Mexico Dried Fruits and Nuts Market Size, Share, Trends and Forecast by Type, Category, Application, and Region, 2026-2034

Mexico Dried Fruits and Nuts Market Summary:

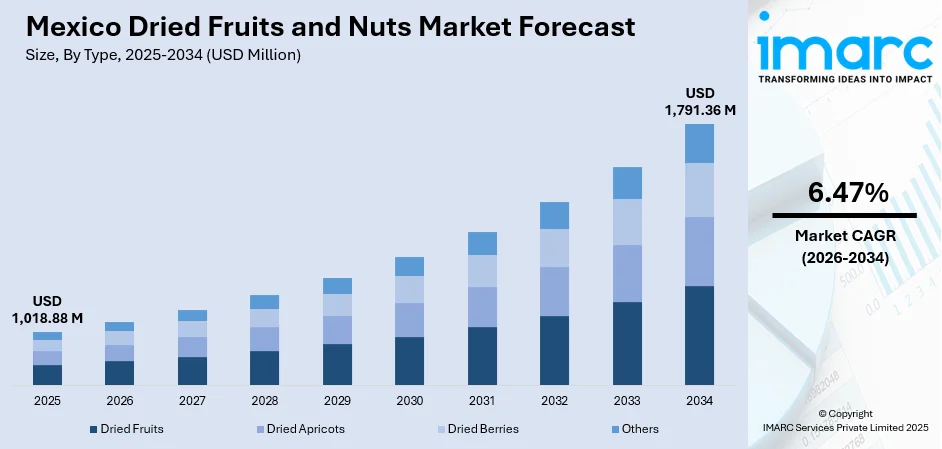

The Mexico dried fruits and nuts market size was valued at USD 1,018.88 Million in 2025 and is projected to reach USD 1,791.36 Million by 2034, growing at a compound annual growth rate of 6.47% from 2026-2034.

The Mexico dried fruits and nuts market is witnessing expansion driven by evolving consumer preferences toward healthier snacking alternatives and nutritious food options. Rising awareness regarding the health benefits of dried fruits and nuts, including their high fiber content, essential vitamins, and natural energy-boosting properties, is encouraging adoption across diverse demographic segments. The growing integration of these products into traditional Mexican cuisine and modern dietary patterns continues to strengthen Mexico dried fruits and nuts market share.

Key Takeaways and Insights:

-

By Type: Dried fruits dominate the market with a share of 46% in 2025, owing to their versatility in culinary applications, natural sweetness as sugar alternatives, and rich nutritional profiles. Increasing consumer demand for healthy snacking options and their widespread use in bakery and confectionery products are fueling the market expansion.

-

By Category: Conventional leads the market with a share of 72% in 2025. This dominance is propelled by established supply chains, competitive pricing structures, and widespread availability across retail channels. Consumer familiarity with conventional products and their accessibility in both modern trade and traditional outlets support continued market leadership.

-

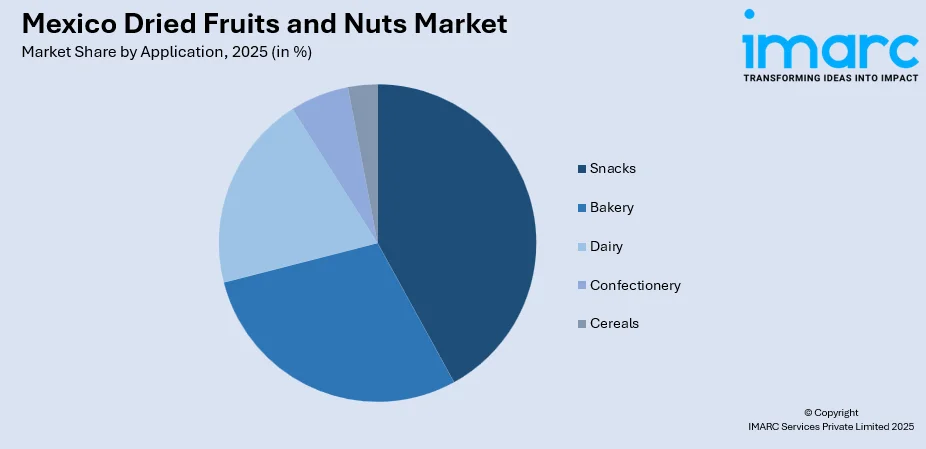

By Application: Snacks represent the largest segment with a market share of 42% in 2025, reflecting the core trend of health-conscious consumers seeking convenient, nutrient-dense snacking alternatives that align with busy urban lifestyles and wellness-focused dietary choices throughout Mexico.

-

Key Players: Key players drive the Mexico dried fruits and nuts market by expanding product portfolios, improving processing technologies, and strengthening nationwide distribution. Their investments in marketing, quality assurance, and partnerships with retailers boost awareness and accelerate adoption across diverse consumer segments.

To get more information on this market Request Sample

The Mexico dried fruits and nuts market is experiencing stable growth as health consciousness among consumers continues to rise significantly. The expanding middle-class population with higher disposable incomes is increasingly prioritizing nutritious food choices that offer convenience without compromising on health benefits. The surge in e-commerce platforms has transformed product accessibility, enabling consumers to explore diverse varieties of dried fruits and nuts from domestic and international sources. The growing trend toward plant-based diets and clean-label products further strengthens market momentum. Traditional Mexican culinary practices that incorporate dried fruits in festive preparations and everyday cooking continue supporting sustained demand, while modern applications in breakfast cereals, trail mixes, and energy bars expand consumption occasions. Furthermore, Mexico launched a junk food ban in schools, with over 1,064 elementary schools visited and 196,701 students assessed as part of the initiative aimed at reaching 11.8 Million children nationwide. This regulatory environment is accelerating consumer transition toward nutrient-dense options including dried fruits and nuts, which offer natural energy, essential vitamins, and dietary fiber without artificial additives

Mexico Dried Fruits and Nuts Market Trends:

Rising Demand for Health-Conscious Snacking Alternatives

Mexican consumers are increasingly gravitating toward healthier snacking options as awareness of nutritional benefits expands across demographic segments. The shift away from processed snacks toward natural alternatives rich in fiber, healthy fats, and essential vitamins is reshaping purchasing decisions. Urban professionals and young families are particularly driving this transformation, seeking convenient yet wholesome food choices that support active lifestyles. Supermarkets and convenience stores are responding by expanding dedicated shelf space for dried fruits and nuts, making these products more accessible to mainstream consumers and supporting Mexico dried fruits and nuts market growth.

E-commerce Expansion Transforming Distribution Channels

Digital commerce platforms are revolutionizing how Mexican consumers discover and purchase dried fruits and nuts, creating unprecedented market accessibility. In 2024, the Mexican Association of Online Sales (AMVO) reported that 67.2 Million Mexicans were active e-commerce shoppers, with convenience, product variety, and competitive pricing cited as primary drivers. Online grocery shopping enables consumers to explore premium, organic, and specialty varieties that may not be available in local retail outlets. The convenience of home delivery particularly appeals to time-constrained urban populations who value efficiency in their shopping experiences. Major e-commerce players and dedicated food delivery applications are expanding their dried fruits and nuts offerings, facilitating product comparisons and competitive pricing that benefit health-conscious shoppers.

Clean-Label and Natural Product Preferences Gaining Momentum

Consumer preferences are shifting decisively toward minimally processed, clean-label products with transparent ingredient lists and natural compositions. This trend reflects broader wellness movements emphasizing whole foods and reduced exposure to artificial additives and preservatives. Dried fruits and nuts positioned as authentic, natural snacking options are benefiting significantly from this consumer sentiment. Packaging innovations highlighting single-ingredient products and traceable sourcing are gaining traction among discerning shoppers who prioritize food quality and production transparency in their purchasing decisions.

Market Outlook 2026-2034:

The Mexico dried fruits and nuts market demonstrates promising growth prospects as consumption patterns evolve favorably toward nutritious snacking alternatives. The market generated a revenue of USD 1,018.88 Million in 2025 and is projected to reach a revenue of USD 1,791.36 Million by 2034, growing at a compound annual growth rate of 6.47% from 2026-2034. Continued urbanization, rising health awareness, and expanding retail infrastructure are expected to drive sustained market expansion throughout the forecast period.

Mexico Dried Fruits and Nuts Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Dried Fruits | 46% |

| Category | Conventional | 72% |

| Application | Snacks | 42% |

Type Insights:

- Dried Fruits

- Dried Apricots

- Dried Berries

- Others

Dried fruits dominate with a market share of 46% of the total Mexico dried fruits and nuts market in 2025.

Dried fruits have established themselves as the predominant type in Mexico's market, driven by their exceptional versatility across culinary applications and their role as natural sweetening alternatives. The segment benefits from deep-rooted cultural traditions where dried fruits feature prominently in traditional Mexican dishes, festive preparations, and everyday cooking. Modern applications in bakery products, breakfast cereals, and healthy snack mixes continue expanding consumption occasions beyond traditional uses, supporting sustained market leadership. Food manufacturers increasingly incorporate dried fruits into product formulations seeking to reduce refined sugar content while enhancing flavor profiles and nutritional value.

The nutritional profile of dried fruits, including concentrated fiber content, natural sugars, and essential micronutrients, aligns perfectly with growing health consciousness among Mexican consumers. Raisins, dates, and dried tropical fruits such as mango and pineapple represent particularly popular choices, reflecting both international trends and local flavor preferences. Extended shelf life without refrigeration requirements makes dried fruits practical for household storage and retail distribution. Their naturally sweet taste appeals across age demographics, from children seeking wholesome treats to adults pursuing healthier dietary alternatives.

Category Insights:

- Organic

- Conventional

Conventional leads with a share of 72% of the total Mexico dried fruits and nuts market in 2025.

Conventional dried fruits and nuts maintain dominant market positioning through established supply chains, competitive pricing structures, and widespread availability across diverse retail channels. The segment benefits from decades of consumer familiarity and trusted product quality that has built strong brand loyalty among Mexican households. Price-sensitive consumers, particularly in middle and lower-income brackets, continue preferring conventional products that offer nutritional benefits at accessible price points, ensuring sustained demand across urban and rural markets. The affordability factor remains paramount for families seeking to incorporate healthy snacking options into daily diets without significantly increasing household food expenditure.

Manufacturing efficiency and economies of scale enable conventional producers to maintain attractive pricing while ensuring consistent product quality and availability. Traditional retail channels including supermarkets, hypermarkets, and convenience stores prioritize conventional offerings due to higher turnover rates and established consumer demand patterns. Bulk purchasing options and family-sized packaging formats further enhance value propositions for budget-conscious shoppers. The extensive distribution network penetration ensures conventional products reach consumers across metropolitan centers, secondary cities, and smaller communities throughout the country.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bakery

- Dairy

- Snacks

- Confectionery

- Cereals

Snacks exhibit a clear dominance with a 42% share of the total Mexico dried fruits and nuts market in 2025.

Snacks command market leadership as Mexican consumers increasingly prioritize convenient, nutritious alternatives to traditional processed snacks. Health-conscious urban professionals and young families are driving significant demand for trail mixes, nut blends, and dried fruit snacks that offer portability without compromising nutritional value. The growing fitness culture and wellness trends among millennials and younger generations particularly support adoption of dried fruits and nuts as preferred on-the-go snacking options. These products align with busy lifestyles requiring quick energy sources that deliver sustained satiety and essential nutrients between main meals.

Retail infrastructure expansion and product innovation continue strengthening the snacks segment across diverse consumption occasions. Single-serve packaging formats and innovative flavor combinations targeting local taste preferences, including chili-lime seasoned nuts and tropical dried fruit mixes, are expanding the consumer base beyond traditional health-focused demographics. Manufacturers are developing portion-controlled offerings suitable for workplace consumption, school lunchboxes, and travel scenarios. The versatility of dried fruits and nuts as standalone snacks or complementary ingredients in homemade trail mixes provides consumers with customization flexibility that enhances product appeal across varied preference profiles and dietary requirements.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant production hub for nuts, particularly pecans, benefiting from favorable climatic conditions in states like Chihuahua and Sonora. The region's industrial development and proximity to United States markets create strong export-oriented production while supporting domestic consumption through established processing facilities and distribution networks that serve both local and national markets effectively.

Central Mexico, encompassing major metropolitan areas including Mexico City and Guadalajara, serves as the primary consumption center for dried fruits and nuts. High population density, elevated urbanization rates, and concentrated retail infrastructure drive substantial market demand. The region's diverse consumer base spanning various income levels supports both premium and value-oriented product segments across modern trade and traditional retail channels.

Southern Mexico contributes significantly to organic production, with states like Chiapas, Oaxaca, and Michoacán leading in certified organic food cultivation. The region's agricultural traditions and biodiversity support diverse dried fruit production including tropical varieties. Growing tourism sectors in coastal and cultural destinations create additional demand channels while traditional culinary practices maintain consistent consumption patterns among local populations.

Market Dynamics:

Growth Drivers:

Why is the Mexico Dried Fruits and Nuts Market Growing?

Government Nutritional Policies and Regulatory Initiatives

Mexican government implementation of comprehensive nutritional labeling requirements and restrictions on unhealthy food marketing is fundamentally reshaping the competitive landscape in favor of naturally nutritious products including dried fruits and nuts. Front-of-pack warning labels mandating disclosure of high sugar, sodium, and saturated fat content have raised consumer awareness regarding processed food composition while creating negative associations with conventional snack products. These regulatory measures extend to restrictions on junk food sales in educational institutions, directly influencing childhood dietary patterns and establishing healthy eating habits among younger generations. The policy environment incentivizes food manufacturers to reformulate products with healthier ingredient profiles and expand portfolios to include naturally nutritious options, accelerating innovation and market diversification within the dried fruits and nuts category.

Rising Disposable Incomes and Middle-Class Expansion

Mexico's expanding middle-class population and increasing household purchasing power are enabling greater consumer expenditure on premium food categories including dried fruits, nuts, and specialty health products. Economic development has elevated living standards particularly in metropolitan areas where consumers demonstrate willingness to pay premium prices for perceived quality, nutritional benefits, and brand reputation. Higher disposable incomes support premiumization trends within the food sector as consumers transition from basic commodities toward value-added products featuring organic certifications, superior packaging, and imported varieties. The growing affluent consumer base is driving demand for specialty products including exotic dried fruits, flavored nut varieties, and functional formulations enriched with additional nutrients. This economic transformation enables manufacturers to introduce premium product lines at higher price points while maintaining volume growth across standard offerings.

Expanding Food Processing and Bakery Industry Demand

The robust growth of Mexico's food processing sector, particularly bakery and confectionery manufacturing, is generating substantial business-to-business demand for dried fruits and nuts as essential production ingredients. Food manufacturers are incorporating these ingredients into diverse product formulations including breakfast cereals, granola bars, artisan breads, premium chocolates, and traditional Mexican confections that require consistent quality and reliable supply volumes. The bakery and tortilla production subsector represents a significant component of Mexico's food processing industry, creating sustained demand for value-added ingredients that enhance product nutritional profiles and sensory appeal. Industrial buyers prioritize supplier relationships offering consistent quality specifications, competitive pricing structures, and dependable logistics capabilities. This institutional demand channel provides market stability independent of retail consumer fluctuations while driving volume growth across multiple dried fruit and nut categories.

Market Restraints:

What Challenges the Mexico Dried Fruits and Nuts Market is Facing?

Price Volatility and Production Cost Pressures

Fluctuating raw material prices and production costs create significant challenges for market participants seeking to maintain competitive pricing while ensuring product quality. Climate-related production variations, currency fluctuations affecting import costs, and rising labor expenses contribute to pricing instability that can discourage price-sensitive consumers from regular purchases.

Climate Change Impacts on Agricultural Production

Climate variability and water scarcity increasingly affect dried fruit and nut production across key growing regions in Mexico. Drought conditions, particularly in northern states, impact pecan and walnut yields while extreme weather events can damage orchards and reduce harvest quality. These agricultural challenges create supply uncertainties affecting market stability.

Competition from Alternative Snacking Options

Intense competition from diverse snacking alternatives, including protein bars, vegetable chips, and other health-positioned products, fragments consumer attention and spending. Traditional snack manufacturers introducing healthier product variants create additional competitive pressure, requiring dried fruit and nut producers to continuously innovate and differentiate their offerings.

Competitive Landscape:

The Mexico dried fruits and nuts market exhibits a moderately fragmented competitive structure with participation from domestic producers, international brands, and regional players serving diverse market segments. Competition intensifies as companies focus on product quality differentiation, packaging innovation, and distribution network expansion to capture market share. Strategic investments in processing technology modernization and supply chain optimization enable leading players to maintain competitive advantages through consistent quality and pricing. Partnerships with retail chains, e-commerce platforms, and food service operators strengthen market presence while new product development targeting evolving consumer preferences drives category growth. The emphasis on sustainability practices and organic certification is increasingly influencing competitive positioning as environmentally conscious consumers prioritize responsible sourcing.

Mexico Dried Fruits and Nuts Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dried Fruits, Dried Apricots, Dried Berries, Others |

| Categories Covered | Organic, Conventional |

| Applications Covered | Bakery, Dairy, Snacks, Confectionery, Cereals |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico dried fruits and nuts market size was valued at USD 1,018.88 Million in 2025.

The Mexico dried fruits and nuts market is expected to grow at a compound annual growth rate of 6.47% from 2026-2034 to reach USD 1,791.36 Million by 2034.

Dried fruits dominated the market with a share of 46%, driven by their versatility in culinary applications, natural sweetness as sugar alternatives, and widespread use in bakery products and healthy snacking options.

Key factors driving the Mexico dried fruits and nuts market include rising health consciousness among consumers, expanding e-commerce distribution channels, growing preference for clean-label and natural products, increasing urbanization, and the integration of dried fruits and nuts into modern dietary patterns.

Major challenges include price volatility and production cost pressures, climate change impacts on agricultural production, competition from alternative snacking options, supply chain complexities, and limited consumer awareness in rural areas regarding nutritional benefits of dried fruits and nuts.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)