Mexico E-Mobility Market Size, Share, Trends and Forecast by Product, Voltage, Battery, and Region, 2025-2033

Mexico E-Mobility Market Overview:

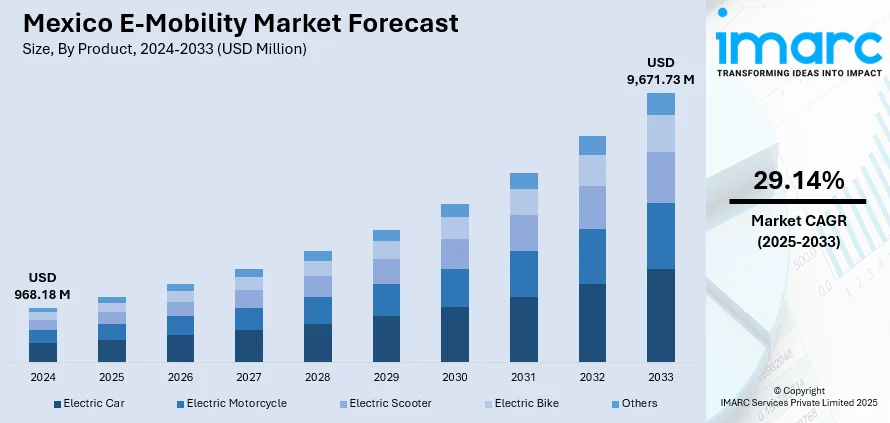

The Mexico e-mobility market size reached USD 968.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,671.73 Million by 2033, exhibiting a growth rate (CAGR) of 29.14% during 2025-2033. Mexico is strengthening its electric transport ecosystem with public electric transit, micro-mobility city solutions, and intelligent charging infrastructure. These are transforming urban mobility through sustainable, efficient, and technologically advanced substitutes for conventional transport. Funding for intelligent infrastructure and adaptive mobility solutions is driving the nation toward low-emission systems at a faster pace. With rising adoption in cities and transport modes, the Mexico e-mobility market share is set to experience meaningful growth in the coming years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 968.18 Million |

| Market Forecast in 2033 | USD 9671.73 Million |

| Market Growth Rate 2025-2033 | 29.14% |

Mexico E-Mobility Market Trends:

Expansion of Public Electric Transit Networks

Mexico is undergoing a radical overhaul of public transit as cities are converting to electric mobility for environmental and performance benefits. Electric buses and service fleets are being rolled out in key urban areas to lower greenhouse gas emissions and use of fossil fuels. Local governments are synchronizing the rollout of electric transit buses through investments in energy-efficient corridors and vehicle purchasing. This change is supplemented by innovative charging infrastructure for public fleets, such as high-density bus depots. Electric public transport is also included in overall sustainable development strategies to reduce traffic jams and urban pollution. The transition towards electrified public transit systems is supporting cities to become climate-action compliant while offering safe and sustainable mobility options to citizens. Mexico e-mobility market growth is being energetically boosted by this extensive investment in public electric transportation, proving the commitment of the country to a clean, sustainable, and technologically advanced transportation future.

Emergence of Urban Micro-Mobility Solutions

Urban micro-mobility is emerging as a more and more essential part of Mexican city transport systems. Electric scooters, e-bikes, and light personal vehicles are revolutionizing short-distance travel with flexible, zero-emission options for standard transportation. According to the sources, in January 2025, Mexico revealed its intention to roll out locally produced electric cars under the brand Olinia by June 2026, with regional plants and government-sponsored development efforts. Moreover, these technologies are perfectly suited to solve the "last-mile" problem, effectively linking riders from transport nodes to their destinations. Upgrades in infrastructure like dedicated bike lanes and electric mobility parking lots are fostering adoption in urban citizens. Municipal governments are also facilitating micro-mobility with internet platforms for real-time vehicle availability and route planning. This phase of electric mobility supports lower congestion, decreased air pollution, and better access to everyday essentials in dense urban areas. While cities become increasingly denser, micro-mobility offers a low-impact, scalable method to facilitate everyday mobility. Mexico e-mobility development is highly characterized by the fast uptake of these nimble transport solutions, satisfying changing urban mobility demands while heightening environmental and economic sustainability.

Building Smart Charging Infrastructure

Smart charging infrastructure is becoming a key driver of the electric mobility revolution in Mexico. The nation is increasing its smart charger base with energy usage optimization, remote monitoring, and dynamic load management features. These technologies ensure electric vehicles charge affordably, without stressing the electricity grid, especially during peak hours. The public and private sectors are collaborating to deploy charging points throughout residential estates, workplaces, shopping centers, and highways, providing coverage that accommodates urban and intercity commuting. For instance, in January 2025, Mexico solidified its position of leadership in the Latin American electric mobility market by installing more than 42,000 charging stations by the end of 2024 and recording a 27% increase in electric vehicle sales, greatly advancing the Mexico E-Mobility Market. Moreover, the deployment involves fast-charging facilities targeted for heavily used locations and long-distance routes, enhancing convenience and limiting range concerns. Smart charging also enables interaction with renewable sources of energy, aligning with overall sustainability objectives. Mexico e-mobility expansion is being driven by this strategic investment in infrastructure, allowing seamless and convenient charging experiences that promote take-up of electric vehicles across the country's varied geographic and urban environments.

Mexico E-Mobility Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, voltage, and battery.

Product Insights:

- Electric Car

- Electric Motorcycle

- Electric Scooter

- Electric Bike

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes electric car, electric motorcycle, electric scooter, electric bike, and others.

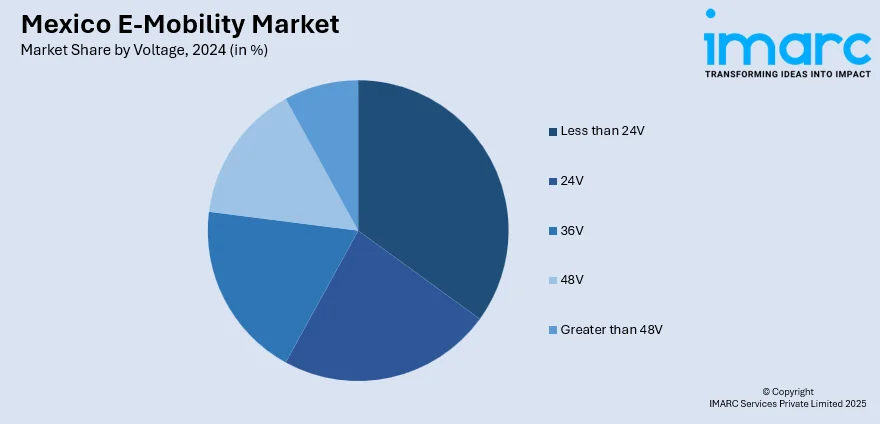

Voltage Insights:

- Less than 24V

- 24V

- 36V

- 48V

- Greater than 48V

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes less than 24V, 24V, 36V, 48V, and greater than 48V.

Battery Insights:

- Sealed Lead Acid

- Li-ion

- NiMH

The report has provided a detailed breakup and analysis of the market based on the battery. This includes sealed lead acid, Li-ion, and NiMH.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico E-Mobility Market News:

- In September 2024, Didi plans to introduce 100,000 electric vehicles in Mexico by 2030, with an investment of \$50.3 million. The firm plans to electrify the app-based transport fleet, cut emissions above 5 million tons, and develop the largest electric vehicle fleet in Mexico and Latin America

- In February 2024, China's BYD will construct a new electric car factory in Mexico with the purpose of creating an export base for the U.S. market. The firm is pursuing feasibility studies and negotiating factory location to increase its overseas production beyond China.

Mexico E-Mobility Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Electric Car, Electric Motorcycle, Electric Scooter, Electric Bike, Others |

| Voltages Covered | Less than 24V, 24V, 36V, 48V, Greater than 48V |

| Batteries Covered | Sealed Lead Acid, Li-ion, NiMH |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico e-mobility market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico e-mobility market on the basis of product?

- What is the breakup of the Mexico e-mobility market on the basis of voltage?

- What is the breakup of the Mexico e-mobility market on the basis of battery?

- What is the breakup of the Mexico e-mobility market on the basis of region?

- What are the various stages in the value chain of the Mexico e-mobility market?

- What are the key driving factors and challenges in the Mexico e-mobility?

- What is the structure of the Mexico e-mobility market and who are the key players?

- What is the degree of competition in the Mexico e-mobility market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico e-mobility market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico e-mobility market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico e-mobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)