Mexico Energy Efficiency Retrofits Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Mexico Energy Efficiency Retrofits Market Overview:

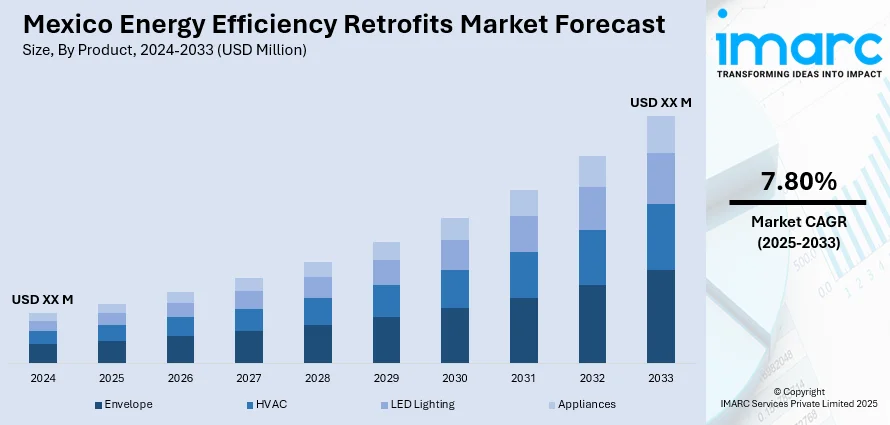

The Mexico energy efficiency retrofits market size is projected to exhibit a growth rate (CAGR) of 7.80% during 2025-2033. The market is steadily growing, owing to the enhanced need for energy optimization in existing commercial, industrial, and residential infrastructure. Encouraging regulation and heightening environmental awareness of adopting sustainable practices continues to drive the adoption of retrofits. Further integration of technologies is also upgrading system performance as well as minimizing costs, contributing to Mexico Energy Efficiency Retrofits market share represents a considerable percentage of the nation's overall energy efficiency services industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 7.80% |

Mexico Energy Efficiency Retrofits Market Trends:

Growing Smart Building Technology Adoption

The adoption of smart building technologies is a high-profile trend in Mexico's retrofit market for energy efficiency. Automated heating, ventilation, and air conditioning (HVAC) controls, energy management systems, and smart lighting solutions are being progressively used across commercial and institutional buildings. These technologies allow for real-time monitoring and optimization of energy consumption, which helps keep costs down and carbon emissions lower. Retrofitting using intelligent solutions further enables buildings to achieve higher levels of energy code compliance and sustainability performance. As per the sources, in October 2023, Fibra Mty, Monterrey-based real estate investment trust, invested US$1.5 million in sustainable upgrades such as solar panels and LED lighting with a target of 11% LEED-certified space by 2024. Furthermore, analysis of usage habits and decision making through data have been driving drivers of widespread uptake. Owners and operators now give higher importance to long-term value as opposed to short-term expenditures because they acknowledge that digitalizing infrastructure yields tangible energy benefits. With incentives from the government adding to market demand, the potential for smart energy retrofits keeps expanding. This technological transition supports the pace of Mexico energy modernization initiatives in pursuing national goals for sustainability.

Development of Retrofitting for Public Infrastructure

Public infrastructure is seeing a proliferation of energy efficiency retrofit initiatives, with municipal and state governments allocating money to upgrade aging infrastructure. The retrofitting of government buildings, including schools, hospitals, and public administration facilities, with high-efficiency lighting, insulation, and HVAC systems has become a strategic imperative. These efforts are driven by the twin advantages of operating cost savings and environmental responsibility. Municipal governments are using performance-based contracts to finance retrofits without any up-front capital expenditures, thus speeding the rate of improvement. Energy audits are being performed more frequently on public properties to search out high-return retrofit opportunities. As the cost of utilities increases, the public sector is highly taking up sustainable infrastructure. This retrofitting activity is adding to Mexico energy transformation objectives by aligning local infrastructure with wider decarbonization and efficiency goals. According to the reports, in August 2023, IDEI and IFC issued an 800 million pesos green bond to finance sustainable construction in Mexico for energy-efficient homes, greenhouse gas reductions, and EDGE-certified green building standards. Moreover, the long-term cost savings and enhanced occupant comfort also boost in retrofit programs in public sectors.

Industrial Sector Takes Up Retrofit Solutions

The Mexico industrial sector is intensely adopting energy efficiency retrofits to curtail consumption and comply with changing sustainability legislation. Retrofitting older equipment with high-efficiency motors, compressors, and process heating systems has become standard practice in energy-intensive processes. Plants are also implementing waste heat recovery and variable frequency drives to achieve better performance without harming the environment. Manufacturing centers and industrial parks are experiencing facility-wide reviews to identify retrofit potential and energy-saving targets. These expenditures stem from a need to compete at home and overseas by reducing the energy intensity of each unit produced. With an increasingly globalized supply chain with more attention placed on sustainability certifications, industrial companies view retrofits as a vehicle for compliance and market entry. Consequently, the industrial retrofit sector is playing an important role in driving Mexico Energy Efficiency Retrofits market growth, supporting the nation's shift toward a low-emission, affordable manufacturing environment.

Mexico Energy Efficiency Retrofits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Envelope

- HVAC

- LED Lighting

- Appliances

The report has provided a detailed breakup and analysis of the market based on the product. This includes envelope, HVAC, led lighting, and appliances.

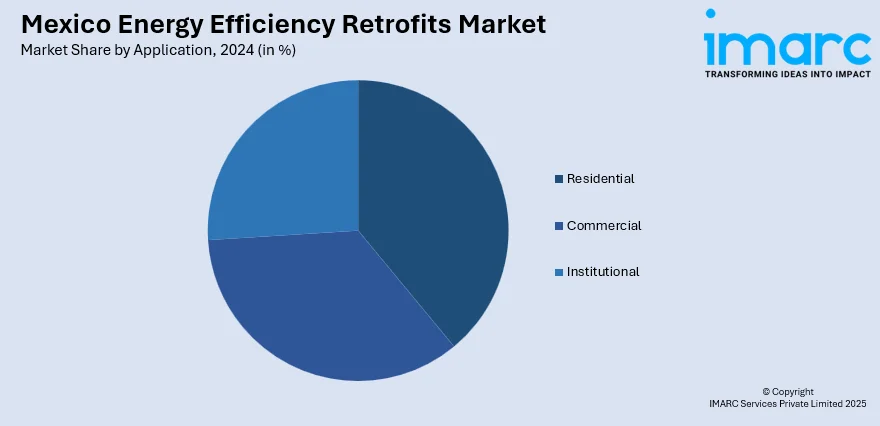

Application Insights:

- Residential

- Single-Family

- 2+ Unit Building

- Mobile Home

- Commercial

- Food Sales & Service

- Lodging

- Mercantile

- Office Buildings

- Public Assembly

- Warehouse/Storage

- Others

- Institutional

- Education

- Healthcare

- Public Order & Safety

- Worship Buildings

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential (single-family, 2+ unit building, and mobile home), commercial, (food sales & service, lodging, mercantile, office buildings, public assembly, warehouse/storage, and others), and institutional, (education, healthcare, public order & safety, and worship buildings).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Energy Efficiency Retrofits Market News:

- In May 2024, Mexico's CONUEE supported the adoption of the BETTER | Mexico toolkit to detect energy-saving potential in buildings without expensive audits. Already implemented in 7,582 federal buildings, the platform aligns with Mexico's objective of reducing energy use by 3% annually, enhancing efficiency and sustainability in public infrastructure management countrywide.

Mexico Energy Efficiency Retrofits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Envelope, HVAC, LED Lighting, Appliances |

| Applications Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico energy efficiency retrofits market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico energy efficiency retrofits market on the basis of product?

- What is the breakup of the Mexico energy efficiency retrofits market on the basis of application?

- What is the breakup of the Mexico energy efficiency retrofits market on the basis of region?

- What are the various stages in the value chain of the Mexico energy efficiency retrofits market?

- What are the key driving factors and challenges in the Mexico energy efficiency retrofits?

- What is the structure of the Mexico energy efficiency retrofits market and who are the key players?

- What is the degree of competition in the Mexico energy efficiency retrofits market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico energy efficiency retrofits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico energy efficiency retrofits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico energy efficiency retrofits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)