Mexico Fire Resistant Clothing Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, Application, End User, and Region, 2025-2033

Mexico Fire Resistant Clothing Market Overview:

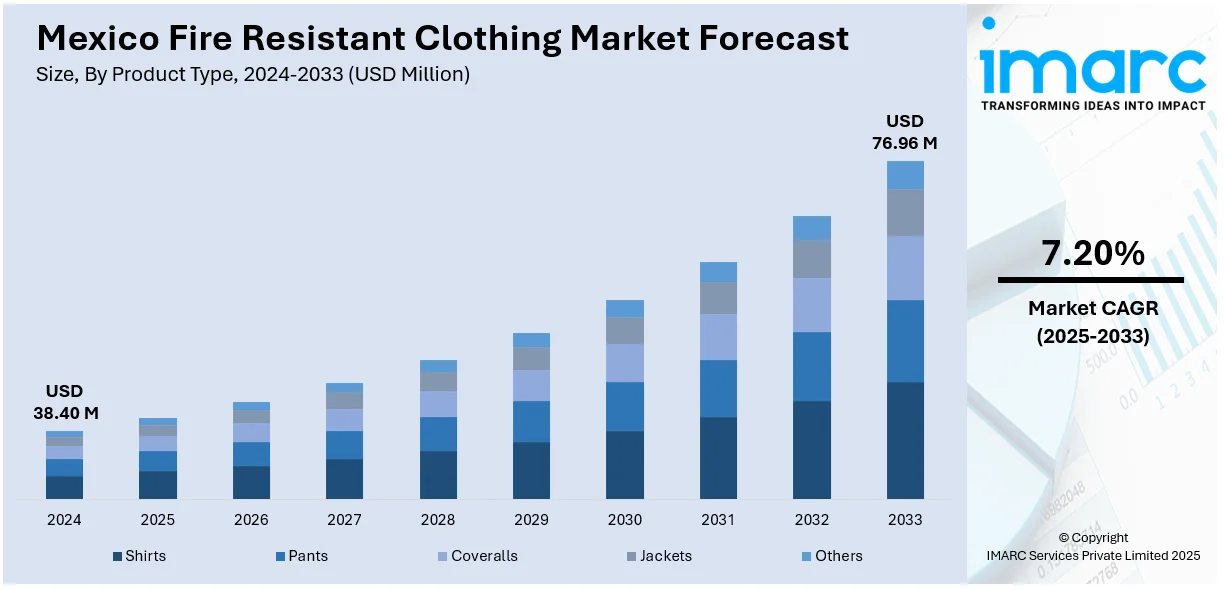

The Mexico fire resistant clothing market size reached USD 38.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 76.96 Million by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The market is transforming through the use of high-tech flame-resistant materials that reconcile protection and comfort. It is increasingly focusing on industry-specific customization, where clothing is designed to address the specific safety requirements of industries such as oil and gas, construction, and firefighting. Furthermore, green-certified manufacturing procedures become a growing priority, incorporating environmentally friendly materials and processes. Allowing these trends together pushes innovation and drives demand, which supports the consistent growth of the Mexico fire resistant clothing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38.40 Million |

| Market Forecast in 2033 | USD 76.96 Million |

| Market Growth Rate 2025-2033 | 7.20% |

Mexico Fire Resistant Clothing Market Trends:

Integration of State-of-the-Art Flame-Resistant Materials

Mexico fire resistant apparel market is increasingly embracing state-of-the-art materials with the capability to provide thermal protection while providing comfort for users. Improvements include naturally flame-resistant fibers including aramids, modacrylics, and advanced combinations developed with persistence, breathability, and light weight capacity. These materials resist extreme temperatures and last even after repeated washing and long periods of use. The move away from conventional treated fabrics and toward inherently resistant materials is part of an overall industry focus on long-term dependability and global safety standards. For instance, in August 2024, TenCate Protective Fabrics underscored that flame-resistant stationwear offers firefighters the necessary burn protection, durability, and comfort, which pays off in long-term safety dividends even at increased initial costs. Moreover, design enhancements also now address ergonomics, providing wearers with improved flexibility and lower fatigue during prolonged operations. This material development is consistent with industry demands for multifunctional safety clothing that does not sacrifice wearability. As industrial industries like energy, utilities, and emergency response embrace more stringent safety standards, the use of such new materials is transforming product development priorities nationwide.

Increase in Sector-Specific Functional Tailoring

Customized functionality is emerging as an important differentiator in fire-resistant apparel throughout Mexico, with more and more garments being tailored to address the requirements of individual industries like oil and gas, construction, electrical utilities, and firefighting. The industry is experiencing the shift from generic safety attire to purpose-built clothing with features like moisture management, anti-static capabilities, chemical resistance, and high-visibility features. Every industry has its own specific set of safety requirements, and this is motivating producers to create clothing that responds to operating risks and legislated requirements. This tendency is an extension of a larger focus on performance-based safety products that provide precision protection at the expense of comfort and efficiency. Customers today value not only flame resistance but also other functionalities that respond to particular workplace environments. By focused innovation, protective clothing is becoming a part of occupational effectiveness as well as safety and productivity. For example, in April 2023, TenCate debuted Tecasafe® 360+, the world's first inherently flame-resistant stretch fabric, adding high-tech protection, comfort, and flexibility to workwear for global safety standards. Furthermore, this shift is supporting the overall Mexico fire resistant clothing market growth.

Focus on Environmentally Responsible Manufacturing

Sustainability is becoming more important in Mexico's fire-resistant apparel market, with players increasingly focusing on environmentally friendly materials and processes. There is a discernible trend away from the use of recycled fibers, low-impact dyes, and green flame-retardant finishes that minimize toxic emissions and water and energy usage. Both regulatory pressure and an expanding cultural focus on environmental stewardship support this trend. Companies are implementing closed loop manufacturing strategies and using renewable resources to ensure corporate sustainability while still being in compliance with safety standards. This movement not only improves the environmental image of the industry but also reaches green-conscious end-consumers and procurement groups. Companies are oftentimes marketing sustainable products as premium options that combine safety with environmental integrity. As green manufacturing emerges as a competitive edge, environmentally sensitive practices will define the future direction of Mexico's fire-resistant clothing.

Mexico Fire Resistant Clothing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, distribution channel, application, and end user.

Product Type Insights:

- Shirts

- Pants

- Coveralls

- Jackets

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes shirts, pants, coveralls, jackets, and others.

Material Type Insights:

- Treated FR Fabric

- Inherent FR Fabric

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes treated FR fabric and inherent FR fabric.

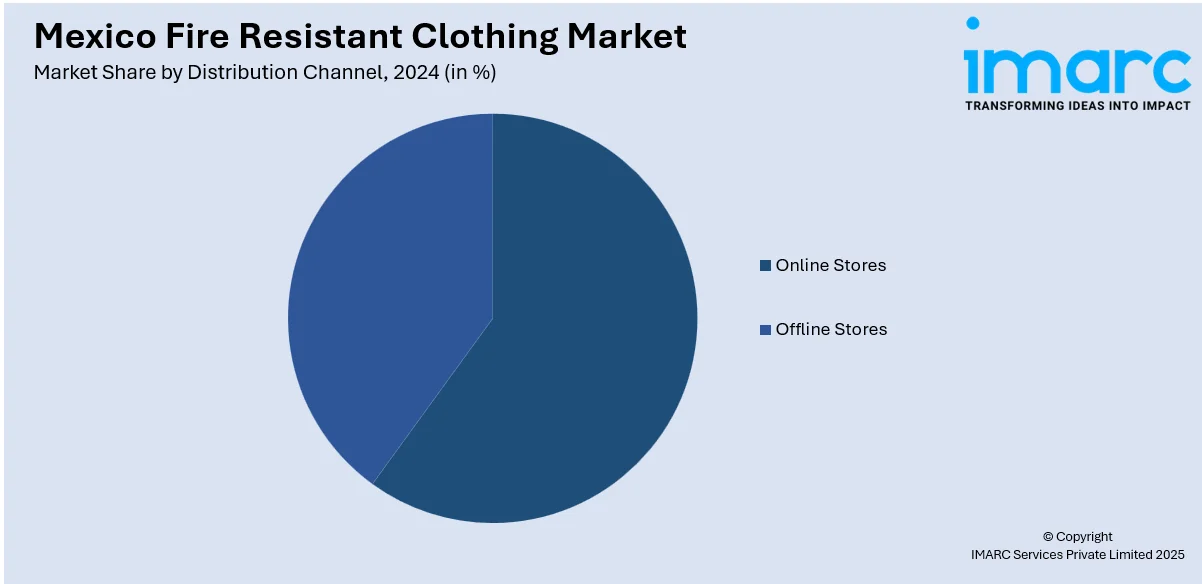

Distribution Channel Insights:

- Online Stores

- Offline Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online stores and offline stores.

Application Insights:

- Oil and Gas

- Construction

- Manufacturing

- Mining

- Military

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas, construction, manufacturing, mining, military, and others.

End User Insights:

- Industrial

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the end user. This includes industrial, commercial, and residential.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fire Resistant Clothing Market News:

- In November 2024, MerinoProtect introduced sustainable fabric technology for flame resistance, thermal protection, and moisture management performance. The technologies are designed for demanding applications and advance Mexico's increasing need for environment-friendly fire-resistant apparel, especially for industries such as firefighting, welding, and oil and gas where safety and sustainability are taking center stage.

- In January 2024, Carrington Textiles launched cutting-edge flame-resistant materials, such as arc-flash-protective Flametougher 290AS Flex and sustainable Tahoe. They are in line with increasing international and Mexican market demands for sector-specific, high-performance, and environmentally friendly protective wear in industries such as oil, gas, construction, and utilities.

Mexico Fire Resistant Clothing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Shirts, Pants, Coveralls, Jackets, Others |

| Material Types Covered | Treated FR Fabric, Inherent FR Fabric |

| Distribution Channels Covered | Online Stores, Offline Stores |

| Applications Covered | Oil and Gas, Construction, Manufacturing, Mining, Military, Others |

| End Users Covered | Industrial, Commercial, Residential |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fire resistant clothing market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fire resistant clothing market on the basis of product type?

- What is the breakup of the Mexico fire resistant clothing market on the basis of material type?

- What is the breakup of the Mexico fire resistant clothing market on the basis of distribution channel?

- What is the breakup of the Mexico fire resistant clothing market on the basis of application?

- What is the breakup of the Mexico fire resistant clothing market on the basis of end user?

- What is the breakup of the Mexico fire resistant clothing market on the basis of region?

- What are the various stages in the value chain of the Mexico fire resistant clothing market?

- What are the key driving factors and challenges in the Mexico fire resistant clothing?

- What is the structure of the Mexico fire resistant clothing market and who are the key players?

- What is the degree of competition in the Mexico fire resistant clothing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fire resistant clothing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fire resistant clothing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fire resistant clothing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)