic waste is encouraging retailers to prioritize environmentally responsible products, signaling further momentum for biodegradable diaper adoption in Mexico’s hygiene segment.

Growth of Adult Incontinence Products

The adult diaper segment in Mexico is witnessing accelerated growth, driven by a rising elderly population and increased healthcare awareness. For instance, according to the data by Pan American Health Organization (PAHO/WHO), in 2024, individuals aged 65 and older made up 8.2% of the overall population in Mexico. As lifestyles evolve and chronic conditions such as diabetes and mobility-related issues become more common, the demand for discreet, comfortable, and absorbent incontinence solutions is rising. Marketing campaigns targeting caregivers and healthcare institutions are boosting product visibility and acceptance. Furthermore, improved product design—featuring thinner profiles, odor control, and better fit—has made adult diapers more socially acceptable. Retailers are also expanding shelf space for adult incontinence products in pharmacies and supermarkets. These developments position the segment as a key driver in the broader diaper market, contributing to year-round demand beyond the infant demographic.

Digitization of Retail and Subscription Models

Digital retailing is reshaping diaper distribution in Mexico, with more consumers purchasing through e-commerce platforms and mobile apps. For instance, in April 2024, Soft N Dry Diapers Corp. and its subsidiary in Mexico launched a new B2B partner portal, ecoFlexCore.com, to support baby diaper manufacturers in Canada, the US, and Mexico. The portal facilitates ordering and production of the company’s tree-free, eco-friendly diapers using ecoFlex Core, a proprietary pulp-free material. The platform will scale commercially through 2024, offering digital tools like invoicing, messaging, and supply chain tracking. Additionally, subscription models offering periodic deliveries of diapers are gaining popularity for their convenience and cost-effectiveness. These services often provide customization based on baby age or incontinence needs, coupled with discounts and flexible delivery options. Major online retailers and direct-to-consumer brands are leveraging data analytics to refine offerings and enhance customer experience. Additionally, digital channels facilitate consumer education through reviews, parenting tips, and comparison tools, which influence buying decisions. The integration of digital payment options and reliable last-mile logistics has further reinforced the shift towards online diaper purchases, particularly among tech-savvy urban parents.

Mexico Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Baby Diaper

- Disposable Diapers

- Training Diapers

- Cloth Diapers

- Swim Pants

- Biodegradable Diapers

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby diaper (disposable diapers, training diapers, cloth diapers, swim pants, and biodegradable diapers) and adult diaper (pad type, flat type, and pant type).

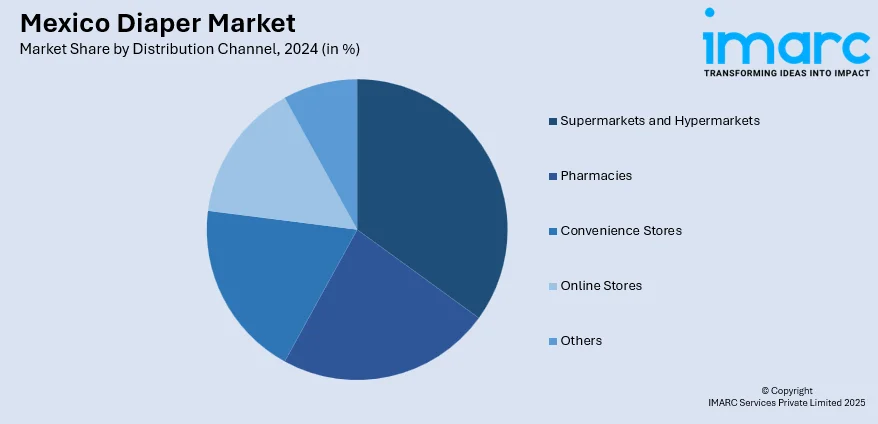

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Diaper Market News:

- In August 2024, Soft N Dry Diapers Corp. launched its Tree Free disposable diapers under the ecoSoft brand through a white-label partner, ecoSoft Diapers & Materials LLC. These diapers use ecoFlex Core Technology to eliminate traditional tree fiber, addressing the environmental cost of the 10 million trees cut annually for conventional diapers. Manufactured in Mexico, the product offers improved sustainability, comfort, and cost-efficiency.

- In August 2023, DelicaWash Care Corp. began operations in Mexico with a new office in Zapopan, Jalisco, and a Spanish-language website (DelicaWash.mx). The expansion includes a partnership with influencer platform StarNgage to drive brand awareness and retail sales. Mexico will serve as a strategic hub for manufacturing, logistics, and sales, supporting growth across Latin America.

Mexico Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico Region, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico diaper market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico diaper market on the basis of product type?

- What is the breakup of the Mexico diaper market on the basis of distribution channel?

- What are the various stages in the value chain of the Mexico diaper market?

- What are the key driving factors and challenges in the Mexico diaper market?

- What is the structure of the Mexico diaper market and who are the key players?

- What is the degree of competition in the Mexico diaper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico diaper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico diaper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)