Mexico Drilling Equipment Market Size, Share, Trends and Forecast by Type, Category, Power Source, Mount Type, Distribution Channel, End Use, and Region, 2026-2034

Mexico Drilling Equipment Market Summary:

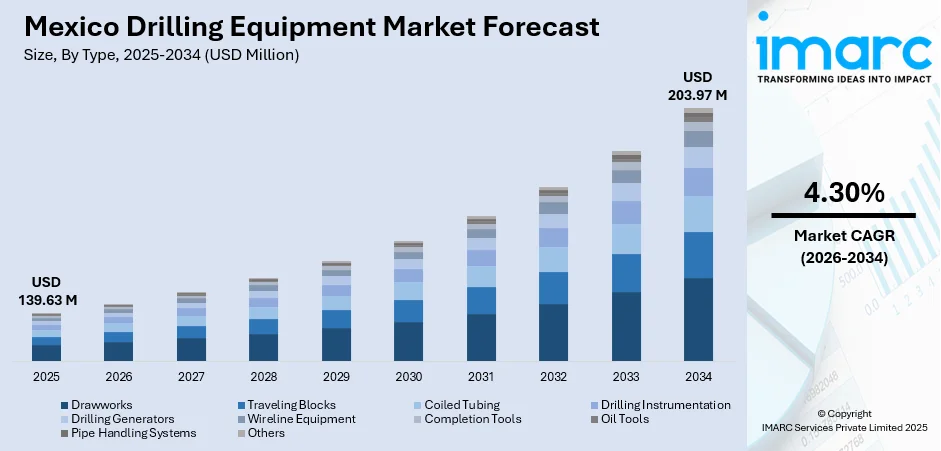

The Mexico drilling equipment market size was valued at USD 139.63 Million in 2025 and is projected to reach USD 203.97 Million by 2034, growing at a compound annual growth rate of 4.30% from 2026-2034.

The Mexico drilling equipment market is driven by the country’s strategic focus on revitalizing hydrocarbon production through expanded exploration and development activities. State-owned ambitious drilling programs, coupled with the growing private sector participation through mixed contract frameworks, are increasing equipment demand across oil and gas operations. The convergence of automation technologies, electrification initiatives, and mining sector expansion is fundamentally reshaping the competitive landscape and creating substantial opportunities for market participants.

Key Takeaways and Insights:

- By Type: Drawworks dominate the market with a share of 18% in 2025, driven by their crucial function in controlling drilling loads, ensuring stable hoisting operations, and supporting efficient wellbore advancement in diverse drilling environments.

- By Category: Automatic leads the market with a share of 62% in 2025, owing to its ability to enhance precision, minimize human error, improve safety, and support consistent drilling performance through advanced control mechanisms.

- By Power Source: Electric represents the largest segment with a share of 55% in 2025, due to lower energy usage, reduced maintenance requirements, quieter operation, and the growing industry preference for cleaner, more efficient power alternatives.

- By Mount Type: Truck mounted dominates the market with a share of 65% in 2025, as this segment provides high mobility, rapid site setup, flexible relocation, and strong suitability for drilling activities in remote or frequently shifting project locations.

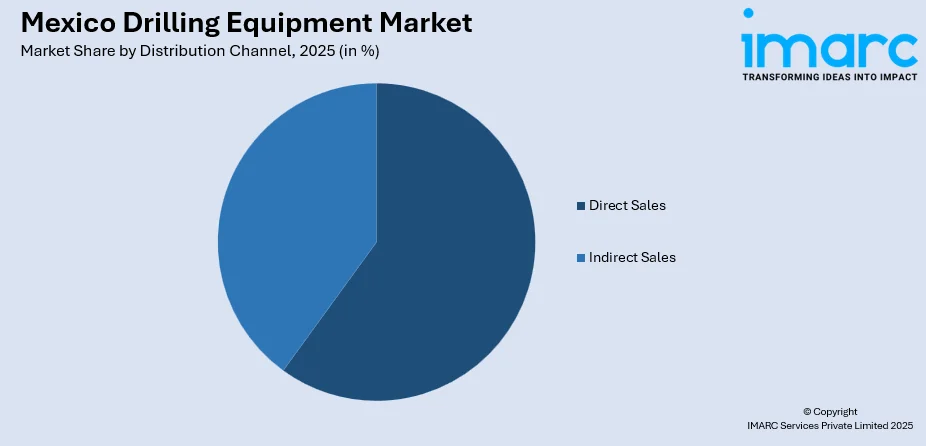

- By Distribution Channel: Direct sales lead the market with a share of 60% in 2025, reflecting stronger supplier engagement, customized equipment configurations, and reliable after-sales support that enhances buyer confidence and long-term operational planning.

- By End Use: Oil and gas represent the largest segment with a share of 50% in 2025, supported by ongoing exploration, rising drilling activity, and the sector’s continuous need for high-performance equipment capable of operating in demanding conditions.

- Key Players: The Mexico drilling equipment market exhibits moderate competitive intensity, with multinational equipment manufacturers competing alongside specialized regional service providers across oil and gas, mining, and construction applications.

To get more information on this market Request Sample

The Mexico drilling equipment market is expanding as activity increases across oil and gas exploration, mining, infrastructure works, and geotechnical assessment. The growing resource development efforts require dependable machinery that can operate across different ground conditions. Large construction programs involving transport links, industrial areas, and new urban districts rely on drilling tools for foundation preparation, soil evaluation, and ground support. Mining firms continue to advance exploration and extraction plans, catalyzing the demand for loaders, drill rigs, and bolting systems. This direction was reinforced in 2025 when Sandvik received a SEK 430 million order from La Cantera Desarrollos Mineros for underground mining equipment to be delivered through 2028. Besides this, operators are also placing greater importance on safety, efficiency, and regulatory compliance, encouraging interest in modern systems with stronger performance and monitoring features.

Mexico Drilling Equipment Market Trends:

Rising Investment in Advanced Mining Equipment

The growing adoption of advanced drilling and material-handling equipment as mining companies upgrade their operations to improve productivity, safety, and overall efficiency, is positively influencing the market. This direction was highlighted in 2024 when Epiroc secured a MSEK 200 equipment order from Dumas Contracting Ltd. in Mexico for a northern silver mine, supplying face drilling rigs, reinforcement rigs, loaders, and mine trucks, along with technical services and digital safety solutions. As mineral development expands and extraction needs become more complex, there is a rise in the demand for durable, high-precision, and digitally integrated systems that support deeper operations and reduce downtime, contributing to sustained sector expansion.

Expansion of Oil and Gas Exploration Activities

Mexico’s drilling equipment market is reinforced by continuous exploration programs aimed at boosting national hydrocarbon production, creating sustained demand for advanced systems capable of operating across diverse geological conditions. This trend was further reflected in 2024, when the National Hydrocarbons Commission approved a $1.8 billion investment by Pemex and ENI for exploration and production in the Gulf of Mexico, including $287 million dedicated to exploratory drilling. As development activity increases across fields such as Ek-Balam, Miztón, Amoca, and Teocalli, operators require high-precision rigs, drill bits, pumps, and monitoring technologies that support efficient extraction, reduce downtime, and enhance operational reliability, strengthening the market growth.

Rise in Infrastructure and Construction Projects

Large-scale infrastructure expansion is catalyzing the demand for drilling equipment for foundation works, tunneling, transportation projects, and geotechnical assessments. This trend gained further momentum in 2024 when Nuevo León’s Governor announced the 10-billion-peso Mitras Tunnel project, reflecting the scale of ongoing civil development. Construction firms rely on high-capacity, durable drilling units to manage complex subsurface conditions and maintain strict project schedules. As public and private investment accelerates across mobility networks, industrial zones, and urban development, procurement of advanced drilling technologies continues to rise, supporting the growth of the market in the country.

Market Outlook 2026-2034:

The Mexico drilling equipment market shows growth prospects over the forecast period, supported by rising exploration activity, expanding construction projects, and increasing demand for advanced drilling technologies across multiple sectors. Modernization of equipment fleets and greater emphasis on operational efficiency are further contributing to market growth. The market generated a revenue of USD 139.63 Million in 2025 and is projected to reach a revenue of USD 203.97 Million by 2034, growing at a compound annual growth rate of 4.30% from 2026-2034.

Mexico Drilling Equipment Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Drawworks | 18% |

| Category | Automatic | 62% |

| Power Source | Electric | 55% |

| Mount Type | Truck Mounted | 65% |

| Distribution Channel | Direct Sales | 60% |

| End Use | Oil and Gas | 50% |

Type Insights:

- Drawworks

- Traveling Blocks

- Coiled Tubing

- Drilling Instrumentation

- Drilling Generators

- Wireline Equipment

- Completion Tools

- Oil Tools

- Pipe Handling Systems

- Others

Drawworks leads with a market share of 18% of the total Mexico drilling equipment market in 2025.

Drawworks dominate the market because they provide the primary hoisting mechanism required for lifting and lowering drill strings, making them indispensable to overall drilling performance. Their reliability ensures smoother operations and reduces downtime during complex drilling activities.

Their advanced load-handling capabilities support deeper wells and heavier drill assemblies. As drilling projects expand in scale and complexity, demand for efficient hoisting systems grows, reinforcing the strong market position of drawworks.

Category Insights:

- Automatic

- Manual

Automatic exhibits a clear dominance with a 62% share of the total Mexico drilling equipment market in 2025.

Automatic leads the market due to its enhanced precision, consistent performance, and reduced dependency on manual operation. It helps operators maintain steady drilling parameters, improving efficiency and reducing operational risks.

Its ability to streamline workflows and optimize real-time adjustments supports safer and more productive drilling environments. As technologies advance, automation becomes increasingly valuable for meeting performance requirements and addressing workforce skill limitations.

Power Source Insights:

- Electric

- Non- Electric

Electric dominates with a market share of 55% of the total Mexico drilling equipment market in 2025.

Electric represents the largest segment because it offers lower operating costs, reduced emissions, and quieter functioning compared to traditional alternatives. These advantages appeal to operators seeking efficiency and long-term cost savings.

Improved energy management and fewer mechanical components also contribute to lower maintenance needs. As sustainability considerations grow, electric systems strengthen their position as practical, durable, and cost-effective solutions for drilling operations.

Mount Type Insights:

- Truck Mounted

- Trailer Mounted

Truck mounted leads with a market share of 65% of the total Mexico drilling equipment market in 2025.

Truck mounted leads the market owing to its mobility, allowing rapid relocation between drilling sites. Its flexibility supports operations requiring frequent movement, reducing setup times and improving project timelines. Its ability to operate effectively in remote or difficult terrains enhances overall project accessibility.

The dominance of truck mounted is further driven by the increasing demand for adaptable and easily deployable drilling equipment, particularly for expanding infrastructure projects. For instance, in 2025, Mexico Business News reported that the Mexican government plans to invest MXN12.5 billion (USD715 million) to enhance road infrastructure across nine states, involving the construction and reconstruction of 19 bridges and highway interchanges.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Direct Sales

- Indirect Sales

Direct sales exhibit a clear dominance with a 60% share of the total Mexico drilling equipment market in 2025.

Direct sales dominate the market, as buyers prefer purchasing equipment with tailored specifications and strong technical support. This channel ensures clear communication, dependable guidance, and better customization options.

Manufacturers can also build long-term relationships through direct engagement, improving client confidence. As equipment becomes more advanced, users value direct access to expertise, strengthening the preference for this distribution model.

End Use Insights:

- Construction

- Oil and Gas

- Mining

- Water Management

- Others

Oil and gas dominate with a market share of 50% of the total Mexico drilling equipment market in 2025.

The oil and gas sector holds the largest market share due to ongoing exploration and steady drilling activity. This industry consistently demands high-performance equipment capable of working in challenging environments.

Its reliance on reliable systems that support efficiency, depth capability, and equipment durability drives continuous procurement. As new fields are developed and production expands, this sector remains the primary driver of drilling equipment demand. The oil and gas sector's continuous reliance on efficient and durable drilling systems is strongly supported by major investments, such as the USD1.8 billion approved by the National Hydrocarbons Commission (CNH) in 2024 for Pemex and Eni Mexico to invest in three oil projects across Tabasco, Veracruz, and Campeche, focusing specifically on drilling and constructing surface facilities.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico drives strong demand for drilling equipment due to extensive mining activity, active exploration programs, and large-scale energy projects. The region’s geological potential and continued investment create consistent requirements for advanced rigs, drilling tools, and support systems.

Central Mexico market growth is shaped by infrastructure expansion, construction projects, and growing industrial development. Increased foundation work, geotechnical studies, and utility installation drive procurement of versatile drilling equipment capable of operating across varied soil and rock conditions.

Southern Mexico experiences rising equipment demand as oil and gas activities, geothermal potential, and selective mining operations expand. Drilling requirements grow alongside new exploration efforts and development projects, increasing the need for durable, high-capacity systems.

Others contribute to market activity through localized construction, water well drilling, and smaller-scale resource development. These areas create steady demand for adaptable drilling equipment that supports diverse applications, ranging from civil works to environmental and agricultural operations.

Market Dynamics:

Growth Drivers:

Why is the Mexico Drilling Equipment Market Growing?

Expansion of Renewable Energy Projects

Drilling equipment plays a central role in supporting renewable energy development by enabling foundation work for wind turbines, securing ground anchors for solar installations, and facilitating geothermal assessments. These systems help evaluate subsurface heat potential, install thermal wells, and ensure stable, long-lasting infrastructure for clean-energy operations. The relevance of such capabilities aligns with growing geothermal interest, reflected in the 2025 partnership between XGS Energy and Meta to develop 150 MW of next-generation geothermal capacity in New Mexico. As sustainable projects expand, there is a higher demand for durable rigs that deliver reliable performance across varied geological settings.

Rise of Water Well Drilling and Groundwater Development

The growing demand for dependable water access is driving the need for drilling equipment across agricultural, industrial, and residential segments in Mexico, as rising usage and supply pressures encourage the development of deeper and more resilient groundwater sources. This broader shift toward advanced drilling capability aligns with national momentum in high-complexity projects, reflected in SLB’s major 2025 contract from Woodside Energy to drill 18 ultra-deepwater wells for the Trion development using AI-enabled technologies. As operators prioritize precision, stability, and faster deployment, equipment suited for deeper penetration and consistent performance becomes more valuable, supporting growth of the drilling equipment market in Mexico.

Growing Use in Utilities and Pipeline Installation

Horizontal and vertical drilling systems are essential for installing underground pipelines, conduits, and cables, enabling utilities to establish accurate subsurface routes for water, gas, telecommunications, and electrical networks. These methods reduce surface disruption, improve installation efficiency, and support faster project execution. Their importance aligns with Mexico’s expanding utility infrastructure, reflected in President Claudia Sheinbaum’s 2025 announcement of a 287-kilometer natural gas pipeline connecting Hidalgo and Puebla. As large-scale energy and utility projects advance, there is a rise in the demand for drilling technologies capable of delivering precise, non-invasive, and reliable subsurface construction.

Market Restraints:

What Challenges the Mexico Drilling Equipment Market is Facing?

High Capital Investment Requirements for Advanced Equipment

Advanced drilling equipment that incorporates automation, electrification, and digital monitoring demands significant upfront capital, creating substantial barriers for smaller contractors and independent operators. These systems carry premium pricing due to their enhanced precision and performance features, making adoption difficult for cost-sensitive firms. Although such technologies offer clear long-term operational gains, high acquisition and integration costs can slow market penetration and limit widespread modernization, ultimately constraining the pace at which the drilling industry transitions to next-generation equipment.

Skilled Labor Shortages Constraining Operational Capacity

The drilling industry continues to face shortages of trained personnel capable of operating, troubleshooting, and maintaining modern high-tech drilling systems. As equipment becomes more sophisticated, the need for specialized technical expertise grows, yet workforce development has not kept pace. This mismatch reduces operational efficiency, increases downtime risks, and restricts the adoption of automated systems that require advanced skill sets. The resulting capacity gaps create bottlenecks for market growth and limit the sector’s ability to scale technologically.

Regulatory and Environmental Compliance Complexities

Environmental regulations and intricate permitting processes pose significant challenges for drilling activities, especially in regions with strict water-use controls or ecologically sensitive offshore zones. Compliance efforts can prolong project timelines, increase administrative and operational costs, and require continuous monitoring to meet evolving standards. Uncertainty surrounding policies for unconventional resource development further complicates investment planning for equipment upgrades. These regulatory pressures influence operator decisions, potentially slowing procurement of new machinery and limiting overall market growth.

Competitive Landscape:

The Mexico drilling equipment market exhibits moderate competitive intensity characterized by multinational equipment manufacturers competing alongside specialized regional service providers across oil and gas, mining, and construction applications. Market dynamics reflect diverse positioning ranging from high-specification automated drilling systems emphasizing efficiency and digital integration to conventional equipment targeting cost-conscious operators. The competitive landscape is increasingly shaped by automation capabilities, electrification technologies, and after-sales service networks. Local content requirements influence procurement decisions, with established international suppliers partnering with Mexican distributors and service companies. Strategic positioning increasingly emphasizes comprehensive solutions combining equipment supply with technical services, spare parts availability, and operator training programs.

Recent Developments:

- In April 2025, Master Drilling Mexico introduced its first remote-controlled drilling system, advancing automation in underground and surface mining. This technology enhances operational safety by reducing operator exposure to hazardous areas, while also improving efficiency and precision in drilling processes. The system is currently in testing and will soon be deployed in active mining operations.

- In January 2025, Sandvik launched the DD312i, an intelligent, compact single-boom underground drill, which demonstrated a 28% productivity increase during field testing at La Cantera in Mexico. The drill offers enhanced drilling accuracy and cost-efficiency, integrating with Sandvik’s digital solutions. It also features a training simulator for quick operator readiness before the machine arrives at the site.

Mexico Drilling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Drawworks, Traveling Blocks, Coiled Tubing, Drilling Instrumentation, Drilling Generators, Wireline Equipment, Completion Tools, Oil Tools, Pipe Handling Systems, Others |

| Categories Covered | Automatic, Manual |

| Power Sources Covered | Electric, Non-Electric |

| Mount Types Covered | Truck Mounted, Trailer Mounted |

| Distribution Channels Covered | Direct Sales, Indirect Sales |

| End-Uses Covered | Construction, Oil and Gas, Mining, Water Management, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico drilling equipment market size was valued at USD 139.63 Million in 2025.

The Mexico drilling equipment market is expected to grow at a compound annual growth rate of 4.30% from 2026-2034 to reach USD 203.97 Million by 2034.

Truck mounted dominates the market with 65% revenue share in 2025, driven by superior mobility, versatility across diverse terrains, and cost-effectiveness for both oil and gas exploration and mining operations throughout Mexico's varied geological regions.

Key factors driving the Mexico drilling equipment market include the rising adoption of advanced, high-precision machinery as mining firms modernize operations. This trend was reinforced by Epiroc’s MSEK 200 order in 2024, reflecting the growing demand for durable, digitally enabled systems that support complex extraction and minimize downtime.

Major challenges include high capital investment requirements for advanced automated equipment, skilled labor shortages constraining operational capacity, regulatory and environmental compliance complexities, infrastructure limitations in remote drilling locations, and supply chain constraints affecting equipment availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)