Mexico Fermented Superfoods Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Mexico Fermented Superfoods Market Overview:

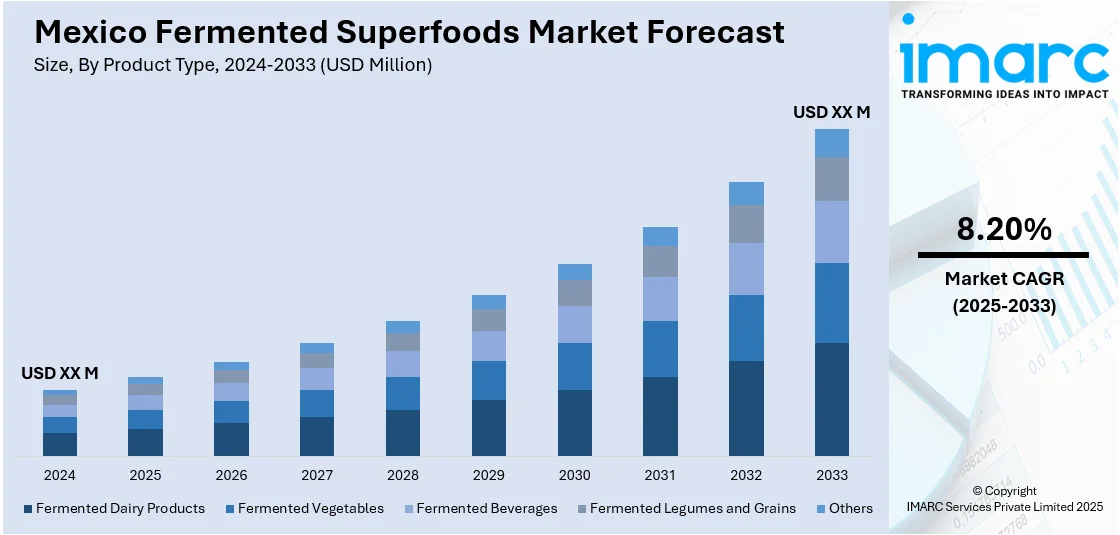

The Mexico fermented superfoods market size is projected to exhibit a growth rate (CAGR) of 8.20% during 2025-2033. Emerging knowledge of gastrointestinal health, revived interest in ancient fermentation techniques, and creativity in convenient, appealing product formulations are major drivers of the growth of fermented superfoods in Mexico. People intensely look for wholesome, health-enhancing foods that respect traditional heritage while adapting to contemporary lifestyles. Such changing demand helps fuel the expanding uptake and acceptance of fermented foods from a wide range of consumers and significantly contributes to overall market growth, increasing penetration of the Mexico fermented superfoods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate (2025-2033) | 8.20% |

Mexico Fermented Superfoods Market Trends:

Increased Consumer Interest in Gut Wellness and Health

Growing consumer interest in the significance of gut health in Mexico is strongly propelling the growth of the fermented superfoods market. More and more Mexican consumers are becoming aware of the advantages of probiotics, enzymes, and beneficial bacteria in fermented foods that aid in digestion and immune function. This heightened health awareness is fostered by educational campaigns and mass media attention to the relationship between gut microbiota and overall health, as well as mental health and energy levels. As a result, fermented superfoods are increasingly becoming popular not only among healthy food enthusiasts but also among mainstream consumers from all age groups. Demand for fermented foods like yogurts, kefir, and fermented vegetables is growing steadily as they become an essential part of every-day diets. For instance, in March 2024, Lifeway Foods, emphasized its growing presence in Mexico, where it now markets its tangy, tart fermented milk products, such as kefir, alongside U.S., Ireland, and France. Moreover, this trend indicates a wider movement towards preventive health and natural nutrition, making fermented superfoods a critical part of Mexico's changing functional food scene.

Demand for Traditional and Indigenous Fermentation Methods

A clear trend in Mexico's fermented superfoods industry is the revival and recognition of heritage and indigenous fermentation techniques. Mexican consumers highly appreciate heritage foods made with traditional, time-honored artisanal processes, which are seen to deliver authentic flavors and higher health benefits. This trend is associated with a larger cultural trend toward celebrating local food heritage, food diversity, and sustainability. Fermented staples such as pulque, tepache, and naturally fermented corn products are experiencing revitalized popularity, both in the countryside and cities. They are gaining favor not just due to their probiotic aspects but also due to their cultural value and distinct flavor profiles. This increasing interest underpins the Mexico fermented superfoods market growth, uniting traditional fermentation techniques with modern consumer tastes, and emphasizing the value of sustainability and food traceability within the functional foods sector in Mexico.

Product Format and Flavor Profile Innovation

Product format and flavor profile innovation is changing Mexico's fermented superfoods market by diversifying product formats and flavor profiles to address changing consumer tastes. Producers are formulating convenient-to-eat products such as probiotic drinks, fermented snack foods, and easy-to-use meal enhancers that fit into the increasingly hectic lifestyles of Mexican consumers. For example, in July 2024, Mez Foods launched a range of mesquite chocolate bars made with fermented pea protein, mirroring Mexico's growing fermented superfoods market spurred by consumer hunger for traditional, healthy, and sustainable food products. Furthermore, there is also increased experimentation with innovative flavor pairings that combine local fruits, spices, and botanicals in order to broaden appeal. This innovative strategy not only heightens the sensory aspect but also communicates the functional aspects of fermentation in more familiar terms. As the market develops, this innovation focus is driving the uptake of fermented superfoods through various demographic segments. These product development initiatives are thus fueling overall Mexico fermented superfoods market growth by accelerating access and conforming to global trends for healthful, delicious, and convenient functional foods.

Mexico Fermented Superfoods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Fermented Dairy Products

- Yogurt

- Kefir

- Buttermilk

- Fermented Vegetables

- Kimchi

- Sauerkraut

- Pickles

- Fermented Beverages

- Kombucha

- Kanji

- Fermented Teas

- Fermented Legumes and Grains

- Idli

- Dosa

- Dhokla

- Tempeh

- Miso

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fermented dairy products (yogurt, kefir, and buttermilk), fermented vegetables (kimchi, sauerkraut, and pickles), fermented beverages (kombucha, kanji, and fermented teas), fermented legumes and grains (idli, dosa, dhokla, tempeh, and miso), and others.

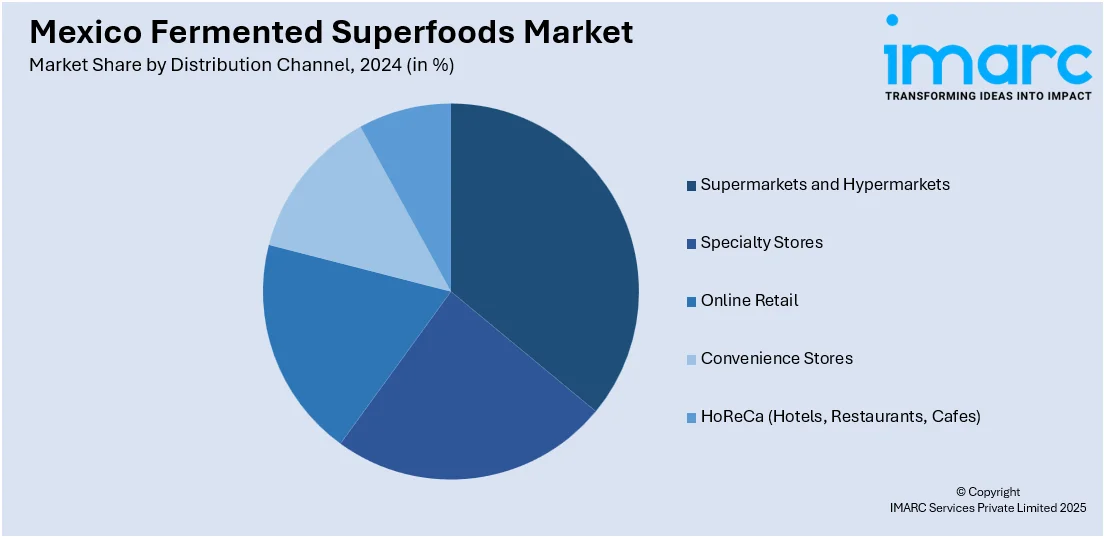

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- HoReCa (Hotels, Restaurants, Cafes)

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online retail, convenience stores, and HoReCa (hotels, restaurants, cafes).

End User Insights:

- Households

- Food Service Industry

- Health and Wellness Industry

The report has provided a detailed breakup and analysis of the market based on the end user. This includes households, food service industry, and health and wellness industry.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fermented Superfoods Market News:

- In February 2024, Innovative Organic announced a new upcoming launch of HOT AGAVE, a product born out of Mexico's rich cultural tradition of fermented superfoods. Blending the natural sweetness of organic agave with intense flavors, it meets increasing demand from consumers for traditional, sustainable, and health-oriented Mexican fermented foods in modern diets.

Mexico Fermented Superfoods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Retail, Convenience Stores, HoReCa (Hotels, Restaurants, Cafés) |

| End Users Covered | Households, Food Service Industry, Health and Wellness Industry |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fermented superfoods market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fermented superfoods market on the basis of product type?

- What is the breakup of the Mexico fermented superfoods market on the basis of distribution channel?

- What is the breakup of the Mexico fermented superfoods market on the basis of end user?

- What is the breakup of the Mexico fermented superfoods market on the basis of region?

- What are the various stages in the value chain of the Mexico fermented superfoods market?

- What are the key driving factors and challenges in the Mexico fermented superfoods?

- What is the structure of the Mexico fermented superfoods market and who are the key players?

- What is the degree of competition in the Mexico fermented superfoods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fermented superfoods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fermented superfoods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fermented superfoods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)