Mexico E-Waste Recycling Market Size, Share, Trends and Forecast by Material, Component, and Region, 2025-2033

Mexico E-Waste Recycling Market Overview:

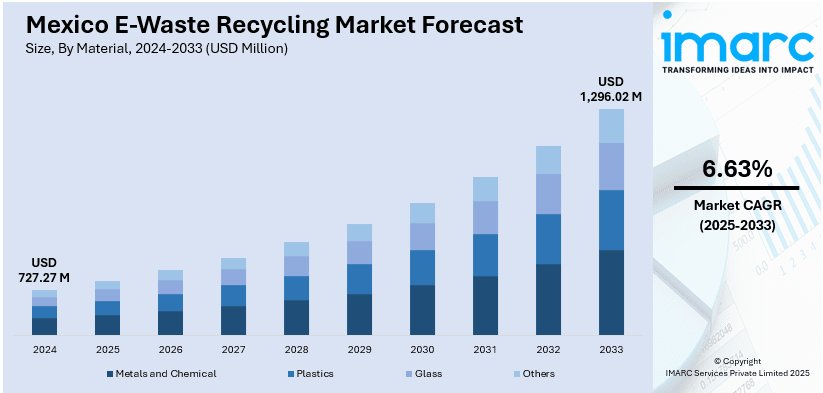

The Mexico E-Waste Recycling Market size reached USD 727.27 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,296.02 Million by 2033, exhibiting a growth rate (CAGR) of 6.63% during 2025-2033. The market includes the growing environmental awareness, increased corporate responsibility, and pressure to comply with global sustainability standards. As consumers and businesses become more conscious of environmental impacts, demand for responsible disposal of electronics rises. Companies are adopting recycling initiatives to enhance their green image, while government and NGO-led campaigns promote public participation. Additionally, the push for a circular economy encourages reuse and material recovery, creating new opportunities for investment and growth in formal recycling infrastructure thus aiding the Mexico e-waste recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 727.27 Million |

| Market Forecast in 2033 | USD 1,296.02 Million |

| Market Growth Rate 2025-2033 | 6.63% |

Mexico E-Waste Recycling Market Trends:

Growing Corporate Responsibility and Green Branding

An increasing number of companies in Mexico are adopting sustainable practices as part of their corporate responsibility strategies, acting as a key driver in the e-waste recycling market. Businesses, particularly in the electronics and retail sectors, are recognizing the importance of managing electronic waste not just for compliance, but also for building consumer trust and enhancing brand image. Many are launching take-back programs, offering recycling incentives, or partnering with certified recyclers to ensure proper handling of discarded devices. This shift is influenced by both global sustainability trends and growing consumer awareness about environmental impact. As businesses compete to appear more eco-conscious, investment in recycling infrastructure and collaboration with recycling firms is rising. This corporate push helps stimulate the formal recycling sector, drives innovation, and promotes responsible consumption patterns, contributing significantly to the development of Mexico’s e-waste recycling ecosystem.

Predominance of Informal Recycling Practices

The informal recycling sector dominates Mexico’s e-waste landscape, with many individuals collecting and dismantling electronics outside formal systems. Driven by economic need and demand for metals and plastics, these activities often occur in unsafe, unregulated environments. Every year, an estimated 58,000 kg of mercury and 45 million kg of plastics containing dangerous flame retardants are released due to improper handling, posing major threats to the environment and human health. Despite their important role, informal recyclers lack proper tools, safety measures, and environmental protections. Formalizing this sector through training, certification, and support can improve worker safety and reduce pollution. Collaboration between government agencies, NGOs, and recyclers is essential to transform informal operations into recognized contributors, fostering a safer, more sustainable e-waste management system in Mexico that benefits both communities and the environment.

Technological Advancements and Circular Economy Initiatives

Mexico is beginning to embrace innovation in its e-waste recycling efforts, aligning with broader circular economy goals. There’s a growing interest in using technology to improve how electronic waste is sorted, processed, and repurposed. Tools like automated sorting systems and eco-friendly dismantling methods are gradually being introduced, offering the potential to recover more materials efficiently and safely. Additionally, businesses and governments are promoting product designs that make electronics easier to repair, upgrade, or recycle. These initiatives aim to extend the life of devices and reduce the environmental impact of electronic consumption. Educational campaigns and corporate responsibility programs also encourage consumers to return used electronics for proper handling. Though still in early stages, these trends reflect a shift toward sustainability and innovation. Continued support and investment are necessary to scale these efforts and integrate them into a nationwide strategy for responsible e-waste management.

Mexico E-Waste Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material and source.

Material Insights:

- Metals and Chemical

- Plastics

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes metals and chemical, plastics, glass, and others.

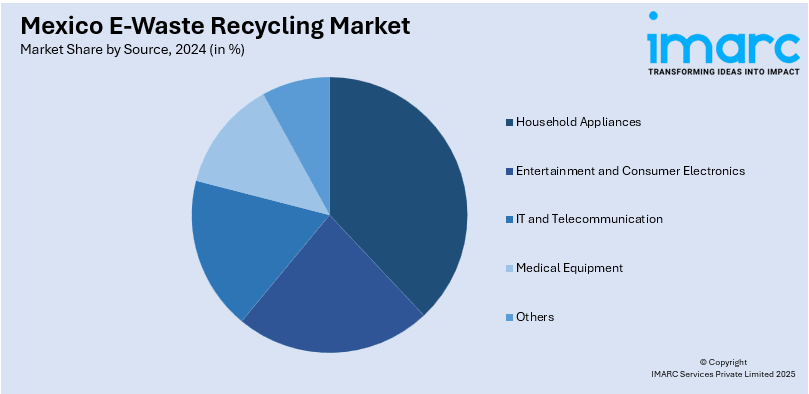

Source Insights:

- Household Appliances

- Entertainment and Consumer Electronics

- IT and Telecommunication

- Medical Equipment

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes household appliances, entertainment and consumer electronics, it and telecommunication, medical equipment, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico E-Waste Recycling Market News:

- In July 2024, Attero, India’s leading e-waste and lithium-ion battery recycler, launched Selsmart, a new consumer take-back platform for electronic waste. The initiative aims to streamline e-waste collection and boost responsible disposal practices. Through Selsmart, Attero targets collecting 140,000 metric tonnes of e-waste annually and achieving INR 1,000 crore in recurring revenue by its third year, reinforcing its commitment to sustainable recycling and circular economy growth.

- In March 2024, The UN urges immediate global action on e-waste, warning that electronic waste is growing five times faster than recycling efforts. Only 22.3% was properly recycled in 2022, risking health and environmental damage. In Mexico, where just 3.5% of e-waste is recycled, Mexico City’s new Circular Economy Law aims to address the issue by promoting sustainable production, responsible consumption, and stronger recycling infrastructure. Global cooperation is essential to reverse declining recycling rates.

Mexico E-Waste Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Metals and Chemical, Plastics, Glass, Others |

| Sources Covered | Household Appliances, Entertainment and Consumer Electronics, IT and Telecommunication, Medical Equipment, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico e-waste recycling market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico e-waste recycling market on the basis of material?

- What is the breakup of the Mexico e-waste recycling market on the basis of source?

- What is the breakup of the Mexico e-waste recycling market on the basis of region?

- What are the various stages in the value chain of the Mexico e-waste recycling market?

- What are the key driving factors and challenges in the Mexico e-waste recycling market?

- What is the structure of the Mexico e-waste recycling market and who are the key players?

- What is the degree of competition in the Mexico e-waste recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico e-waste recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico e-waste recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico e-waste recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)