Mexico Energy as a Service Market Size, Share, Trends and Forecast by Service Type, End User, and Region, 2025-2033

Mexico Energy as a Service Market Size, Share & Analysis:

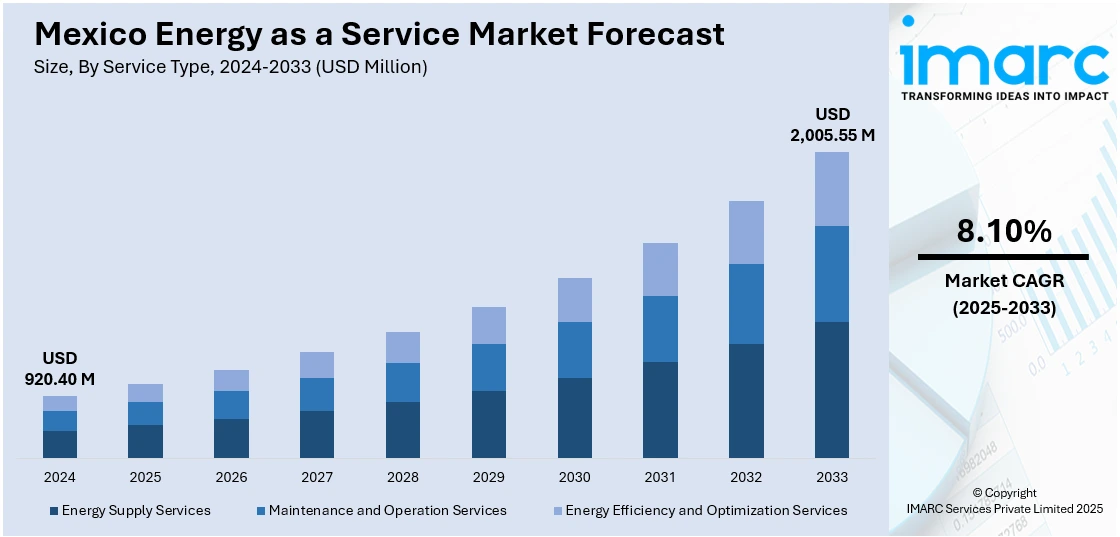

The Mexico energy as a service market size reached USD 920.40 Million in 2024. The market is projected to reach USD 2,005.55 Million by 2033, exhibiting a growth rate (CAGR) of 8.10% during 2025-2033. The growth of the market is fueled by growing energy prices, the uptake of distributed energy systems, and policies for clean energy. Higher industrial demand, expanding interest in solar-plus-storage packages, power outages, and advancements in digital energy management technologies further drive market expansion. Apart from this, carbon-neutralization transition, third-party models of services, and decentralized systems investment are factors propelling the Mexico energy as a service market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 920.40 Million |

| Market Forecast in 2033 | USD 2,005.55 Million |

| Market Growth Rate 2025-2033 | 8.10% |

Mexico Energy as a Service Market Trends:

Growing Adoption of Distributed Energy Systems

Mexico energy as a service (EaaS) industry is directly affected by the expansion of distributed energy systems, such as rooftop solar, battery storage, and microgrids. As per the sources, in April 2025, Niko Energy, a Mexican startup, revealed that it will construct the nation's first virtual power plant. By dealing with decentralized energy sources, it will help stabilize grids as well as deliver affordable solar power. Moreover, technologies give companies and government institutions increased control over energy consumption as well as reduced dependence on the national grid. In an economy burdened with power outages and grid inefficiency, distributed solutions fill the spaces of higher reliability and cost predictability. EaaS vendors are taking advantage of this trend with bundles including distributed system installation, maintenance, and monitoring packaged together under multiyear service contracts. Customers benefit from energy savings as well as reducing operation risk without the infrastructure-management hassles. As Mexico's grid modernization moves at a glacial pace, distributed generation offers a realistic alternative. This is most noticeable among factory complexes and property developers for commercial properties seeking stable sources of power in industrial parks and secondary cities with less developed utility infrastructures.

Rising Demand for Energy Cost Optimization

Energy cost management is a key driver for EaaS adoption in Mexico, especially among medium to large enterprises facing high operational expenses. According to the reports, in March 2025, BioEsol funded $15 million to introduce BioEnergía Total in Mexico. The Energy-as-a-Service solution optimizes renewables for companies, minimizes energy expenditure, and circumvents infrastructure investment via a subscription. Furthermore, with electricity prices steadily rising over the years, companies are under pressure to control their energy-related spending without compromising output. Energy as a service providers address this need by offering customized solutions that enhance energy efficiency, lower peak demand, and optimize load consumption. These services often include energy audits, retrofitting, automated control systems, and analytics-based performance tracking. Businesses are increasingly open to outsourcing energy operations to experts who can guarantee measurable savings and reduce volatility in energy bills. The pay-per-use or performance-based pricing structures offered under EaaS models also allow companies to achieve cost reductions with minimal upfront investment, which is further driving the Mexico energy as a service market growth.

Increasing Government Incentives for Clean Energy

The Mexican government has launched several policy initiatives and financial support mechanisms aimed at boosting clean energy use, which directly contributes to the EaaS market’s expansion. Incentives such as accelerated depreciation for renewable energy assets, low-interest loans, and net metering schemes encourage businesses to adopt solar and storage solutions. Additionally, regulatory frameworks like Mexico’s Energy Transition Law and long-term clean energy targets create a favorable environment for EaaS providers. These policies not only support the use of renewables but also open the door for third-party energy service models to flourish. Companies that were previously hesitant to explore clean energy now see a lower risk profile and improved return on investment when partnering with EaaS firms. Government-backed support further increases the credibility and attractiveness of service providers in the Mexico energy as a service market trend.

Opportunities in Mexico's Energy as a Service Market:

Abundant Resources Boost the Market Demand

Mexico's Energy-as-a-Service (EaaS) market holds high growth prospects with its rich renewable resources such as solar and wind, offering clean energy services as highly feasible. The business model enables companies and users to secure energy solutions without heavy capital expenditures, driving adoption in industrial, commercial, and residential sectors. Government support in terms of energy transition and sustainability facilities the use of distributed energy resources and storage devices. Collaborations between foreign energy companies and domestic vendors may facilitate technology transfer, funding, and operating experience. Increasing demand for smart grids and digital energy management systems also presents opportunities for innovation in monitoring, efficiency, and predictive maintenance. Further, increasing corporate interest in sustainability objectives promotes tailored EaaS services such as energy optimization and carbon footprint minimization, presenting opportunities in Mexico energy as a service market analysis.

Challenges in Mexico's Energy as a Service Market:

Regulations Uncertainties Impede the Market Growth

Regulatory uncertainty, involving regular changes in energy policy and government priorities, may deter private investment and postpone projects in the Mexico Energy as a Service Market forecast, impacting investor confidence and project timelines. Infrastructural constraints, including an old grid and inadequate energy storage capacity, impede the seamless deployment of distributed energy systems. The expensive nature of such sophisticated technologies as batteries and smart meters is still a constraint for most prospective customers. There is also a lack of trained professionals who can install, operate, and maintain complicated energy systems. The potential for cyber attacks on digital energy platforms makes data security and system dependability issues of concern. There is also limited awareness of EaaS advantages among small enterprises and local communities that can impede market penetration. These are challenges to be overcome through more transparent policies, human development, upgrades to infrastructure, and consumer education about the benefits of Energy-as-a-Service solutions.

Mexico Energy as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type and end user.

Service Type Insights:

- Energy Supply Services

- Maintenance and Operation Services

- Energy Efficiency and Optimization Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes energy supply services, maintenance and operation services, and energy efficiency and optimization services.

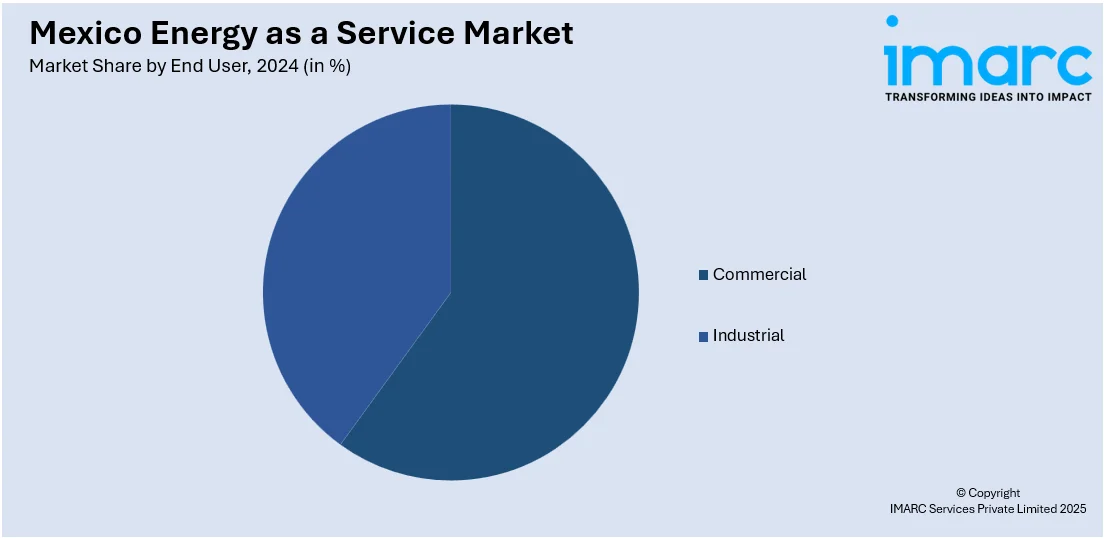

End User Insights:

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes commercial and industrial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Energy as a Service Market News:

- In January 2025, Solar startup Niko Energy is developing Mexico’s first virtual power plant (VPP) to address the country’s strained electricity grid and rising energy demand. Founded in 2023, Niko helps finance and install solar panels for homes and small businesses. Now, it’s expanding into battery storage and plans to aggregate decentralized energy resources like home batteries and EV chargers. Niko aims to build a VPP portfolio with tens of megawatts of capacity.

- In January 2024, Copenhagen Infrastructure Partners (CIP) confirmed a large-scale green hydrogen project in Oaxaca, Mexico, with an investment of USD 10 billion. The project, part of the Interoceanic Corridor of the Isthmus of Tehuantepec, aims to produce green hydrogen to support Mexico's clean energy transition.

- In 2024, Mexico published new energy laws, reshaping the country's energy sector. The reforms aim to return control to the state while redefining private participation, allowing private parties to add between 6,400 MW and 9,550 MW of renewable energy between 2025 and 2030, with an expected investment of USD 6– USD 9 billion.

Mexico Energy as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Energy Supply Services, Maintenance and Operation Services, Energy Efficiency and Optimization Services |

| End Users Covered | Commercial, Industrial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico energy as a service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico energy as a service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico energy as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Mexico energy as a service market was valued at USD 920.40 Million in 2024.

The Mexico energy as a service market is projected to exhibit a CAGR of 8.10% during 2025-2033, reaching a value of USD 2,005.55 Million by 2033.

Key factors driving Mexico's Energy as a Service market include growing industrial power demand, grid reliability challenges, rising renewable energy adoption, government support for clean energy, and technological advancements in solar, battery storage, and virtual power plants. These factors encourage decentralized energy solutions and flexible energy management services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)