Mexico Digital Printing Market Size, Share, Trends and Forecast by Type, Ink Type, Application, and Region, 2025-2033

Mexico Digital Printing Market Overview:

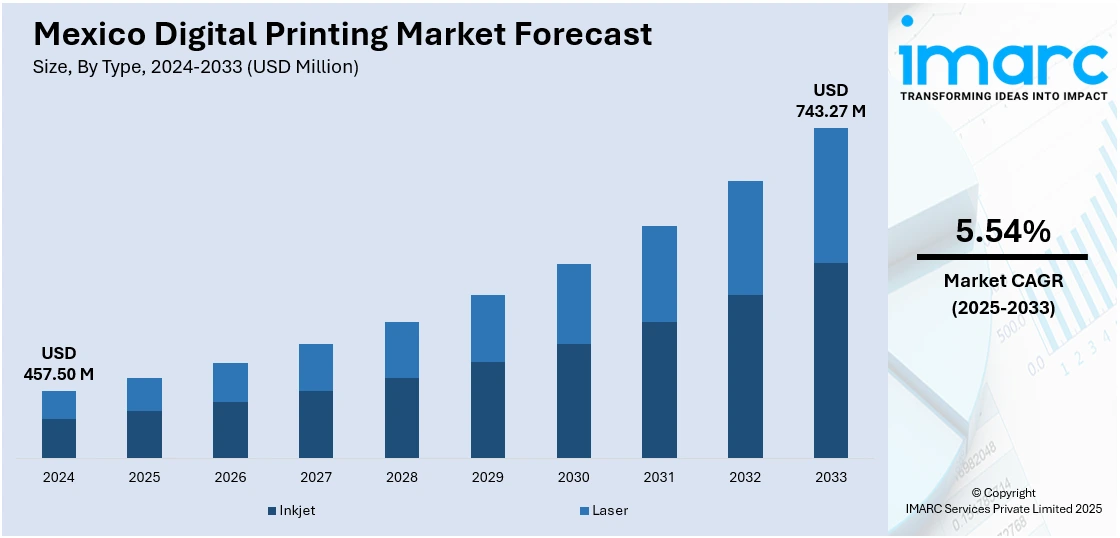

The Mexico digital printing market size reached USD 457.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 743.27 Million by 2033, exhibiting a growth rate (CAGR) of 5.54% during 2025-2033. The growing adoption of digital printing by home décor, sportswear, and casual apparel manufacturers to enhance efficiency and design flexibility is positively influencing the market. Besides this, the broadening of e-commerce portals and retail outlets is contributing to the expansion of the Mexico digital printing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 457.50 Million |

| Market Forecast in 2033 | USD 743.27 Million |

| Market Growth Rate 2025-2033 | 5.54% |

Mexico Digital Printing Market Trends:

Increasing demand in textile industry

The rising demand for digital printing in the textile industry is offering a favorable market outlook. As fashion and textile manufacturers are looking for ways to produce vibrant, customized, and small-batch designs, digital printing is offering the perfect solution. It allows quick changes in patterns and colors without the need for traditional screens or plates, making it ideal for short-run and personalized production. The textile industry is benefiting from the ability to experiment with designs and respond quickly to changing fashion trends. Digital printing supports eco-friendly practices by using less water and producing less waste compared to traditional printing methods, which aligns with the growing focus on sustainability. It also speeds up the manufacturing process, helping manufacturers meet tight deadlines and market demands. Home décor, sportswear, and casual apparel producers in Mexico are adopting digital printing for its efficiency and design flexibility. As local and international demand for printed fabrics is rising, digital printing is becoming a valuable tool for innovation and competitiveness in the Mexican textile sector. As reported by Data Mexico, in the second quarter of 2024, the gross domestic product (GDP) of the textile sector hit MXD 6.58 Billion (USD 318 Million), reflecting a 5.06% rise compared to Q1.

Expansion of e-commerce portals

The expansion of e-commerce sites is impelling the Mexico digital printing market growth. As numerous businesses are selling products online, they are seeking unique and visually appealing packaging to attract customers and stand out in a competitive digital marketplace. Digital printing offers fast turnaround, high-quality output, and the flexibility to print short runs, making it ideal for e-commerce sellers who require quick changes in design and branding. E-commerce platforms are encouraging personalized marketing, where companies are using variable data printing to customize products and packaging based on customer preferences. This trend is enabling digital printers to provide solutions that support creativity, personalization, and rapid delivery. Sellers are also utilizing digital printing for inserts, thank-you cards, and item instructions that enhance the customer experience. In addition, the rise in small and home-based businesses on e-commerce platforms is creating the need for affordable and professional-looking printed materials. The ability to print on demand reduces inventory costs and waste, which aligns with the operational needs of online sellers. Logistics and shipping companies are using digital printing for labels, tags, and barcodes to streamline delivery processes. As the e-commerce industry continues to thrive across urban and rural areas in Mexico, the need for fast, reliable, and cost-effective digital printing services is rising. As per industry reports, the e-commerce market in Mexico is anticipated to grow by 8.78% on an annual basis to reach USD 61.4 Billion in 2024.

Mexico Digital Printing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, ink type, and application.

Type Insights:

- Inkjet

- Laser

The report has provided a detailed breakup and analysis of the market based on the type. This includes inkjet and laser.

Ink Type Insights:

- Aqueous Ink

- UV-Cured Ink

- Solvent Ink

- Latex Ink

- Dye Sublimation Ink

A detailed breakup and analysis of the market based on the ink type have also been provided in the report. This includes aqueous ink, UV-cured ink, solvent ink, latex ink, and dye sublimation ink.

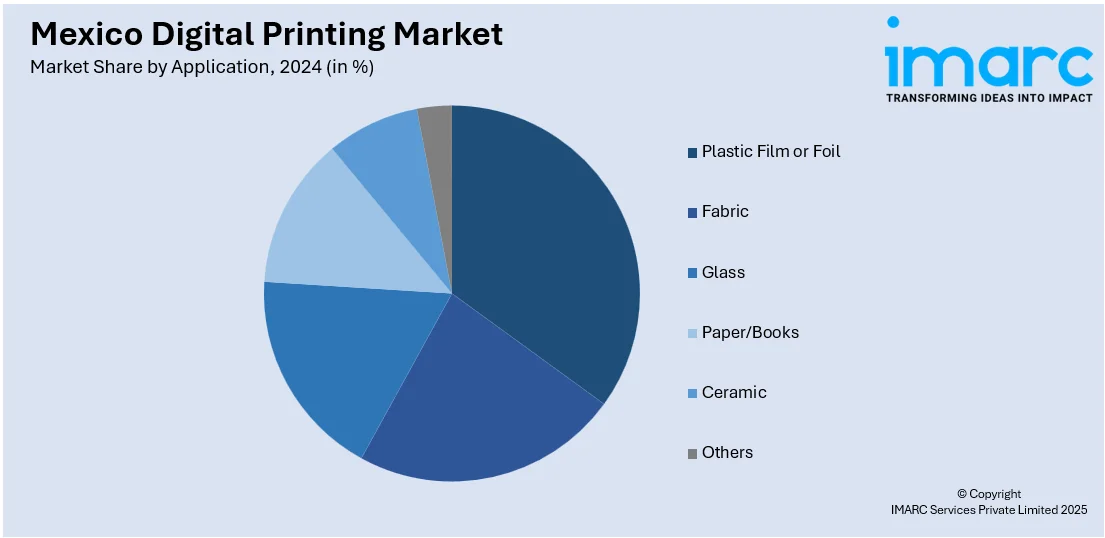

Application Insights:

- Plastic Film or Foil

- Fabric

- Glass

- Paper/Books

- Ceramic

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes plastic film or foil, fabric, glass, paper/books, ceramic, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Digital Printing Market News:

- In April 2025, Mark Andy commemorated its achievement at Labelexpo Mexico by holding an open house event and introducing its improved service model in the nation. The launch brought in a local Mark Andy-trained technical team, ensuring on-site parts availability, quicker response rates, and specialized assistance for flexo, digital, and finishing products.

- In February 2024, Domino Printing Sciences, the worldwide authority in variable data printing solutions, revealed its involvement in Labelexpo Mexico 2025. Visitors were welcome to ‘Discover the Domino Difference’ at booth C55, explore the variety of color label presses and monochrome printing technology showcased, and learn how Domino’s knowledge, services, and solutions could assist them in ‘Doing more’ on their digital printing adventure. Notable features consisted of live demonstrations of the firm’s acclaimed N610i digital label press, a reliable option for converters transitioning to digital.

Mexico Digital Printing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Inkjet, Laser |

| Ink Types Covered | Aqueous Ink, UV-Cured Ink, Solvent Ink, Latex Ink, Dye Sublimation Ink |

| Applications Covered | Plastic Film or Foil, Fabric, Glass, Paper/Books, Ceramic, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico digital printing market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico digital printing market on the basis of type?

- What is the breakup of the Mexico digital printing market on the basis of ink type?

- What is the breakup of the Mexico digital printing market on the basis of application?

- What is the breakup of the Mexico digital printing market on the basis of region?

- What are the various stages in the value chain of the Mexico digital printing market?

- What are the key driving factors and challenges in the Mexico digital printing market?

- What is the structure of the Mexico digital printing market and who are the key players?

- What is the degree of competition in the Mexico digital printing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico digital printing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico digital printing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico digital printing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)