Mexico Factory Automation Market Size, Share, Trends and Forecast by Component, System Type, Industry Vertical, and Region, 2026-2034

Mexico Factory Automation Market Overview:

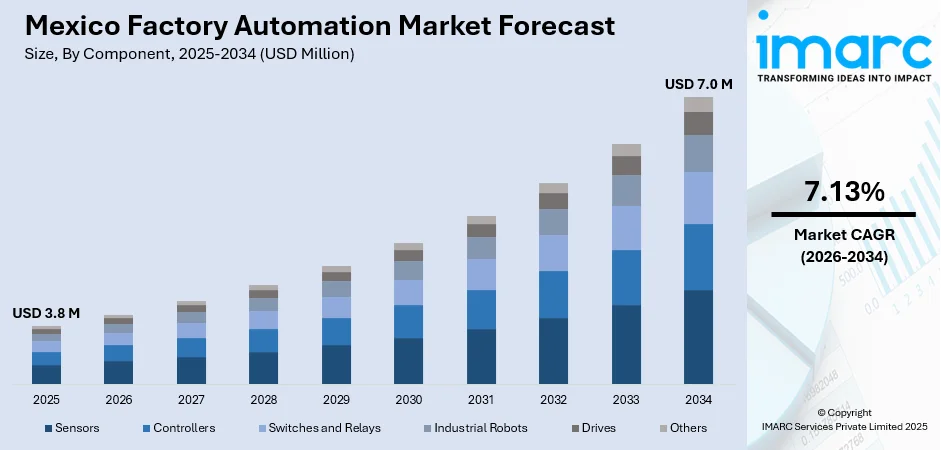

The Mexico factory automation market size reached USD 3.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 7.0 Million by 2034, exhibiting a growth rate (CAGR) of 7.13% during 2026-2034. The market is driven by the growth of industrialization and manufacturing in Mexico, leading to a higher demand for automation to improve efficiency and scalability. Furthermore, the need for cost efficiency and enhanced productivity is pushing manufacturers to adopt smart, automated systems that streamline operations. Government initiatives and Industry 4.0 support are also playing a pivotal role in facilitating the transition toward more technologically advanced manufacturing solutions, further augmenting the Mexico factory automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.8 Million |

| Market Forecast in 2034 | USD 7.0 Million |

| Market Growth Rate 2026-2034 | 7.13% |

Access the full market insights report Request Sample

Mexico Factory Automation Market Trends:

Increasing Industrialization and Manufacturing Growth in Mexico

The growth of industrialization and manufacturing industry in Mexico has been one of the major market drivers. Mexico has emerged as a major manufacturing center, especially in the automotive, electronics, and consumer goods sectors, considering its proximity to the United States and favorable trade agreements like the USMCA. With the nation still drawing foreign direct investments and consolidating its position in international supply chains, there is mounting pressure to have automation solutions that enhance production efficiency, save costs, and uphold high-quality levels. Factory automation systems like robotic arms, automated guided vehicles (AGVs), and control systems play a vital role in amplifying productivity, particularly in high-volume production settings. Automation assists in relieving issues like labor shortages, increasing wages, and the demand for accuracy in the production process. With Mexico's manufacturing industry expanding, both by local and global demand, automation of factories is likely to be central to maintaining competitiveness and scalability. On January 19, 2023, ABB announced the opening of its Mexico Technology and Engineering Center (MXTEC) in Mérida, Yucatán, to support North American process industries. The center, with an initial investment of USD 1 million, aims to enhance ABB’s automation, electrical, and software engineering capabilities. It will focus on sectors like mining, pulp and paper, and battery manufacturing, increasing engineering capacity by 25% and improving project delivery. Furthermore, the government's push to modernize manufacturing capabilities through technological advancements has further strengthened the need for automation solutions, contributing significantly to the Mexico factory automation market growth.

To get more information on this market Request Sample

Increasing Focus on Cost Efficiency and Productivity

Cost efficiency and productivity improvements have become central to the operational strategies of manufacturers in Mexico, further propelling the market. As businesses face growing pressure to optimize operations in the face of rising labor costs and the demand for shorter production cycles, automation has emerged as an essential tool for achieving these goals. Automated systems, such as robotic assembly lines and precision manufacturing equipment, can operate continuously without the need for breaks, thus increasing overall productivity. Additionally, automation helps reduce the risk of human error and minimizes downtime, which are critical factors in maintaining consistent output and quality. Companies are increasingly adopting smart factory concepts that integrate Internet of Things (IoT) devices, sensors, and data analytics to monitor and optimize production processes in real-time. On June 26, 2023, Bosch Rexroth opened a new 42,000-square-meter plant in Querétaro, Mexico, with an investment of 160 million euros to boost manufacturing capacity in North America. The plant, which started operations in June, will produce hydraulic pumps, motors, and valves for mobile machinery like excavators and forklifts, as well as linear motion products for factory automation. Bosch Rexroth aims to create 900 jobs by 2027, enhancing supply chain flexibility, reducing CO2 emissions, and enabling faster delivery to customers in the agricultural, construction, and OEM sectors. The use of data to fine-tune manufacturing systems allows companies to identify inefficiencies and implement improvements swiftly. With these benefits, the demand for factory automation solutions is expected to grow as companies seek to enhance their competitiveness in both local and global markets.

Mexico Factory Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, system type, and industry vertical.

Component Insights:

- Sensors

- Controllers

- Switches and Relays

- Industrial Robots

- Drives

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes sensors, controllers, switches and relays, industrial robots, drives, and others.

System Type Insights:

- Distributed Control System (DCS)

- Supervisory Control and Data Acquisition System (SCADA)

- Manufacturing Execution System (MES)

- Systems Instrumented System (SIS)

- Programmable Logic Controller (PLC)

- Human Machine Interface (HMI)

The report has provided a detailed breakup and analysis of the market based on the system type. This includes distributed control system (DCS), supervisory control and data acquisition system (SCADA), manufacturing execution system (MES), systems instrumented system (SIS), programmable logic controller (PLC), and human machine interface (HMI).

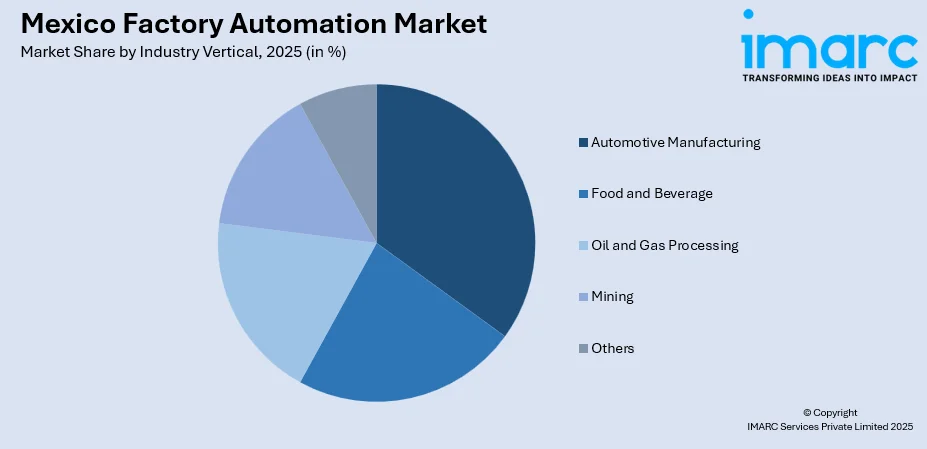

Industry Vertical Insights:

To get detailed segment analysis of this market Request Sample

- Automotive Manufacturing

- Food and Beverage

- Oil and Gas Processing

- Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes automotive manufacturing, food and beverage, oil and gas processing, mining, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Factory Automation Market News:

- On January 15, 2024, Jabil expanded its Center of Manufacturing Excellence in Chihuahua, Mexico, adding a third plant with over one million square feet of production space. This expansion significantly enhances factory automation capabilities by focusing on retail and warehouse automation solutions like robotics, AI, and additive manufacturing. The new facility enables Jabil to streamline the manufacturing of advanced solutions such as autonomous robots, self-checkout systems, and electronic shelf labels.

Mexico Factory Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Sensors, Controllers, Switches and Relays, Industrial Robots, Drives, Others |

|

System Types Covered |

Distributed Control System (DCS), Supervisory Control and Data Acquisition System (SCADA), Manufacturing Execution System (MES), Systems Instrumented System (SIS), Programmable Logic Controller (PLC), Human Machine Interface (HMI) |

| Industry Verticals Covered | Automotive Manufacturing, Food and Beverage, Oil and Gas Processing, Mining, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico factory automation market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico factory automation market on the basis of component?

- What is the breakup of the Mexico factory automation market on the basis of system type?

- What is the breakup of the Mexico factory automation market on the basis of industry vertical?

- What is the breakup of the Mexico factory automation market on the basis of region?

- What are the various stages in the value chain of the Mexico factory automation market?

- What are the key driving factors and challenges in the Mexico factory automation market?

- What is the structure of the Mexico factory automation market and who are the key players?

- What is the degree of competition in the Mexico factory automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico factory automation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico factory automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico factory automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)