Mexico Electric Motor Market Size, Share, Trends and Forecast by Motor Type, Voltage, Rated Power, Magnet Power, Weight, Speed, Application, and Region, 2025-2033

Mexico Electric Motor Market Overview:

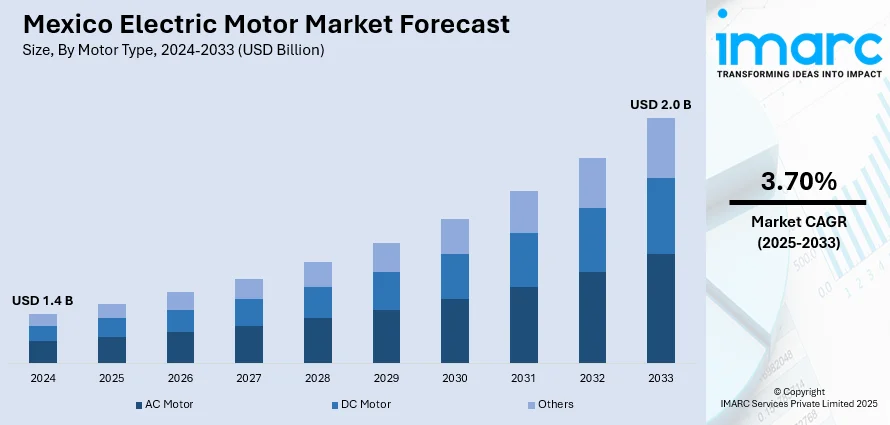

The Mexico electric motor market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.70% during 2025-2033. The market is driven by rising industrial automation, growing demand from HVAC and automotive sectors, increasing energy efficiency regulations, and expansion in manufacturing. Government incentives for clean energy adoption, along with Mexico’s integration in global supply chains, further stimulate market growth across commercial and industrial applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Market Growth Rate 2025-2033 | 3.70% |

Mexico Electric Motor Market Trends:

Surge in Industrial Automation Adoption

Mexico is witnessing a steady uptick in the deployment of automation technologies across manufacturing, food processing, and assembly lines. This has increased demand for electric motors, particularly in precision-driven equipment. For instance, as per industry reports, the Mexico factory automation and ICS market is projected to be valued at USD 5.90 Billion in 2025 and is anticipated to grow at a CAGR of 7.80%, reaching USD 8.58 Billion by 2030. As factories modernize to improve operational efficiency and reduce human error, the role of electric motors in robotics, conveyors, and automated tools becomes more pronounced. Global manufacturers setting up facilities in regions like Nuevo León and the Bajío are driving demand for high-performance, low-maintenance motors. Additionally, government efforts to strengthen the industrial base under programs like the ProMéxico initiative have supported machinery upgrades reliant on electric motor systems. This trend is expected to continue as industries seek competitive advantages through advanced automation solutions and integrated motor-control systems.

Growth of EV Production and Automotive Electrification

Mexico’s position as a key automotive manufacturing hub is amplifying its role in the electric motor segment, particularly in relation to electric vehicle (EV) production. For instance, as per industry reports, Mexico’s auto industry recorded notable growth in March 2025, producing 338,669 light vehicles (up 12.1% YoY) and exporting 296,964 units (up 3.8%). Electric and hybrid vehicle production surged 179% in Q1 to 57,601 units. Sales of green vehicles rose 30.1% in Q1 to 33,360 units, now representing 9.1% of total auto sales. With leading automakers expanding EV assembly in cities like Puebla and Guanajuato, demand for electric traction motors and motor components is rising. As more manufacturers transition to hybrid and fully electric models, suppliers are increasing local output of brushless DC motors, permanent magnet synchronous motors (PMSMs), and motor controllers. Mexico’s free trade agreements and proximity to the U.S. market make it a preferred location for EV supply chain development. This growing ecosystem of tier-one and tier-two suppliers focused on electric powertrains is accelerating domestic motor production capacity and fostering localized innovation.

Mexico Electric Motor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on motor type, voltage, rated power, magnet power, weight, speed, and application.

Motor Type Insights:

- AC Motor

- Induction AC Motor

- Synchronous AC Motor

- DC Motor

- Brushed DC Motor

- Brushless DC Motor

- Others

The report has provided a detailed breakup and analysis of the market based on the motor type. This includes AC motor (induction AC motor and synchronous AC motor) and DC motor (brushed DC motor and brushless DC motor), and others

Voltage Insights:

- Low Voltage Electric Motors

- Medium Voltage Electric Motors

- High Voltage Electric Motors

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low voltage electric motors, medium voltage electric motors, and high voltage electric motors.

Rated Power Insights:

- Fractional Horsepower Motors

- Fractional Horsepower (< 1/8) Motors

- Fractional Horsepower (1/8 - 1/2) Motors

- Fractional Horsepower (1/2 - 1) Motors

- Integral Horsepower Motors

- Integral Horsepower (1 - 5) Motors

- Integral Horsepower (10 - 50) Motors

- Integral Horsepower (50 - 100) Motors

- Integral Horsepower (>100) Motors

The report has provided a detailed breakup and analysis of the market based on the rated power. This includes fractional horsepower motors (fractional horsepower (< 1/8) motors, fractional horsepower (1/8 - 1/2) motors, and fractional horsepower (1/2 - 1) motors) and integral horsepower motors (integral horsepower (1 - 5) motors, integral horsepower (10 - 50) motors, integral horsepower (50 - 100) motors, and integral horsepower (>100) motors).

Magnet Type Insights:

- Ferrite

- Neodymium (NdFeB)

- Samarium Cobalt (SmCo5 and Sm2Co17)

A detailed breakup and analysis of the market based on the magnet type have also been provided in the report. This includes ferrite, neodymium (NdFeB), and samarium cobalt (SmCo5 and Sm2Co17).

Weight Insights:

- Low Weight Motors

- Medium Weight Motors

- High Weight Motors

The report has provided a detailed breakup and analysis of the market based on the weight. This includes low weight motors, medium weight motors, and high weight motors.

Speed Insights:

- Ultra-High-Speed Motors

- High-Speed Motors

- Medium Speed Motors

- Low Speed Motors

A detailed breakup and analysis of the market based on the speed have also been provided in the report. This includes ultra-high-speed motors, high-speed motors, medium speed motors, and low speed motors.

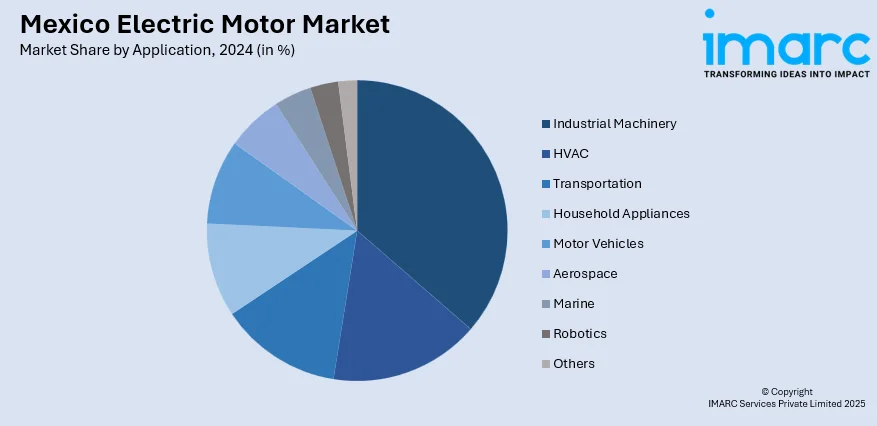

Application Insights:

- Industrial Machinery

- HVAC

- Transportation

- Household Appliances

- Motor Vehicles

- Aerospace

- Marine

- Robotics

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes industrial machinery, HVAC, transportation, household appliances, motor vehicles, aerospace, marine, robotics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Motor Market News:

- In February 2025, Safran Electrical & Power secured EASA certification for the ENGINeUS 100, the first electric motor approved for new air mobility applications. The motor delivers 125 kW with a top-tier 5 kW/kg power-to-weight ratio and features integrated control electronics. Designed for flexibility, the ENGINeUS 100 supports electric and hybrid aircraft from 2-seat planes to 150-passenger regional models.

- In September 2024, Ford invested USD 273 Million to convert its Irapuato, Mexico plant into the Irapuato Electric Powertrain Center for producing drive units for the Mustang Mach-E. The facility will manufacture key electric motor components, including the motor and transaxle, supporting Ford’s EV expansion. This marks a significant shift from producing gasoline transmissions to electric propulsion systems. The move strengthens Mexico’s role in EV manufacturing and aligns with growing global demand for electric motors in automotive applications.

- In April 2024, Seojin Mobility begun construction of a USD 260 Million electric motor manufacturing plant in Escobedo, Nuevo León, Mexico. The facility, expected to complete its first phase by February 2025, will generate over 300 jobs and focus on assembling motors for electric vehicles. The Korean firm is a major supplier to Hyundai, Kia, and GM, reinforcing Mexico’s role in the global electric vehicle supply chain.

- In January 2024, EuroGroup Laminations, an Italian manufacturer specializing in stators and rotors for electric motors, announced a €50 million (approximately USD 55 Million) investment to expand its production capacity in Mexico. The expansion includes a new plant in Querétaro, augmenting the company's existing facilities in the region. This initiative aims to meet the increasing demand in the North American electric vehicle (EV) market, for which EuroGroup has secured €3.5 billion in orders for the 2024–2028 period.

Mexico Electric Motor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Motor Types Covered |

|

| Voltages Covered | Low Voltage Electric Motors, Medium Voltage Electric Motors, High Voltage Electric Motors |

| Rated Powers Covered |

|

| Magnet Types Covered | Ferrite, Neodymium (NdFeB), Samarium Cobalt (SmCo5 and Sm2Co17 |

| Weights Covered | Low Weight Motors, Medium Weight Motors, High Weight Motors |

| Speeds Covered | Ultra-High-Speed Motors, High-Speed Motors, Medium Speed Motors, Low Speed Motors |

| Applications Covered | Industrial Machinery, HVAC, Transportation, Household Appliances, Motor Vehicles, Aerospace, Marine, Robotics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric motor market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric motor market on the basis of motor type?

- What is the breakup of the Mexico electric motor market on the basis of voltage?

- What is the breakup of the Mexico electric motor market on the basis of rated power?

- What is the breakup of the Mexico electric motor market on the basis of magnet power?

- What is the breakup of the Mexico electric motor market on the basis of weight?

- What is the breakup of the Mexico electric motor market on the basis of speed?

- What is the breakup of the Mexico electric motor market on the basis of application?

- What is the breakup of the Mexico electric motor market on the basis of region?

- What are the various stages in the value chain of the Mexico electric motor market?

- What are the key driving factors and challenges in the Mexico electric motor market?

- What is the structure of the Mexico electric motor market and who are the key players?

- What is the degree of competition in the Mexico electric motor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric motor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric motor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric motor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)