Mexico Dog Food Market Size, Share, Trends and Forecast by Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2026-2034

Mexico Dog Food Market Overview:

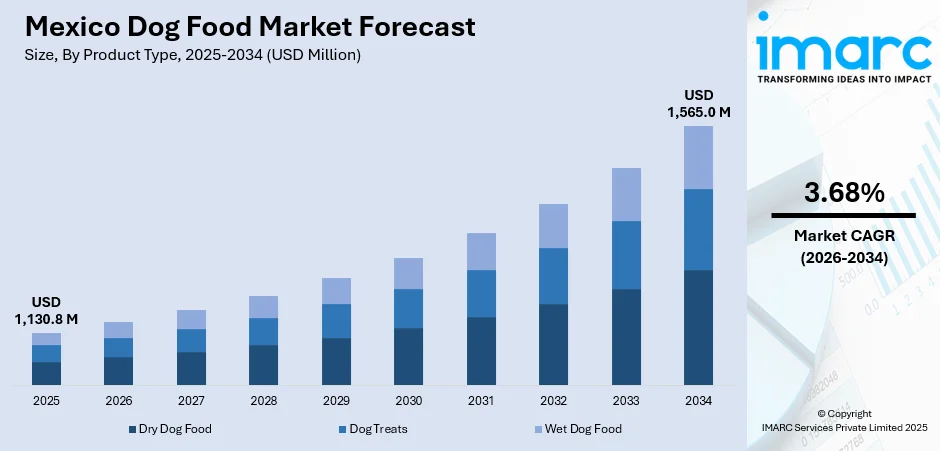

The Mexico dog food market size reached USD 1,130.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,565.0 Million by 2034, exhibiting a growth rate (CAGR) of 3.68% during 2026-2034. The market is being driven by rapid urbanization, rising pet humanization, growing disposable incomes, expanding e-commerce access, and heightened awareness of pet health and nutrition, prompting demand for premium, natural, and specialized diets that cater to the evolving lifestyle of pet owners across urban and semi-urban regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,130.8 Million |

| Market Forecast in 2034 | USD 1,565.0 Million |

| Market Growth Rate 2026-2034 | 3.68% |

Access the full market insights report Request Sample

Mexico Dog Food Market Trends:

Rising Urbanization and Changing Pet Ownership Trends

Mexican urbanization has registered a significant spike over the last decade, changing the very nature of consumer habits and lifestyle decisions—pet keeping included. As more individuals move to urban areas like Mexico City, Guadalajara, and Monterrey, families are moving away from the traditional multi-generational households to smaller, nuclear family arrangements. This change has had a profound impact on the nature of pet keeping, with dogs extensively being considered as companions instead of simply guard animals. This way of life encourages pet humanization - a cultural trend in which pets are treated with similar attention and care as members of the family. City residents, including Millennials and Gen Z shoppers, are investing more in high-end dog food that focuses on wellness, nutrition, and ethical production. These consumers favor brands with functional ingredients, grain-free products, and natural compositions. Convenience is also very important in populated cities. As such, consumers would rather buy pre-made, packaged food for dogs rather than make their own meals.

To get more information on this market Request Sample

Expansion of E-Commerce and Digital Pet Retail Ecosystems

Another significant driver is the growth of the e-commerce and digital pet retail segments. With Mexico’s internet penetration exceeding 80% of the population, shoppers are adopting digital shopping practices for pet accessories, including dog food. This transition is not simply about ease: online platforms provide more product options, price comparisons, and access to international and specialty brands that may not be easily accessible in brick-and-mortar locations. Large digital platforms such as Amazon Mexico, Mercado Libre, and even pet-specialty e-retailers like Petco.mx have diversified their product offerings, logistics infrastructures, and shipping services. All these factors have greatly diminished entry barriers for pet owners in urban and semi-urban settings, better access to high-end and specialty canine food. Subscription-based models of repeat delivery of canine food are also becoming popular, building customer loyalty and consistent sales volumes.

Mexico Dog Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, pricing type, ingredient type, and distribution channel.

Product Type Insights:

- Dry Dog Food

- Dog Treats

- Wet Dog Food

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dry dog food, dog treats, and wet dog food.

Pricing Type Insights:

- Mass Products

- Premium Products

A detailed breakup and analysis of the market based on the pricing type have also been provided in the report. This includes mass products and premium products.

Ingredient Type Insights:

- Animal Derived

- Plant Derived

The report has provided a detailed breakup and analysis of the market based on the ingredient type. This includes animal derived and plant derived.

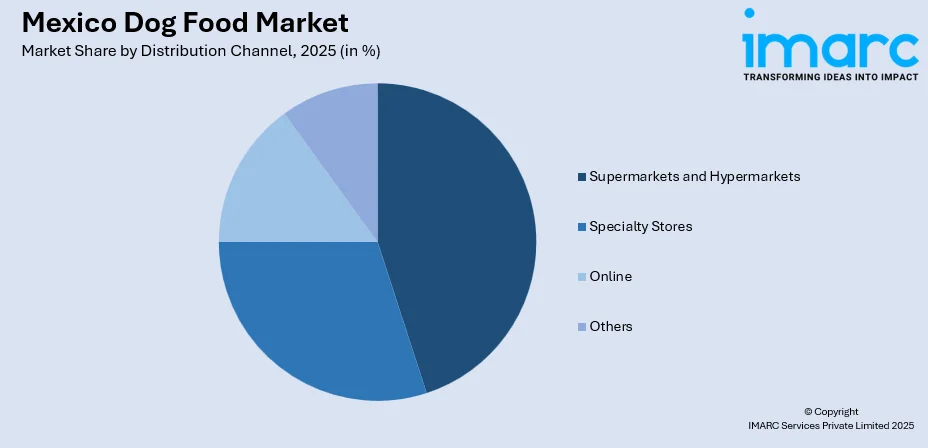

Distribution Channel Insights:

To get detailed segment analysis of this market Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Dog Food Market News:

- April 2025: ADM inaugurated its first wet pet food facility in Yecapixtla, Morelos, investing USD 39 million to bolster local production of its Ganador and Minino brands. Equipped with three production lines, the plant aims to meet Mexico’s wet pet food demand for both cats and dogs, reducing reliance on imports.

- May 2024: Nestlé Purina announced a USD 221 million investment to expand its pet food production facility in Silao, Guanajuato. This expansion includes adding a third line for wet pet food and a fourth for dry pet food, including dog food, aiming to increase production capacity by 25% for dry food and 40% for wet food.

- August 2023: Cargill announced that it would reenter the Mexican pet food market by revamping its three brands: Pingo, Keycan, and Petmaster. This initiative involves updating product formulations and packaging to align with evolving consumer preferences for quality and nutrition.

Mexico Dog Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dry Dog Food, Dog Treats, Wet Dog Food |

| Pricing Types Covered | Mass Products, Premium Products |

| Ingredient Types Covered | Animal Derived, Plant Derived |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico dog food market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico dog food market on the basis of product type?

- What is the breakup of the Mexico dog food market on the basis of pricing type?

- What is the breakup of the Mexico dog food market on the basis of ingredient type?

- What is the breakup of the Mexico dog food market on the basis of distribution channel?

- What is the breakup of the Mexico dog food market on the basis of region?

- What are the various stages in the value chain of the Mexico dog food market?

- What are the key driving factors and challenges in the Mexico dog food market?

- What is the structure of the Mexico dog food market and who are the key players?

- What is the degree of competition in the Mexico dog food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico dog food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico dog food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico dog food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)