Mexico Factoring Market Size, Share, Trends and Forecast by Type, Organization Size, Application, and Region, 2025-2033

Mexico Factoring Market Overview:

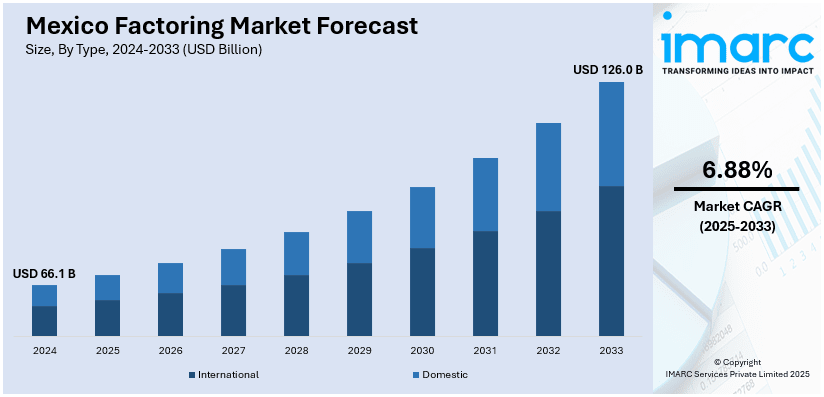

The Mexico factoring market size reached USD 66.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 126.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.88% during 2025-2033. The market is growing due to rising demand for working capital from small and medium-sized enterprises (SMEs), increasing cross-border trade, widespread adoption of digital platforms, improved regulatory support, heightened awareness of alternative financing options, expanding e-commerce, and stronger participation from financial institutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 66.1 Billion |

| Market Forecast in 2033 | USD 126.0 Billion |

| Market Growth Rate 2025-2033 | 6.88% |

Mexico Factoring Market Trends:

Expansion of Reverse Factoring Services

The Mexico factoring market is witnessing reverse factoring as an important developing pattern, as businesses seek to enhance their supply chain relationships and enhance the financial stability of their vendors. This transition is contributing notably to the expansion of the Mexico’s factoring market share. In line with this, a buyer who seeks to improve supplier relationship trust and speed up the delivery of goods or services arranges early payments through a financial intermediary. For instance, in August 2024, IFC and Citi launched a $500 million facility in Mexico to promote sustainable supply chains and expand SME access to finance through reverse factoring, strengthening supplier networks nationwide. Moreover, the main attraction of reverse factoring comes from providing superior payment terms to suppliers without creating any impact on the buyer's cash availability. The benefits of this approach prove essential for Mexico's SME suppliers because they usually lack sufficient credit access. Besides this, ever-increasing numbers of large businesses, alongside government organizations, choose reverse factoring to develop resilient supplier networks. Furthermore, financial institutions and fintech companies are now expanding their product lines by adding reverse factoring solutions because they observe increasing marketplace needs for collaborative financing models that advantage all supply chain participants.

Integration of Digital Technologies in Factoring Processes

The digital transformation of financial services is driving the Mexico factoring market growth through new online platforms, as businesses use automated solutions to handle their receivables. For example, in March 2025, MercadoLibre plans to invest $3.4 Billion in tech and financial services, to boost digital platforms, streamlining receivables management, and accelerating Mexico’s shift toward automated (artificial intelligence) AI-driven factoring solutions. In addition to this, factoring companies use digital solutions to simplify client acceptance procedures, conduct automatic credit analysis, and verify invoices more efficiently. Concurrently, AI technology, powered by machine learning (ML), helps identify fraud patterns and develop better credit scoring models. These are further delivered through cloud-based services that provide clients with immediate funding access. Multiple institutions also explore blockchain technology, because it demonstrates promising capabilities to enhance transaction transparency and security mechanisms. Furthermore, digitalization generates operational speedups that improve factoring service availability for businesses serving locations where underserved segments operate, including SMEs in remote areas. As a result, factoring providers throughout Mexico are discovering technology adoption as a vital factor, because customers demand quicker services and transparent systems with convenience, thereby enhancing the Mexico factoring market outlook.

Mexico Factoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, organization size and application.

Type Insights:

- International

- Domestic

The report has provided a detailed breakup and analysis of the market based on the type. This includes international and domestic.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium enterprises, and large enterprises.

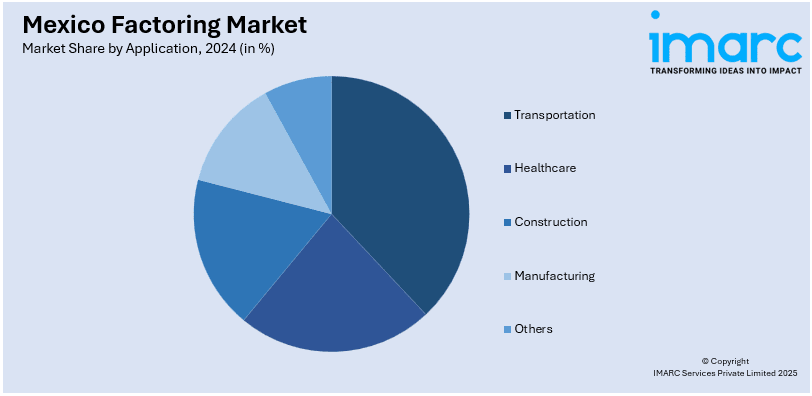

Application Insights:

- Transportation

- Healthcare

- Construction

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes transportation, healthcare, construction, manufacturing, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Factoring Market News:

- In September 2024, MercadoLibre's fintech arm, Mercado Pago, secured a $250 million financing deal with JPMorgan to enhance its credit offerings in Mexico. This investment enables Mercado Pago to reinvest and finance more small and medium-sized businesses (SMBs) and individuals, thereby expanding access to credit in the region.

- In April 2024, Revolut secured a banking license from Mexico's National Banking and Securities Commission. This approval allows Revolut to offer a range of financial services, including remittances in the market. By entering the Mexican market, Revolut aims to enhance financial inclusion and provide more options for consumers.

Mexico Factoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | International, Domestic |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| Applications Covered | Transportation, Healthcare, Construction, Manufacturing, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico factoring market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico factoring market on the basis of type?

- What is the breakup of the Mexico factoring market on the basis of organization size?

- What is the breakup of the Mexico factoring market on the basis of application?

- What is the breakup of the Mexico factoring market on the basis of region?

- What are the various stages in the value chain of the Mexico factoring market?

- What are the key driving factors and challenges in the Mexico factoring?

- What is the structure of the Mexico factoring market and who are the key players?

- What is the degree of competition in the Mexico factoring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico factoring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico factoring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico factoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)