Mexico Energy Management Software Market Size, Share, Trends and Forecast by Software, Solution, End Use Industry, and Region, 2025-2033

Mexico Energy Management Software Market Overview:

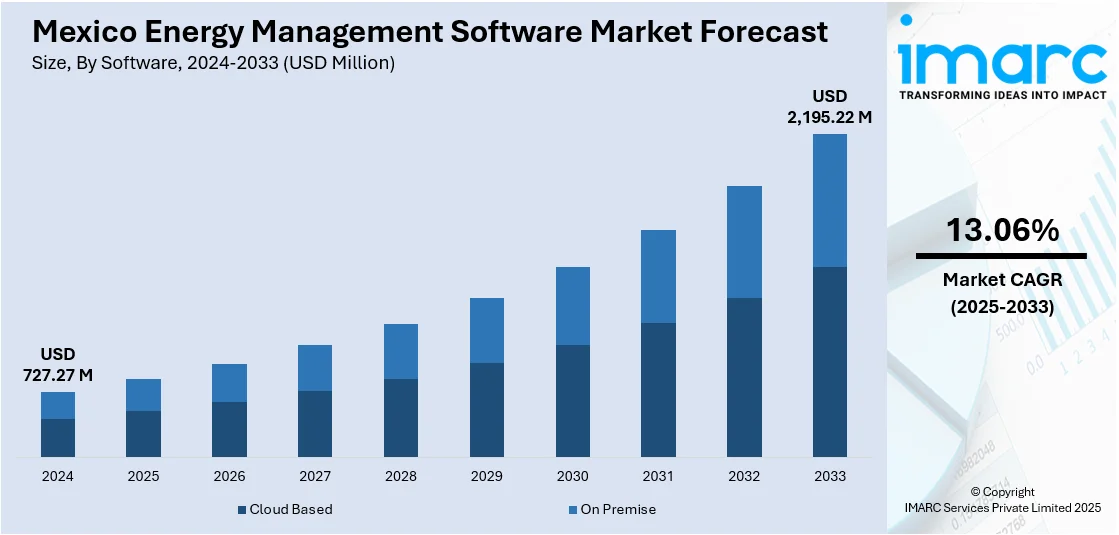

The Mexico energy management software market size reached USD 727.27 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,195.22 Million by 2033 exhibiting a growth rate (CAGR) of 13.06% during 2025-2033. The heightened need for energy efficiency in different industries is impelling the growth of the market. Moreover, improvements in technology in energy management solutions are contributing to the market growth. This, along with the government policies and initiatives in Mexico are playing a crucial role in expanding the Mexico energy management software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 727.27 Million |

| Market Forecast in 2033 | USD 2,195.22 Million |

| Market Growth Rate 2025-2033 | 13.06% |

Mexico Energy Management Software Market Trends:

Growing Need for Energy Efficiency

The Mexico energy management software industry is driven by the need for energy efficiency in different industries. Organizations and businesses are embracing energy management solutions to maximize their energy consumption, save costs, and enhance sustainability. In light of the growing awareness about climate change and the environment, there is mounting pressure to cut carbon footprints. This trend is cultivating a change towards more efficient and regulated energy usage patterns. Regulatory efforts by the Mexican government, including the Energy Transition Law, are also compelling companies to adopt energy-saving practices. Energy management software is pivotal in assisting companies with monitoring, analyzing, and optimizing energy usage, aligning with both regulatory requirements and sustainability objectives. As companies concentrate on lowering operational expenditures and improving environmental performance, the call for advanced energy management tools is rising in Mexico. In 2025, the government initiated a national energy plan aiming for 54% renewable electricity production by 2030, along with immediate enhancements to outdated grid infrastructure. At RE+ Mexico 2025 (previously Solar + Storage Mexico), global renewable leader Sungrow showcased innovative solar and energy storage solutions aimed at enhancing Mexico's sustainable future.

Technological Developments in Energy Management Solutions

The improvements in technology in energy management solutions is impelling the Mexico energy management software market growth. Technology developments like machine learning (ML), artificial intelligence (AI), and the Internet of Things (IoT) are modernizing the way energy consumption is tracked, analyzed, and optimized. These technologies are facilitating real-time gathering of energy data, more accurate analysis, and automating the processes of energy management. With the deployment of smart meters, sensors, and cloud-based systems, companies are getting better insights into their energy usage patterns. These solutions are not just making energy usage more efficient but are also enhancing predictive maintenance capabilities, enabling firms to identify inefficiencies before they worsen. As Mexican businesses embrace these state-of-the-art solutions, energy management software becomes a part of their plans for sustainable improvement in energy consumption and achievement of sustainability goals. The IMARC Group stated that the Mexico IoT market will reach USD 46,079.0 Million by 2033.

Government Policies and Initiatives

Government policies and initiatives in Mexico are playing a crucial role in facilitating the adoption of energy management software. Mexico's pledge to energy reform and drive for sustainable development are prodding the implementation of energy management practices in different industries. Regulations such as the Energy Transition Law, which seeks to mitigate greenhouse gas emissions as well as enhance the consumption of renewable energy, are pushing companies to implement energy management software in order to comply with regulations. Moreover, government incentives and funding programs for promoting green technology are giving financial assistance to businesses that are making investments in energy-saving solutions. In 2025, the Mexican Government has unveiled the Strategy for Enhancing and Expanding the National Electric System 2025-2030 of the publicly owned Federal Electricity Commission (CFE). The strategy anticipates 51 electricity initiatives that require an approximate investment of US$22.3bn, intending to produce 22,674 MW. To achieve this, the CFE intends to establish 7 wind projects, 9 solar PV facilities (673 MW), 5 natural gas CCGT power plants, and one internal combustion project (240 MW) within a span of six years.

Mexico Energy Management Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on software, solution, and end use industry.

Software Insights:

- Cloud Based

- On Premise

The report has provided a detailed breakup and analysis of the market based on the software. This includes cloud based and on premise.

Solution Insights:

- Carbon Management System

- Utility Billing System

- Customer Information System

- Demand Response Management

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes carbon management system, utility billing system, customer information system, demand response management, and others.

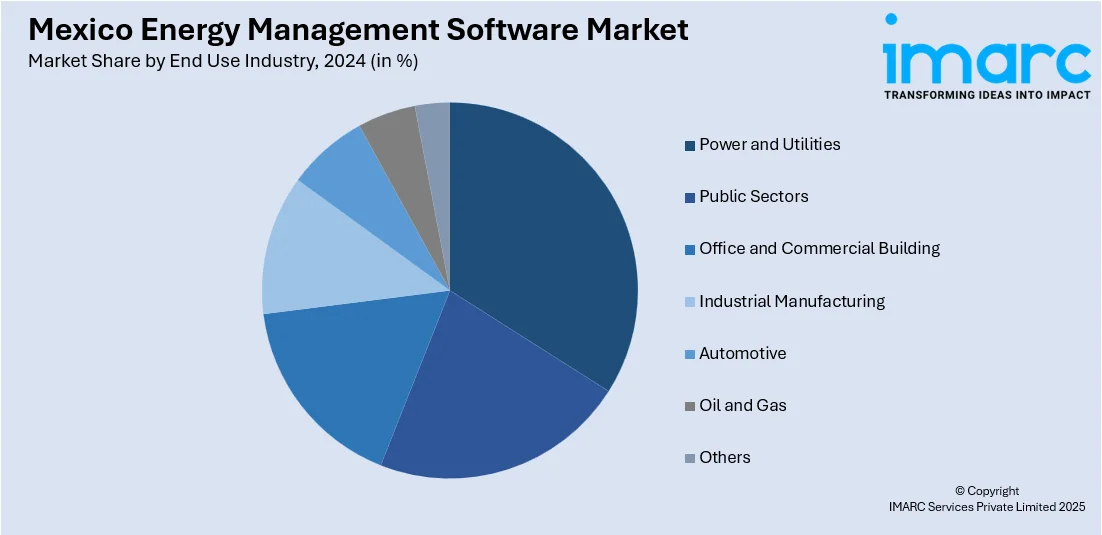

End Use Industry Insights:

- Power and Utilities

- Public Sectors

- Office and Commercial Building

- Industrial Manufacturing

- Automotive

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes power and utilities, public sectors, office and commercial building, industrial manufacturing, automotive, oil and gas, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Energy Management Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Softwares Covered | Cloud Based, On Premise |

| Solutions Covered | Carbon Management System, Utility Billing System, Customer Information System, Demand Response Management, Others |

| End Use Industries Covered | Power and Utilities, Public Sectors, Office and Commercial Building, Industrial Manufacturing, Automotive, Oil and Gas, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico energy management software market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico energy management software market on the basis of software?

- What is the breakup of the Mexico energy management software market on the basis of solution?

- What is the breakup of the Mexico energy management software market on the basis of end use industry?

- What is the breakup of the Mexico energy management software market on the basis of region?

- What are the various stages in the value chain of the Mexico energy management software market?

- What are the key driving factors and challenges in the Mexico energy management software market?

- What is the structure of the Mexico energy management software market and who are the key players?

- What is the degree of competition in the Mexico energy management software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico energy management software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico energy management software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico energy management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)