Mexico Environmental Monitoring Market Size, Share, Trends and Forecast by Component, Product Type, Sampling Method, Application, and Region, 2025-2033

Mexico Environmental Monitoring Market Overview:

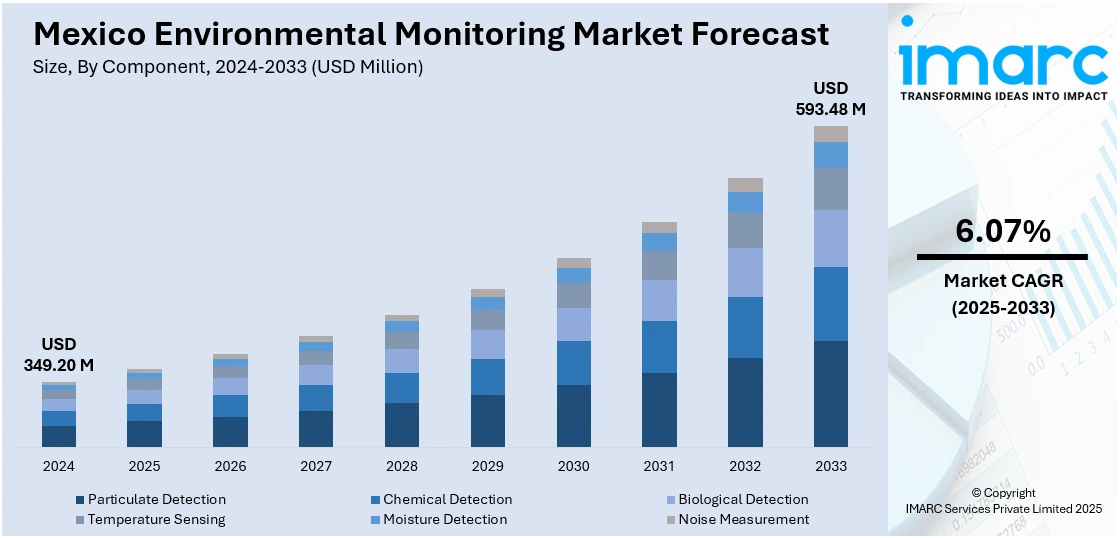

The Mexico environmental monitoring market size reached USD 349.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 593.48 Million by 2033, exhibiting a growth rate (CAGR) of 6.07% during 2025-2033. Drivers for the market include rising industrial activities, mounting environmental concerns about degradation, tightening government regulations, and expanding requirements for data-based solutions. Additionally, advancements in sensor technology, data analytics, and real-time monitoring capacity have all contributed enormously to Mexico environmental monitoring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 349.20 Million |

| Market Forecast in 2033 | USD 593.48 Million |

| Market Growth Rate 2025-2033 | 6.07% |

Mexico Environmental Monitoring Market Trends:

Government Regulations and Policies

Mexico’s growing commitment to environmental sustainability has driven the implementation of more rigorous regulations focused on monitoring air, water, and soil quality. Frameworks like the General Law of Ecological Balance and Environmental Protection define pollutant limits and assess ecological risks. These policies have fueled the need for advanced environmental monitoring systems among businesses and government agencies aiming to meet compliance standards. A notable example is the March 2025 legislation in the State of Mexico, which imposes fines up to MX$339,420 on businesses distributing single-use plastics, with certain exemptions. The law also mandates environmental education in schools and bans non-recyclable plastics in public offices. Monitoring technologies are crucial for gathering accurate environmental data, facilitating compliance, and supporting the country’s broader transition toward sustainable, biodegradable alternatives and improved waste management.

Advancements in Technology

Technological advancements are changing the environment monitoring market in Mexico. The use of Internet of Things (IoT) sensors, artificial intelligence (AI), and machine learning (ML) has made it possible to collect data in real time and make predictive analyses, providing more accurate and timely information about environmental conditions. Cloud computing integration makes it possible to store data in a central location and access it easily, making decision-making more efficient. In addition, sensor technology advancements have enabled environmental monitoring systems to be cost-saving, efficient, and available to a wider base of industries. The technology advancements are opening up the application of environmental monitoring from large-scale industries to small and medium-sized ones that are increasingly embracing sustainability strategies. For instance, in November 2024, NASA highlighted the work of Guardián Forestal, a Mexican nonprofit using satellite imagery to monitor environmental issues like illegal avocado-related deforestation. This recognition took place during the International Colloquium on Space and Environmental Justice in Morelia, Michoacán. The event brought together around 200 Mexican stakeholders and NASA experts to explore how Earth observation tools can support sustainable development, empower indigenous communities, protect environmental defenders, and strengthen legal responses to environmental crimes in Mexico.

Rising Awareness of Environmental Protection

As environmental awareness increases among the public and businesses in Mexico, the demand for environmental monitoring systems continues to grow. The population’s rising concern about issues such as air pollution, water contamination, and climate change has resulted in greater pressure on both companies and governments to adopt more sustainable practices. Public and private sector collaborations are focusing on improving environmental quality through better monitoring systems. Non-governmental organizations and citizens are also actively advocating for transparent environmental reporting, pushing businesses to invest in monitoring technologies. In response, industries such as agriculture, manufacturing, and energy are deploying advanced environmental monitoring tools to meet growing public demand for accountability and sustainability, thereby acting as a crucial factor accelerating the Mexico environmental monitoring market growth. For instance, in January 2025, the State of Mexico launched four key environmental projects with a MX$54 million investment. These initiatives aim to address pollution, promote clean energy, and preserve natural resources. Projects include upgrading the atmospheric monitoring system, promoting sustainable agave farming, restoring ravines, and reducing emissions from fossil fuels. The Ministry of Environment and Sustainable Development (SMAyDS) and the Megalopolis Environmental Commission (CAMe) will collaborate on these efforts, supporting the state's goal of becoming a sustainability leader.

Mexico Environmental Monitoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, product type, sampling method, and application.

Component Insights:

- Particulate Detection

- Chemical Detection

- Biological Detection

- Temperature Sensing

- Moisture Detection

- Noise Measurement

The report has provided a detailed breakup and analysis of the market based on the component. This includes particulate detection, chemical detection, biological detection, temperature sensing, moisture detection, and noise measurement.

Product Type Insights:

- Environmental Monitoring Sensors

- Environmental Monitors

- Environmental Monitoring Software

- Wearable Environmental Monitors

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes environmental monitoring sensors, environmental monitors, environmental monitoring software, and wearable environmental monitors.

Sampling Method Insights:

- Continuous Monitoring

- Active Monitoring

- Passive Monitoring

- Intermittent Monitoring

The report has provided a detailed breakup and analysis of the market based on the sampling method. This includes continuous monitoring, active monitoring, passive monitoring, and intermittent monitoring.

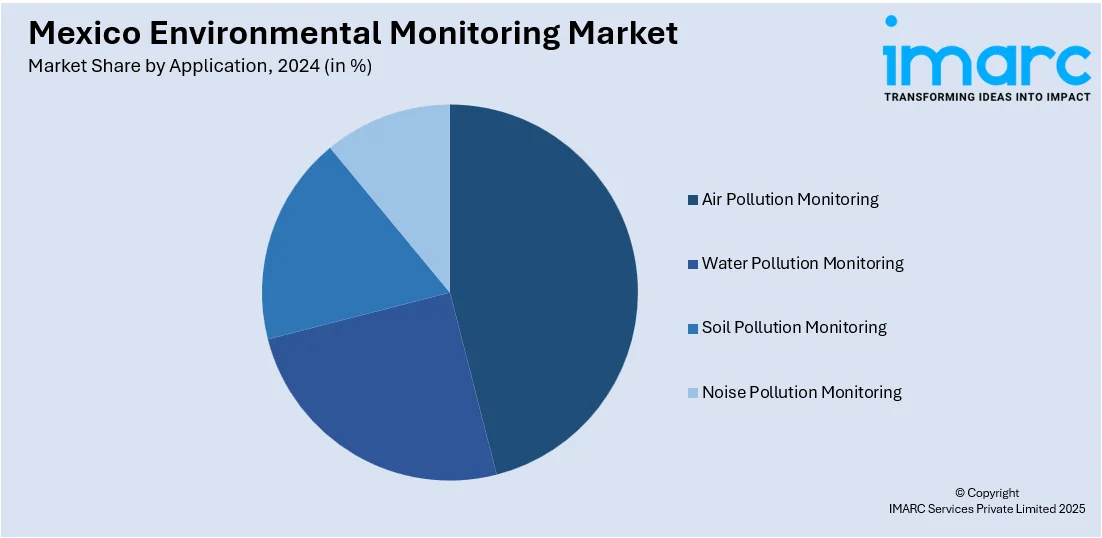

Application Insights:

- Air Pollution Monitoring

- Water Pollution Monitoring

- Soil Pollution Monitoring

- Noise Pollution Monitoring

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes air pollution monitoring, water pollution monitoring, soil pollution monitoring, and noise pollution monitoring.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, and Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Environmental Monitoring Market News:

- In April 2025, SEMARNAT and UNAM created an air pollution inventory for Mexico City, Guadalajara, and Monterrey to identify pollutant types and sources. Seasonal heat, vehicle use, and industrial emissions, including from the Cadereyta refinery, worsen air quality. Forest fires and agricultural burns also contribute. Monterrey has launched a Metropolitan Environmental Commission and is upgrading its monitoring system.

- In April 2025, ENVEA launched the OPM250, a next-generation Optical Aerosol Spectrometer for real-time particulate matter (PM) monitoring. The device offers high precision across a wide particle size range (0.178µm to 29.4µm) and is ideal for urban, industrial, and scientific environments. With TÜV QAL1 certification for PM10 and PM2.5, it operates efficiently with low power use and maintenance. Featuring robust design and versatile communication protocols, the OPM250 supports enhanced air quality data collection for governments, researchers, and industries worldwide.

- In March 2025, Nuevo Leon launched the Metropolitan Environmental Commission to combat severe air pollution in Monterrey, where residents face poor air quality 240 days a year. Major pollutants include PM10, ozone, and sulfur dioxide, worsened by over 239 recent fires. The government declared an environmental contingency and is upgrading air monitoring systems with a MX$14 million investment. Measures include stricter vehicle and industrial emissions regulations, improved fuel standards, and enhanced monitoring. Collaboration across federal, state, and municipal levels aims to protect public health and reduce pollution.

- In December 2024, the Megalopolis Environmental Commission (CAMe) announced new initiatives to improve air quality in industrial and densely populated cities of Mexico, focusing on pollutant monitoring and vehicle inspections. Measures include gas vapor recovery, harmonizing vehicle inspection regulations, and addressing the heat island effect. CAMe also aims to strengthen institutional capacities and collaborate with health ministries to manage pollution exposure. These efforts align with broader environmental protection and sustainability goals.

- In November 2024, Mexico, UNEP and UNIDO launched a USD 12 Million project to eliminate mercury use in the chloralkali sector by 2025, aligning with the Minamata Convention. The initiative promotes safer industrial practices, sustainable technologies, and mercury waste management. Key activities include decommissioning mercury-based facilities, remediating contaminated sites in Monterrey and Coatzacoalcos, and building national capacity. The project, a first in Latin America, aims to protect human health and the environment while supporting Mexico’s transition to a cleaner, mercury-free chemical industry.

Mexico Environmental Monitoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Particulate Detection, Chemical Detection, Biological Detection, Temperature Sensing, Moisture Detection, Noise Measurement |

| Product Types Covered | Environmental Monitoring Sensors, Environmental Monitors, Environmental Monitoring Software, Wearable Environmental Monitors |

| Sampling Methods Covered | Continuous Monitoring, Active Monitoring, Passive Monitoring, Intermittent Monitoring |

| Applications Covered | Air Pollution Monitoring, Water Pollution Monitoring, Soil Pollution Monitoring, Noise Pollution Monitoring |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico environmental monitoring market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico environmental monitoring market on the basis of component?

- What is the breakup of the Mexico environmental monitoring market on the basis of product type?

- What is the breakup of the Mexico environmental monitoring market on the basis of sampling method?

- What is the breakup of the Mexico environmental monitoring market on the basis of application?

- What is the breakup of the Mexico environmental monitoring market on the basis of region?

- What are the various stages in the value chain of the Mexico environmental monitoring market?

- What are the key driving factors and challenges in the Mexico environmental monitoring market?

- What is the structure of the Mexico environmental monitoring market and who are the key players?

- What is the degree of competition in the Mexico environmental monitoring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico environmental monitoring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico environmental monitoring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico environmental monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)