Mexico Extended Reality Market Size, Share, Trends and Forecast by Component, Type, Organization Size, Application, End User Industry, and Region, 2025-2033

Mexico Extended Reality Market Overview:

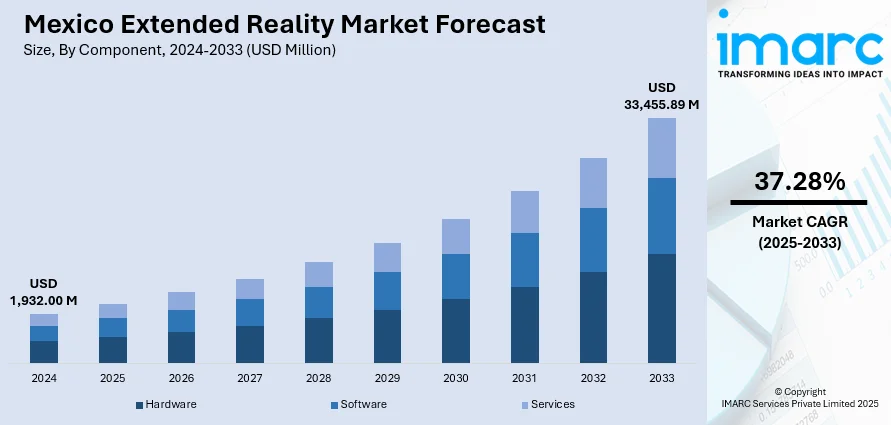

The Mexico extended reality market size reached USD 1,932.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 33,455.89 Million by 2033, exhibiting a growth rate (CAGR) of 37.28% during 2025-2033. The growth of the market is propelled by the increasing adoption of extended reality (XR) across sectors such as gaming, healthcare, and education, alongside rising investments in XR technology. Additionally, government initiatives supporting digital innovation and the growing demand for immersive experiences are key drivers. Technological advancements in AR, VR, and MR are further boosting the market, contributing significantly to Mexico extended reality market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,932.00 Million |

| Market Forecast in 2033 | USD 33,455.89 Million |

| Market Growth Rate 2025-2033 | 37.28% |

Mexico Extended Reality Market Trends:

Adoption in Healthcare and Medicine

In Mexico, adoption of extended reality (XR) technologies in the health sector is rising swiftly. Medical professionals and learning institutions are integrating XR solutions for medical education, surgical training, and patient care. Augmented reality (AR) and virtual reality (VR) are being employed to simulate intricate surgeries, allowing medical experts to practice in a risk-free environment. In addition, XR technologies are being used for pain relief, mental health treatment, and rehabilitation programs. The ability of XR to enhance the efficiency of training and therapy is fueling its increasing adoption in Mexico's healthcare industry. By offering novel, accessible, and affordable health solutions, XR has the potential to revolutionize the Mexican healthcare industry. For instance, in March 2025, Dräger and VirtualiSurg won the inaugural Obsidian Award for their Dräger Virtuo XR Babyleo project, an extended reality (XR) simulator designed for NICU training. This innovative solution combines clinical and emotional aspects of care, enabling medical staff to train in real clinical scenarios while engaging parents. The award recognizes XR innovations in hardware, software, and content creation. Dräger and VirtualiSurg aim to expand their immersive healthcare training solutions globally, contributing to more effective and compassionate medical education, as well as improved patient outcomes.

Growth in Retail and E-commerce Experiences

Extended reality is revolutionizing shopping in Mexico through immersive experiences that merge physical and digital environments. Augmented reality (AR) is being more and more applied by retailers to enable customers to see products at home before purchasing, making the decision-making process more effective. Virtual reality (VR) is also being employed by online shops to establish virtual stores, enabling consumers to experience a realistic, interactive environment. Additionally, the rise of virtual fitting rooms and AR-enabled product try-ons has boosted online shopping engagement and sales, thereby propelling the Mexico extended reality market growth. As consumer behavior shifts toward more personalized, engaging, and interactive experiences, the demand for XR solutions in Mexico's retail and e-commerce sectors is growing, shaping the future of shopping. For instance, in January 2025, Google introduced the Android XR platform, enhancing extended reality (XR) technology by integrating seamlessly with Android’s ecosystem. Launching on Samsung’s Project Moohan headset, the platform offers immersive experiences with AI-driven features. It supports various apps, prioritizing affordability, compatibility, and developer access. Partnering with Samsung and Qualcomm, Google aims to make XR mainstream, rivaling Apple’s Vision Pro. The platform’s AI integration enhances interactions and enables hands-free device control, improving XR’s accessibility, particularly in retail and education sectors.

Mexico Extended Reality Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on component, type, organization size, application, and end user industry.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Type Insights:

- Consumer Engagement

- Business Engagement

The report has provided a detailed breakup and analysis of the market based on the type. This includes consumer engagement and business engagement.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

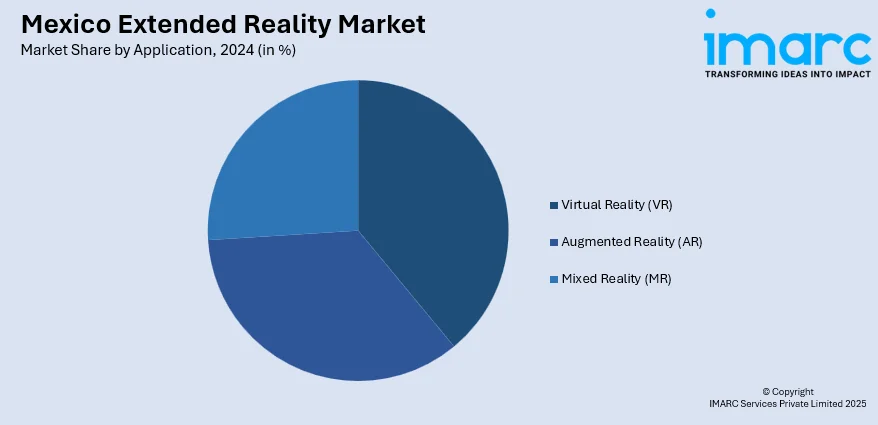

Application Insights:

- Virtual Reality (VR)

- Augmented Reality (AR)

- Mixed Reality (MR)

The report has provided a detailed breakup and analysis of the market based on the application. This includes virtual reality (VR), augmented reality (AR), and mixed reality (MR).

End User Industry Insights:

- Education

- Retail

- Industrial and Manufacturing

- Healthcare

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes education, retail, industrial and manufacturing, healthcare, media and entertainment, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Extended Reality Market News:

- In March 2025, Ericsson, T-Mobile, and Qualcomm successfully trialed XR (Extended Reality) on a live 5G SA network, demonstrating its potential to enhance user experiences. The trial focused on testing XR deployment aspects, including network readiness and device capabilities using AI-powered smart glasses. The collaboration aims to unlock the full potential of 5G Advanced, validating the use of network slicing, low latency, and scalable throughput, paving the way for immersive XR experiences across 5G networks, with implications for both consumer and industrial applications.

- In February 2024, LG and Meta strengthened their partnership to advance extended reality (XR) technologies. This collaboration aims to develop disruptive XR devices aligned with LG's Future Vision 2030 strategy. The companies plan to combine Meta's technology with LG's products and services to create a unique XR ecosystem. The focus is on improving customer experiences in virtual spaces through innovative, immersive XR devices. LG's new XR business unit will help drive the next generation of XR technology, contributing to its long-term goal of evolving into a smart living solutions company.

Mexico Extended Reality Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Types Covered | Consumer Engagement, Business Engagement |

| Organization Sizes Covered | Small And Medium-Sized Enterprises, Large Enterprises |

| Applications Covered | Virtual Reality (VR), Augmented Reality (AR), Mixed Reality (MR) |

| End User Industries Covered | Education, Retail, Industrial and Manufacturing, Healthcare, Media and Entertainment, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico extended reality market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico extended reality market on the basis of component?

- What is the breakup of the Mexico extended reality market on the basis of type?

- What is the breakup of the Mexico extended reality market on the basis of organization size?

- What is the breakup of the Mexico extended reality market on the basis of application?

- What is the breakup of the Mexico extended reality market on the basis of end user industry?

- What is the breakup of the Mexico extended reality market on the basis of region?

- What are the various stages in the value chain of the Mexico extended reality market?

- What are the key driving factors and challenges in the Mexico extended reality market?

- What is the structure of the Mexico extended reality market and who are the key players?

- What is the degree of competition in the Mexico extended reality market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico extended reality market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico extended reality market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico extended reality industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)