Mexico Electric Vehicle Charging Station Market Size, Share, Trends and Forecast by Charging Station Type, Vehicle Type, Installation Type, Charging Level, Connector Type, Application, and Region, 2026-2034

Mexico Electric Vehicle Charging Station Market Overview:

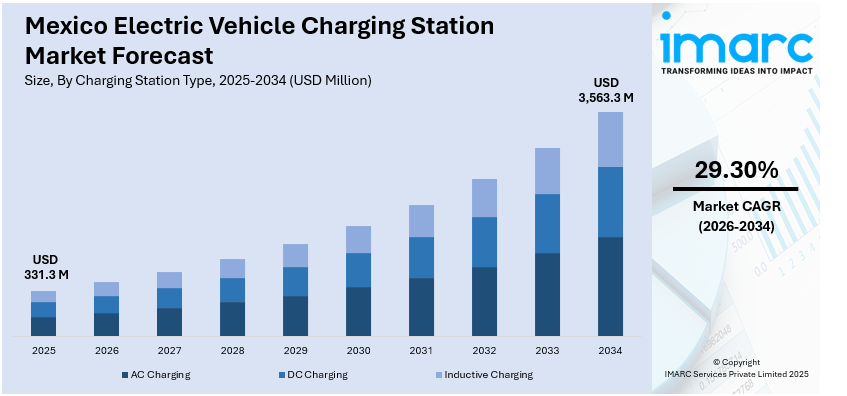

The Mexico electric vehicle charging station market size reached USD 331.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,563.3 Million by 2034, exhibiting a growth rate (CAGR) of 29.3% during 2026-2034. The market is propelled by government incentives, expanding EV adoption, increasing fuel costs, urban air quality concerns, and private sector investments. Technological advancements in charging infrastructure, collaborations with automakers, and the country’s alignment with global decarbonization targets further support market expansion and long-term infrastructure development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 331.3 Million |

| Market Forecast in 2034 | USD 3,563.3 Million |

| Market Growth Rate 2026-2034 | 29.3% |

Mexico Electric Vehicle Charging Station Market Trends:

Rising EV and PHEV Sales

A defining trend in Mexico’s electric vehicle (EV) charging station market is the rapid growth in EV and plug-in hybrid electric vehicle (PHEV) adoption. As per industry reports, in 2024, combined EV and PHEV sales surged by 83.8%, reaching 69,713 units. This spike reflects shifting consumer preferences and growing confidence in electrified mobility. Plug-in hybrids accounted for a larger share, with sales rising 154.7% to 38,420 units, surpassing fully electric vehicles at 31,293 units. The demand for diverse charging solutions is increasing as more households and businesses adopt these vehicles. The trend signals a pressing need for scalable and accessible charging infrastructure, especially fast-charging networks in urban and intercity areas, to match the evolving vehicle mix and support sustained market momentum.

To get more information on this market Request Sample

Expansion of Private Sector Involvement in Charging Infrastructure

Mexico has seen a growing presence of private companies entering the EV charging space, signaling a shift from solely public infrastructure to mixed-ownership models. Corporations are investing in both urban and highway networks, often in partnership with automakers or energy providers. This has led to a more competitive market, improved service quality, and a wider distribution of stations. Retail chains and commercial complexes are increasingly integrating charging facilities as a customer amenity, enhancing accessibility while supporting sustainable branding. Furthermore, investment from foreign charging solution providers has brought advanced technologies and operational expertise into the market. As a result, private sector participation is accelerating infrastructure rollout, especially in areas underserved by public networks, thereby contributing to a more balanced and resilient ecosystem. For instance, in January 2025, GAC and Vemo launched 24 GAC Aion ES electric sedans in Mexico as part of a joint effort to promote electric mobility and grow the country’s charging infrastructure. Vemo will provide GAC users access to its Vemo Charging Network (VCN), which includes over 600 stations nationwide. GAC aims to establish Mexico’s largest Aion EV fleet by 2025, with plans to expand into EVs, hybrids, and plug-in hybrids. The Aion ES and Y models, now available in Mexico, offer 64 kWh battery capacity and up to 490 km range.

Integration of Renewable Energy in Charging Station Design

A notable trend is the integration of renewable energy sources especially solar power into EV charging station design. With Mexico’s strong solar potential, operators are increasingly deploying photovoltaic systems to power charging units, reducing dependence on the conventional grid and lowering operational costs. This model supports sustainability goals and appeals to environmentally conscious consumers. Some projects now feature energy storage systems to stabilize output and ensure availability during peak demand or grid outages. Additionally, clean energy-powered stations often qualify for government incentives or international funding aimed at promoting green infrastructure. This dual benefit of economic viability and environmental responsibility is encouraging more developers to adopt renewable-integrated solutions, setting a new standard for future installations in both urban and rural locations. For instance, VEMO partnered with Siemens to install 500 EV charging points across Mexico by the end of 2024, targeting range anxiety and supporting the country’s growing electric vehicle market. The plan includes deploying 160kW fast-charging stations at six key highway locations. VEMO aims to double its current infrastructure to meet increasing demand, as Mexico's EV fleet exceeds 40,000 vehicles. This collaboration reinforces both companies' commitment to sustainable urban mobility and carbon emissions reduction. Siemens will contribute technological expertise, while VEMO continues to focus on green transport solutions.

Mexico Electric Vehicle Charging Station Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on charging station type, vehicle type, installation type, charging level, connector type, and application.

Charging Station Type Insights:

- AC Charging

- DC Charging

- Inductive Charging

The report has provided a detailed breakup and analysis of the market based on the charging station type. This includes AC charging, DC charging, and inductive charging.

Vehicle Type Insights:

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), and hybrid electric vehicle (HEV).

Installation Type Insights:

- Portable Charger

- Fixed Charger

The report has provided a detailed breakup and analysis of the market based on the installation type. This includes portable charger and fixed charger.

Charging Level Insights:

- Level 1

- Level 2

- Level 3

A detailed breakup and analysis of the market based on the charging level have also been provided in the report. This includes level 1, level 2, and level 3.

Connector Type Insights:

- Combines Charging Station (CCS)

- CHAdeMO

- Normal Charging

- Tesla Supercharger

- Type-2 (IEC 621196)

- Others

The report has provided a detailed breakup and analysis of the market based on the connector type. This includes combines charging station (ccs), CHAdeMO, normal charging, tesla supercharger, type-2 (IEC 621196), and others.

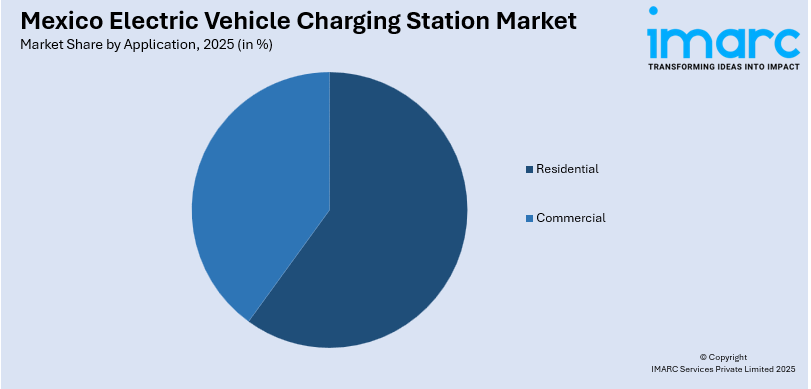

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, and Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Electric Vehicle Charging Station Market News:

- In February 2025, City Energy and Grupo Solarever inaugurated their first electric vehicle (EV) charging station in Iztacalco, Mexico City. The new facility features 10 fast DC chargers with 30-kW and 60-kW capacities, capable of serving up to 180 electric vehicles per day at a 65% usage rate. The SEV chargers are compatible with GBT connectors, improving vehicle compatibility and user convenience. This launch represents the beginning of a broader national initiative to strengthen EV infrastructure in line with Mexico’s clean mobility goals.

- In August 2024, BMW Group Mexico partnered with VEMO to install 144 new EV chargers across at least 20 premium locations such as malls, hotels, offices, and restaurants. This move is part of a broader €724,000 investment covering 251 chargers across Latin America. BMW aims to support EV adoption by giving customers access to VEMO’s 500+ charging point network, alongside 33,000+ private chargers already installed in homes and offices.

Mexico Electric Vehicle Charging Station Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Charging Station Types Covered | AC Charging, DC Charging, Inductive Charging |

| Vehicle Types Covered | Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV) |

| Installation Types Covered | Portable Charger, Fixed Charger |

| Charging Levels Covered | Level 1, Level 2, Level 3 |

| Connector Types Covered | Combines Charging Station (CCS), CHAdeMO, Normal Charging, Tesla Supercharger, Type-2 (IEC 621196), Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico electric vehicle charging station market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico electric vehicle charging station market on the basis of charging station type?

- What is the breakup of the Mexico electric vehicle charging station market on the basis of vehicle type?

- What is the breakup of the Mexico electric vehicle charging station market on the basis of installation type?

- What is the breakup of the Mexico electric vehicle charging station market on the basis of charging level?

- What is the breakup of the Mexico electric vehicle charging station market on the basis of connector type?

- What is the breakup of the Mexico electric vehicle charging station market on the basis of application?

- What are the various stages in the value chain of the Mexico electric vehicle charging station market?

- What are the key driving factors and challenges in the Mexico Electric vehicle charging station market?

- What is the structure of the Mexico electric vehicle charging station market and who are the key players?

- What is the degree of competition in the Mexico electric vehicle charging station market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico electric vehicle charging station market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico electric vehicle charging station market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico electric vehicle charging station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)