Mexico Edtech Hardware Market Size, Share, Trends and Forecast by Sector, End User, and Region, 2025-2033

Mexico Edtech Hardware Market Overview:

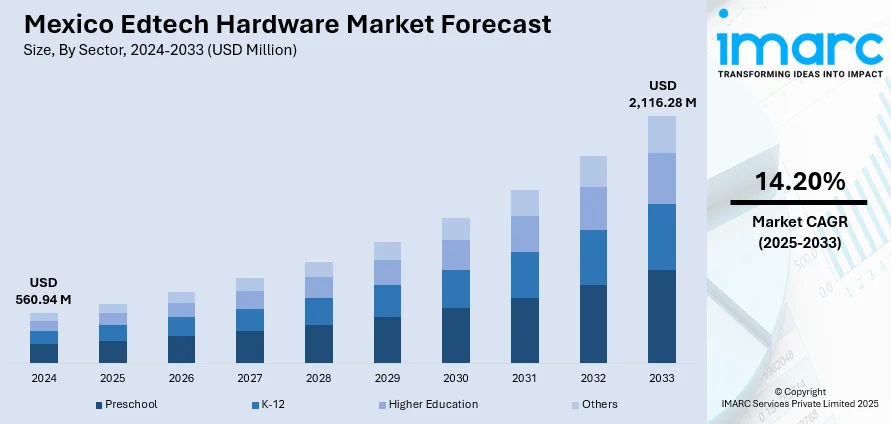

The Mexico edtech hardware market size reached USD 560.94 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,116.28 Million by 2033, exhibiting a growth rate (CAGR) of 14.20% during 2025-2033. The market is driven by government-led initiatives supporting digital infrastructure, institutional investments in remote and blended learning environments, and vendor innovation focused on local needs. Efforts to bridge the digital divide in rural areas and the expansion of e-learning platforms are enhancing hardware adoption, which contribute to a strong foundation for the overall edtech industry, further augmenting the Mexico edtech hardware market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 560.94 Million |

| Market Forecast in 2033 | USD 2,116.28 Million |

| Market Growth Rate 2025-2033 | 14.20% |

Mexico Edtech Hardware Market Trends:

Government Investment and Policy Support

The Mexican government has been prioritizing digital transformation in education through several key initiatives, including the implementation of the "México Conectado" program and the promotion of digital literacy across the nation. These efforts focus on enhancing access to technology, especially in rural and underserved areas, where educational hardware can bridge significant gaps in learning opportunities. Financial support has been extended to both public and private institutions to enable the integration of technology into classrooms. Programs designed to support the procurement of laptops, tablets, and other educational devices have been aligned with long-term strategies to modernize teaching and learning processes. Additionally, the government’s efforts in reforming educational policies have led to the creation of tech-friendly environments in schools and universities. As the nation continues to strengthen its digital infrastructure, hardware adoption is expected to accelerate. The regulatory framework governing education technology is also becoming more conducive to the widespread use of hardware solutions. Increased budget allocations for digital education ensure sustained growth in demand for devices across Mexico.

This continued emphasis on education technology remains one of the driving forces behind Mexico edtech hardware market growth.

Rising Demand for Digital Learning Tools in Education Institutions

Mexican educational institutions are increasingly adopting digital learning environments to improve teaching outcomes, a shift prompted by the pandemic and ongoing advancements in educational technology. Schools and universities are investing heavily in devices such as tablets, laptops, and interactive displays that support both in-class and remote learning models. With blended learning becoming more prevalent, the need for versatile hardware solutions that can support a variety of learning styles and subject areas is greater than ever. This trend is particularly evident in higher education institutions, where there is an increased reliance on virtual classrooms, online assessments, and cloud-based applications. The education sector’s move towards integrating educational software with hardware solutions has led to a demand for devices that offer seamless performance and user experience. At the K-12 level, Mexican schools are focused on equipping students with the tools necessary for modern education, where devices are used for everything from interactive learning to access to digital resources. The rise of e-learning platforms and educational apps is further fueling this demand for more sophisticated hardware, ensuring that institutions are prepared for future educational trends. As institutions increasingly embrace technology, the hardware market is set for continued expansion in Mexico.

Vendor Innovation and Adaptation to Local Needs

Hardware vendors are keenly aware of the unique needs of the Mexican education system and are responding with tailored solutions that fit the specific requirements of local institutions. Products designed for the Mexican market are increasingly focusing on durability, affordability, and ease of use, which are essential factors in schools with limited budgets or in remote regions. Vendors are also developing localized content and applications compatible with Mexico’s national curriculum, making it easier for schools to integrate technology into their classrooms. Manufacturers are working closely with education authorities to offer products that not only meet educational standards but also adhere to regional safety and connectivity requirements. The ability to offer in-country support and repair services has also become an important competitive differentiator, ensuring that hardware remains functional throughout its lifecycle. Additionally, many suppliers are bundling devices with software subscriptions, teacher training, and technical support, providing a comprehensive solution to educational institutions. This innovation and localization are fostering trust in the technology and making it easier for schools to implement new hardware solutions. The strategic alignment of hardware offerings with local education goals continues to drive market growth in Mexico.

Mexico Edtech Hardware Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on sector and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

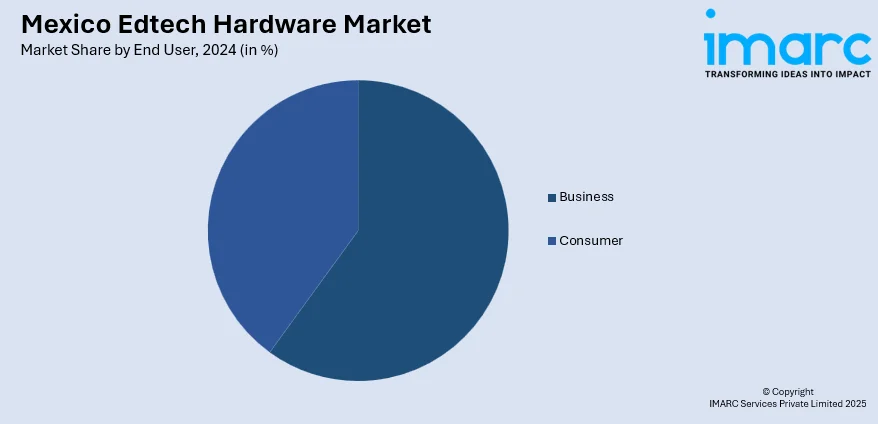

End User Insights:

- Business

- Consumer

The report has provided a detailed breakup and analysis of the market based on the end user. This includes business and consumer.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Edtech Hardware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| End Users Covered | Business, Consumer |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico edtech hardware market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico edtech hardware market on the basis of sector?

- What is the breakup of the Mexico edtech hardware market on the basis of end user?

- What is the breakup of the Mexico edtech hardware market on the basis of region?

- What are the various stages in the value chain of the Mexico edtech hardware market?

- What are the key driving factors and challenges in the Mexico edtech hardware market?

- What is the structure of the Mexico edtech hardware market and who are the key players?

- What is the degree of competition in the Mexico edtech hardware market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico edtech hardware market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico edtech hardware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico edtech hardware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)