Mexico Energy Efficient Transformers Market Size, Share, Trends and Forecast by Type, Cooling Type, Efficiency Level, Application, and Region, 2025-2033

Mexico Energy Efficient Transformers Market Overview:

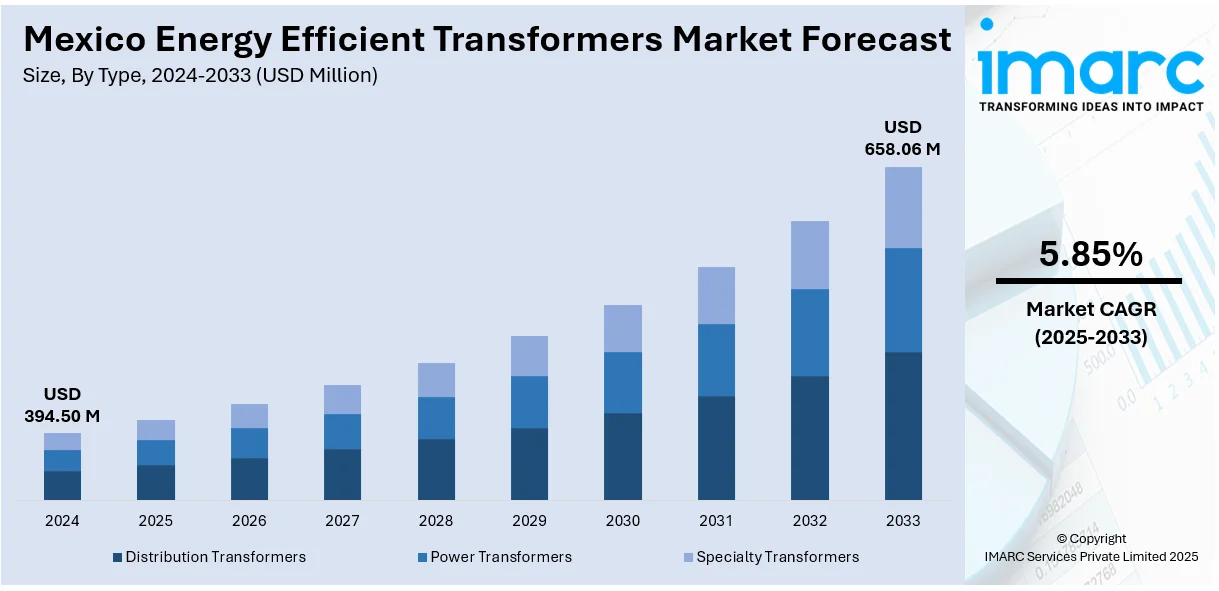

The Mexico energy efficient transformers market size reached USD 394.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 658.06 Million by 2033, exhibiting a growth rate (CAGR) of 5.85% during 2025-2033. The market is being driven by rising electricity demand, grid modernization efforts, and stricter environmental regulations promoting energy conservation. Additionally, industrial expansion and government support for renewable energy integration are boosting the Mexico energy efficient transformers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 394.50 Million |

| Market Forecast in 2033 | USD 658.06 Million |

| Market Growth Rate 2025-2033 | 5.85% |

Mexico Energy Efficient Transformers Market Trends:

Integration of Smart Grid Infrastructure

The ongoing integration of smart grid technology is a key factor propelling Mexico energy efficient transformers market growth. Utilities across Mexico are investing in upgrading traditional electrical infrastructure with digital monitoring and control capabilities to improve energy distribution efficiency and reliability. For instance, in May 2025, LUMA is leading a $5 billion upgrade of Puerto Rico’s power grid, with $1.8 billion in construction underway. Backed by FEMA, the project includes replacing 89 aging transformers, installing 22 new breakers, and submitting over 520 projects totaling $12 billion. Vegetation clearing will cover 1,000 km to boost grid resilience. Energy-efficient transformers, capable of minimizing power loss and supporting grid intelligence, are essential in these modern systems. These transformers not only meet the performance requirements of smart grids but also contribute to long-term cost savings and reduced environmental impact. In line with Mexico’s commitments to clean energy, smart grid deployment is gaining momentum, thus increasing demand for advanced transformer solutions. This trend is anticipated to further reinforce the shift from conventional transformers to energy-efficient variants in the country.

Industrial and Commercial Energy Demand Surge

The rapid growth of industrial and commercial sectors in Mexico is significantly impacting the demand for energy-efficient transformers. Industries such as automotive, manufacturing, and data centers require stable and efficient energy supply systems to maintain uninterrupted operations. As electricity consumption continues to rise in these segments, the need for transformers that minimize energy loss and reduce operational costs is becoming critical. Furthermore, multinational corporations establishing manufacturing bases in Mexico are emphasizing sustainable infrastructure, which includes energy-efficient components. For instance, in 2024, states such as Guanajuato and Querétaro secured more than USD 10 Billion in foreign direct investment (FDI), as major corporations set up production facilities. These industrial expansions require high-capacity power transformers to sustain manufacturing operations, thereby boosting the demand for both power and distribution transformers.

Technological Advancements and Product Innovation

Continuous innovation in transformer design and materials is contributing to the Mexico energy efficient transformers market growth. Manufacturers are focusing on incorporating amorphous metal cores, high-temperature insulation, and advanced cooling techniques to enhance efficiency and durability. These innovations allow transformers to operate with significantly lower energy losses, aligning with Mexico's long-term energy efficiency goals. Additionally, the rise of digital twin technology and IoT-enabled diagnostics in transformers is enabling predictive maintenance and performance optimization, thereby improving asset management for utilities and industries alike. For instance, in May 2025, Hitachi Energy successfully tested the world’s largest 765 kV, 250 MVA natural ester-filled transformer, enhancing grid safety and environmental protection. This biodegradable transformer offers higher flash point and self-extinguishing properties compared to mineral oil, reducing pollution risks. Part of Hitachi’s TrafoStar platform, it supports ultra-high-voltage AC grids globally, improving efficiency and sustainability. The innovation advances energy transition goals by providing safe, reliable power for sensitive areas worldwide.

Mexico Energy Efficient Transformers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on type, cooling type, efficiency level, and application.

Type Insights:

- Distribution Transformers

- Power Transformers

- Specialty Transformers

The report has provided a detailed breakup and analysis of the market based on the type. This includes distribution transformers, power transformers, and specialty transformers.

Cooling Type Insights:

- Oil-Cooled Transformers

- Dry-Type Transformers

A detailed breakup and analysis of the market based on the cooling type have also been provided in the report. This includes oil-cooled transformers and dry-type transformers.

Efficiency Level Insights:

- Low-Efficiency Transformers

- High-Efficiency Transformers

- Ultra-High-Efficiency Transformers

The report has provided a detailed breakup and analysis of the market based on the efficiency level. This includes low-efficiency transformers, high-efficiency transformers, and ultra-high-efficiency transformers.

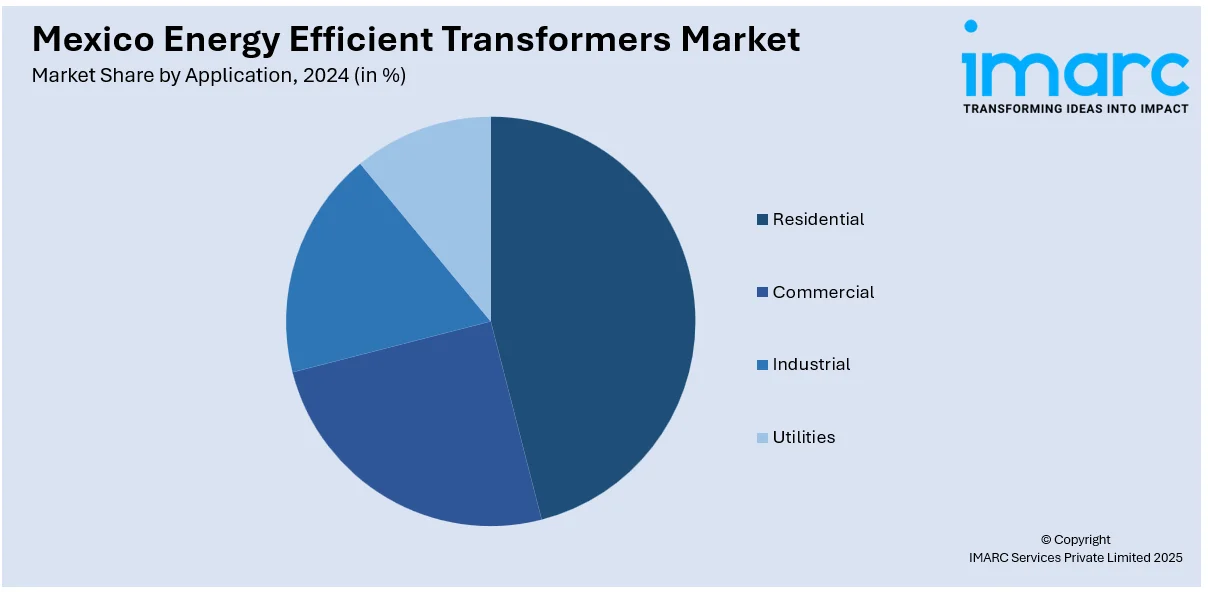

Application Insights:

- Residential

- Commercial

- Industrial

- Utilities

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, industrial, and utilities.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Energy Efficient Transformers Market News:

- In September 2024, Hitachi Energy invested USD 155 Million to expand manufacturing capacity in North America, including USD 70 Million for a new transformer plant in Reynosa, Mexico. The Reynosa factory will produce single-phase, padmount transformers for the North American market. These efforts support rising demand for electrical equipment and align with Hitachi’s strategy to lead the energy transition through innovation and capacity expansion.

Mexico Energy Efficient Transformers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Distribution Trabsformers, Power Transformers, Speciality Transformers |

| Cooling Types Covered | Oil-Cooled Transformers, Dry-Type Transformers |

| Efficiency Levels Covered | Low-Efficiency Transformers, High-Efficiency Transformers, Ultra-High-Efficiency Transformers |

| Applications Covered | Residential, Commercial, Industrial, Utilities |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico energy efficient transformers market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico energy efficient transformers market on the basis of type?

- What is the breakup of the Mexico energy efficient transformers market on the basis of cooling type?

- What is the breakup of the Mexico energy efficient transformers market on the basis of efficiency level?

- What is the breakup of the Mexico energy efficient transformers market on the basis of application?

- What is the breakup of the Mexico energy efficient transformers market on the basis of region?

- What are the various stages in the value chain of the Mexico energy efficient transformers market?

- What are the key driving factors and challenges in the Mexico energy efficient transformers market?

- What is the structure of the Mexico energy efficient transformers market and who are the key players?

- What is the degree of competition in the Mexico energy efficient transformers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico energy efficient transformers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico energy efficient transformers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico energy efficient transformers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)