Mexico Digital Video Content Market Size, Share, Trends and Forecast by Business Model, Type, Device, and Region, 2025-2033

Mexico Digital Video Content Market Size and Share:

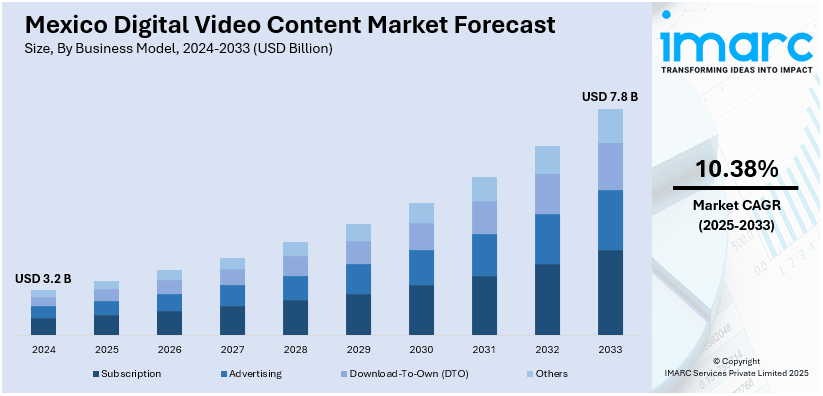

The Mexico digital video content market size reached USD 3.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.8 Billion by 2033, exhibiting a growth rate (CAGR) of 10.38% during 2025-2033. The market is witnessing significant growth driven by rising streaming platform adoption, AVOD growth, and increasing mobile video consumption. AI-driven personalization and regional content investments are enhancing viewer engagement, shaping a dynamic market outlook with strong future growth potential.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Market Growth Rate 2025-2033 | 10.38% |

Mexico Digital Video Content Market Trends:

Rising Adoption of AVOD (Ad-Supported Video on Demand)

The adoption of AVOD (Ad-Supported Video on Demand) is rapidly growing in Mexico as viewers seek free access to high-quality digital content. The Mexico digital video content market share is expanding as streaming platforms introduce AVOD models to attract cost-conscious consumers. With rising internet penetration and mobile accessibility, audiences are increasingly shifting toward ad-supported platforms like YouTube, Pluto TV and Vix, which offer diverse content without subscription fees. Global streaming giants are increasingly embracing AVOD models to diversify revenue streams and attract a broader audience. For instance, in September 2023, Amazon Prime Video announced its plans to launch advertising in Mexico and other key markets by late 2024. While ad-supported streaming will start in early 2024 for the US, UK, Germany and Canada, subscribers globally can pay to avoid ads. This move aims to offset rising production costs amidst increased competition. Advertisers are also leveraging this trend by investing in targeted video ads enhancing revenue opportunities for streaming services. Additionally, global and regional streaming providers are integrating AI-driven ad placements to improve user engagement and optimize ad effectiveness. As consumer preferences evolve and advertising strategies become more sophisticated, AVOD is expected to play a key role in shaping the future of digital video consumption, further strengthening the market.

Expanding Mobile Video Consumption

The expansion of mobile video consumption in Mexico is accelerating as affordable data plans and increasing smartphone penetration drive digital content streaming. The Mexico digital video content market growth is fueled by improved 4G and 5G connectivity, enabling seamless access to high-quality video on mobile devices. Platforms like YouTube, TikTok, and Netflix are optimizing content for mobile users, offering adaptive streaming and offline viewing options to enhance user experience. The rapid digitalization of Mexico is significantly boosting mobile video consumption, with increasing internet and smartphone penetration driving content accessibility. According to industry reports, in early 2024, Mexico reported 107.3 million internet users, representing an 83.2% penetration rate. Social media usage reached 90.20 million users or 70.0% of the population. Additionally, there were 125.4 million mobile connections, equivalent to 97.3% of the total population, highlighting significant digital engagement in the country. Additionally, short-form videos and live streaming have gained popularity, particularly among younger audiences, reshaping content consumption trends. Telecom providers are also partnering with streaming services to offer bundled subscriptions, further promoting mobile-based viewing. As mobile internet accessibility improves and content providers invest in localized, mobile-friendly offerings, mobile video consumption will continue to surge, playing a crucial role in shaping the Mexico digital video content market outlook in the coming years.

Mexico Digital Video Content Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on business model, type, and device.

Business Model Insights:

- Subscription

- Advertising

- Download-To-Own (DTO)

- Others

The report has provided a detailed breakup and analysis of the market based on the business model. This includes subscription, advertising, download-to-own (DTO), and others.

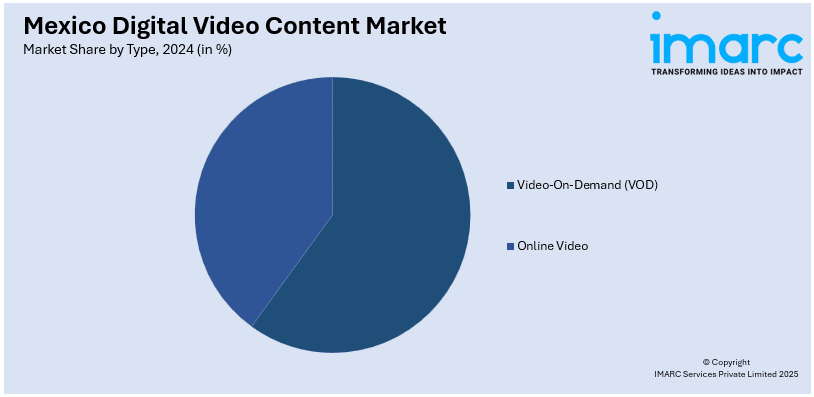

Type Insights:

- Video-On-Demand (VOD)

- Online Video

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes video-on-demand (VOD) and online video.

Device Insights:

- Laptop

- PC

- Mobile

- Others

A detailed breakup and analysis of the market based on the device have also been provided in the report. This includes laptop, PC, mobile, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Digital Video Content Market News:

- In February 2025, Netflix announced a $1 billion investment in Mexico over the next four years to produce films and series, enhancing the local audiovisual industry. Co-CEO Ted Sarandos emphasized the benefits for Mexican production companies. Additionally, Netflix will invest $2 million in Churubusco Studios to upgrade facilities and support emerging talents.

- In April 2024, CJ 4DPLEX and Cinépolis announced their plans to expand the partnership by launching four new ScreenX locations in Mexico, enhancing the immersive cinema experience. The first site will open in Morelia this spring, joining two existing ScreenX auditoriums in Mexico City, with additional locations planned in key areas across the country.

Mexico Digital Video Content Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | Subscription, Advertising, Download-To-Own (DTO), Others |

| Types Covered | Video-On-Demand (VOD), Online Video |

| Devices Covered | Laptop, PC, Mobile, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico digital video content market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico digital video content market on the basis of business model?

- What is the breakup of the Mexico digital video content market on the basis of type?

- What is the breakup of the Mexico digital video content market on the basis of device?

- What is the breakup of the Mexico digital video content market on the basis of region?

- What are the various stages in the value chain of the Mexico digital video content market?

- What are the key driving factors and challenges in the Mexico digital video content market?

- What is the structure of the Mexico digital video content market and who are the key players?

- What is the degree of competition in the Mexico digital video content market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico digital video content market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico digital video content market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico digital video content industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)