Mexico Diesel Engine Market Size, Share, Trends and Forecast by Power Rating, End User, and Region, 2025-2033

Mexico Diesel Engine Market Overview:

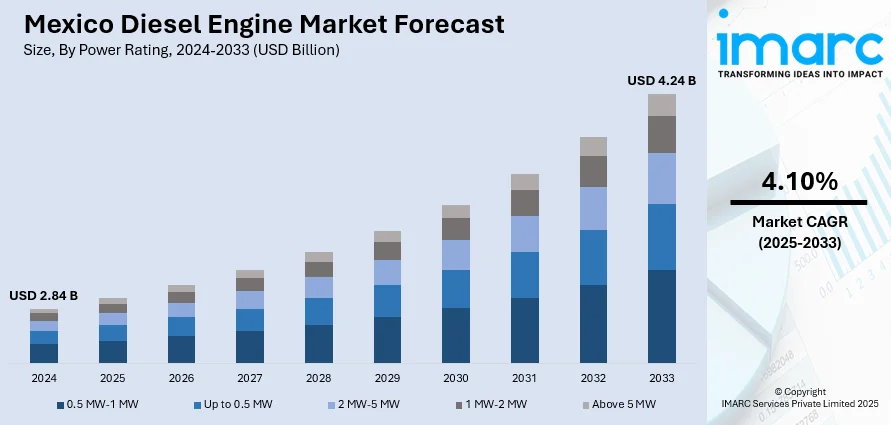

The Mexico diesel engine market size reached USD 2.84 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.24 Billion by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market is being driven by large-scale infrastructure development and the rapid expansion of cold chain logistics. Diesel engines remain crucial for powering construction machinery, transport vehicles, and mobile equipment across challenging terrains with limited grid access. In the cold chain sector, they ensure continuous refrigeration and auxiliary functions in transport and storage, especially in remote or semi-urban areas. The reliability, fuel efficiency, and adaptability of diesel engines are making them a core component of construction and logistics sectors, significantly contributing to the Mexico diesel engine market share across diverse operational environments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.84 Billion |

| Market Forecast in 2033 | USD 4.24 Billion |

| Market Growth Rate 2025-2033 | 4.10% |

Mexico Diesel Engine Market Trends:

Infrastructure Growth and Off-Highway Equipment Demand

The expansion of infrastructure in Mexico is creating steady demand for high-performance diesel engines, especially in major transportation, energy, and industrial initiatives. In 2025, the federal government revealed a US$2.5 billion investment in road infrastructure, focusing on seven priority areas alongside essential highway, bridge, and local road projects. The initiative includes 437 kilometers of artisanal roads and combines public and private investments, enhancing the scale and speed of construction efforts across the country. These advancements necessitate a broad use of earthmoving machinery, mobile power systems, and robust transport vehicles, applications where diesel engines continue to be essential. Their output, which is rich in torque, along with a lengthy operational lifespan and efficiency when handling heavy loads, makes them ideal for tough, high-use settings. Contractors and equipment producers are opting for diesel engines with electronic management that provide accurate diagnostics and longer maintenance intervals, enhancing operational availability in areas with restricted service infrastructure. Distant construction sites, particularly in hilly and rural regions with unreliable or absent grid access, still depend on diesel-operated equipment for digging, transporting, and providing power on-site. These engines provide cold-start functionality and load adaptability, both of which are crucial for areas with high altitudes and variable temperatures. With the increase in government expenditure and private sector participation in infrastructure development, diesel engines are playing a crucial role in project implementation, thereby supporting the Mexico diesel engine market growth. Incorporating them into both modern and older machines guarantees that the construction value chain remains efficient across regions with difficult landscapes or inadequate energy supply systems.

Logistics Expansion and Cold Chain Infrastructure Development

The growth of Mexico’s e-commerce, retail, and food distribution industries is encouraging investments in cold chain logistics, where diesel engines are crucial for continuous refrigeration and transport activities. In 2024, the cold chain industry in Mexico had a valuation of USD 4.75 billion, with expectations to rise to USD 23.21 billion by 2033, experiencing a CAGR of 19.29% from 2025 to 2033, as per the IMARC Group. This swift expansion is fueling the use of refrigerated trucks, portable cold storage solutions, and diesel backup generators at distribution centers to maintain product quality during long-distance and time-sensitive shipments. Diesel engines provide dependable, transportable energy, especially vital in areas with unreliable grid connectivity or difficult landscapes. Their steady torque delivery aids in vehicle movement and auxiliary tasks, such as refrigeration units and hydraulic lift systems, guaranteeing that perishable items like seafood, medications, and fresh fruits are maintained from source to endpoint. Logistics companies are putting money into newer diesel engine designs that deliver improved fuel efficiency, reduced emissions, and longer maintenance periods to enhance fleet effectiveness. Diesel-driven systems are crucial in temporary storage locations and cross-docking facilities where quick cooling is vital. As cold chain networks grow more advanced and widespread to fulfill local and export needs, diesel engines remain the foundation of both mobile and stationary refrigeration systems. Their capacity to function autonomously from the grid guarantees the continuity of the cold chain, even in areas with infrastructure constraints.

Mexico Diesel Engine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on power rating and end user.

Power Rating Insights:

- 0.5 MW-1 MW

- Up to 0.5 MW

- 2 MW-5 MW

- 1 MW-2 MW

- Above 5 MW

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes 0.5 MW-1 MW, up to 0.5 MW, 2 MW-5 MW, 1 MW-2 MW, and above 5 MW.

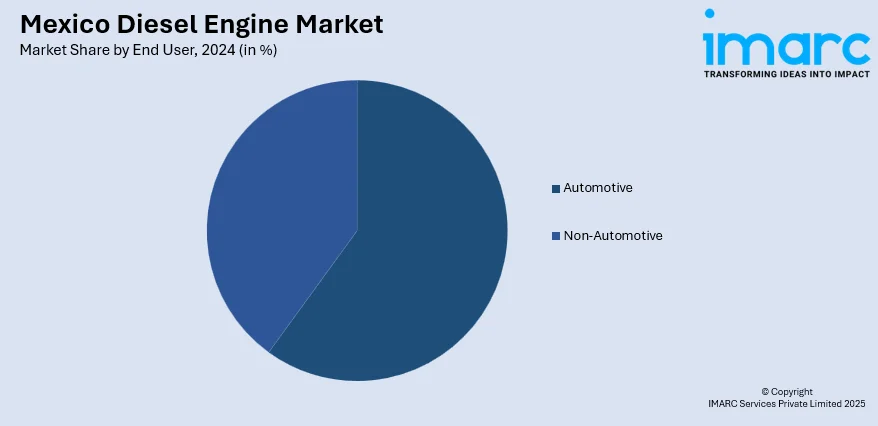

End User Insights:

- Automotive

- On-Road

- Light Vehicles

- Medium/Heavy Trucks

- Light Trucks

- Off Road

- Industrial/Construction Equipment

- Agriculture Equipment

- Marine Applications

- On-Road

- Non-Automotive

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive [on-road (light vehicles, medium/heavy trucks, and light trucks) and off road (industrial/construction equipment, agriculture equipment, and marine applications)] and non-automotive.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Diesel Engine Market News:

- In March 2025, GM officially launched the brand-new 2025 Chevy Express Max Van in Mexico, expanding its commercial lineup with a midsize cargo van. Based on the Maxus V70 from SAIC Motor, it features a 2.0L turbodiesel engine, 1,295 kg payload, and 8.3 m³ cargo space.

- In July 2024, Foton Motor launched its TUNLAND pickup range in Mexico, including the hybrid TUNLAND V and electric TUNLAND E5. The TUNLAND V offered L2.5 autonomous driving and smart features, while the TUNLAND G targets off-road use with a powerful diesel engine and advanced safety systems.

Mexico Diesel Engine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Ratings Covered | 0.5 MW-1 MW, Up to 0.5 MW, 2 MW-5 MW, 1 MW-2 MW, Above 5 MW |

| End Users Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico diesel engine market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico diesel engine market on the basis of power rating?

- What is the breakup of the Mexico diesel engine market on the basis of end user?

- What is the breakup of the Mexico diesel engine market on the basis of region?

- What are the various stages in the value chain of the Mexico diesel engine market?

- What are the key driving factors and challenges in the Mexico diesel engine?

- What is the structure of the Mexico diesel engine market and who are the key players?

- What is the degree of competition in the Mexico diesel engine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico diesel engine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico diesel engine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico diesel engine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)