Mexico Electric Bus Market Size, Share, Trends and Forecast by Propulsion Type, Battery Type, Length, Range, Battery Capacity, and Region, 2025-2033

Mexico Electric Bus Market Overview:

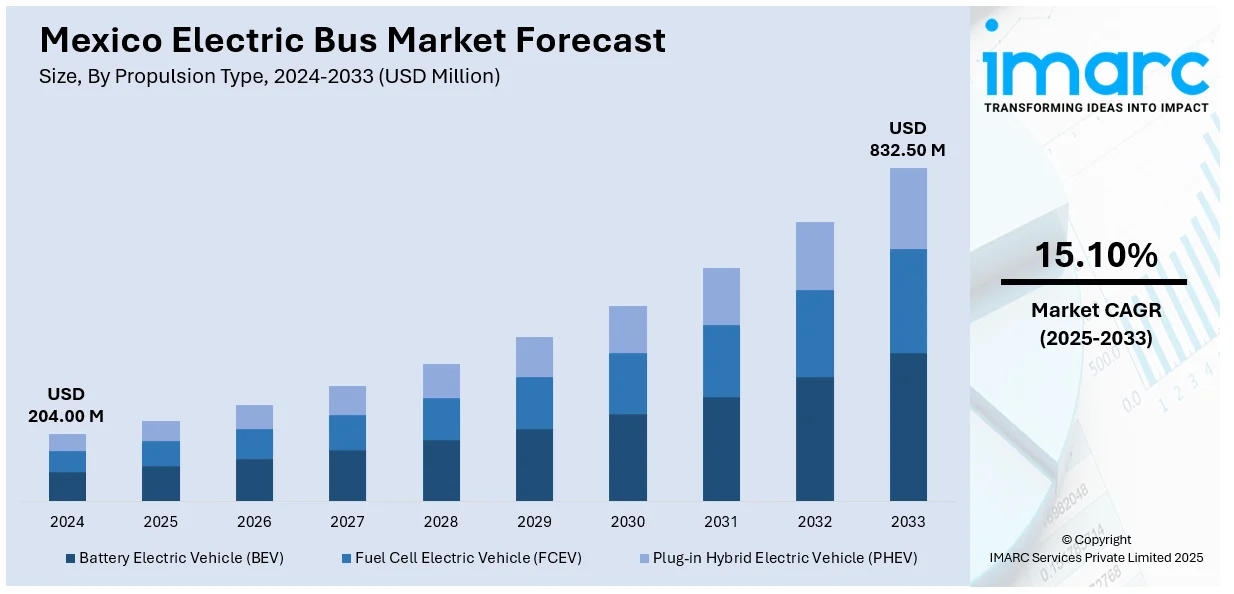

The Mexico electric bus market size reached USD 204.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 832.50 Million by 2033, exhibiting a growth rate (CAGR) of 15.10% during 2025-2033. The market is propelled by escalating environmental concerns, governmental incentives, and advancements in battery technology. These factors collectively foster a conducive environment for the adoption of electric buses, aligning with Mexico's commitment to sustainable urban mobility. As a result, the Mexico electric bus market share is experiencing significant growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 204.00 Million |

| Market Forecast in 2033 | USD 832.50 Million |

| Market Growth Rate 2025-2033 | 15.10% |

Mexico Electric Bus Market Trends:

Strong Government Incentives and Urban Transport Reform

The Mexican government is playing a pivotal role in transforming public transportation through financial incentives and structural reforms aimed at decarbonization. Programs such as the Cities Finance Facility (CFF) and support from international climate funds are facilitating large-scale pilot projects in cities like Mexico City, Guadalajara, and Monterrey. These efforts aim to reduce reliance on diesel-powered buses and improve urban air quality. Additionally, regulatory frameworks are being streamlined to attract private sector investment in electric mobility. For instance, according to industry reports, in February 2025, Mexico is advancing toward zero-emission public transport with the launch of electric buses in León, Guanajuato. Around 20 units from Chinese firms Yutong and BYD will operate on Line 1 of the SIT system. These electric buses aim to cut CO₂ emissions by 32 tons over 15 years, comparable to planting 42,000 trees. León leads this transition, with additional electric buses already running in San Miguel de Allende and Riviera Maya, highlighting growing nationwide support for sustainable mobility. The alignment of public policy with environmental goals is accelerating fleet conversions and stimulating local manufacturing. These government-led initiatives are expected to drive long-term Mexico electric bus market growth by reducing barriers to entry and ensuring continued funding and infrastructure development.

Rapid Technological Innovation and Local Manufacturing

The Mexico electric bus market is witnessing significant technological innovation, particularly in battery efficiency, lightweight materials, and modular vehicle design. Companies are investing in local production facilities, which not only lowers procurement costs but also creates opportunities for customized designs suited to Mexico's urban infrastructure. For instance, in March 2025, Mexico unveiled the Taruk, the country’s first domestically manufactured electric bus. Developed jointly by Mexican truck maker Dina and EV conversion company Megaflux, the Taruk marks a major milestone in Mexico’s push for homegrown electric vehicle innovation. This initiative supports national sustainability goals and aims to reduce dependence on foreign e-bus technology. Furthermore, advances in charging infrastructure, such as depot fast-charging and opportunity charging, are improving operational uptime. Smart diagnostics and telematics systems are also being integrated, allowing real-time monitoring of performance and maintenance needs. These technological and industrial developments are fostering robust supply chains and contributing to sustained Mexico electric bus market growth through improved performance and cost-effectiveness.

Environmental Awareness and Cost Efficiency Driving Fleet Electrification

Rising environmental consciousness among municipal authorities and citizens is prompting a shift toward low-emission transportation solutions. Electric buses, which produce zero tailpipe emissions, align with these sustainability goals while offering long-term economic benefits. The lower total cost of ownership, stemming from reduced fuel and maintenance expenses, makes electric buses attractive to both public and private operators. Additionally, urban areas facing air quality challenges are prioritizing electric buses to meet health and environmental standards. For instance, in 2024, WRI México and WRI India shared India’s electric bus strategies with Mexican stakeholders, highlighting India’s Aggregated Demand Model to reduce costs and encourage manufacturing. With 90% of Mexico’s 100,000 public buses outdated and only 804 electric, experts emphasized Mexico’s need to procure 40,000 new electric buses. Workshops stressed collaboration among federal and local governments, industry, and NGOs to address challenges in financing, manufacturing, and infrastructure. These factors are collectively propelling Mexico electric bus market growth as stakeholders increasingly recognize electric mobility as both an environmental necessity and a financially sound investment.

Mexico Electric Bus Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on propulsion type, battery type, length, range, and battery capacity.

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes battery electric vehicle (BEV), fuel cell electric vehicle (FCEV), and plug-in hybrid electric vehicle (PHEV).

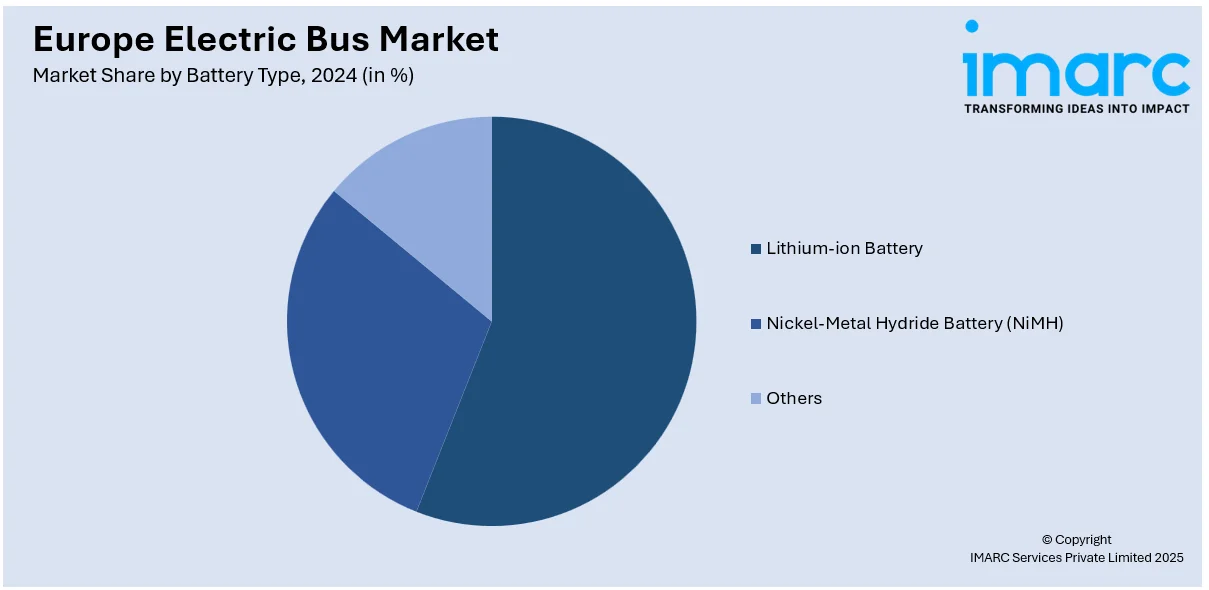

Battery Type Insights:

- Lithium-ion Battery

- Nickel-Metal Hydride Battery (NiMH)

- Others

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion battery, nickel-metal hydride battery (NiMH), and others.

Length Insights:

- Less than 9 Meters

- 9-14 Meters

- Above 14 Meters

The report has provided a detailed breakup and analysis of the market based on the length. This includes less than 9 meters, 9-14 meters, and above 14 meters.

Range Insights:

- Less than 200 Miles

- More than 200 Miles

A detailed breakup and analysis of the market based on the range have also been provided in the report. This includes less than 200 miles and more than 200 miles.

Battery Capacity Insights:

- Up to 400 kWh

- Above 400 kWh

A detailed breakup and analysis of the market based on the battery capacity have also been provided in the report. This includes up to 400 kWh and above 400 kWh.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Bus Market News:

- In March 2025, Volvo Buses launched the Volvo 7800 Electric in Mexico, the country’s first electric articulated and bi-articulated bus, built locally on the Volvo BZR platform. Designed for Bus Rapid Transit (BRT) systems, it carries up to 300 passengers and features a 250 kWh charging capacity, active safety systems, and maintenance services. This move supports Mexico’s transition to sustainable urban mobility. Initial deliveries are expected in 2026, reinforcing Volvo's leadership and investment in the country’s clean transport future.

- In January 2025, Yutong unveiled the world’s first 26-metre double articulated pure electric bus, specifically designed for the Mexican market. Built at Yutong’s New Energy plant in Zhengzhou, China, the bus addresses local demand for high-capacity, low-energy transport solutions. It features advanced battery and motor technology, ADAS, climate control for Mexican conditions, and enhanced accessibility. The launch marks a significant step in modernizing Mexico’s public transport infrastructure and sets a new global benchmark for electric bus innovation.

- In September 2024, Nuvve Holding Corp. launched its first Vehicle-to-Grid (V2G)-capable electric school bus deployment in New Mexico, partnering with Las Cruces Public Schools. The project includes installing five DC Fast Chargers and seven Level II PowerPorts, integrating Nuvve’s energy management platform to optimize energy use and reduce emissions. This initiative supports the district’s transition to electric vehicles and promotes sustainability in education. The partnership marks a milestone in expanding EV infrastructure within schools and sets a precedent for future statewide adoption.

Mexico Electric Bus Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Electric Vehicle (PHEV) |

| Battery Types Covered | Lithium-Ion Battery, Nickel-Metal Hydride Battery (Nimh), Others |

| Lengths Covered | Less Than 9 Meters, 9-14 Meters, Above 14 Meters |

| Ranges Covered | Less Than 200 Miles, More Than 200 Miles |

| Battery Capacities Covered | 400 Kwh, Above 400 Kwh |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric bus market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric bus market on the basis of propulsion type?

- What is the breakup of the Mexico electric bus market on the basis of battery type?

- What is the breakup of the Mexico electric bus market on the basis of length?

- What is the breakup of the Mexico electric bus market on the basis of range?

- What is the breakup of the Mexico electric bus market on the basis of battery capacity?

- What is the breakup of the Mexico electric bus market on the basis of region?

- What are the various stages in the value chain of the Mexico electric bus market?

- What are the key driving factors and challenges in the Mexico electric bus?

- What is the structure of the Mexico electric bus market and who are the key players?

- What is the degree of competition in the Mexico electric bus market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric bus market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric bus market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric bus industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)