Mexico Fisheries Infrastructure Market Size, Share, Trends and Forecast by Infrastructure Type, Sector, End-User, and Region, 2025-2033

Mexico Fisheries Infrastructure Market Overview:

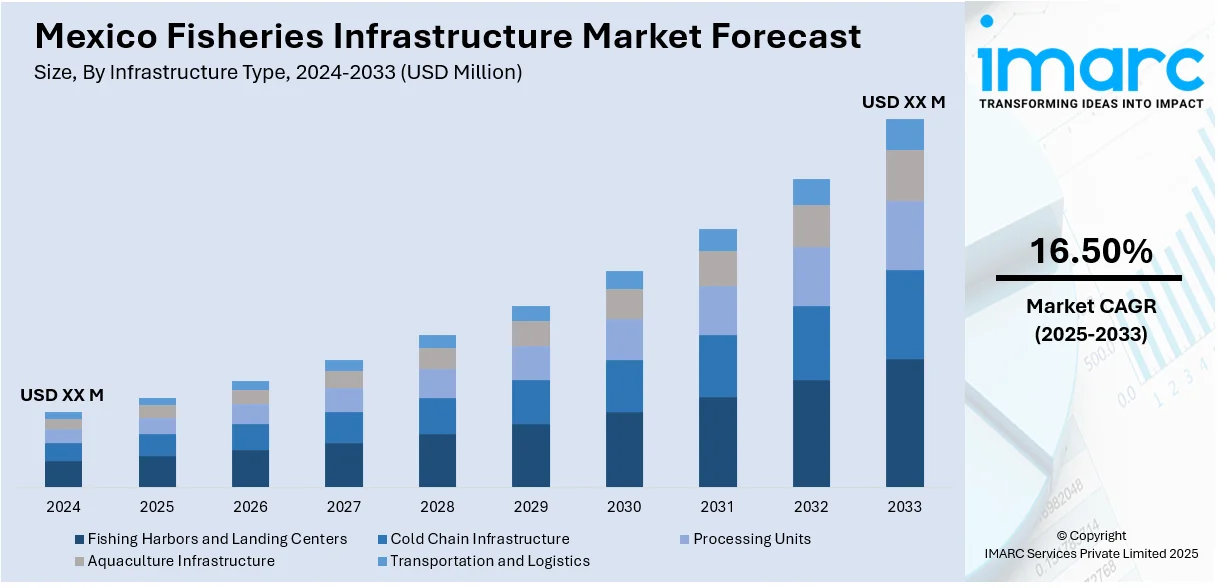

The Mexico fisheries infrastructure market size is anticipated to exhibit a growth rate (CAGR) of 16.50% during 2025-2033. Key drivers of the market include increased government investments in port modernization, rising demand for sustainable fishing practices, and advancements in cold chain logistics. Enhanced regulatory frameworks and growing exports also support industry expansion. These factors collectively contribute to the increasing Mexico fisheries infrastructure market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 16.50% |

Mexico Fisheries Infrastructure Market Trends:

Adoption of Smart Fishing Technologies

The Mexico fisheries infrastructure market growth is significantly influenced by the integration of smart fishing technologies such as GPS tracking, automated sorting systems, and IoT-enabled monitoring tools. These innovations enhance operational efficiency, reduce overfishing risks, and improve resource management. The use of real-time data analytics allows fishermen to optimize routes and reduce fuel consumption, contributing to sustainability goals. For instance, in September 2024, NOAA Fisheries and Gulf partners released a research blueprint to enhance recreational fishing data in the Gulf of Mexico. It prioritizes efforts over 1–2 years, including improving fishing effort surveys, data infrastructure, and survey consistency. The plan supports stock assessments and fisheries management by addressing discrepancies in state-level data. By 2027, it aims to standardize and integrate data across Gulf surveys, ensuring accurate, sustainable fisheries decisions. Partners include NOAA, Gulf States, and the Gulf Fisheries Management Council.

Government Initiatives Promoting Sustainable Fisheries

Government initiatives focused on sustainable fisheries management are a pivotal trend in the Mexico fisheries infrastructure market growth. Policies encouraging responsible fishing, habitat restoration, and community engagement help preserve marine biodiversity and ensure resource availability for future generations. Funding and subsidies support infrastructure projects that enable eco-friendly fishing practices, such as selective gear technology and waste management systems. For instance, in December 2024, Mexico issued its first blue bond for sustainable fisheries and aquaculture, raising 4.5 billion pesos (approx. USD 220 million). Supported by GGGI, IDB, AFD, and the EU, this 6-year bond will fund environmentally responsible coastal and offshore fishing, and aquaculture projects. This issuance marks a major step in financing sustainable ocean economies and enhancing livelihoods in vulnerable coastal communities. Apart from this, such initiatives foster collaboration between public and private sectors, enhancing compliance with environmental regulations and international trade agreements. By promoting sustainability, the government strengthens Mexico’s global reputation, boosting market share and ensuring the long-term viability of the fisheries infrastructure industry.

Mexico Fisheries Infrastructure Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on infrastructure type, sector, and end-user.

Infrastructure Type Insights:

- Fishing Harbors and Landing Centers

- Cold Chain Infrastructure

- Cold Storage

- Ice Plants

- Processing Units

- Fish Processing Plants

- Packaging Units

- Aquaculture Infrastructure

- Hatcheries

- Feed Plants

- Transportation and Logistics

- Refrigerated Vehicles

- Supply Chain

The report has provided a detailed breakup and analysis of the market based on the infrastructure type. This includes fishing harbors and landing centers, cold chain infrastructure (cold storage and ice plants), processing units (fish processing plants and packaging units), aquaculture infrastructure (hatcheries and feed plants), and transportation and logistics (refrigerated vehicles and supply chain).

Sector Insights:

- Marine Fisheries

- Inland Fisheries

- Aquaculture

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes marine fisheries, inland fisheries, and aquaculture.

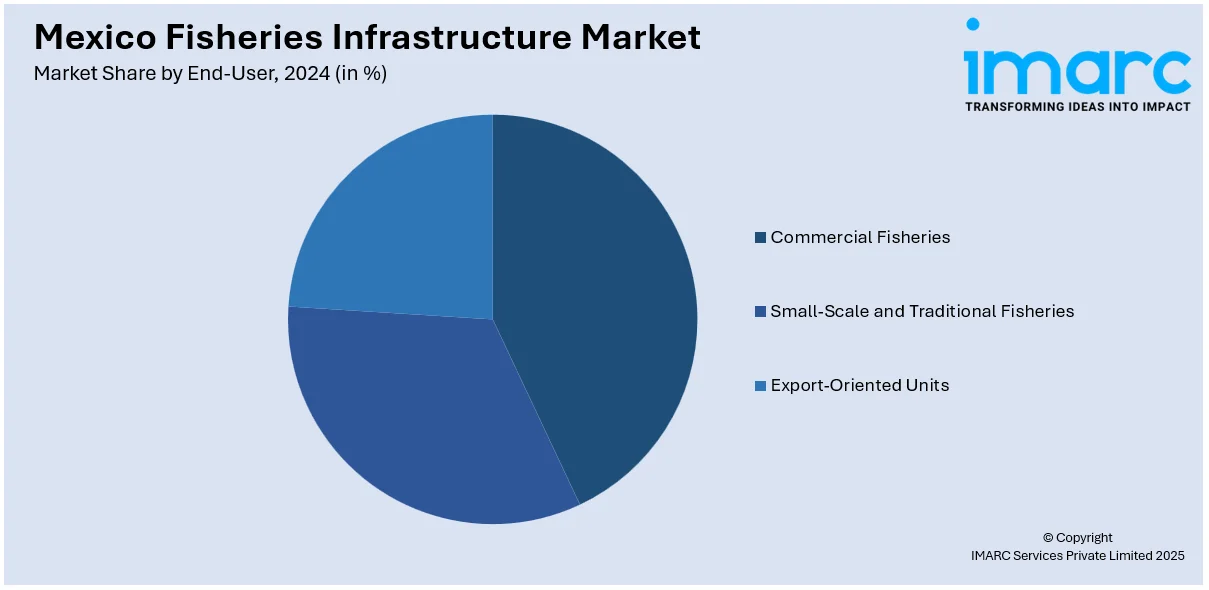

End-User Insights:

- Commercial Fisheries

- Small-Scale and Traditional Fisheries

- Export-Oriented Units

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes commercial fisheries, small-scale and traditional fisheries, and export-oriented units.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Fisheries Infrastructure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Infrastructure Types Covered |

|

| Sectors Covered | Marine Fisheries, Inland Fisheries, Aquaculture |

| End-Users Covered | Commercial Fisheries, Small-Scale and Traditional Fisheries, Export-Oriented Units |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fisheries infrastructure market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fisheries infrastructure market on the basis of infrastructure type?

- What is the breakup of the Mexico fisheries infrastructure market on the basis of sector?

- What is the breakup of the Mexico fisheries infrastructure market on the basis of end-user?

- What is the breakup of the Mexico fisheries infrastructure market on the basis of region?

- What are the various stages in the value chain of the Mexico fisheries infrastructure market?

- What are the key driving factors and challenges in the Mexico fisheries infrastructure market?

- What is the structure of the Mexico fisheries infrastructure market and who are the key players?

- What is the degree of competition in the Mexico fisheries infrastructure market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fisheries infrastructure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fisheries infrastructure market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fisheries infrastructure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)