Mexico Electric Vehicle Component Market Size, Share, Trends and Forecast by Component, Distribution, and Region, 2026-2034

Mexico Electric Vehicle Component Market Summary:

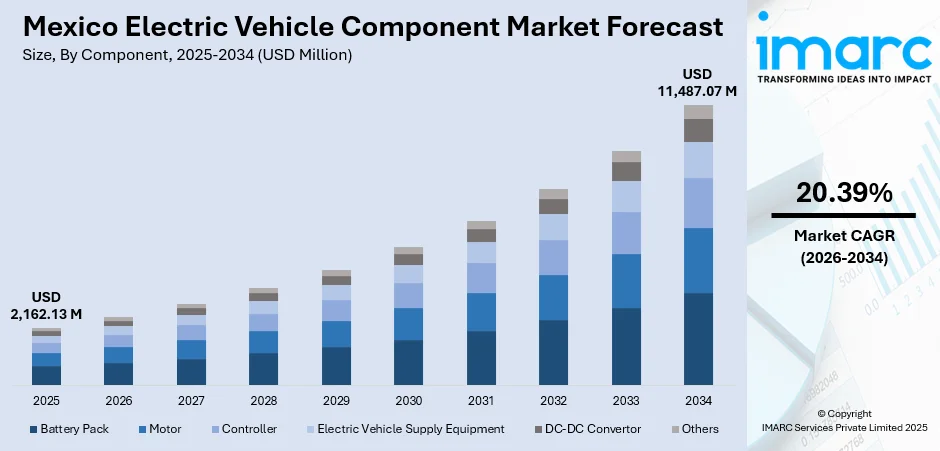

The Mexico electric vehicle component market size was valued at USD 2,162.13 Million in 2025 and is projected to reach USD 11,487.07 Million by 2034, growing at a compound annual growth rate of 20.39% from 2026-2034.

The market's robust expansion is propelled by Mexico's strategic positioning as a manufacturing hub for North American electromobility production, with the country leveraging USMCA trade advantages to attract substantial foreign investment in component manufacturing facilities. Major automotive manufacturers are establishing battery assembly plants, motor production facilities, and controller manufacturing operations throughout traditional automotive clusters in northern and central Mexico, capitalizing on the established supplier ecosystem and skilled workforce that has transitioned from internal combustion engine production to electric powertrain technologies, significantly strengthening the Mexico electric vehicle component market share.

Key Takeaways and Insights:

- By Component: Battery pack dominates the market with a share of 45% in 2025, driven by major manufacturers establishing high-voltage battery assembly facilities.

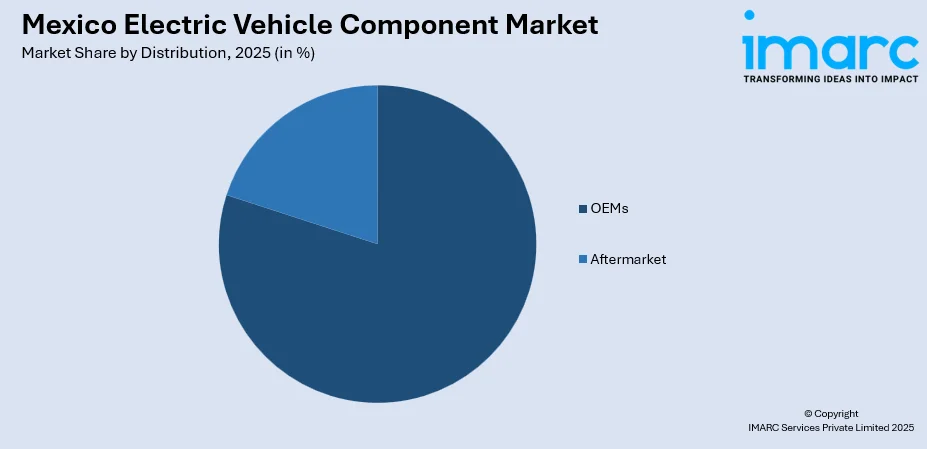

- By Distribution: OEMs lead the market with a share of 80% in 2025, supported by major automakers producing massive numbers of electric vehicles annually in Mexico.

- Key Players: The Mexico electric vehicle component market features established global automotive suppliers alongside emerging Asian manufacturers, with multinational corporations leveraging Mexico's strategic location to serve North American production networks while new entrants focus on specialized technologies including battery systems, thermal management, and power electronics.

To get more information on this market Request Sample

Mexico has emerged as a critical node in North American electric vehicle supply chains, with the component manufacturing ecosystem expanding, marking substantial growth from previous years. The supplier base encompasses battery pack assemblers, electric motor manufacturers, power control system producers, and thermal management specialists concentrated in traditional automotive hubs, with emerging centers in Durango and Puebla. Foreign direct investment (FDI) in Mexico rose 14.5% during the initial nine months of 2025, exceeding US $40.9 billion, according to the federal government. The market benefits from Mexico's established automotive manufacturing infrastructure, specialized in electromobility components, while the country focuses on copper production, providing critical materials for electric motor and wiring harness production.

Mexico Electric Vehicle Component Market Trends:

Accelerated Nearshoring Under USMCA Trade Framework

Mexico has witnessed remarkable growth in EV component manufacturing as multinational corporations leverage USMCA trade advantages to establish regional supply chains close to United States automotive production. The supplier ecosystem expanded to 453 companies across 29 technical subcategories including battery systems, powertrain components, thermal management, and power control by Q3 2025. Major investments include key market players investing in assembly facilities, demonstrating the accelerating shift toward Mexico-based component production to serve North American electric vehicle manufacturing networks while reducing dependence on Asian supply chains.

Integration of Advanced Battery Assembly Technologies

Major manufacturers are implementing innovative battery production methods in Mexican facilities, with BMW establishing cell-to-pack assembly technology in San Luis Potosi where hundreds of battery cells are assembled directly into large packs rather than using traditional modular construction. The 800 million euro investment in the facility in 2025 exemplifies the technological advancement occurring in Mexico's component manufacturing sector. This approach eliminates production steps while enhancing space efficiency and reducing costs, positioning Mexico as a hub for next-generation battery assembly techniques that support weight reduction requirements and improved energy density for electric powertrains.

Expansion of High-Technology Manufacturing Ecosystem

Mexico's high-technology sector is growing with strategic programs like IMMEX 4.0 modernizing the manufacturing framework specifically for semiconductors and electric vehicle components. In 2025, Foxconn is investing US$168 million investment in its Mexican subsidiary as segment of a global expansion transitioning toward AI server production. This evolution strengthens Mexico's competitiveness in producing sophisticated power electronics, controller systems, and sensor technologies required for modern electric powertrains, complementing traditional mechanical manufacturing expertise with cutting-edge digital and electronic component production capabilities.

Market Outlook 2026-2034:

The Mexico electric vehicle component market is positioned for sustained expansion as manufacturers continue establishing production capacity to serve accelerating North American electric vehicle adoption. The market generated a revenue of USD 2,162.13 Million in 2025 and is projected to reach a revenue of USD 11,487.07 Million by 2034, growing at a compound annual growth rate of 20.39% from 2026-2034. The component supplier ecosystem will continue expanding beyond current hubs into emerging centers, supported by Mexico's established automotive infrastructure and skilled workforce.

Mexico Electric Vehicle Component Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Battery Pack | 45% |

| Distribution | OEMs | 80% |

Component Insights:

- Battery Pack

- Motor

- Controller

- Electric Vehicle Supply Equipment

- DC-DC Convertor

- Others

Battery pack dominates with a market share of 45% of the total Mexico electric vehicle component market in 2025.

Battery pack assemblies represent the largest and fastest-growing component category in Mexico's electric vehicle supply chain, driven by major manufacturers establishing high-voltage battery production facilities throughout traditional automotive clusters. Major market player are investing in battery assembly plants, implementing innovative cell-to-pack technology where hundreds of cells are assembled directly into large battery structures without intermediate modular construction. This approach reduces production steps while improving space utilization and cost efficiency for electric powertrain applications.

Investment in lithium-ion battery manufacturing is accelerating as Mexico positions itself as a key player in the North American battery supply chain, providing essential materials for battery pack electrical connections and thermal management systems. In 2025, SENER has initiated a new project for battery manufacturing to aid the production of the Olinia electric vehicle, representing one of the government's key initiatives in the nation's drive for clean mobility and technological advancement. The initiative forms a part of the federal government's larger plan to establish a domestic lithium value chain, spearheaded by LitioMX, and to enhance cooperation between public entities and the private sector.

Distribution Insights:

Access the Comprehensive Market Breakdown Request Sample

- OEMs

- Aftermarket

OEMs lead with a share of 80% of the total Mexico electric vehicle component market in 2025.

Original equipment manufacturers represent the dominant distribution channel for electric vehicle components in Mexico, driven by the country's role as a major production base for complete vehicle assembly destined primarily for export markets. According to the third EvolvX Mexico Mobility Report by Latam Mobility, Mexico is now the top exporter of electric vehicles to the United States, outpacing major automotive countries like Japan and South Korea. The report released in 2025 indicates that Mexico shipped approximately 145,000 electric vehicles (EVs) to the US in the previous year, primarily models from General Motors, Ford, Stellantis, and Toyota.

This export-oriented manufacturing model positions Mexico as a critical supplier of electric vehicle components to North American automakers who integrate Mexican-produced battery packs, motors, and controllers into vehicles assembled throughout the USMCA trading bloc. Moreover, parts sourced from OEMs are always more trustworthy and come with guaranteed proper functioning capabilities. These reasons further increase the market share of OEMs in the Mexican industry.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico dominates electric vehicle component manufacturing, anchored by traditional automotive hubs in various states that leverage proximity to United States borders for efficient component exports to American assembly plants. The northern states host established automotive suppliers that have transitioned to electric vehicle component production, benefiting from mature logistics networks, skilled manufacturing workforces, and proximity to major automotive assembly facilities on both sides of the border that enables just-in-time delivery of battery packs, electric motors, and power electronics to vehicle production lines.

Central Mexico encompasses key manufacturing states including Guanajuato, Queretaro, San Luis Potosi, and Mexico State, hosting major automotive assembly plants and component suppliers that form the country's industrial heartland. The central region benefits from established automotive infrastructure, transportation networks connecting to northern export corridors, and concentration of technical universities that supply skilled engineers and technicians to electromobility manufacturing operations.

Southern Mexico represents an emerging region for electric vehicle component manufacturing, with states like Puebla developing new production capabilities as the industry expands beyond traditional northern and central automotive clusters. The region's development is supported by government initiatives to distribute manufacturing investment more evenly across the country, though current activity remains concentrated in established automotive states.

Other regions include emerging manufacturing areas in states like Durango that are developing as new Tier 2 and Tier 3 supplier centers supporting primary automotive clusters. These peripheral regions benefit from lower labor costs and available industrial space, attracting component manufacturers seeking to establish production capacity outside congested traditional automotive zones.

Market Dynamics:

Growth Drivers:

Why is the Mexico Electric Vehicle Component Market Growing?

Strategic Geographic Positioning for North American Market Access

Mexico serves as a critical manufacturing hub for North American electric vehicle production, with the country exporting a major portion of its EV output. Between January and August 2025, Mexico manufactured 163,778 battery electric vehicles (BEVs), representing a 30.5% rise from the corresponding period in 2024. The nation is expected to achieve 252,050 units by the end of the year, indicating an annual growth rate of 21.8%. The country's strategic proximity to the vast American market reduces logistics costs substantially compared to Asian manufacturing alternatives while enabling companies to benefit from USMCA provisions that ease cross-border commerce and eliminate tariffs on qualifying products.

Established Automotive Manufacturing Ecosystem and Skilled Workforce

Mexico ranks as the fourth-largest global producer of automotive parts and serves as the primary supplier to the United States automotive industry, with innumerable suppliers specialized in electromobility and electrification components ranging from battery systems to electric drivetrains. The mature network of suppliers and manufacturing capabilities provides a robust foundation for transitioning from traditional automotive production to electric vehicle component manufacturing, with a huge number of employees working in OEM facilities who possess transferable skills in precision manufacturing, quality control, and supply chain coordination. Strategic programs modernize the manufacturing framework specifically for semiconductors and electric vehicle components, while partnerships between industry and educational institutions ensure continued workforce development to support expanding component production capacity throughout traditional automotive clusters and emerging manufacturing centers.

Access to Critical Mineral Resources and Raw Materials

Mexico stands as a major copper production hub, while serving as one of the top three suppliers for 14 of the 50 critical minerals identified by the United States, including fluorspar, strontium, and gold that support advanced manufacturing processes. The country possesses substantial lithium deposits concentrated in Sonora state, which the federal government nationalized to support domestic battery manufacturing development and reduce reliance on imported critical materials from geopolitically sensitive sources. Copper availability is particularly critical for electric vehicle component manufacturing, as battery packs, electric motors, charging equipment, and power distribution systems require substantially more copper per vehicle compared to internal combustion engine alternatives. Moreover, adoption of enhanced mining tactics is increasing the accessibility to critical minerals, providing long-term competitive advantages as global demand for battery materials intensifies and countries implement export restrictions on strategic minerals. IMARC Group predicts that the Mexico mining market is projected to attain USD 47.6 Million by 2034.

Market Restraints:

What Challenges the Mexico Electric Vehicle Component Market is Facing?

Heavy Dependence on Imported Battery Cells and Electronic Components

Mexico faces significant challenges in sourcing battery cells, power electronics, and advanced semiconductor components domestically, with much of this content currently imported from China and other Asian manufacturers for final assembly into complete battery packs and controller systems. The country's battery cell production capability remains underdeveloped despite possessing substantial lithium deposits in Sonora state, creating vulnerability in the supply chain and limiting potential for fully integrated domestic electric vehicle component manufacturing.

Investment Uncertainty Driven by Geopolitical and Trade Policy Risks

Investment in electromobility is not happening properly, reflecting growing uncertainty around potential United States tariffs on Mexican-made vehicles and components under shifting trade policies. High-profile projects, especially potential high tariffs on Mexican-made vehicles proposed by United States policymakers concerned about Chinese components in regional supply chains. This investment volatility constrains expansion of component manufacturing capacity precisely when North American electric vehicle production is accelerating and requiring increased component supplies. The uncertainty particularly affects long-term capital investments in battery production facilities and advanced manufacturing technologies that require stable policy environments and predictable market access to justify billion-dollar facility construction and equipment purchases.

Infrastructure and Grid Capacity Limitations

Despite rapid growth in electric vehicle production, Mexico struggles with inadequate supporting infrastructure including limited public charging networks and electricity grid constraints that affect both manufacturing operations and domestic market development. The national electrical grid already faces energy deficits and will struggle to keep pace with rising power demand from both electric vehicle manufacturing facilities requiring substantial electricity for battery production and vehicle assembly operations. The infrastructure challenge extends to manufacturing operations, where component producers require reliable electrical supply for automated assembly systems, clean room environments for power electronics manufacturing, and climate-controlled facilities for battery production that are sensitive to power interruptions and voltage fluctuations.

Competitive Landscape:

The Mexico electric vehicle component market exhibits moderate competitive intensity with established global automotive suppliers competing alongside emerging Asian manufacturers across technology segments and price points. Multinational corporations leverage existing automotive component operations in Mexico to expand into electric vehicle systems, utilizing established relationships with OEM customers and technical expertise in power electronics and electric motors. The competitive landscape is characterized by specialization across component categories, with some suppliers focusing on battery pack assembly, others concentrating on electric motor production, and additional competitors targeting controller systems and charging equipment manufacturing niches that require distinct technical capabilities and capital investments.

Recent Developments:

- In July 2025, Giant Motors Latinoamérica (GML) has announced a MX$3 billion investment to enhance its production facility in Ciudad Sahagún, Hidalgo, strengthening its enduring dedication to Mexico’s industrial growth and electric mobility plans.

Mexico Electric Vehicle Component Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Battery Pack, Motor, Controller, Electric Vehicle Supply Equipment, DC-DC Convertor, Others |

| Distributions Covered | OEMs, Aftermarket |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico electric vehicle component market size was valued at USD 2,162.13 Million in 2025.

The Mexico electric vehicle component market is expected to grow at a compound annual growth rate of 20.39% from 2026-2034 to reach USD 11,487.07 Million by 2034.

Battery pack components dominate the market with 45% share, driven by major manufacturers establishing high-voltage battery assembly facilities throughout traditional automotive clusters, implementing innovative cell-to-pack technology that eliminates intermediate modular construction steps while improving space utilization and cost efficiency.

Key factors driving the Mexico electric vehicle component market include strategic geographic positioning for North American market access, with Mexico increasing its electric vehicle part exports to United States, established automotive manufacturing ecosystem, and access to critical mineral resources supporting electric motor and battery pack manufacturing requirements.

Major challenges include heavy dependence on imported battery cells and electronic components from China for final assembly into complete systems despite possessing domestic lithium deposits, investment uncertainty reflecting concerns about potential United States tariffs on Mexican-made components, and infrastructure limitations including electricity grid capacity constraints that affect manufacturing operations requiring reliable power for automated assembly systems and climate-controlled production facilities for battery and power electronics manufacturing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)