Mexico Fast Food and Quick Service Restaurant Market Size, Share, Trends and Forecast by Business Model, Cuisine, Product Type, Service Type, and Region, 2025-2033

Mexico Fast Food and Quick Service Restaurant Market Overview:

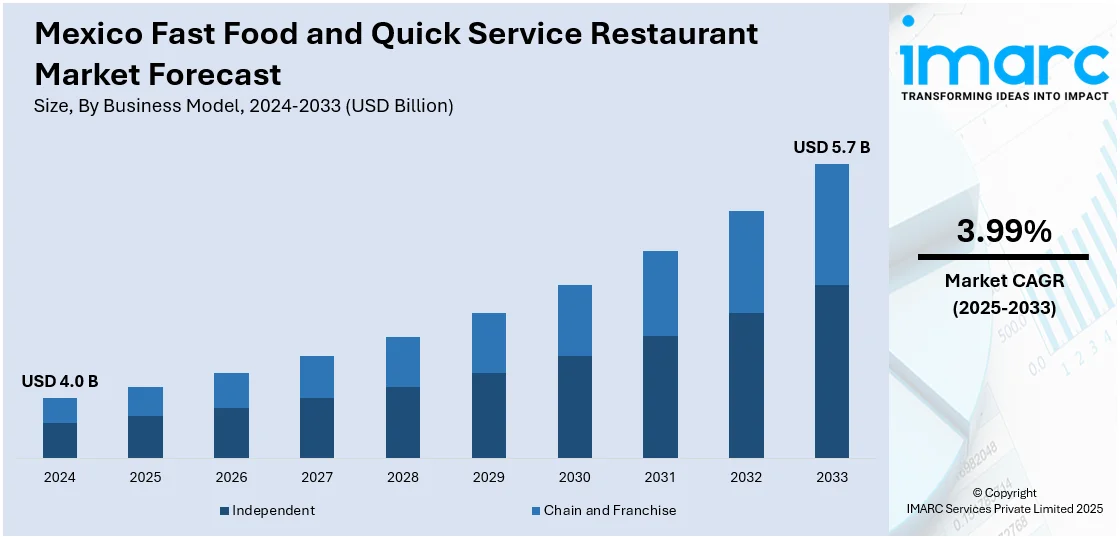

The Mexico fast food and quick service restaurant market size reached USD 4.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.99% during 2025-2033. The market is experiencing significant growth mainly driven by urbanization, rising disposable incomes, and changing lifestyles. In line with this, digital ordering, localized menus, and franchise growth are supporting overall market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.0 Billion |

| Market Forecast in 2033 | USD 5.7 Billion |

| Market Growth Rate 2025-2033 | 3.99% |

Mexico Fast Food and Quick Service Restaurant Market Trends:

Rising Demand for Delivery and Takeaway

The surge in delivery and takeaway demand is transforming the fast food and QSR landscape in Mexico. Increasing internet penetration, smartphone usage, and consumer preference for convenience have fueled the growth of app-based food delivery platforms. Urban populations, especially working professionals and students, are relying more on digital channels for quick meals, driving strong off-premise consumption. QSR brands are adapting by partnering with third-party delivery apps and investing in their own platforms to handle growing online orders. Cloud kitchens and delivery-focused outlets are also emerging to meet this demand efficiently. Promotions, subscription-based loyalty programs, and real-time order tracking further enhance customer experience. This shift is not only improving accessibility but also expanding the customer base beyond traditional dine-in models. As a result, the delivery and takeaway segment is contributing significantly to the overall Mexico fast food and quick service restaurant market share.

Expansion of International QSR Chains

International quick service restaurant (QSR) brands are rapidly expanding their footprint in Mexico, targeting not only major urban centers but also tier-2 and tier-3 cities with rising consumer spending. This shift is driven by growing demand for branded, standardized food options among younger demographics and middle-income households. Global chains are leveraging franchise models to enter new regions efficiently, often partnering with local operators to navigate regulatory and cultural nuances. For instance, in November 2024, FAT Brands announced new openings for Fatburger and Buffalo’s Express in Mexico, expanding to five locations in Mexico City. The growth is supported by the partnership with franchisee Red Rombo Group. Fatburger is known for its customizable burgers, while Buffalo’s Express specializes in chicken wings with various sauces. These brands bring established reputations, consistent quality, and innovative marketing strategies that appeal to aspirational consumers in smaller cities. Their presence also intensifies competition, pushing domestic players to innovate and modernize. As a result, the influx of international QSRs is broadening access, improving service quality, and elevating overall industry standards. This strategic regional penetration is a key factor contributing to sustained Mexico fast food and quick service restaurant market growth.

Digital Integration and Self-Service Kiosks

Restaurants across Mexico are increasingly embracing digital technologies to enhance operational efficiency and improve customer experience. The adoption of self-service kiosks, mobile ordering systems, and contactless payment options is transforming how fast food and QSR outlets operate. These tools reduce wait times, minimize order errors, and allow for personalized upselling through AI-driven interfaces. Many global and domestic chains are also integrating loyalty apps, QR code menus, and digital receipt systems to cater to tech-savvy consumers, especially in urban areas. The pandemic further accelerated this shift, normalizing digital-first interactions in food service. For instance, in October 2024, La Casa de Toño introduced a self-service fast-food concept at its Plaza Oriente location, allowing customers to order and collect meals without waitstaff. As labor costs rise and consumers demand faster service with minimal contact, digital solutions are becoming essential across all customer touchpoints. This technological evolution is expected to play a significant role in shaping the Mexico fast food and quick service restaurant market outlook, especially in urban and high-traffic locations.

Mexico Fast Food and Quick Service Restaurant Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on business model, cuisine, product type, and service type.

Business Model Insights:

- Independent

- Chain and Franchise

The report has provided a detailed breakup and analysis of the market based on the business model. This includes independent and chain and franchise.

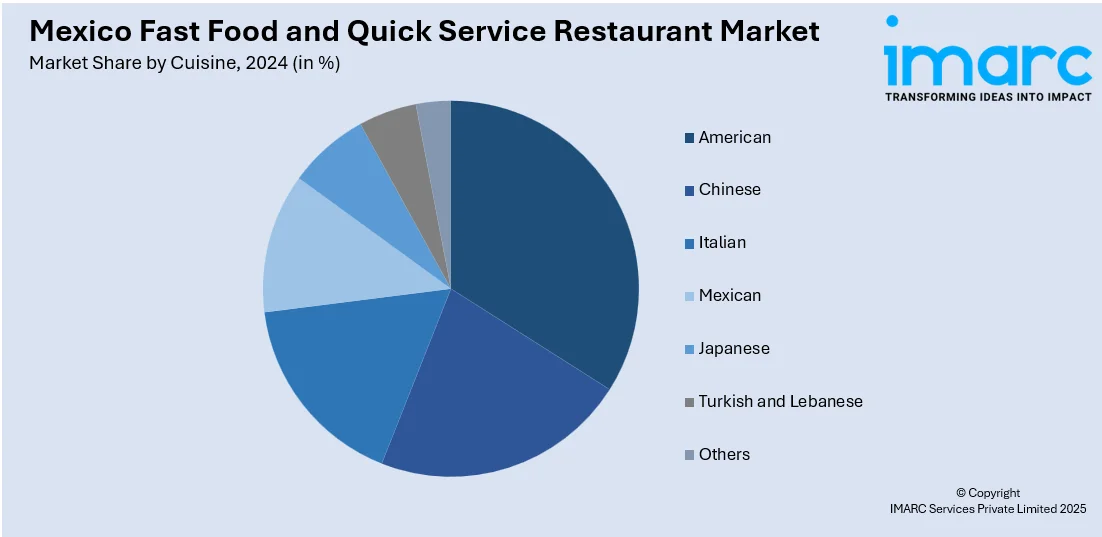

Cuisine Insights:

- American

- Chinese

- Italian

- Mexican

- Japanese

- Turkish and Lebanese

- Others

A detailed breakup and analysis of the market based on the cuisine have also been provided in the report. This includes American, Chinese, Italian, Mexican, Japanese, Turkish and Lebanese, and others.

Product Type Insights:

- Burgers and Sandwiches

- Pizzas and Pastas

- Drinks and Desserts

- Chicken and Seafood

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes burgers and sandwiches, pizzas and pastas, drinks and desserts, chicken and seafood, and others.

Service Type Insights:

- Online Service

- Offline Service

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes online service and offline service.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fast Food and Quick Service Restaurant Market News:

- In August 2024, KFC Mexico announced its partnership with Google Cloud for a three-year digital transformation plan, focusing on advanced data analytics and machine learning. This initiative aims to enhance customer experiences through personalized offers and improved operational efficiency by consolidating data on a digital platform, building on previous collaboration successes with Google Cloud.

- In January 2024, Popeyes, US-based fast-food chain, announced a $9 million investment to expand in Mexico, adding 14 new locations to its existing 36 outlets. The brand, which entered the Mexican market in 2021, operates in regions, including Mexico City, Jalisco, Nuevo Leon, and Queretaro, signaling strong growth potential.

Mexico Fast Food and Quick Service Restaurant Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | Independent, Chain and Franchise |

| Cuisines Covered | American, Chinese, Italian, Mexican, Japanese, Turkish and Lebanese, Others |

| Product Types Covered | Burgers and Sandwiches, Pizzas and Pastas, Drinks and Desserts, Chicken and Seafood, Others |

| Service Types Covered | Online Service, Offline Service |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fast food and quick service restaurant market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fast food and quick service restaurant market on the basis of business model?

- What is the breakup of the Mexico fast food and quick service restaurant market on the basis of cuisine?

- What is the breakup of the Mexico fast food and quick service restaurant market on the basis of product type?

- What is the breakup of the Mexico fast food and quick service restaurant market on the basis of service type?

- What is the breakup of the Mexico fast food and quick service restaurant market on the basis of region?

- What are the various stages in the value chain of the Mexico fast food and quick service restaurant market?

- What are the key driving factors and challenges in the Mexico fast food and quick service restaurant?

- What is the structure of the Mexico fast food and quick service restaurant market and who are the key players?

- What is the degree of competition in the Mexico fast food and quick service restaurant market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fast food and quick service restaurant market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fast food and quick service restaurant market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fast food and quick service restaurant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)