Mexico E-KYC Market Size, Share, Trends and Forecast by Product, Deployment Mode, End User, and Region, 2025-2033

Mexico E-KYC Market Overview:

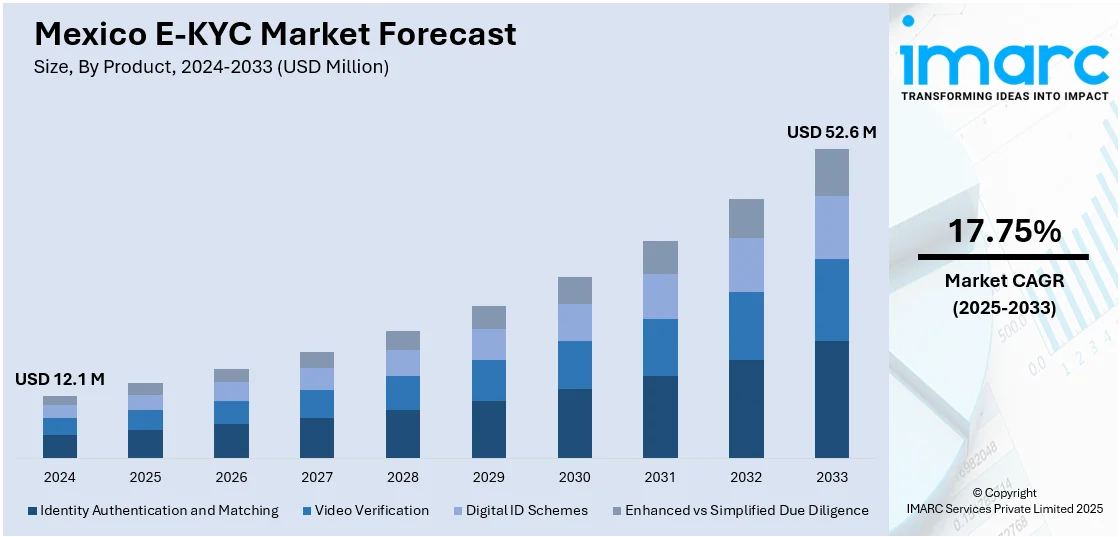

The Mexico e-KYC market size reached USD 12.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 52.6 Million by 2033, exhibiting a growth rate (CAGR) of 17.75% during 2025-2033. Increasing digital adoption, regulatory support, rising smartphone and internet penetration, growth in digital banking, and increased use of mobile wallets are supporting the market growth. Traditional banks and fintechs are investing in secure onboarding systems, which is fueling the market growth. Government support for digital identification (ID) and financial inclusion and growing demand for remote verification in rural areas are propelling the market growth. Advancements in facial and biometric recognition, document scanning, and AI-based identity checks are enhancing reliability, which is further boosting the Mexico e-KYC market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.1 Million |

| Market Forecast in 2033 | USD 52.6 Million |

| Market Growth Rate 2025-2033 | 17.75% |

Mexico E-KYC Market Trends:

Changing Regulatory Landscape

In Mexico, the regulatory landscape is a primary driver for the uptake of E-KYC solutions. The financial industry in the country is governed by strict anti-money laundering (AML) and counter-terrorism financing (CTF) regulations that are aligned with international standards. The passing of the Ley Fintech (Fintech Law) and other financial regulations has made it mandatory for financial institutions to adopt advanced identity verification systems to avert fraud and enhance security. These regulations compel businesses to have the identities of customers duly verified so that they can avoid forbidden transactions and funding of illicit activities. Moreover, the regulatory environment is pushing institutions towards technology-driven Know-Your-Customer (KYC) processes that are more efficient and less prone to human error compared to manual systems. As a result, e-KYC is increasingly being seen as a necessity for businesses to comply with regulations, mitigate risks, and avoid penalties, thus driving the Mexico e-KYC market growth.

Digitization and Expanding Financial Services

The rapid digitalization of the banking and financial sector of Mexico is another key driver fueling the market growth. Traditional banks and new financial service providers need robust and efficient platforms to verify their customers remotely. E-KYC solutions facilitate frictionless digital onboarding and reduces the friction brought about by physical verification procedures. With more consumers embracing mobile payments, digital wallets, and online investment platforms, the demand for E-KYC solutions that can ensure the process is considerably high, which is creating a positive market outlook.

Surging Smartphone Adoption and Widespread Internet Availability

Mexico has witnessed tremendous growth in internet and smartphone penetration in the past several years, which directly affects the adoption of E-KYC. With smartphones becoming the device of choice to access online services, financial institutions are looking at E-KYC solutions that can leverage mobile technology for identity verification. Additionally, facial recognition, fingerprint scanning, and document reading capabilities are now integrated into smartphones, making it easier and more secure for individuals to verify their identities online, which is another factor supporting the market growth.

Mexico E-KYC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on product, deployment mode, and end user.

Product Insights:

- Identity Authentication and Matching

- Video Verification

- Digital ID Schemes

- Enhanced vs Simplified Due Diligence

The report has provided a detailed breakup and analysis of the market based on product categories. This includes identity authentication and matching, video verification, digital ID schemes, and enhanced vs simplified due diligence.

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on deployment modes have also been provided in the report. This includes cloud-based and on-premises solutions.

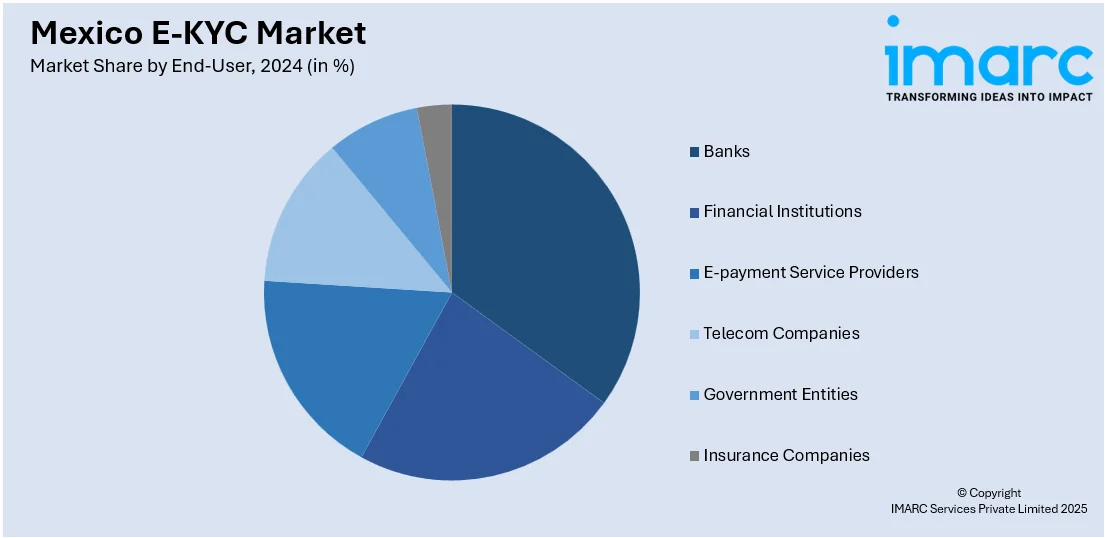

End-User Insights:

- Banks

- Financial Institutions

- E-payment Service Providers

- Telecom Companies

- Government Entities

- Insurance Companies

The report has provided a detailed breakup and analysis of the market based on end-users. This includes banks, financial institutions, e-payment service providers, telecom companies, government entities, and insurance companies.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report also provides a comprehensive analysis of the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and other regions.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico E-KYC Market News:

- In 2024, AiPrise, a leading provider of digital identity verification solutions, has integrated advanced biometric technologies, including facial recognition and liveness detection, into its eKYC platform. This enhancement aims to streamline customer onboarding processes for financial institutions in Mexico, ensuring compliance with stringent anti-money laundering regulations.

- In 2024, ZignSec, a global identity verification provider, has launched a suite of eKYC solutions specifically designed for the Mexican market. These solutions comply with local regulations and cater to the unique needs of Mexican businesses, facilitating seamless customer onboarding and enhancing regulatory compliance.

Mexico E-KYC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Identity Authentication and Matching, Video Verification, Digital ID Schemes, Enhanced vs Simplified Due Diligence |

| Deployment Mode Covered | Cloud-based, On-premises |

| End-Users Covered | Banks, Financial Institutions, E-payment Service Providers, Telecom Companies, Government Entities, Insurance Companies |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico e-KYC market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico e-KYC market on the basis of product?

- What is the breakup of the Mexico e-KYC market on the basis of deployment mode?

- What is the breakup of the Mexico e-KYC market on the basis of end user?

- What is the breakup of the Mexico e-KYC market on the basis of region?

- What are the various stages in the value chain of the Mexico e-KYC market?

- What are the key driving factors and challenges in the Mexico e-KYC?

- What is the structure of the Mexico e-KYC market and who are the key players?

- What is the degree of competition in the Mexico e-KYC market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico e-KYC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico e-KYC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico e-KYC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)