Mexico Fitness Equipment Market Report by Type (Cardiovascular Training Equipment, Strength Training Equipment, and Others), Price Point (Standard, Premium/Luxury), End User (Commercial, Residential), and Region 2026-2034

Mexico Fitness Equipment Market Size, Share & Analysis

Mexico fitness equipment market size reached USD 376.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 558.3 Million by 2034, exhibiting a growth rate (CAGR) of 4.24% during 2026-2034. The integration of technology into fitness equipment, such as smart features, interactive displays, and connectivity options, that has attracted consumers, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 376.9 Million |

|

Market Forecast in 2034

|

USD 558.3 Million |

| Market Growth Rate 2026-2034 | 4.24% |

Access the full market insights report Request Sample

Mexico Fitness Equipment Market Insights:

- Major Market Drivers: The Mexican fitness equipment market is driven by rising urbanization, growing health awareness, and a greater focus on preventive healthcare. Active lifestyles and physical well-being are driving the adoption of commercial and in-home equipment.

- Key Market Trends: There is increasing demand for connected fitness devices with digital connectivity, offering virtual classes and performance monitoring. There is also growth in compact, space-saving machines tackling urban living limitations and driving demand for home-use options.

- Competitive Landscape: The industry has a variety of local and international brands competing on price, innovation, and service. Firms are shifting their attention toward increasing their online presence and providing customized products to address the changing needs of individual and institutional customers.

- Challenges and Opportunities: Limited consumer availability of financing and unbalanced gym infrastructure present difficulties. But increasing wellness programs, fitness travel, and customized training solutions present significant opportunities for expansion and market diversification.

Fitness equipment refers to a wide range of tools and devices designed to enhance physical exercise, strength training, and overall well-being. These devices cater to various fitness goals, including cardiovascular health, muscle development, flexibility, and endurance. Common examples include treadmills, elliptical trainers, dumbbells, resistance bands, and yoga mats. Advanced technologies have led to the development of smart fitness equipment that integrates with digital platforms, allowing users to track their progress and customize workouts. Home gyms often feature a combination of fitness equipment to provide a comprehensive approach to fitness. Gyms and fitness centers also utilize specialized equipment to offer diverse workout options. Regardless of the specific type, fitness equipment plays a crucial role in promoting an active lifestyle and supporting individuals in achieving their fitness objectives.

Mexico Fitness Equipment Market Trends:

Home Fitness Culture Growth Driving Equipment Demand

The increased focus on health and convenience has stimulated a strong increase in demand for home workout solutions, which has had a significant impact on the Mexico fitness equipment market size. Consumers in urban areas are increasingly making purchases of treadmills, stationary bicycles, resistance bands, and multi-functional home gyms. This lifestyle change is based on changing lifestyles, time factors, and increasing fitness awareness. According to the Mexico fitness equipment market trends, the home segment is growing in double digits every year due to online sales, fitness influencer marketing, and virtual workouts by subscription. This trend is also driving product innovation as small, foldable, and smart-connected equipment is gaining momentum. The market demand will see further growth as more people turn to on-demand, personalized fitness routines within the comfort of their own homes. This change is not only expanding market opportunity but also transforming conventional gym equipment distribution channels throughout the nation.

Intelligent and Networked Fitness Equipment on the Rise

Technology integration is transforming the Mexico fitness equipment market growth as smart and networked machines are becoming the core of customer interests. IoT-enabled equipment, Bluetooth-enabled equipment, and app-linked equipment now enable users to monitor performance levels, receive guided workouts, and even compete against peer groups in real-time. This technology improves user interaction and aids in long-term fitness objectives. As part of the overall Mexico fitness equipment market analysis, manufacturers are placing their attention on digital features like AI-powered coaching, virtual reality fitness, and cloud-based performance monitoring. These features are attractive particularly to younger, technology-oriented consumers and corporate wellness initiatives. Smart equipment's market share is growing steadily, particularly amongst premium customers in urban cities. As fitness converges with digital ecosystems, connected solutions are expected to drive a substantial portion of the market forecast, making them a core focus for future product development.

Commercial Fitness Sector Driving Equipment Investment

The growth of gyms, wellness studios, and boutique fitness clubs is a primary driver of the propelling Mexico fitness equipment market share. As per the sources, in April 2025, World Gym Mexico added nine units of SportsArt's ECO-POWR™ cardio equipment at Playa Del Carmen, converting energy from workouts into electricity while avoiding municipal power limits in a sustainable way. Moreover, with increasing memberships and more investor attraction towards organized fitness chains, the need for commercial-grade strength, cardio, and functional training equipment is improving. Increasing traffic in co-working spaces, home clubs, and hotel gyms, all of which demand tough, high-performance machines—are also driving this trend. As per recent market trends, durable, multi-functional, and space-saving equipment are the top choices for commercial customers. This category now accounts for a major share in the market, and continued infrastructure spending indicates a bright future. According to industry analysis, Mexico City, Guadalajara, and Monterrey are driving the wave of commercial growth. The business segment will continue to be crucial to the long-term Mexico fitness equipment market forecast, especially with growing health consciousness and fitness-driven lifestyles.

Mexico Fitness Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, price point, and end user.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Cardiovascular Training Equipment

- Treadmills

- Stationary Cycles

- Elliptical

- Others

- Strength Training Equipment

- Free Weights

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes cardiovascular training equipment (treadmills, stationary cycles, elliptical, and others), strength training equipment (free weights and others), and others.

Price Point Insights:

- Standard

- Premium/Luxury

A detailed breakup and analysis of the market based on the price point have also been provided in the report. This includes standard and premium/luxury.

End User Insights:

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the end user. This includes commercial and residential.

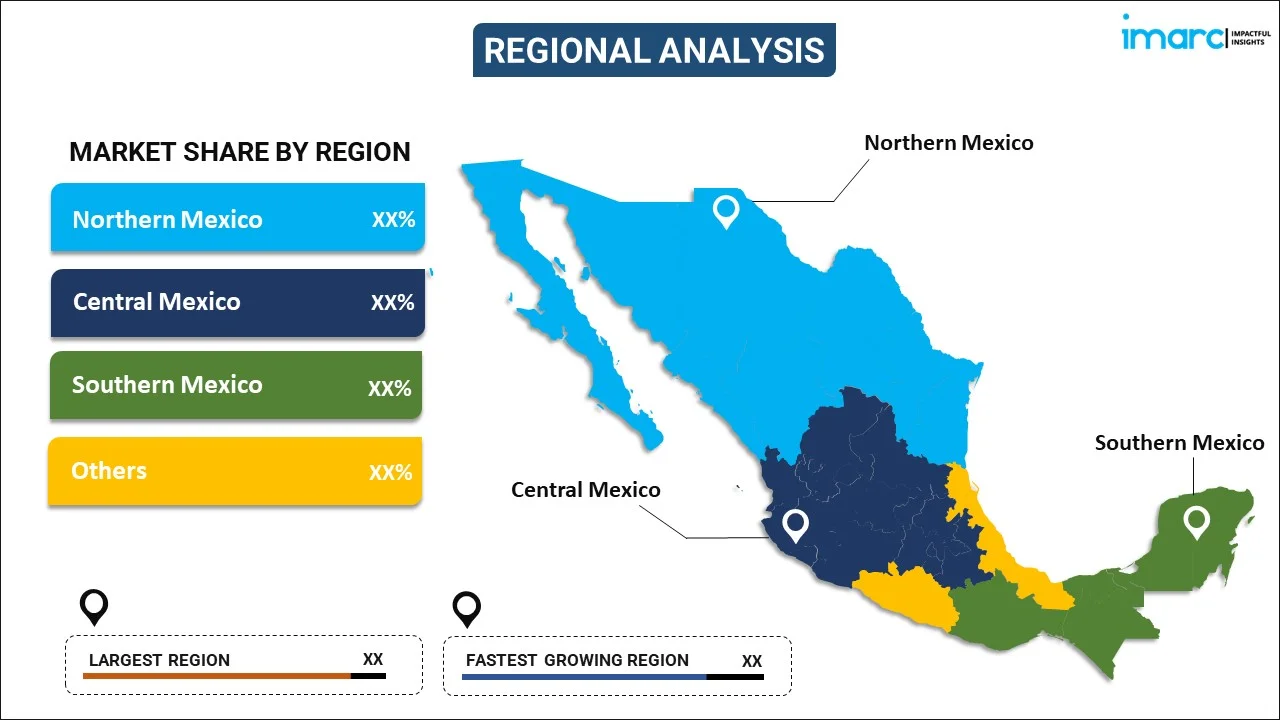

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In September 2024, Pure Barre's revelation of its initial studio opening in Mexico City in early 2025 marks increasing traction in the Mexico Fitness Equipment Market, as boutique fitness growth fuels the demand for specialized, high-performance equipment specific to barre-based training, recovery models, and upscale studio settings throughout urban wellness centers.

- In April 2024, Spanish exercise equipment company Bodytone unveiled its entry into Mexico, France, and the UK with its AI-based Biostrength series. The launch assists growing demand for intelligent strength-training solutions among gyms and is Bodytone's first-hand entry into new international markets as part of its expansion strategy globally.

Mexico Fitness Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Price Points Covered | Standard, Premium/Luxury |

| End Users Covered | Commercial, Residential |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico fitness equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico fitness equipment market on the basis of type?

- What is the breakup of the Mexico fitness equipment market on the basis of price point?

- What is the breakup of the Mexico fitness equipment market on the basis of end user?

- What are the various stages in the value chain of the Mexico fitness equipment market?

- What are the key driving factors and challenges in the Mexico fitness equipment?

- What is the structure of the Mexico fitness equipment market and who are the key players?

- What is the degree of competition in the Mexico fitness equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico fitness equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico fitness equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico fitness equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)