Mexico Fasteners Market Size, Share, Trends and Forecast by Product, Sales Channel, End Use, and Region, 2025-2033

Mexico Fasteners Market Overview:

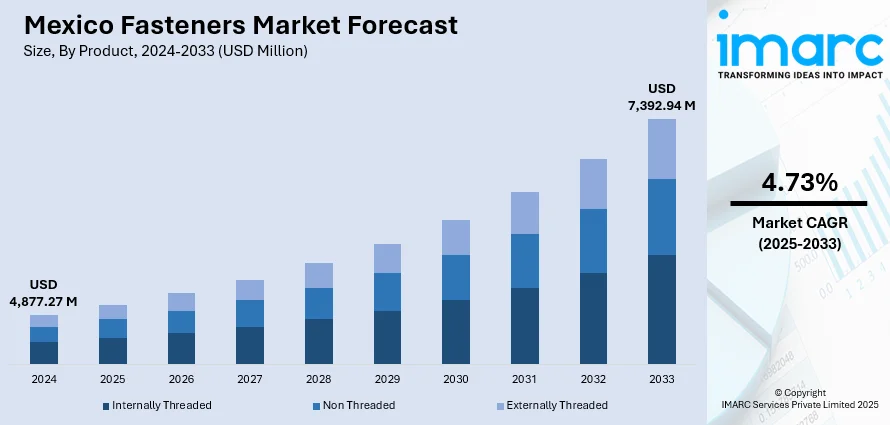

The Mexico fasteners market size reached USD 4,877.27 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,392.94 Million by 2033, exhibiting a growth rate (CAGR) of 4.73% during 2025-2033. Robust demand from the automotive, aerospace, construction, and electronics sectors is one of the factors contributing to Mexico fasteners market share. Factors such as nearshoring trends, infrastructure development, adoption of lightweight materials, and government support for industrial growth further bolster this demand. Additionally, the rise of e-commerce and sustainability initiatives contributes to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,877.27 Million |

| Market Forecast in 2033 | USD 7,392.94 Million |

| Market Growth Rate 2025-2033 | 4.73% |

Mexico Fasteners Market Trends:

Rising Strategic Investments in the Fasteners Sector

The fasteners market in Mexico is witnessing increased strategic investments aimed at strengthening local manufacturing and regional supply capabilities. Companies are focusing on acquiring long-established domestic players to deepen their operational footprint and meet growing industrial demand more efficiently. These moves not only enhance supply chain resilience but also position Mexico as a vital link in global infrastructure and industrial production networks. With decades of manufacturing expertise available locally, such integration supports faster response times, cost efficiencies, and greater customization to market needs. This evolving landscape highlights Mexico’s importance as both a manufacturing base and a distribution hub for critical fastening solutions, especially in sectors like automotive, construction, aerospace, and heavy industry. These factors are intensifying the Mexico fasteners market growth. For example, in August 2024, Lamons acquired AUGE Industrial Fasteners, a key Mexican manufacturer based in Lerma with over 50 years of experience in fastening solutions. This move enhances Lamons’ regional supply chain capabilities and supports growing demand in Mexico’s fasteners market. The acquisition is expected to boost local manufacturing, improve responsiveness to market needs, and reinforce Mexico’s strategic role in global industrial and infrastructure supply chains.

Strengthening Supply Chains Through Local Manufacturing Expansion

Mexico is gaining momentum through strategic expansions aimed at localizing supply chains and improving service delivery across key industries. New facilities are being established to support growing demand from the commercial, construction, and aerospace sectors. These hubs enhance access to certified fastening components, streamline inventory management, and reduce reliance on international logistics, which improves responsiveness and lowers costs. Backed by specialized support divisions with expertise in aerospace and defense, these operations ensure high-quality standards and industry-specific compliance. The move also positions Mexico as a central manufacturing and distribution base for North America, benefiting from nearshoring trends and a robust industrial infrastructure. By offering tailored supply solutions and a strong local presence, companies are reinforcing Mexico’s role in global supply chains while simultaneously boosting domestic manufacturing capabilities. This evolution reflects a broader shift toward efficiency, reliability, and long-term investment in Mexico’s fasteners and industrial components sector. For instance, in March 2024, Birmingham Fastener launched a new facility in Querétaro, Mexico, through its subsidiary, CASM. This expansion supports Mexico’s growing fasteners market by enhancing local supply chain access for commercial, construction, and aerospace sectors. Backed by Alabama Aerospace, CASM would provide certified parts across diverse industries.

Mexico Fasteners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, sales channel, and end use.

Product Insights:

- Internally Threaded

- Non Threaded

- Externally Threaded

The report has provided a detailed breakup and analysis of the market based on the product. This includes internally threaded, non threaded, and externally threaded.

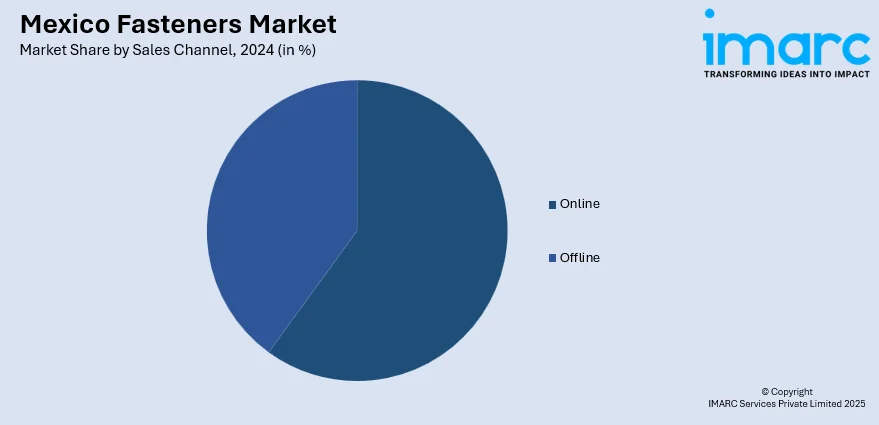

Sales Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes online and offline.

End Use Insights:

- Automotive

- Building and Construction

- Aerospace

- Machinery

- Electronics

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes automotive, building and construction, aerospace, machinery, electronics, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fasteners Market News:

- In February 2025, AFC Industries opened a new facility in Monterrey, Mexico, enhancing its role in the country's industrial corridor. The site would serve as a hub for AFC Industries de Mexico, offering fasteners, tooling, and industrial supplies. With services like inventory management, just-in-time delivery, and custom packaging, the expansion strengthens AFC’s supply chain capabilities and supports the growing demand in Mexico’s fasteners market.

Mexico Fasteners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Internally Threaded, Non Threaded, Externally Threaded |

| Sales Channels Covered | Online, Offline |

| End Uses Covered | Automotive, Building and Construction, Aerospace, Machinery, Electronics, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fasteners market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fasteners market on the basis of product?

- What is the breakup of the Mexico fasteners market on the basis of sales channel?

- What is the breakup of the Mexico fasteners market on the basis of end use?

- What is the breakup of the Mexico fasteners market on the basis of region?

- What are the various stages in the value chain of the Mexico fasteners market?

- What are the key driving factors and challenges in the Mexico fasteners market?

- What is the structure of the Mexico fasteners market and who are the key players?

- What is the degree of competition in the Mexico fasteners market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fasteners market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fasteners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fasteners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)